Coinbase Delivers on Q4 Financial Outlook, Doubles Total Trading Volume and Crypto Trading Volume Market Share in 2025

Key Terms

usdc financial

perpetual-style futures financial

derivatives financial

prediction markets technical

crypto-as-a-service technical

open interest financial

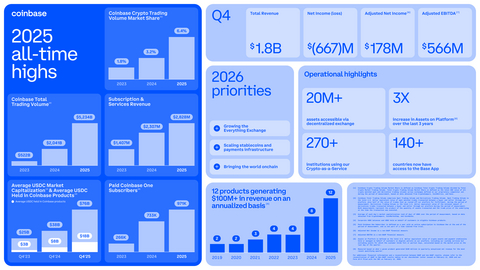

All-time high Coinbase Total Trading Volume, up

All-time high Coinbase Crypto Trading Volume Market Share up

All-time high Subscription and Services Revenue in 2025

All-time high Paid Coinbase One Subscribers in 2025, up 3x in 3 years

Everywhere/

All Q4 financial results were within expected ranges, reflecting strong operational discipline alongside accelerating product velocity.

“The Everything Exchange is working,” said Brian Armstrong, Co-founder and CEO. “In 2025, we drove all-time highs across our products: Coinbase One subscriptions reached ~1 million, trading volume and market share doubled, and USDC held on platform reached an all-time high. We’re in pole position to capitalize on whatever 2026 has in store. Already in Q1, we’ve had the highest 24 hour trading volume in over a year, as well as record-breaking volumes in gold and silver, DEX-enabled spot trading, and prediction markets.”

“2025 was a strong year for Coinbase, both operationally and financially,” said Alesia Haas, CFO. “We executed consistently against our goals, delivering or outperforming our revenue and expense guidance every quarter, and extending our multi-year track record of profitability. We also drove growth and diversification of revenue, reaching 12 products that generate more than

2025 All-time Highs

-

12 products that generate more than

$100 million -

Total Coinbase trading volume2 reached

$5.2 trillion 156% Y/Y -

Coinbase crypto trading volume market share of

6.4% , up 2x Y/Y -

Subscription and services revenue of

$2.8 billion -

Average USDC balances held in Coinbase products reached

$17.8 billion -

Average USDC market capitalization reached

$76.2 billion - Paid Coinbase One Subscribers almost 1 million, over 3x growth in three years

In Q4 and 2025, Coinbase demonstrated increasing product velocity against the Everything Exchange vision, a one-stop-shop where users can trade every asset class

-

Coinbase was first-to-market with 24/7

U.S. perpetual-style futures, contributing to a 4x increase inU.S. derivatives market share year-over-year - All-time highs in derivatives trading volume in Q4

- Internationally, Coinbase closed its acquisition of Deribit, becoming a global leader in crypto derivatives by open interest and options volume, and achieving new all-time highs in both volume and revenue since close

- Launched prediction markets and equities, expanding the asset classes we offer means our revenue is less correlated to crypto price fluctuations

- Coinbase is the trusted partner of choice for thousands of companies integrating crypto, including for over 270 Crypto-as-a-Service clients and 150 government agencies

As the most trusted crypto platform with the broadest product suite, we’re proud to share that customers now store more crypto at Coinbase than any other company. Assets on Platform3 increased 3x over the last three years. And in 2025, more than

Quarterly Conference Call

The Company will hold a webcast to discuss these financial results at 2:30 p.m. PT today. The live webcast of the call can be accessed here. Following the call, a replay of the call, as well as a transcript, will be available on the Investor Relations website at investor.coinbase.com.

Disclosure Information

In addition to filings with the Securities and Exchange Commission, the Company uses its Investor Relations website (investor.coinbase.com), its blog (blog.coinbase.com), press releases, public conference calls and webcasts, its X feed (@coinbase), Brian Armstrong’s X feed (@brian_armstrong), its LinkedIn page, and its YouTube channel as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These statements include, but are not limited to, statements regarding our future operating results and financial position; our business strategy and plans; expectations relating to our industry, the regulatory environment, market conditions, trends and growth; our market position; potential market opportunities; and our objectives for future operations. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on management’s expectations, assumptions, and projections based on information available at the time the statements were made. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions including those discussed in our SEC filings, including our Annual Report on Form 10-K for the year ended December 31, 2025 filed with the SEC on February 12, 2026. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

About Coinbase

Crypto creates economic freedom by ensuring that people can participate fairly in the economy, and Coinbase (Nasdaq: COIN) is on a mission to increase economic freedom for more than 1 billion people. We’re updating the century-old financial system by providing a trusted platform that makes it easy for people and institutions to engage with crypto assets, including trading, staking, safekeeping, spending, and fast, free global transfers. We also provide critical infrastructure for onchain activity and support builders who share our vision that onchain is the new online. And together with the crypto community, we advocate for responsible rules to make the benefits of crypto available around the world.

____________________ |

1 Measured based on when a given product generated

2 During the fourth quarter of 2025, we redefined Trading Volume to add our half of the trade value of spot trades that are routed off our platform for fulfillment, in order to provide a more comprehensive view of Trading Volume that drives our transaction revenue. Prior period amounts have been recast to conform to the current period’s definition.

3 Assets on Platform is defined as the total

View source version on businesswire.com: https://www.businesswire.com/news/home/20260212063960/en/

Press:

press@coinbase.com

Investor Relations:

investor@coinbase.com

Source: Coinbase Global, Inc.