Idaho Strategic Resources Provides 2022 Year in Review, Including Record 4th Quarter Revenue in Excess of $3m

Rhea-AI Summary

Idaho Strategic Resources (IDR) has reviewed its 2022 performance, highlighting key achievements including its up listing on the NYSE American and significant progress in rare earth elements projects. The company aims to reduce U.S. reliance on foreign minerals through various legislative efforts and partnerships. Notably, IDR recorded over $3 million in revenue for Q4 2022 and expanded its landholdings, now being the second largest REE landholder in the U.S. The management also proposed a business combination with Westwater Resources, advocating for stakeholder engagement.

Positive

- Achieved over $3 million in revenue for Q4 2022.

- Successful up listing on NYSE American in March 2022.

- Expanded landholdings, becoming the second largest REE landholder in the U.S.

- Progress made on rare earth elements projects, including Diamond Creek and Lemhi Pass.

Negative

- Westwater Resources management initially opposed the business combination proposal.

News Market Reaction

On the day this news was published, IDR gained 0.53%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

COEUR D'ALENE, ID / ACCESSWIRE / January 3, 2023 / Idaho Strategic Resources (NYSE American:IDR) ("IDR" or the "Company") is pleased to provide the following review of 2022 and objectives for 2023.

Corporate Developments:

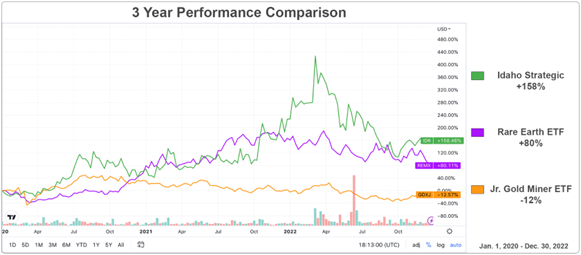

Early in 2022 Idaho Strategic added Rich Beaven to its Board of Directors and completed its up listing onto the New York Stock Exchange American in March. In celebration of IDR's up listing, the company rang the opening bell of the NYSE from underground at the Golden Chest Mine, becoming the first company in history to do so. Following the up listing, Idaho Strategic's management participated in the "Idaho Mining, Critical Minerals, and Water Resources" panel discussion in Boise, ID, appeared as a guest on the Planet MicroCap Due Diligence Podcast, and attended the 18th Annual International Rare Earth Elements Conference. The panel, the podcast, and the conference were all indicative of the growing interest in domestic critical minerals, namely rare earth elements, amongst nontraditional stakeholders within the mining industry. IDR's operating history, proven track record of stewardship, and willingness to give all stakeholders a seat-at-the-table has proven to be both appreciated and beneficial (Figure 1).

Throughout 2022 there were several announcements/executive orders/bills proposed to President Biden and the U.S. Government with the goal of showing support for domestic critical mineral production in order to reduce the U.S.' reliance on foreign sources. The most notable of which were the Inflation Reduction Act, the recent expansion of the Defense Production Act, the Thorium Energy Security Act, the 2023 Omnibus Appropriations Bill, and the Industrial Base Policy Consortium. While many of these have been aimed at the processing and permitting of domestic critical minerals, the shift toward domestic mining has begun. IDR continues to advance its Diamond Creek, Roberts, and Lemhi Pass rare earth elements projects and continued expanding its partnerships with local stakeholders like Idaho National Labs, the University of Idaho, and the Idaho Geological Survey to potentially appeal to larger Government programs.

At the closing of 2022, IDR also announced a business combination proposal to Westwater Resources' Stakeholders. For a more comprehensive overview of IDR's offer, please read our press release dated Dec. 22nd, 2022. IDR's management continues to believe that the combination of the two companies represents an attractive opportunity for the stakeholders of both. While members of Westwater's management initially responded not in favor of the proposal, Idaho Strategic is a shareholder-focused company and believes that Westwater's shareholders deserve to have a voice with regard to the proposal. IDR's management has evaluated its next steps, beginning with a recent invitation to Westwater's management to engage in further discussion/negotiation.

Rare Earth Elements Projects:

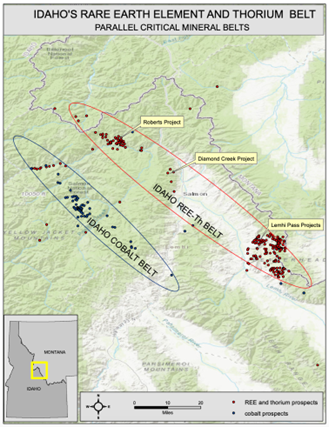

Since adding our Diamond Creek and Roberts rare earth elements projects in 2020, they have proven to be transformative additions for the Company and led to IDR's addition of Lemhi Pass in 2022, which is not only the largest known concentration of Thorium resources in U.S., but also a highly prospective rare earth element property as well. It became apparent to us during the year that the prior work and coverage conducted over the area has made ‘Lemhi Pass' a more well-known location amongst industry folks and academics. In 2022 IDR completed its inaugural drill program at Diamond Creek despite the Moose Fire doing its best to delay the program by nearly 3 months (see post-fire drill rig photo on IDR website). With the results from our drill program expected to be released early in 2023, IDR has taken a proactive approach by expanding its land position and partnerships within the industry. In addition to conducting one of the few REE drill programs in the country in 2022, Idaho Strategic is now the second largest rare earth elements landholder in the United States and has accumulated much of the land along the Idaho REE-Th Belt, which runs subparallel to the Idaho Cobalt Belt (Figure 2).

Also in 2022, Idaho Strategic announced its partnership in the IGEM Program along with the University of Idaho, Idaho National Labs, the Center for Advanced Energy Studies, and the Idaho Geological Survey in a research program to discover environmentally friendly processes for the separation and extraction of rare earth elements using drill core and surface samples from IDR's Diamond Creek property. The IGEM program is currently underway and is being funded by the Idaho Department of Commerce. In order to support Idaho Strategic's investment in its rare earth projects, the Company purchased a building in Salmon, ID during 2022 in part due to the obvious cost savings over time and to establish a more permanent presence in the community. The property was nicely setup for core cutting, storage, and living and will serve as a great base of operations for future exploration and development work.

Golden Chest Mine, Murray Gold Belt, and New Jersey Mill:

Rounding out Idaho Strategic's busy 2022 are the achievements the Company has made at its Golden Chest Mine and the surrounding Murray Gold Belt district. The Company experienced a very high success rate drilling at the Golden Chest Mine in 2022 leading to the further delineation of two ore shoots, the Klondike and the Paymaster, which are adjacent to the Skookum shoot. In September of 2022, the Company drove an exploration drift from the currently producing Skookum shoot into the nearby Klondike shoot to follow-up and confirm vein orientations, sizes, and grades that were discovered with the drill. Once the exploration drift into the Klondike began, IDR shifted the focus of its drilling to the Paymaster shoot for the remainder of 2022. With consistent and favorable results coming from the Paymaster drill program, the Company has plans to begin to drive a similar style exploration drift into the Paymaster shoot during 2023. Because we have the necessary skillsets (and the best miners in the area), it was presented to the team to determine if the Paymaster development under IDR's existing cost structure was feasible. This ‘goal' included the completion of ample development ahead of production in the Skookum in order to begin development toward the Paymaster without the need to greatly increase the current level of manpower.

In addition to the Company's favorable production-based drilling at the Golden Chest, Idaho Strategic conducted the first ever drill program on its additional 7,000 acres of contiguous patented and unpatented mining claims that surround the Golden Chest Mine within the Murray Gold Belt. On September 1st, 2022, IDR released favorable results from a drill hole in an area of land referred to as the Argus. The results from the Argus drill program help confirm IDR's belief that the Murray Gold Belt has district scale potential and remains as one of the last great undeveloped patented/private land holdings in the western U.S.

Beyond drilling/exploration, Idaho Strategic has advanced its gold production and is currently mining the 821-level underground within the Skookum shoot. Throughout 2022 IDR began its transition from a mix of underground and open pit operations to solely producing from underground. In response to softening gold prices and higher inflation in the second half of 2022, IDR implemented a revised mine plan which prioritized the higher-grade stopes on the North side of the Skookum ore shoot which has worked out favorably so far. Also in 2022, Idaho Strategic completed a ~

Idaho Strategic's President and CEO, John Swallow concluded, "Our track record and dedication to this Company speaks for itself. In addition to the above-mentioned accomplishments including over

Figure 1

Idaho Strategic's 3-year share performance compared to the VanEck Rare Earth ETF and the VanEck Junior Gold Miner ETF.

Figure 2

Idaho's Rare Earth Elements-Thorium Trend (REE-Th) which runs subparallel to the Idaho Cobalt Belt

About Idaho Strategic Resources, Inc.

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho), the largest known concentration of thorium resources in the U.S., and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more "at-risk" Rare Earth Elements (REE's) and Thorium. With over 11,000 acres of Rare Earth Element landholdings, the Company is the second largest REE landholder in the U.S. The Company's Diamond Creek and Roberts REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. IDR's Lemhi Pass Thorium-REE Project is recognized by the USGS and IGS as containing the largest concentration of thorium resources in the country. All three projects are located in central Idaho and are participating in the IGEM Program and the USGS Earth MRI program.

The Company produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d'Alene Mining District, north of the prolific Silver Valley. With over 7,000 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

With an impressive mix of mining and business experience, the folks at IDR maintain a long-standing "We Live Here" approach to corporate culture, land management, and historic preservation. Furthermore, it is our belief that successful operations begin with the heightened responsibility that only local oversight and a community mindset can provide. Its "everyone goes home at night" policy would not be possible without the multi-generational base of local exploration, drilling, mining, milling, and business professionals that reside in and near the communities of the Silver Valley and North Idaho.

For more information on Idaho Strategic Resources click here for our corporate presentation, go to www.idahostrategic.com or call:

Travis Swallow, Investor Relations & Corporate Development

Email: tswallow@idahostrategic.com

Phone: (208) 625-9001

Forward Looking Statements

This release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are intended to be covered by the safe harbor created by such sections. Often, but not always, forward-looking information can be identified by forward-looking words such as "intends", "potential", "believe", "plans", "expects", "may", "goal', "assume", "estimate", "anticipate", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, assumptions, intentions, or statements about future events or performance. Forward-looking information includes, but are not limited to, Idaho Strategic Resources targeted production rates and results, the expected market prices of gold, individual rare earth elements, and/or thorium, as well as the related costs, expenses and capital expenditures, the potential advancement of the Company's projects, the potential development into the Paymaster and/or Klondike shoots, and the economics of the Paymaster and Klondike shoots. Forward-looking information is based on the opinions and estimates of Idaho Strategic Resources as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of IDR to be materially different from those expressed or implied by such forward-looking information. Forward-looking information also includes the risks and uncertainties regarding the proposed acquisition of Westwater and the expected benefits and synergies from the proposed acquisition, results from due diligence and evaluation of Westwater assets, business plans, projects and current and ongoing required capex. There is no certainty that any transaction with Westwater will ultimately be agreed to or as to the terms on which such a transaction, if any, might occur. Idaho Strategic would also like to inform investors that the metrics used to determine Idaho Strategic is the second largest rare earth elements property holder come from reviewing the readily available publicly announced landholding of MP Materials, US Rare Earths, UCore, Rare Element Resources, and Western Rare Earths. Similarly, the metric used to determine that IDR's Lemhi Pass Thorium Project is the largest in the US comes from reviewing readily available public information reported by the USGS and has not been verified by IDR. IDR would also like investors to note that while Idaho Strategic works with the University of Idaho, Idaho National Labs, the Center for Advanced Energy Studies and the Idaho Geological Survey as a part of the IGEM Program, this does not serve as an indication or obligation that IDR will be successful in obtaining any additional government funded programs with the help of the aforementioned partners. The forward-looking statement information above, and those following are applicable to both this press release, as well as the links contained within this press release. With respect to the business of Idaho Strategic Resources, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreaks, if they occur, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; the accuracy of historic estimates; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms; the ability to operate the Company's projects; and risks associated with the mining industry such as economic factors (including future commodity prices, and energy prices), ground conditions, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward‐looking information is available in Idaho Strategic Resources filings with the SEC on EDGAR. IDR does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

SOURCE: Idaho Strategic Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/733755/Idaho-Strategic-Resources-Provides-2022-Year-in-Review-Including-Record-4th-Quarter-Revenue-in-Excess-of-3m