Idaho Strategic Provides Exploration and Development Update - Spanning its Entire Asset Base

Rhea-AI Summary

Idaho Strategic Resources (NYSE American:IDR) has provided a comprehensive update on its exploration and development activities across its precious metals and critical minerals projects. The company's Golden Chest Mine continues production while expanding exploration with two active drill rigs and development of paste backfill system. IDR has initiated surface drilling in the Murray Gold Belt, completed a first-phase drill program at Eastern Star, and is advancing critical minerals exploration at Mineral Hill, Lemhi Pass, and Diamond Creek.

The company has also expanded its portfolio with the Oxford copper project, where a 3D IP geophysics survey is planned for summer 2025. IDR's strategy leverages its gold production to fund exploration across its diverse asset base, positioning itself as the largest rare earth elements landholder in the United States while maintaining gold production growth.

Positive

- Active exploration across entire property portfolio with multiple drill programs underway

- Strong gold production and prices enabling increased exploration investment

- Development of paste backfill system and new Murray Mill at Golden Chest Mine

- Strategic position as largest rare earth elements landholder in the US

- Solid balance sheet and strong share structure supporting growth

Negative

- Drilling challenges at Eastern Star project including clay alteration and weather conditions

- Oxford copper project remains extremely underexplored with limited historic data

- Multiple early-stage projects requiring significant capital investment

News Market Reaction – IDR

On the day this news was published, IDR declined 4.88%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

COEUR D'ALENE, IDAHO / ACCESS Newswire / June 25, 2025 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is pleased to share an update on exploration and development activities across its extensive portfolio of precious metals and critical minerals projects.

John Swallow, President and CEO of Idaho Strategic Resources commented, "With our annual meeting this Monday, increased activity around the Russell reconstitution, and production moving as expected- by almost any measure the breadth of activity underway at IDR is impressive. We have spent many years building the gold production side of the Company's business plan while also building an asset base, strong balance sheet and share structure to not only capitalize on today but have the flexibility to strategically position for what comes next. With the help of solid gold grades, a strong gold price and being a producing gold company, IDR finds itself in a position to invest in the exploration side of its business plan like never before. For the first time ever, we are testing drill targets and advancing exploration plans across the entirety of our extensive property portfolio. Below is an overview of our multi-tiered exploration and development activities thus far in 2025:"

Precious Metals

Golden Chest Mine: The Golden Chest continues to be the busiest of the Company's assets. In addition to production as usual, 2025 has seen a significant increase in the amount of exploration and development work on-site. On the development front, the Company is continuing with the buildout of the paste backfill system and its plans for the new Murray Mill (Figures 1 & 2). The second quarter saw the completion of four bore holes drilled from the surface into the existing underground infrastructure to facilitate the eventual pumping of paste underground for backfilling stopes, additional equipment purchases were made as a part of the Company's Murray Mill plans, and construction began on a new storage building located between the Company's existing core shed and the mechanic's shop (Figures 3 & 4). Additionally, late in the second quarter, Small Mines Development ("SMD") was mobilized to develop two underground drill stations in the northern part of the Golden Chest Mine. The two drill stations are necessary for better drilling orientations of the Red Star area and targeting multiple known veins in the footwall of the Idaho Fault, such as the Claggett and Popcorn veins.

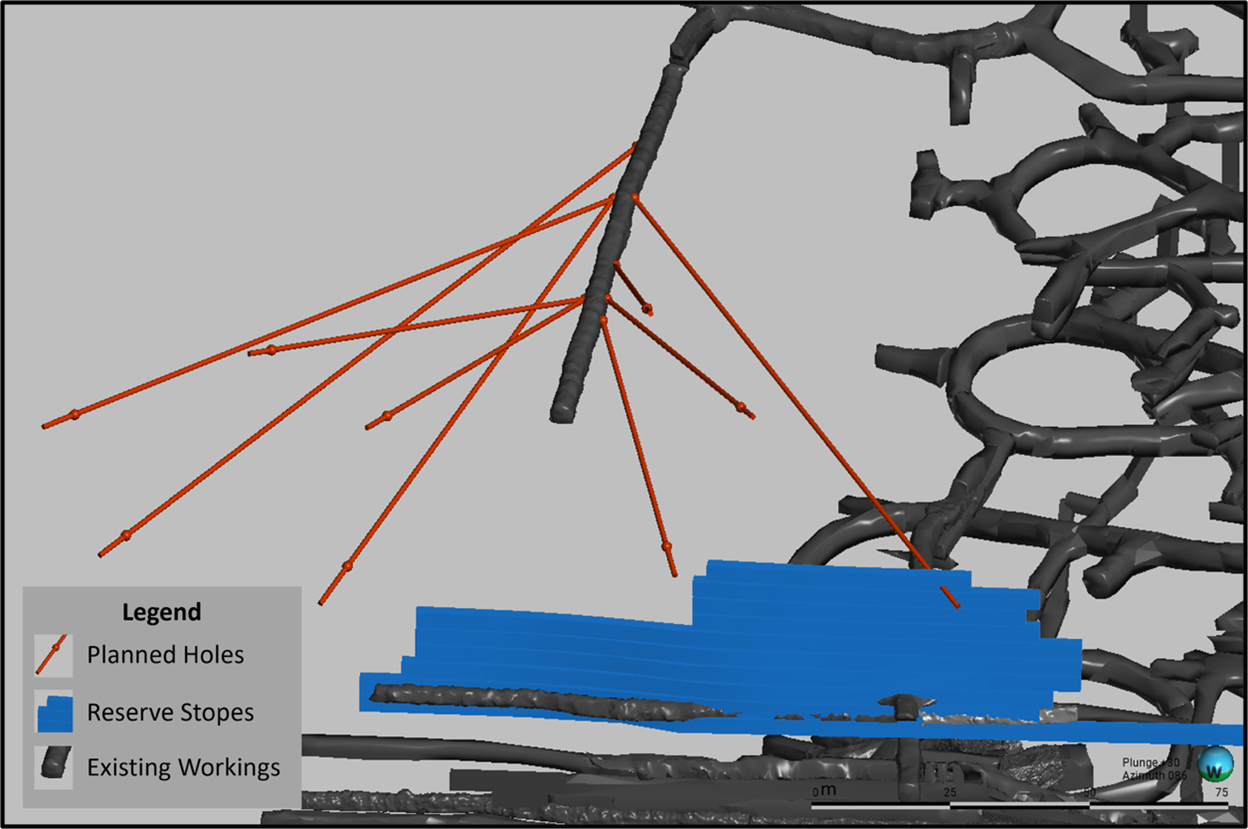

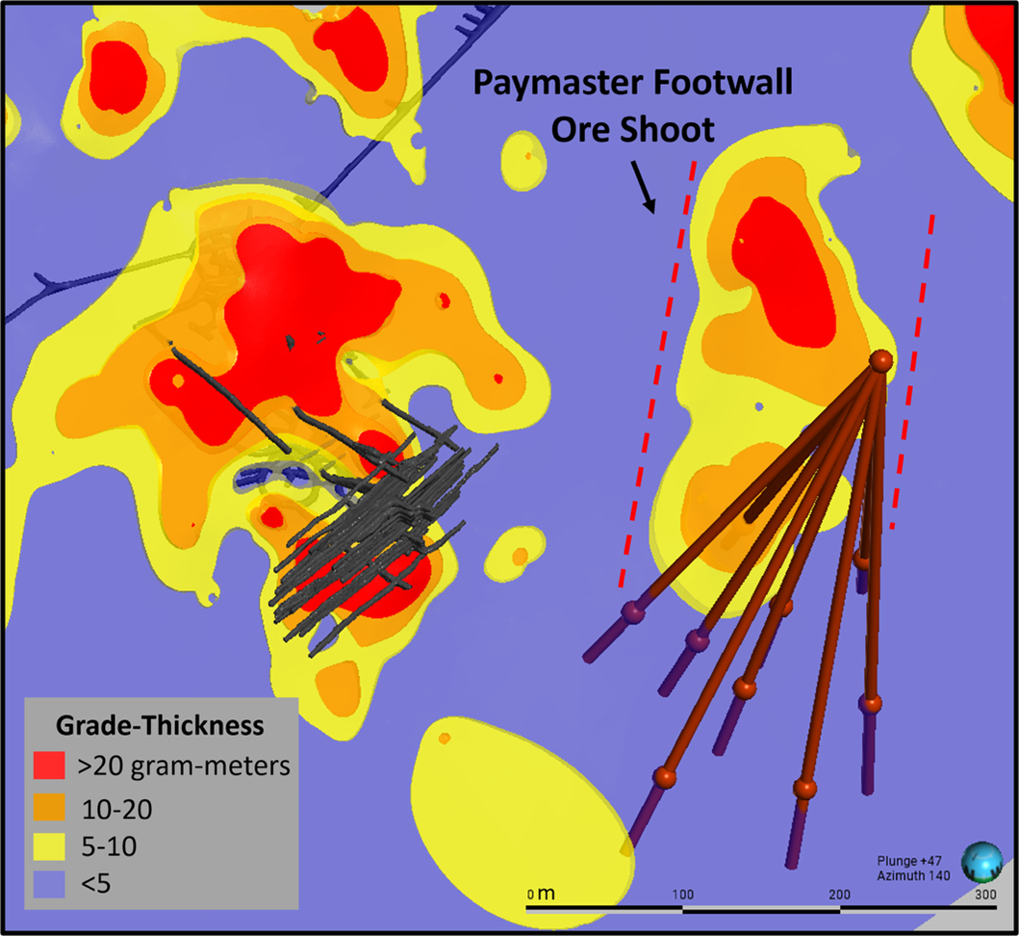

On the exploration front, there are currently two drill rigs turning at the Golden Chest Mine, one underground and one on the surface. The drill rig underground is primarily drilling infill targets on the H-Vein north and updip of the current underground workings (Figure 5). The timeline for this infill drill program is coinciding with the development timeline for the two additional underground drill stations being developed by SMD, which should allow for a seamless move to those stations upon completion. The surface drill rig at the Golden Chest was mobilized to the site in mid-June and is following up on promising drill results from the Paymaster Footwall Vein. The planned program is designed to test the Paymaster Vein downdip from the current resource and will consist of approximately 9 holes for 3,000 total meters (Figure 6).

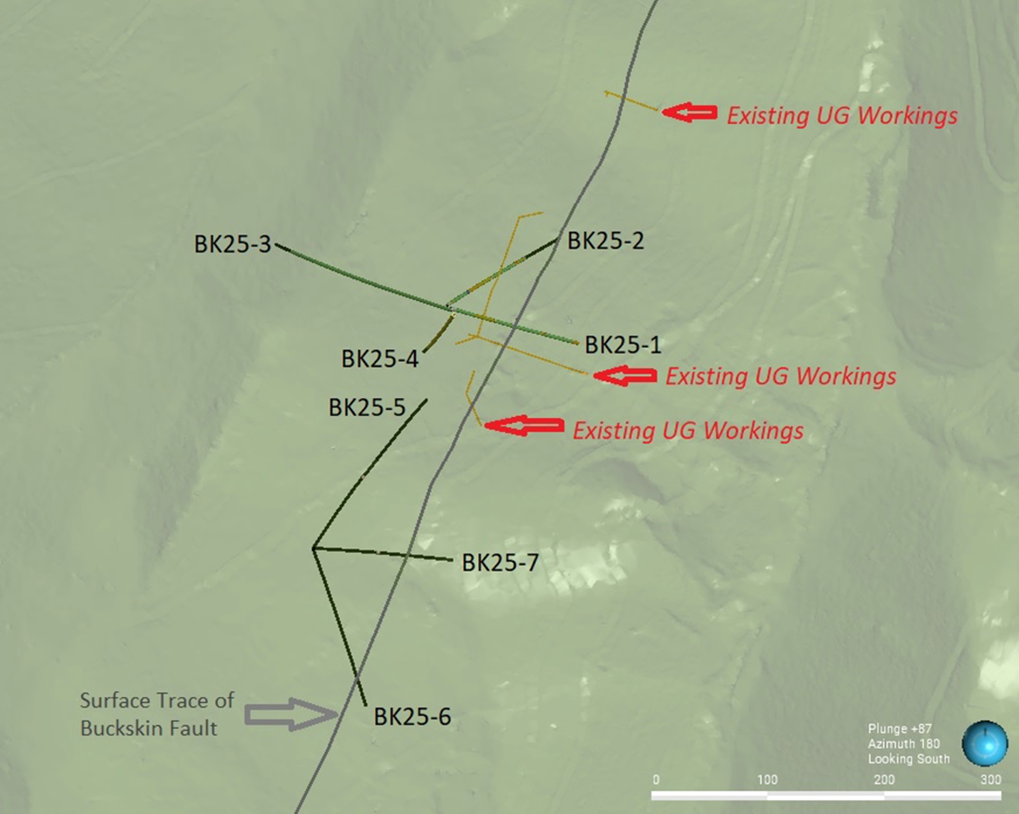

Murray Gold Belt: Surface drilling in the Murray Gold Belt began at the start of June. The drilling planned in the Murray Gold Belt this summer is designed to provide a 1st phase drill test of various prospects throughout the district. IDR's geologists have had drill programs in mind for many of these prospects for years, and only just now has the Company had the cash flow and resources to put those plans into action. Drilling throughout the Murray Gold Belt is expected to continue throughout the summer with at least 5 different prospects being tested. Thus far, 7 holes have been completed at the Company's Buckskin prospect. The drill program outlined at the Buckskin prospect is targeting a large fault structure and its associated gold-bearing veins; identified by historic adits, trenching, and magnetics (Figure 7). Following a sufficient 1st phase test of the Buckskin prospect, the drill rig will be moved to the King Mine prospect to test a set of parallel gold-bearing quartz veins referenced in historic literature and seen in surface work conducted by IDR (see Figure 8 for an overview of approximate prospect locations within the Murray Gold Belt).

Eastern Star: Idaho Strategic completed a 1st phase drill program at its Eastern Star project located near Elk City, Idaho during the months of April and May this year. The 1st phase drill program was designed to test areas beneath a surface trenching program that yielded positive results in 2014. The recently completed drill program totaled 13 holes for 1,965 meters and tested various targets from three different locations across the property. IDR specifically targeted narrow vein, high-grade underground structures rather than lower-grade, bulk minable mineralization commonly targeted at nearby projects within the Orogrande Shear Zone. While there were challenges faced throughout the program, including clay alteration and tough drilling in certain areas as well as difficult weather conditions, the Company believes that the program was ultimately successful, and a visual review of the drill core shows some promising intercepts. IDR geologists are looking forward to receiving the final multi-element assay results from ALS Chemex later in the summer.

Critical Minerals

Mineral Hill: During the second quarter, IDR completed its planned LiDAR and magnetics geophysical drone survey on its extensive landholdings in the Mineral Hill area and scheduled a follow-on radiometrics drone survey to be completed next month. While the results of the comprehensive dataset have not yet been received, the Company is extremely encouraged by the magnetics "bullseye" data viewed to date. Due to the presence of magnetite within the carbonatites at Mineral Hill, the magnetics survey picked up the known rare earth bearing carbonatites well and identified additional areas of similar magnetics readings within the Company's project boundary that have yet to be visited by IDR's geologists, making for additional high priority exploration targets during the remainder of 2025 (see also Lemhi Pass plans below).

Lemhi Pass: The planned widespread soil sampling (approx. 2,000 samples) and ground-based radiometrics program at Lemhi Pass is well underway by an experienced crew of contractors. This phase of work is targeting high-potential prospects where known rare earth elements mineralization occurs. Additionally, after seeing the effectiveness of the magnetics program at Mineral Hill, the Company has decided to contract the same - yet considerably larger - survey at Lemhi Pass to compliment the current work planned for the summer. The geophysical work completed at both Mineral Hill and Lemhi Pass will aid immensely as IDR plans for future drilling at both projects as the next phase of its rare earth exploration plans.

Diamond Creek: IDR's Diamond Creek project is currently planned to be advanced through an initial trenching program at both the Simer and Frank Burch prospects, with possible drilling late in the season pending successful trenching results. Simer and Frank Burch are two prospects on-strike from Diamond Creek's Lucky Gem and Contact prospects, which were successfully trenched and drilled in 2022. In addition to drilling and trenching yielding wide intercepts exceeding

Additional Projects

Oxford: Idaho Strategic added the Oxford copper project to its mineral portfolio in 2024. The Oxford project is located near the town of Pierce, Idaho approximately 3.5 hours south of the Company's headquarters in Coeur d'Alene, Idaho. The Oxford project consists of approximately 3,000 total acres, made up of a combination of state mineral lease land and unpatented mining claims. While the Oxford project is extremely underexplored and lacks substantial geologic data, IDR's geologists believe it to be a compelling exploration stage project with the target being a potential buried copper porphyry. Similar copper porphyry targets have recently been discovered in Idaho and share some of the characteristics expressed by the Company's Oxford project to date. Thus far, IDR has carried out multiple soil sampling programs showing anomalous copper-in-soil results and revealing high-grade grab samples near the collapsed shaft of the historic Oxford copper mine- a small underground copper mine located on the property with limited historic data available. Idaho Strategic's plan to further test its hypothesis for a potential buried copper porphyry is to complete a 3D IP geophysics survey to test the chargeability and resistivity of the rock deep beneath the surface. All necessary approvals from the state have been received and the contractor is scheduled to complete the planned work this summer. The results of the 3D IP geophysics survey will likely determine the next steps in the exploration of this project.

Idaho Strategic's President and CEO, John Swallow concluded, "Now is the time to make the additional investment in our future. Corporate growth in the mining industry is almost never a linear path, however given the (now well documented) multi-generational convergence of a lack of US investment in domestic-sourced commodities, currency challenges and global uncertainty, I believe that IDR's timing and prior investment in its production-backed exploration business plan provides our stakeholders with the most optimized risk-reward ratio and more importantly, the most downside protection while pursuing production growth and next phase asset expansion. Simply put, there's no such thing as being a little bit pregnant. We have a favorable deck and first and third bases are strong. With our expanded team and experienced leaders, this is the year to pull-forward our efforts and invest further in IDR's first mover/early-mover positions."

Figures 1 & 2: Paste Backfill Plant and Murray Mill Building

Figures 3 & 4: New Shop Building Under Construction- Looking North (left) and East (right)

Figure 5: Underground Drill Plans from the 888 Attack Ramp Testing the H-Vein Updip and to the North

Figure 6: Surface Drill Plans to Test the Paymaster Vein Downdip of Current Resource

Figure 7: 1st Phase Buckskin Drill Program

Figure 8: Approximate Locations of Murray Gold Belt Prospects

About Idaho Strategic Resources, Inc.

Idaho Strategic Resources (IDR) is an Idaho-based gold producer which also owns the largest rare earth elements land package in the United States. The Company's business plan was established in anticipation of today's volatile geopolitical and macroeconomic environment. IDR finds itself in a unique position as the only publicly traded company with growing gold production and significant blue-sky potential for rare earth elements exploration and development in one Company.

For more information on Idaho Strategic Resources, visit https://idahostrategic.com/presentation/, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Forward looking information includes references to drill core and samples looking visually good without assay results received, the potential for resource and/or reserve growth from drilling planned at the Golden Chest, the expected benefits of the underground drill station, the potential for positive exploration results from the geophysical surveys completed at the Company's rare earth projects, the potential for a buried copper porphyry at the Oxford project, the success of any of IDR's exploration plans, and ultimately management's belief that the Company's production-backed exploration business plan is beneficial to stakeholders by providing downside protection and a favorable risk/reward ratio. Investors should note that IDR's claim as the largest rare earth elements landholder in the U.S. is based on the Company's internal review of publicly available information regarding the rare earth landholdings of select companies within the U.S., which IDR is aware of. Investors are encouraged not to rely on IDR's claim as the largest rare earth elements landholder in the U.S. while making investment decisions. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks; inability to obtain permits required for future exploration, development or production; fluctuating mineral and commodity prices; and risks associated with the mining industry such as economic factors, ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View the original press release on ACCESS Newswire