Copper Quest to Acquire Past-Producing Alpine Gold Mine

Rhea-AI Summary

Copper Quest (OTCQB: IMIMF) entered an option to purchase the Alpine Gold Property (4,611.49 ha) on Nov 7, 2025, from Privco, subject to diligence and exchange approval.

Key metrics: 2018 NI43-101 inferred resource of 268,000 tonnes @ 16.52 g/t Au (≈142,000 oz Au); ~24,000 tonnes run-of-mine stockpile; 1,650 m of underground workings; multiple additional vein targets. Transaction consideration: 14,177,517 shares at deemed $0.175; $225,000 reimbursement; 2% NSR with half buyback for CAD 1,000,000. Closing includes 24-month escrow on shares.

Positive

- Inferred resource of 268,000 tonnes (≈142,000 oz Au)

- Near-term stockpile of 24,000 tonnes for possible cash flow

- 1,650 m of existing underground workings accessing mineable zones

- Multiple unexplored veins offering expansion potential

Negative

- Share consideration of 14,177,517 shares issued at $0.175 (dilution risk)

- 2,600,000 stock options at $0.20 outstanding to insiders and consultants

- Transaction subject to 45-day due diligence and exchange approval

News Market Reaction

On the day this news was published, IMIMF declined 4.42%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, Nov. 14, 2025 (GLOBE NEWSWIRE) -- Copper Quest Exploration Inc. (CSE: CQX; OTCQB: IMIMF; FRA: 3MX) (“Copper Quest” or the “Company”) is pleased to announce that it has entered into an arms-length Option to Purchase Agreement (the "Agreement") dated November 7th, 2025 with 0847114 B.C. Ltd. ("Privco"), a British Columbia Incorporated company that holds

Highlights of the Alpine Gold Property

- 2018 NI43-101 Inferred Resource of 268,000 tonnes estimated using a cut-off grade of 5.0 g/t Au and an average grade of 16.52 g/t Au that represents an inferred resource of 142,000 oz of gold (McCuaig & Giroux, 2018).

- Substantial opportunity to grow the maiden Alpine resource to the east-west and to depth with only about 300m of the roughly 2km long vein system explored to date by underground mine workings and drilling.

- Estimated 24,000 tonnes Run of Mine mineralized stockpile on surface presenting a possible near term cash flow opportunity.

- 1,650 meters of clean and dry underground workings accessing sampled and mineable zones.

- At least 4 additional relatively unexplored vein systems on the Property (Black Prince, Cold Blow, Gold Crown & past-producing King Solomon), all hosting historic high-grade gold values.

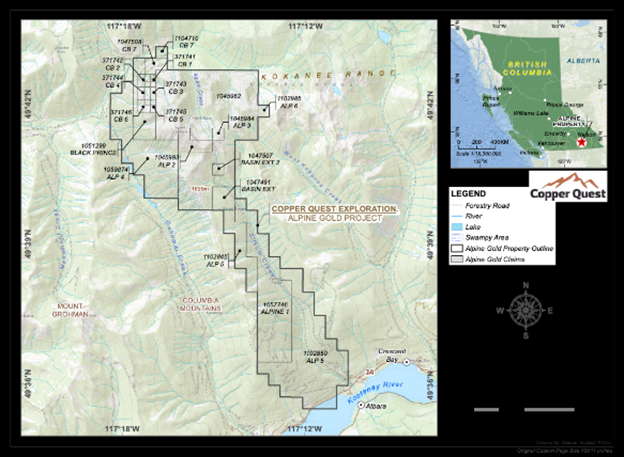

- Road accessible 4,611.49-hectare Property including 15 Crown Grants (1 with surface rights) and 19 staked mineral claims with all-season operation potential (Figure 1).

- Additions of Mr. Allan Matovich to the Board of Directors. Mr. Ted Muraro and Mr. John Mirko as Technical Advisors on closing. They have a combined mining and exploration experience of 150+ years in the industry.

The 4,611.49-hectare Property is approximately 20 kilometers northeast of the City of Nelson (Figure 1) and hosts the former operating underground mine with a recorded production of approximately 16,810 tonnes of mineralized vein material (Table 1). This material contained 356,360 grams of gold, 222,054 grams of silver, 49,329 kilograms of lead and 17,167 kilograms of zinc. The other 4 significant vein systems on the property will also be explored including the Black Prince and Cold Blow quartz veins approximately 3km to the northeast of the Alpine mine, the Gold Crown vein system 600m southeast, and the past-producing King Solomon vein workings 1.8km to the south. Further information about the Alpine Gold property will be forthcoming in the upcoming weeks.

Brian Thurston, President & CEO of Copper Quest, commented: “With Gold prices at all-time highs, The Alpine Gold property creates a tremendous opportunity to create near term value. I look forward to closing the transaction and welcoming Mr. Matovich, Mr. Muraro and Mr. Mirko to the team.”

Figure 1: Location Claim Map

Appointment of Mr. Allan Matovich as Director

Copper Quest is also pleased to announce that upon closing of the acquisition, Mr. Allan Matovich will join the Company’s Board of Directors. Mr. Matovich is the principal owner of the Alpine Gold Property.

Mr. Matovich has 60+ years of mining and exploration experience in Canada and the United States. He first started with Cominco in Trail BC working in the smelter operation. Mr. Matovich then started Matovich Mining Industries where they supplied considerable tonnages of siliceous flux materials, lead and zinc concentrates to Cominco for over 20 years. Mr. Matovich then opened up a mining operation in 1997 in Northern British Columbia to supply barite for drilling fluids in the oil and gas industry. This mining operation is still in production today. Mr. Matovich also opened up a barite operation in Washington State that is going into production. He also worked with Halliburton, Baker Hughes, and Newmont and was very successful. In 2000, Mr. Matovich purchased the Alpine Gold Mine and since then has spent a considerable amount of time proving up the project.

Mr. Matovich commented “I am very pleased to bring the Alpine Gold Property to Copper Quest and join as a director. The company has a fantastic portfolio of critical mineral projects advancing and the Alpine Gold Project gives a potential near term cash flow opportunity along with upside to grow the current resource with drilling. I look forward to working with the Copper Quest team to help create value for all stakeholders involved.”

Table 1 – Production History – Minfile (082FNW127) for Alpine Mine for gold (Au) and silver (Ag)

| YEAR | Tonnes | Tonnes | Au Grams | Ag Grams | Est Grade | Est Grade |

| Mined | Milled | Recovered | Recovered | Au (g/t) | Ag (g/t) | |

| 1988 | 200 | 90 | 198 | 591 | 2.20 | 6.57 |

| *1948 | - | - | 16,889 | 11,384 | 25.32 | 17.07 |

| *1947 | - | - | 2,768 | 1,866 | 15.38 | 10.37 |

| *1946 | - | - | 11,042 | 5,785 | 18.59 | 9.74 |

| *1942 | - | - | 56,079 | 34,182 | 824.69 | 502.68 |

| 1941 | 11,517 | 11,517 | 219,350 | 130,011 | 18.26 | 11.29 |

| 1940 | 3,992 | 3,992 | 57,852 | 35,333 | 14.49 | 8.85 |

| 1939 | 3 | 0 | 62 | 62 | ||

| 1938 | 35 | 0 | 1,120 | 902 | ||

| 1915 | 4 | 0 | 1,938 | |||

| *ore milled not reported | ||||||

Appointment of Mr. Ted Muraro as Technical Advisor to the Board

Mr. Muraro will be appointed as Technical Advisor to the board on closing of the transaction. Mr. Theodore (Ted) W. Muraro has accumulated over six decades of experience in mineral exploration, including 35 years with Cominco where he advanced through Exploration to serve as the companies Chief Geologist and Internal Consulting Geologist. Early in his career, Mr. Muraro gained underground experience at Keno Hill, HB Mine, Sullivan, and Western Mines. His tenure at Cominco was marked by direct involvement in the discovery and subsequent successful development of the Westmin Mine at Buttle Lake, the Polaris Mine on Little Cornwallis Island in the high Arctic, and Snip Mine on the Iskut River. Following his service at Cominco, Mr. Muraro assumed the role of Vice President, Exploration at Romanex and International Barytex Resources, contributing his expertise to international gold projects.

Mr. Muraro, who was awarded the Spud Huestis award in 2021 for his outstanding contributions to the industry and excellence in exploration, worked as an independent consultant (T.W. Muraro Consulting 1993-2016) on base metal and gold exploration projects around the world until his retirement in 2016. In these later years, he served on several boards as Director and/or Advisor, most recently with Imperial Metals. Mr. Muraro’s working relationship with Al Matovich started in the Rossland Mining Camp and shifted to the Alpine Property in the late 80’s.

Appointment of Mr. John Mirko as Technical Advisor to the Board.

Mr. Mirko will be appointed as Technical Advisor to the board on closing of the transaction. Mr. Mirko has over 40 years’ experience in the mining industry, past President and Founder of Canam Alpine Ventures Ltd. (recently sold to Vizsla Resources Ltd.), currently President and Founder of Canam Mining Corp. and Rokmaster Resources Corporation.

From 1986 to 2010 Mr. Mirko the founder, President-CEO and Director of 4 public mining-exploration companies and a founder and Director of 3 others. He has been self-employed in the sector since 1972 as a prospector, contractor and consultant involved in exploration, development and mine construction of various projects in 12 counties, and commercial production of mineral concentrates and metal products from 5 of the projects.

In 2008, Mr. Mirko was a recipient of the "E. A. Scholtz Medal for Excellence in Mine Development" from the Association for Mineral Exploration of British Columbia, and in 2009, the Mining Association of British Columbia's "Mining and Sustainability Award" for the MAX Mine.

Mr. Mirko is currently a member in good standing of the Society of Economic Geologists, Inc., the Canadian Institute of Mining, Metallurgy and Petroleum, the Prospectors and Developers Association of Canada and AME BC.

Transaction Details

The Agreement provides for the purchase of all the minerals claims and crown grants held by the Privco that make up the Alpine Gold Property. At closing Copper Quest will issue 14,177,517 Copper Quest common shares to Privco at a deemed price of

Additionally, Copper Quest will reimburse

Closing is subject to a 45-day due diligence period, exchange approval and other customary closing conditions. Closing may occur prior to the 45-day due diligence period. A finder’s fee is payable in common shares in connection with the transaction.

Qualified Person

Brian Thurston, P.Geo., the Company’s President, CEO and a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical information in this news release.

Gold: Global Demand & Supply

Global demand for gold remains strong, supported by persistent geopolitical uncertainty, inflationary pressures, and ongoing central bank purchases. At the same time, supply growth is limited, with declining reserves at mature mines, few large-scale discoveries, and rising development costs. This tightening supply backdrop highlights the strategic value of advancing new gold projects in secure, mining-friendly jurisdictions. Copper Quest is aligned with these global trends, positioning Alpine to contribute to the next generation of significant gold discoveries.

Stock Options

The Company has granted stock options to Directors, Management, and Consultants of the Company to acquire an aggregate of 2,600,000 common shares in the capital of the Company, pursuant to the Company’s Equity Incentive Plan. The stock options are each convertible into a common share of the Company at an exercise price of

About Copper Quest Exploration Inc.

Copper Quest (CSE: CQX; OTCQB: IMIMF; FRA: 3MX) is focused on building shareholder value through strategic acquisitions and the exploration and development of its North American Critical Mineral portfolio of assets. The Company’s land package currently comprises five critical mineral projects that span over 40,000+ hectares in great mining jurisdictions.

Copper Quest has a

Copper Quest has a

Copper Quest has a

Copper Quest’s leadership and advisory teams are senior mining industry executives who have a wealth of technical and capital markets experience and a strong track record of discovering, financing, developing, and operating mining projects on a global scale. Copper Quest is committed to sustainable and responsible business activities in line with industry best practices, supportive of all stakeholders, including the local communities in which it operates. For more information on Copper Quest, please visit the Company’s website at Copper Quest.

On behalf of the Board of Copper Quest Exploration Inc.

Brian Thurston, P.Geo.

Chief Executive Officer and Director

Tel: 778-949-1829

For further information contact:

Investor Relations

info@copper.quest

Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact included herein, including without limitation, future operations and activities of Copper Quest, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, risks associated with possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, risks associated with the interpretation of exploration results, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. The Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws.

The Canadian Securities Exchange has not reviewed, approved or disapproved the contents of this press release, and does not accept responsibility for the adequacy or accuracy of this release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3309c0ba-17fd-4a57-b498-e8a3c49534fc