HIVE Delivers Record Q3 Revenue of $93.1 Million with $32.1 Million Gross Operating Margin, Up Over 6x Year-Over-Year

Rhea-AI Summary

HIVE (NASDAQ:HIVE) reported record Q3 revenue of $93.1M for the quarter ended Dec 31, 2025, a 219% YoY increase, with gross operating margin of $32.1M (34.5%) and Adjusted EBITDA of $5.7M. Installed Bitcoin hashrate reached 25 EH/s and BUZZ HPC revenue was $4.9M. GAAP net loss was $91.3M, driven by $57.4M accelerated depreciation tied to Paraguay expansion.

Positive

- Revenue +219% YoY to $93.1M

- Gross operating margin expanded to $32.1M (34.5%)

- Installed 25 EH/s hashrate capacity

- Adjusted EBITDA of $5.7M

- $30M two-year GPU contract for 504 Nvidia B200 GPUs

Negative

- GAAP net loss of $91.3M due to $57.4M accelerated depreciation

- Issued 4.93M shares via ATM for C$22.0M (C$4.47 avg)

- Hashrate revenue pressured by ~10% lower BTC price and 15% higher network difficulty

- Depreciating next-gen ASICs over 2 years increases near-term non-cash charges

News Market Reaction – HIVE

On the day this news was published, HIVE declined 4.07%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

HIVE gained 3.27% pre-earnings while multiple crypto/financial peers also traded higher (e.g., BTBT +1.15%, BITF +1.18%, AMRK +2.17%), though FUFU slipped 0.82%, suggesting a mix of sector and stock-specific drivers.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 13 | AI cloud contracts | Positive | +3.3% | BUZZ unit secured about $30M in two-year AI GPU cloud contracts. |

| Feb 13 | AI contracts detail | Positive | +3.3% | Further detail on $30M AI contracts, lifting HPC annualized revenue expectations. |

| Feb 12 | Earnings date notice | Neutral | -4.0% | Announcement of timing for fiscal Q3 2026 results and conference call. |

| Feb 12 | Earnings call info | Neutral | -4.0% | Additional details on Q3 results release and webcast logistics for investors. |

| Feb 05 | Hashrate update | Positive | -12.2% | Reported 290% YoY hashrate growth and 297 BTC produced with >2% network share. |

Recent positive operational and AI announcements have not produced consistently positive price reactions, with several selloffs following seemingly constructive news.

Over the last weeks, HIVE has highlighted rapid hashrate expansion, strong Bitcoin production, and new AI/HPC contracts. A January update reported 290% year-over-year hashrate growth and 297 BTC produced, yet shares fell 12.23%. Two February AI contract releases totaling about $30 million over two years saw a modest 3.27% gain. Earnings-date notices on Feb 12 coincided with a 4.04% decline. Today’s Q3 results extend this narrative of strong operational growth against a volatile share price backdrop.

Market Pulse Summary

This announcement highlights record Q3 revenue of $93.1 million, a gross operating margin of $32.1 million, and growing BUZZ HPC revenue alongside a sizable GAAP net loss of $91.3 million driven largely by accelerated depreciation. It also details a recent ATM equity raise and continued build-out of Bitcoin hashrate and AI GPU capacity. Investors may focus on the balance between non-cash charges, dilution, and the company’s ability to translate its expanding infrastructure into sustained, high-margin, recurring revenue.

Key Terms

short form base shelf prospectus regulatory

adjusted ebitda financial

exahash per second technical

ppa financial

gpu technical

at-the-market offering financial

arr financial

AI-generated analysis. Not financial advice.

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated November 25, 2025 to its short form base shelf prospectus dated October 31, 2025.

San Antonio, Texas--(Newsfile Corp. - February 17, 2026) - HIVE Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0) (BVC: HIVECO) (referred to as the "Company" or "HIVE"), a global leader in sustainable data center infrastructure, announced its results for the third quarter ended December 31, 2025 (all amounts in US dollars, unless otherwise indicated).

HIVE delivered record quarterly revenue of

This quarter marks the strongest "dual-engine" growth in HIVE's history, driven by the rapid scale-out of its Bitcoin hashrate fleet to an installed base of 25 Exahash per Second ("EH/s") by period end December 31, 2025 and accelerating demand for BUZZ HPC platforms.

Q3 FY2026 Financial Highlights:

- Total Revenue:

$93.1 million , a219% increase from$29.2 million in Q3 FY2025 and a7% increase over last quarter. Gross operating margin was$32.1 million or35% 3, up from18% in fiscal Q3 FY2025. See the calculation of direct costs and mining margin included below in this press release.

- Digital Currency Hashrate Revenue:

$88.2 million , up8% from Q2 FY2026, reflecting a41% quarter-over-quarter increase in average hashrate to 22.9 EH/s, partially offset by approximately10% lower Bitcoin prices and15% higher network difficulty. This hashrate revenue was achieved at a direct cost of$57.8 million , of which approximately90% is energy costs. See the calculation of direct costs included below in this press release.

- Bitcoin Output: Generated 885 Bitcoin, representing a

23% quarter over quarter increase, despite a15% rise in network difficulty.

- HPC Revenue: BUZZ HPC revenue was

$4.9 million during the quarter. This revenue was achieved against direct costs of$2.3 million .

- G&A:

$8.4 million , up from$7.8 million in Q2 2026, primarily as a result of increased staff to support HIVE's global expansion, including Paraguay, and the BUZZ HPC business. Notably, while gross operating margin increased more than 6x year-over-year, corporate G&A grew only 1.8x over the same period, demonstrating operating leverage and disciplined scaling.

- Net Loss: GAAP net loss of

$91.3 million was primarily driven by$57.4 million in accelerated depreciation related to the Paraguay expansion and non-cash revaluation adjustments. The loss reflects HIVE's decision to depreciate the next-generation ASIC fleet over a two-year cycle, rather than the typical four-year schedule, to reflect the faster pace of efficiency improvements and shorter economic lives of new ASICs-a conservative approach aligned with our strong growth in Paraguay and focus on operating income.

- Adjusted EBITDA1:

$5.7 million .

OPERATING PERFORMANCE: SCALE WITH DISCIPLINE

Infrastructure Expansion

- Completed Paraguay Buildout and Achieved 25 EH/s: Operating 440 megawatts ("MW") of global, hydro-powered capacity with 25 EH/s installed and 22.9 EH/s average operational hashrate, while reaching 17.5 Joules per Terahash ("J/TH") fleet efficiency; record completion of 300 MW of green-energy Tier-I infrastructure brought online in 6 months (from May 2025 to November 2025).

- Land & Power: The company signed an additional 100 MW PPA in Yguazú and bought 10 hectares of land, with energization targeted for Q4 2026. This maintains our growth in Paraguay by an additional 10 EH/s. Subsequent to the quarter end, the Company has purchased an additional 63 hectares of land.

Positioning for AI and HPC Growth

Future Capacity & Growth Outlook

- Accelerating AI Revenue: In February 2026, the Company signed a 2-year,

$30 million contract for 504 Nvidia B200 GPUs. Expected deployments to be live in calendar Q1 2026 at Bell's Tier-III facility; adds ~$15 million of ARR and lifts HPC annualized revenue ~75% (from$20 million to$35 million ). Targeting$140 million ARR by Q4 2026 for GPU AI Cloud with 11,000 GPUs, subject to market conditions and successful infrastructure deployment.

- BUZZ's Growth Plan: Targeting

$225 million ARR for total HPC revenue (HPC Tier-III colocation at HIVE's New Brunswick 70 MW Tier-I data center to be converted to 50 MW of IT Load for Tier-III hyperscaler colocation, estimated to generate$85 million ARR in addition to the GPU AI Cloud revenue) by end of calendar 2026 or early 2027 as GPU cloud and colocation capacity expands.

- Strengthened Runway for Scalable Compute: By year-end, HIVE expects to operate a 540 MW energy footprint (440 MW currently operating, plus the additional 100 MW PPA contracted). Existing and incremental megawatts will be evaluated to preserve flexibility for highest-value deployments - toward expanding EH/s or supporting future AI and high-performance computing workloads.

Management Insights

Frank Holmes, HIVE's Executive Chairman, stated, "This quarter marked an inflection point for HIVE. We delivered record revenue, scaled our renewable-powered Tier-I hashrate platform to 25 EH/s and accelerated our AI strategy. These milestones reflect disciplined execution across both engines of our business - Bitcoin hashrate services as the cash generator and BUZZ as our high-growth HPC platform, positioning HIVE for diversified, recurring revenue growth. Demand for AI compute continues to rise, and HIVE is leveraging its long track record in high-performance compute infrastructure and deep technical expertise in AI cloud services and data center operations to capture that opportunity. Notably, we are also positioning Paraguay to be a leader in HPC for Latin America. With abundant and stable green energy, and a government that is strongly-aligned with the United States, we believe Tier-III data centers are the future in Paraguay. Our future deployments in Paraguay will have the architecture and infrastructure footprint for Tier III future deployments as we build out our powered land. Our team has ordered the substation for the additional 100 MW at Yguazú, which we expect to come online in calendar Q3 2026. Moreover, the Company has a strategic alignment with Paraguay's largest Tier III telecom datacenter operator, where we are sending a cluster of high-performance GPUs which will operate on the BUZZ AI Cloud out of Asuncion. Thus, by laying the foundation for long-term and rapid scale HPC Tier III Data Center deployment with our next 100 MW in Yguazú, and curating HIVE's first Latin America GPU AI cloud proof-of-concept this quarter from Asuncion, our vision is to be a first mover in Latin America, powering the AI industrial revolution with renewable energy from Paraguay. HIVE will be a key economic driver for Paraguay, as we anticipate materially contributing to the GDP growth of the country through our data center construction expenditures and stable and long-term consumption of power from the Itaipu Dam, which will strengthen Paraguay's domestic energy market and drive revenue for ANDE and the government. President Santiago Pena has demonstrated great leadership, along with Marcos Riquelme and Ruben Ramirez Lezcano, which gives us the confidence to advance our investments into Paraguay."

Mr. Holmes continued, "Our wholly owned subsidiary, BUZZ AI has begun to demonstrate the scale of its earnings power. With this growth, our early-stage Paraguay platform becomes even more strategic, as we partner with a leading Tier-III telecom data center operator in the country and deploy our first cluster of high-performance GPUs into that facility, demonstrating that our GPU chips have arrived and that Paraguay can be a cornerstone market for BUZZ in Latin America. Tier-I data centers are a critical first step in building the power and infrastructure backbone required for future Tier-III AI and HPC campuses, and we see them as the key runway for grid build-out and long-term capacity planning across our global platform. This is the strategy we are executing in Canada and Sweden today, and now in Paraguay as we develop large-scale, renewable-powered Tier-I capacity that can be systematically upgraded into Tier-III AI and HPC data centers over time."

Aydin Kilic, President & CEO, stated, "This quarter demonstrated HIVE's execution in both our Tier-I hashrate platform and GPU AI Cloud. Our business has scaled substantially over the last year. Notably, our gross operating margin has increased over 6x YoY, from

Darcy Daubaras, HIVE's CFO, stated, "This quarter demonstrates strong revenue growth and operating margin expansion despite a more competitive hashrate environment. Accelerated depreciation impacted net income, but reflects conservative accounting and disciplined balance sheet management. We believe our cost structure and renewable power strategy position us to generate attractive operating margins as competition increases."

Strategic Positioning

HIVE's "dual-engine" strategy - Bitcoin infrastructure as cash generator and BUZZ AI Cloud as high-growth recurring revenue - provides diversification and capital allocation flexibility.

The Company remains focused on:

- Expanding gross operating margin

- Scaling recurring AI revenue

- Maintaining disciplined G&A growth

- Preserving balance sheet strength

With renewable-powered infrastructure across Canada, Sweden, and Paraguay, HIVE believes it is positioned to build a durable, margin-driven digital infrastructure platform through 2026 and beyond.

Conference Call Information

HIVE will hold its fiscal Q3 2026 earnings call on Tuesday, February 17 at 8:00 AM EST. To participate in this event, please log on or dial in approximately 5 minutes before the call.

Date: February 17, 2026

Time: 8:00 AM EST

Webcast: Registration link here

Dial-in: Provided after registration

Financial Statements and MD&A

The Company's Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three months ended December 31, 2025 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE's profile and on the Company's website at www.HIVEdigitaltechnologies.com.

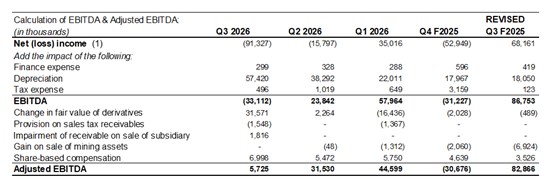

¹ The Company has presented certain non-GAAP measures in this report. The Company uses EBITDA and Adjusted EBITDA as a metric that is useful to management, the board and investors for assessing its operating performance on a cash basis before the impact of non-cash items and acquisition related activities. EBITDA is net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for by removing other non-cash items, including share-based compensation, finance expense, depreciation and one-time transactions. The following table provides an illustration of the calculation of EBITDA and Adjusted EBITDA for the last five quarters:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/284123_4dc33d3a64b539ce_002full.jpg

² Net realized and unrealized gains (losses) on digital currencies is calculated as the change in fair value (gain or loss) on the coin inventory, and the gain (loss) on the sale of digital currencies which is the net difference between the proceeds and the carrying value of the digital currency.

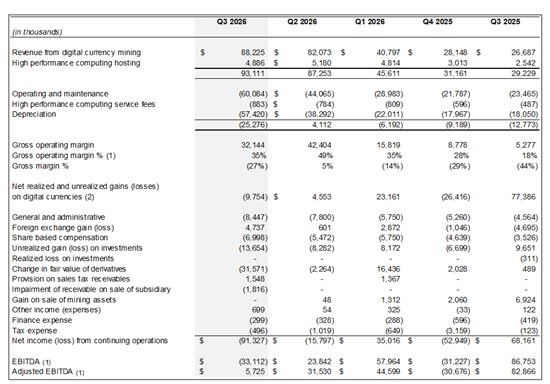

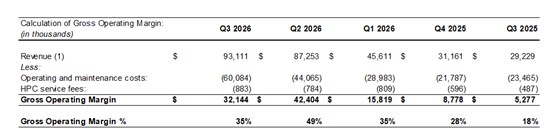

³ The following represents the Revenue and related costs that comprise the gross mining margin. We include connectivity, security, data center maintenance, and electrical equipment maintenance. Electrical costs may vary quarter over quarter.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/284123_4dc33d3a64b539ce_003full.jpg

*Average revenue per BTC is for hashrate services operations only and excludes HPC operations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/284123_4dc33d3a64b539ce_004full.jpg

⁴ References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

Quarterly ATM Sales Report

For the three-month period ended December 31, 2025, the Company issued 4,925,948 common shares (the "November 2025 ATM Shares") pursuant to the at-the-market offering commenced in November 2025 (the "November 2025 ATM Equity Program") for gross proceeds of C

About HIVE Digital Technologies Ltd.

Founded in 2017, HIVE Digital Technologies Ltd. is the first publicly listed company to mine digital assets powered by green energy. Today, HIVE builds and operates next-generation Tier-I and Tier-III data centers across Canada, Sweden, and Paraguay, serving both Bitcoin and high-performance computing clients. HIVE's twin-turbo engine infrastructure-driven by hashrate services and GPU-accelerated AI computing-delivers scalable, environmentally responsible solutions for the digital economy.

For more information, visit hivedigitaltech.com, or connect with us on:

X: https://x.com/HIVEDigitalTech

YouTube: https://www.youtube.com/@HIVEDigitalTech

Instagram: https://www.instagram.com/hivedigitaltechnologies/

LinkedIn: https://linkedin.com/company/hiveblockchain

On Behalf of HIVE Digital Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information, please contact:

Nathan Fast, Director of Marketing and Branding

Frank Holmes, Executive Chairman

Aydin Kilic, President & CEO

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes but is not limited to: the acquisition of the new sites in Paraguay and Toronto and their potential, the timing of it becoming operational; business goals and objectives of the Company, including its target hashrate milestones and the costs to achieve the milestones; the results of operations for the three and nine months ended December 31, 2025; the expected costs of maintaining and growing its operations; financial information related to annualized run rate; the acquisition, deployment and optimization of the hashrate fleet and equipment; the continued viability of its existing Bitcoin hashrate services operations; the receipt of government consents; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to: the inability to complete the construction of the Paraguay acquisition on an economic and timely basis and achieve the desired operational performance; the ongoing support and cooperation of local authorities and the Government of Paraguay; the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our hashrate facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's ATM Program and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency hashrate assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of Tier-I hashrate services in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate Tier-I hashrate assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of pandemics on the business of the Company, including but not limited to the effects of pandemics on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedarplus.ca.

The forward-looking information in this news release reflects the Company's current expectations, assumptions, and/or beliefs based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance, and accordingly, undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284123