NRSInsights’ November 2025 Retail Same-Store Sales Report

Rhea-AI Summary

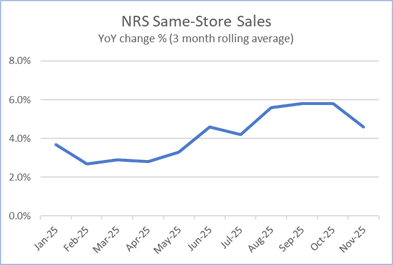

NRSInsights (IDT) reported November 2025 same-store retail results: same-store sales +3.8% year-over-year and a dollar-weighted average price for top 500 items +3.1% year-over-year. The NRS network comprised ~38,000 active terminals scanning purchases at ~32,900 independent retailers. For November the NRS POS processed $2.07 billion in sales (+14% YoY) across 135 million transactions. Month-over-month, same-store sales fell 0.7% versus October 2025; baskets (transactions per store) were down 0.9% YoY and 3.7% MoM. Three-month same-store sales through November rose 4.6% YoY. The report notes November data are derived from hundreds of millions of transactions across the NRS retailer base.

Positive

- Network sales of $2.07B in November (+14% YoY)

- Network scale of ~38,000 terminals covering 205 of 210 DMAs

Negative

- Same-store sales -0.7% month-over-month (Nov vs Oct 2025)

- Baskets per store -0.9% year-over-year in November

- Baskets per store -3.7% month-over-month in November

News Market Reaction

On the day this news was published, IDT gained 2.67%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

IDT fell 1.6% while peers were mixed: LILA -2.12%, LILAK -2.56%, GOGO -18.75%, but CCOI and IRDM rose modestly. Moves do not indicate a unified telecom sector direction.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Earnings results | Positive | +0.5% | Stronger revenue, record gross profit, and higher EPS year over year. |

| Dec 03 | Legal ruling | Positive | +2.1% | Delaware Supreme Court affirmed dismissal of all Straight Path claims. |

| Nov 17 | Product launch | Positive | -1.1% | Launch of HIPAA-compatible AI agent for healthcare communications. |

| Nov 14 | Earnings date notice | Neutral | +0.5% | Announcement of timing and access details for upcoming earnings call. |

| Nov 11 | Platform integration | Positive | +1.6% | NRS enabled Grubhub integration for independent retailers’ POS systems. |

Recent news has mostly seen modest positive price alignment, with only one notable divergence on a positive AI product launch.

Over the last month, IDT reported strong 1Q26 results with revenue of $322.8M and record gross profit, which was followed by a small positive price reaction. Legal overhang eased when Delaware courts dismissed Straight Path-related claims, aligning with a stronger 2.1% gain. Product and platform updates at NRS and net2phone, including a Grubhub integration and a healthcare-focused AI agent, drew mixed but generally mild reactions. Today’s NRSInsights sales report adds further detail on the performance of IDT’s retail network.

Market Pulse Summary

This announcement highlights continued growth in NRS’ independent retail network, with same-store sales up 3.8% year over year and total November sales of $2.07 billion, up 14%. It also notes rising basket prices, with a 3.1% inflation measure on top items. In the context of IDT’s recent strong quarterly results and ongoing product initiatives, investors may track whether transaction growth, unit volumes, and inflation trends at NRS remain supportive of the segment’s contribution to consolidated performance.

Key Terms

point-of-sale (POS) technical

forward-looking statements regulatory

AI-generated analysis. Not financial advice.

November same-store sales increased

The average price paid for the top 500 items in November increased

NEWARK, N.J., Dec. 09, 2025 (GLOBE NEWSWIRE) -- NRSInsights, a provider of sales data and analytics drawn from retail transactions processed through the National Retail Solutions (NRS) point-of-sale (POS) platform, today announced comparative retail same-store sales results for November 2025.

As of November 30, 2025, the NRS retail network comprised approximately 38,000 active terminals nationwide, scanning purchases at approximately 32,900 independent retailers, including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers, predominantly serving urban consumers.

November Highlights

(Same-store sales, unit sales, transactions, and average price data refer to November 2025 and are compared to November 2024 unless otherwise noted. All comparisons are provided on a “per calendar day” basis to remove from consideration variability in the number of days per month or three-month period.)

- SALES

- Same-store sales increased

3.8% year-over-year. In the previous month (October 2025), same-store sales increased5.7% year-over-year.

- Same-store sales increased

- Same-store sales decreased

0.7% compared to the previous month (October 2025). Same-store sales in October 2025 also decreased0.7% compared to the previous month (September 2025).- For the three months ended November 30, 2025, same-store sales increased

4.6% compared to the corresponding three months a year ago.

- For the three months ended November 30, 2025, same-store sales increased

- UNITS SOLD

- Units sold increased

0.9% year-over-year. In the previous month (October 2025), units sold increased1.3% year-over-year. - Units sold decreased

0.9% compared to the previous month (October 2025). Units sold in October 2025 decreased1.8% compared to the previous month (September 2025).

- Units sold increased

- BASKETS (TRANSACTIONS) PER STORE

- Baskets decreased

0.9% year-over-year. In the previous month (October 2025), baskets increased0.1% year-over-year. - Baskets decreased

3.7% compared to the previous month (October 2025). Baskets in October 2025 decreased2.6% compared to the previous month (September 2025).

- Baskets decreased

- AVERAGE PRICES

- A dollar-weighted average of prices for the top 500 items purchased in November increased

3.1% year-over-year, a slight increase from the3.0% year-over-year increase in October 2025.

- A dollar-weighted average of prices for the top 500 items purchased in November increased

Retail Trade Comparative Data

As a result of the recent government shutdown, U.S. Commerce Department’s Advance Monthly Retail Trade same-store sales data excluding food service for October has not been released.

Commentary from Brandon Thurber (VP, Data Sales & Client Success at NRS)

“NRS’ independent retailer network generated steady momentum in November, with transactions up

“Growth was driven by continued strong performance in key convenience categories, including cigarettes, RTD cocktails, smokeless tobacco, and energy beverages.

“Our measure of inflation in November reached

“These results highlight the resilience of everyday convenience spending and the value our retailers provide to their local communities.”

NRSInsights Reports

The NRSInsights monthly Same-Store Retail Sales Reports are intended to provide timely topline data reflective of sales at NRS’ network of independent, predominantly urban, retail stores.

Same-store data comparisons of November 2025 with November 2024 are derived from approximately 216 million transactions processed through the approximately 24,000 stores on the NRS network that scanned transactions in both months. Same-store data comparisons of November 2025 with October 2025 are derived from approximately 272 million transactions processed through approximately 32,000 stores.

Same-store data comparisons for the three months ended November 30, 2025 with the year-ago three months are derived from approximately 651 million transactions processed through those stores that scanned transactions in both three-month periods.

NRS POS Platform

The NRS platform predominantly serves small-format, independent, retail stores nationwide including convenience stores, bodegas, liquor stores, grocers, and tobacco and sundries sellers. These independent retailers operate in all 50 states and the District of Colombia, including 205 of the 210 designated market areas (DMAs) in the United States, and in Canada. During November 2025, NRS’ POS terminals processed

About National Retail Solutions (NRS):

National Retail Solutions operates a leading point-of-sale (POS) terminal-based platform and digital payment processing service for independent retailers nationwide. Retailers utilize NRS offerings to process transactions and effectively manage their businesses. Consumer packaged goods (CPG) suppliers, brokers, analytics firms, and advertisers access the terminal’s digital display network to reach these retailers’ predominantly urban, multi-cultural shopper base, and to harness transaction data-based learnings to identify growth opportunities and measure execution and returns on marketing investment. NRS is a subsidiary of IDT Corporation (NYSE: IDT).

All statements above that are not purely about historical facts, including, but not limited to, those in which we use the words “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “target” and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially from the results expressed or implied by these statements due to numerous important factors. Our filings with the SEC provide detailed information on such statements and risks, and should be consulted along with this release. To the extent permitted under applicable law, IDT assumes no obligation to update any forward-looking statements.

NRSInsights Contact:

Brandon Thurber

VP, Data Sales & Client Success at NRS

National Retail Solutions

Brandon.Thurber@nrsplus.com

IDT Corporation Contact:

Bill Ulrey

william.ulrey@idt.net

# # #