Hut 8 Energizes Vega Data Center

Rhea-AI Summary

Hut 8 Corp. (Nasdaq | TSX: HUT) has announced the initial energization of Vega, believed to be the largest single-building Bitcoin mining facility by nameplate hashrate. The 205-megawatt facility spans 162,000 square feet and will support up to ~15 exahash per second (EH/s) of BITMAIN U3S21EXPH servers, representing nearly 2.0% of current global Bitcoin network hashrate.

The facility features a proprietary, rack-based, direct-to-chip liquid cooling system supporting ASIC deployments at densities of up to 180 kilowatts per rack. BITMAIN has committed to the full ~15 EH/s deployment under an ASIC colocation agreement expected to generate $110-120 million in annualized revenue upon full energization. The agreement includes a purchase option allowing Hut 8 to acquire the hosted fleet in up to three tranches.

Key technical specifications include a power usage effectiveness (PUE) of 1.06, capacity to host 17,280 BITMAIN U3S21EXPH servers, and 96 custom-designed cooling modules. The project was completed in under a year at an estimated cost of $430,000-450,000 per MW of nameplate capacity.

Positive

- None.

Negative

- Significant capital investment required ($430,000-450,000 per MW)

- High concentration risk with single client (BITMAIN) for entire facility

- Exposure to ERCOT energy pricing volatility affecting revenue

- Facility uptime uncertainty could impact projected revenue

News Market Reaction

On the day this news was published, HUT gained 5.32%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

205 MW facility will support up to ~15 EH/s of next-generation rack-based ASIC compute with direct-to-chip liquid cooling

Believed to be the largest single-building Bitcoin mining facility by nameplate hashrate

MIAMI, June 30, 2025 (GLOBE NEWSWIRE) -- Hut 8 Corp. (Nasdaq | TSX: HUT) (“Hut 8” or the “Company”), an energy infrastructure platform integrating power, digital infrastructure, and compute at scale to fuel next-generation, energy-intensive use cases such as Bitcoin mining and high-performance computing, today announced the initial energization of Vega. Based on publicly available information, we believe Vega to be the largest single-building Bitcoin mining facility by nameplate hashrate. Spanning the equivalent of five football fields and covering 162,000 square feet, Vega is powered by 205 megawatts (“MW”) of nameplate energy capacity and at full energization will support up to ~15 exahash per second (“EH/s”) of BITMAIN U3S21EXPH servers for Bitcoin mining ASIC compute, or nearly

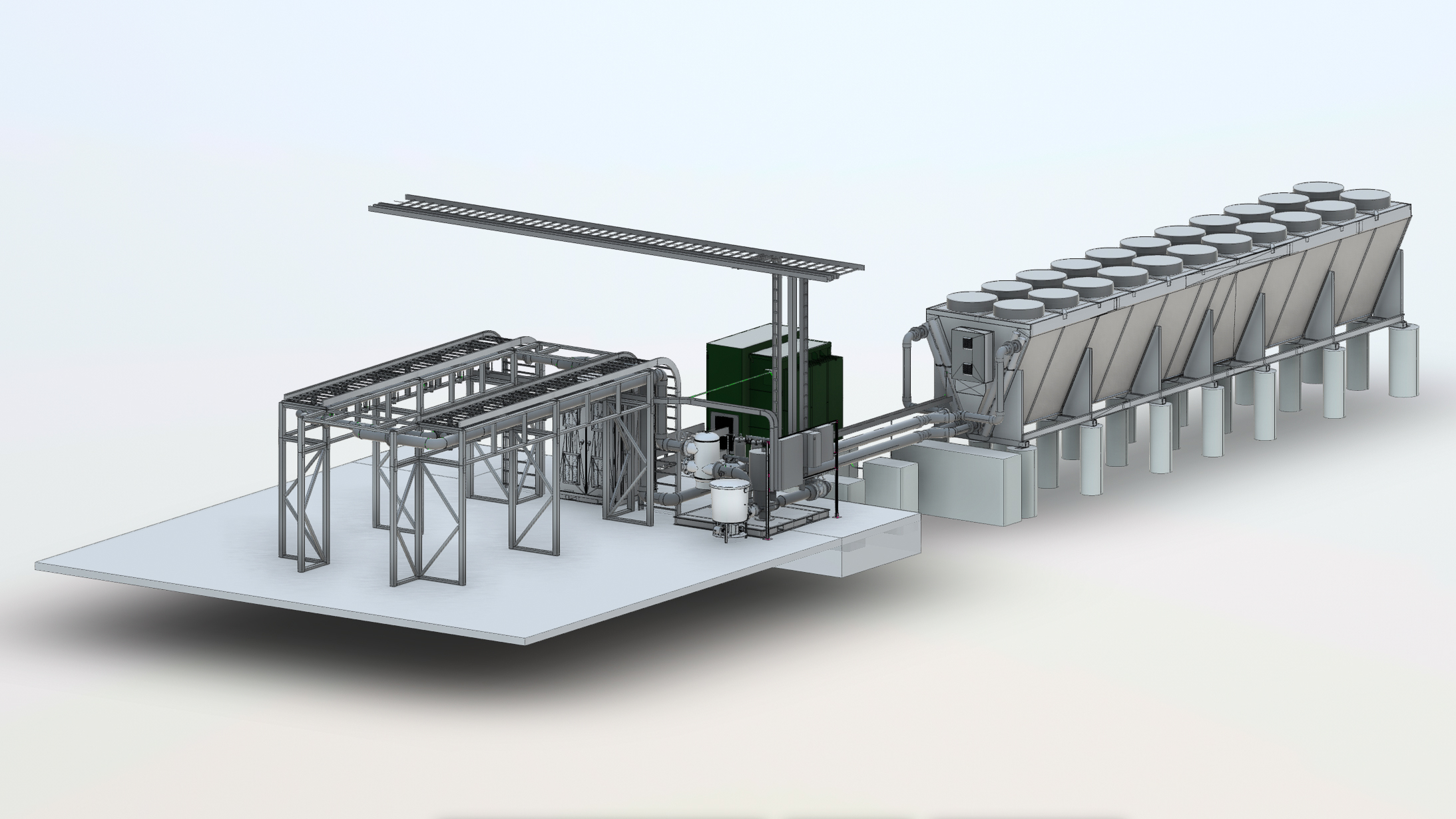

Vega debuts a new Tier I data center form factor that narrows the gap between legacy air-cooled ASIC infrastructure and liquid-cooled GPU infrastructure. Unlike traditional mining facilities that rely on forced-air cooling and shelving systems that constrain compute density, Vega features a proprietary, rack-based, direct-to-chip liquid cooling system designed in-house by Hut 8. The architecture supports ASIC deployments at densities of up to 180 kilowatts (“kW”) per rack.

The system’s modular architecture—including pump skids, fluid distribution networks, server racks, switchboards, and smart power distribution units—was designed by Hut 8’s in-house development organization to optimize thermal efficiency, miner stability, and operational reliability. The result is materially higher compute density, greater thermal control, and improved uptime in high-ambient environments like Texas. Initial customer discussions support the potential viability of this architecture for future iterations of high-density, direct-to-chip liquid cooled infrastructure to support emerging HPC workloads and customer needs.

“Vega exemplifies our innovation-driven approach to digital infrastructure design,” said Asher Genoot, CEO of Hut 8. “We built it for where we believe the market is going, using modular architecture and adaptive thermal systems designed to scale and evolve as workload requirements grow more complex. Over the past several weeks, as we’ve brought the site online, it has become clear how well this architecture performs under real-world conditions.”

“Vega’s design is particularly relevant for AI training and other non-customer-facing HPC workloads, where we believe speed, density, and cost efficiency will increasingly take precedence over traditional redundancy standards,” said Jake Palmer, Senior Vice President of Development at Hut 8. “The project represents a design philosophy we intend to scale, refine, and deploy as we continue to bridge the gap between high-cost, high-redundancy builds and lower-cost, application-optimized infrastructure.”

BITMAIN is the client for the full ~15 EH/s deployment at Vega under an ASIC colocation agreement. Based on ERCOT forward energy prices, the agreement is expected to generate between

“We are proud to have partnered with Hut 8 to successfully develop and commercialize the next generation of ASIC compute technology,” said Irene Gao, Vice President of Mining at BITMAIN. “Vega demonstrates what is possible when two industry leaders with deep technical expertise come together to push the boundaries of performance, efficiency, and design. We believe this collaboration has set a new benchmark for the industry, and we look forward to expanding on this success in the coming years.”

Project Highlights

- Industrial scale: 205 MW of nameplate capacity with a power usage effectiveness (“PUE”) of 1.06, powered behind-the-meter by a wind farm and front-of-the-meter by the ERCOT grid

- Rack-based architecture: Proprietary rack-based architecture supports 180 kilowatts per rack,

50% higher than the 120-kW requirement of NVIDIA Blackwell HGX GPUs - Next-generation ASIC compute technology: Site will host up to 17,280 BITMAIN U3S21EXPH servers (at full energization), the first ASIC miner mass-commercialized by BITMAIN with direct liquid-to-chip cooling within a U form factor, each delivering up to 860 terahash per second (“TH/s”) at 13 joules per terahash (“J/TH”)

- Direct-to-chip liquid cooling: 96 custom-designed cooling modules circulate 120,000 gallons of glycol-water solution through a closed-loop, reverse return system designed to reduce water consumption versus conventional high-density cooling systems

- Capital efficiency: Estimated all-in cost of approximately

$430,000 t o$450,000 per MW of nameplate capacity - Time to market: From site acquisition in July 2024 to initial energization in June 2025, Vega was brought online in under a year, demonstrating Hut 8’s ability to use Bitcoin mining infrastructure development to rapidly monetize power assets

- Commercialization through ASIC Colocation: BITMAIN will consume the full ~15 EH/s deployment at full energization pursuant to a colocation agreement that will generate revenue for Hut 8's Digital Infrastructure segment and includes a purchase option that, if exercised, would enable American Bitcoin to scale its self-mining capacity from 10 to ~25 EH/s

About Hut 8

Hut 8 Corp. is an energy infrastructure platform integrating power, digital infrastructure, and compute at scale to fuel next-generation, energy-intensive use cases such as Bitcoin mining and high-performance computing. We take a power-first, innovation-driven approach to developing, commercializing, and operating the critical infrastructure that underpins the breakthrough technologies of today and tomorrow. Our platform spans 1,020 megawatts of energy capacity under management across 15 sites in the United States and Canada: five Bitcoin mining, hosting, and Managed Services sites in Alberta, New York, and Texas, five high performance computing data centers in British Columbia and Ontario, four power generation assets in Ontario, and one non-operational site in Alberta. For more information, visit www.hut8.com and follow us on X at @Hut8Corp.

Cautionary Note Regarding Forward–Looking Information

This press release includes “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities laws and United States securities laws, respectively (collectively, “forward-looking information”). All information, other than statements of historical facts, included in this press release that address activities, events, or developments that Hut 8 expects or anticipates will or may occur in the future, including statements relating to the ability of the Vega facility to support up to ~15 EH/s of next-generation rack-based ASIC compute with direct-to-chip liquid cooling, the ability of Vega’s new Tier I data center form factor to narrow the gap between legacy air-cooled ASIC infrastructure and liquid-cooled GPU infrastructure, the ability of the infrastructure at the Vega facility to support ASIC deployments at densities of up to 180 kW per rack, the ability of the facility’s modular infrastructure to scale and evolve as workload requirements grow more complex, the performance of the infrastructure deployed at the Vega facility under real-world conditions, the relevance of the Vega design to AI training and other non-customer-facing HPC workloads, Hut 8’s intention to scale, refine, and deploy its design philosophy to bridge the gap between high-cost, high-redundancy builds and lower-cost, application-optimized infrastructure, the estimated revenues from the Bitmain colocation agreement and the factors impacting such revenues, the potential exercise of the ASIC purchase option and the benefits thereof to Hut 8 and American Bitcoin Corp., the total all-in cost to develop the Vega facility, and other such matters is forward-looking information. Forward-looking information is often identified by the words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “allow”, “believe”, “estimate”, “expect”, “predict”, “can”, “might”, “potential”, “predict”, “is designed to”, “likely,” or similar expressions.

Statements containing forward-looking information are not historical facts, but instead represent management’s expectations, estimates, and projections regarding future events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by Hut 8 as of the date of this press release, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking information, including, but not limited to, failure of critical systems; geopolitical, social, economic, and other events and circumstances; competition from current and future competitors; risks related to power requirements; cybersecurity threats and breaches; hazards and operational risks; changes in leasing arrangements; Internet-related disruptions; dependence on key personnel; having a limited operating history; attracting and retaining customers; entering into new offerings or lines of business; price fluctuations and rapidly changing technologies; construction of new data centers, data center expansions, or data center redevelopment; predicting facility requirements; strategic alliances or joint ventures; operating and expanding internationally; failing to grow hashrate; purchasing miners; relying on third-party mining pool service providers; uncertainty in the development and acceptance of the Bitcoin network; Bitcoin halving events; competition from other methods of investing in Bitcoin; concentration of Bitcoin holdings; hedging transactions; potential liquidity constraints; legal, regulatory, governmental, and technological uncertainties; physical risks related to climate change; involvement in legal proceedings; trading volatility; and other risks described from time to time in Company’s filings with the U.S. Securities and Exchange Commission. In particular, see the Company’s recent and upcoming annual and quarterly reports and other continuous disclosure documents, which are available under the Company’s EDGAR profile at www.sec.gov and SEDAR+ profile at www.sedarplus.ca.

Hut 8 Corp. Investor Relations

Sue Ennis

ir@hut8.com

Hut 8 Corp. Public Relations

Gautier Lemyze-Young

media@hut8.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/99a463ce-e274-4ee7-a8e4-e134abc19825

https://www.globenewswire.com/NewsRoom/AttachmentNg/30d0ece1-8f33-4444-b754-a4c5f49538e5

https://www.globenewswire.com/NewsRoom/AttachmentNg/33bbd349-a468-455f-b11a-8cbaaad40232