Inozyme Pharma Reports First Quarter 2025 Financial Results and Provides Business Highlights

Rhea-AI Summary

The ENERGY 3 trial shows promising interim data with sustained phosphate increases and favorable safety profile. At Week 39, mean phosphate levels increased by +12.1% in the INZ-701 arm versus a -9.0% decrease in conventional treatment. No patient dropouts or safety concerns were reported, with topline data expected in Q1 2026.

The company appointed Dr. Petra Duda as Chief Medical Officer, effective May 15, 2025. Financial results show cash position of $84.8 million as of March 31, 2025, with funding expected into Q1 2026. Q1 net loss was $28.0 million ($0.44/share) compared to $23.3 million ($0.38/share) in the prior year.

Notable regulatory progress includes new ICD-10 codes for ENPP1 Deficiency (effective October 2025) and agreement with Japan's PMDA on filing strategy for INZ-701.

Positive

- Positive interim data from ENERGY 3 trial showing +12.1% increase in phosphate levels vs -9.0% decrease in conventional treatment

- No patient discontinuations, dose adjustments, or safety concerns in ENERGY 3 trial

- Favorable immunogenicity profile with 15 out of 17 patients showing no or low titer ADA responses

- Agreement with Japan's PMDA on regulatory filing strategy without requiring Japanese patient data

- New ICD-10 codes accepted for ENPP1 Deficiency, effective October 2025

Negative

- Net loss increased to $28.0 million from $23.3 million year-over-year

- 25% workforce reduction across all areas of the company

- $1.9 million in restructuring charges in Q1 2025

News Market Reaction

On the day this news was published, INZY gained 23.85%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

- Interim data from ENERGY 3 trial highlight INZ-701’s potential to modify disease course in ENPP1 Deficiency, with sustained phosphate increases and favorable safety and immunogenicity profile to date -

- ENERGY 3 trial on track for topline data in first quarter of 2026; no patient dropouts, dose adjustments or discontinuations, and no new safety signals -

- Petra Duda, M.D., Ph.D. appointed Chief Medical Officer -

BOSTON, May 14, 2025 (GLOBE NEWSWIRE) -- Inozyme Pharma, Inc. (Nasdaq: INZY) (“the Company” or “Inozyme”), a clinical-stage biopharmaceutical company developing innovative therapeutics for rare diseases that affect bone health and blood vessel function, today reported financial results for the first quarter ended March 31, 2025, and provided business highlights.

“We are extremely pleased with how the ENERGY 3 trial is progressing,” said Douglas A. Treco, Ph.D., CEO and Chairman of Inozyme Pharma. “The consistency we have observed across safety, immunogenicity, and increases in phosphate levels reinforces our conviction in INZ-701’s ability to address the underlying biology of ENPP1 Deficiency. With no dropouts or dose modifications to date, the emerging profile in pediatric patients is highly encouraging. As we move toward topline data in the first quarter of 2026, we believe INZ-701 is well positioned to become the first approved therapy for this serious and underserved disease.”

ENERGY 3 Pivotal Trial Update: Positive Trends in Safety, Phosphate Levels, and Immunogenicity Support INZ-701’s Potential

The ENERGY 3 trial evaluating INZ-701 in pediatric patients with ENPP1 Deficiency completed enrollment in January 2025. Dosing is expected to conclude in January 2026, with topline data anticipated in the first quarter of 2026. To date, there have been no patient discontinuations, dose adjustments, or dosing holidays due to safety or tolerability concerns. The Data Safety Monitoring Board (DSMB) has not identified any new safety signals.

Preliminary Anti-Drug Antibody (ADA) Data from ENERGY 3 Trial

The Company today announced preliminary anti-drug antibody (ADA) data from the ENERGY 3 trial, based on an evaluation conducted as part of ongoing safety monitoring.

This analysis included 17 of the 19 patients in the INZ-701 treatment arm who had completed at least 13 weeks of dosing. Of these 17 patients, 15 had no detectable ADAs or low titer responses. The highest titer among these 15 patients was 1,280 - a level comparable to those previously observed in the Company’s adult trials (INZ701-101 and INZ701-201). These titer levels in adults had no effect on drug exposure or patient safety and typically declined over time with continued treatment.

Two of the 17 patients exhibited higher-titer ADA responses (5,120 and 40,960) similar to levels observed in some infants. These infants had reduced drug exposure yet still showed potentially clinically beneficial transient increases in PPi.

The median ADA titer at Week 13 was 80 across all 17 patients. At this time, ADAs have not been associated with any impact on patient tolerability or adverse events. The safety and immunogenicity profile observed to date in the ENERGY 3 trial is encouraging and consistent with what was observed in our prior Phase 1/2 trials in adults.

Additional Immunogenicity Insights from ENERGY 1 Trial and Expanded Access Program

Today, the Company also updated observations on ADAs from its ENERGY 1 clinical trial and Expanded Access Program (EAP). In INZ-701-treated infants who developed high-titer ADAs affecting exposure (n=3), titers stabilized or declined over time, following transition to twice-weekly dosing or a dose increase. These data suggest that extended treatment duration, dose concentration and/or increased dosing frequency may help mitigate immunogenicity, an observation that is well-documented across other enzyme replacement therapies (ERTs).

Notably, one infant with high-titer ADAs carried the same homozygous mutation as an adult patient in our completed Phase 1/2 trial who had a low titer antibody response (range 40-160), suggesting that impactful ADA responses may be restricted to the youngest patients.

Interim Biomarker Data from ENERGY 3 Support Potential for Skeletal Improvement

Along with pyrophosphate (PPi) deficiency, low serum phosphate (hypophosphatemia) is the key driver of rickets and osteomalacia in patients with ENPP1 Deficiency. We believe that by demonstrating an ability to increase serum phosphate levels, INZ-701 can meaningfully reduce the clinical burden of skeletal abnormalities.

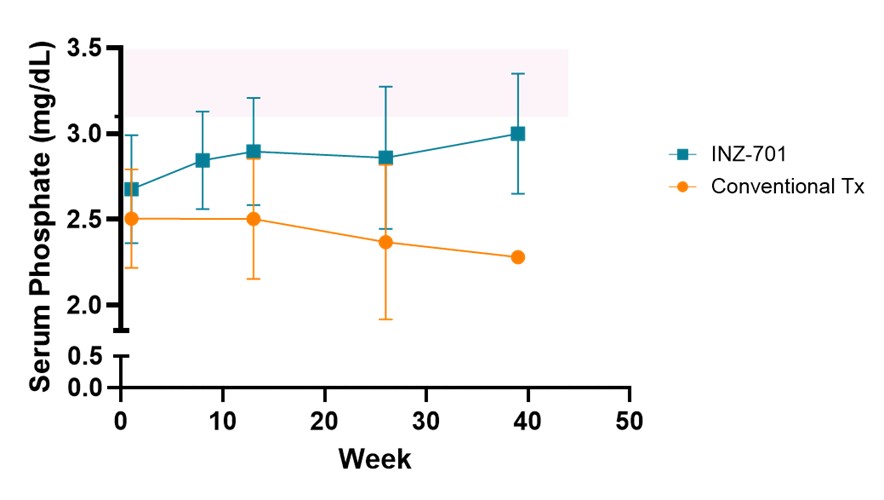

Interim data from ENERGY 3 demonstrate that mean serum phosphate levels increased over time in the INZ-701 arm, while levels declined in the conventional therapy arm, despite ongoing active vitamin D3 and phosphate supplementation. At Week 13, mean serum phosphate levels increased from baseline by +

| % mean change of serum phosphate from baseline | ||||||

| Treatment | Week 13 (n) | Week 26 (n) | Week 39 (n) | |||

| INZ-701 | +8.2 (17) | +6.8 (11) | +12.1 (4) | |||

| Conventional Tx | -0.04 (7) | -5.5 (6) | -9.0 (2) | |||

INZ-701 increased serum phosphate in ENERGY 3 pivotal trial

Normal serum phosphate levels for this group of patients ranged from 3.1 to 6.1 milligrams/deciliter (mg/dL), as indicated by the pink shaded area. The normal range of serum phosphate levels varies by age and sex, and ranges may vary by testing laboratory. Data: Mean ± SD; Conventional Tx: active vitamin D3 + phosphate

The upward trajectory of serum phosphate levels towards normalization over time supports the potential of INZ-701 to address the underlying pathophysiology of ENPP1 Deficiency and improve long-term skeletal outcomes.

“These emerging data on serum phosphate levels suggest that INZ-701 may have a meaningful impact on the severity of rickets and other skeletal complications in children with ENPP1 Deficiency,” said Thomas Carpenter, M.D., Professor of Pediatrics and Orthopaedics at Yale School of Medicine, who is not involved in the study. “The consistency of the safety profile and biomarker responses to date is encouraging and supports further clinical development.”

Leadership Transition

- Petra Duda, M.D., Ph.D. Appointed Chief Medical Officer. The Company today announced the appointment of Petra Duda, M.D., Ph.D., as Chief Medical Officer, effective May 15, 2025. Dr. Duda will succeed Kurt Gunter, M.D., who will retire and transition to an advisory role. Dr. Duda brings more than two decades of global clinical development, medical affairs, and regulatory leadership, with deep expertise in rare and ultra-rare diseases. Prior to joining Inozyme in November 2024, Dr. Duda served as Global Development Lead at UCB, where she oversaw the Zilbrysq® (zilucoplan) program and led it through global approvals for generalized myasthenia gravis. She joined UCB through its acquisition of Ra Pharmaceuticals, where she directed clinical development for complement pathway inhibitors. Earlier in her career, she played pivotal roles in the advancement and approval of Exondys 51® for Duchenne Muscular Dystrophy at Sarepta Therapeutics, led neurology programs at Biogen Idec, and supported medical affairs and drug safety at Boehringer Ingelheim. She is board certified in Neurology and Pharmaceutical Medicine and holds both an M.D. and Ph.D. in molecular biology and biochemistry from the University of Bern.

Dr. Treco added, “I’ve been fortunate to work with both Kurt and Petra in the past. Petra is a strategic and thoughtful leader with deep experience in rare diseases. We are fortunate to have her step into this role as we prepare for late-stage development milestones. Kurt provided extraordinary leadership at critical junctures in the Company’s evolution. We are grateful for his outstanding contributions, and we will continue to benefit from his guidance as an advisor to the Company.”

Recent Clinical and Scientific Progress

- ICD-10 Codes Accepted for ENPP1 Deficiency; Effective October 2025. The Company announced that the U.S. Centers for Medicare & Medicaid Services (CMS) has accepted a new set of ICD-10 diagnosis codes to support the classification of disorders of pyrophosphate metabolism, including ENPP1 Deficiency. These include distinct codes for generalized arterial calcification of infancy (GACI), autosomal recessive hypophosphatemic rickets type 2 (ARHR2), and pseudoxanthoma elasticum (PXE). The codes are expected to be published in early September 2025 and go into effect in October 2025.

- Regulatory Progress in Japan for ENPP1 Deficiency. In the first quarter of 2025, the Company reached agreement with Japan’s Pharmaceuticals and Medical Devices Agenda (PMDA) on a regulatory filing strategy for INZ-701 in ENPP1 Deficiency. Notably, the PMDA has agreed to accept data generated from clinical trials conducted outside of Japan and will not require the inclusion of Japanese patients for filing. This agreement provides a clear path toward potential approval in Japan.

- JBMR Plus Publication Demonstrating Real-World Impact of ENPP1 Deficiency. In April 2025, the Company announced a publication in JBMR Plus titled, “Phenotypic characterization of ENPP1 deficiency: generalized arterial calcification of infancy and autosomal recessive hypophosphatemic rickets type 2”. The publication characterized the severity and progression of ENPP1 Deficiency based on data from the largest retrospective analysis of the disease.

- Positive Interim Data from the ENERGY 1 trial and Expanded Access Program. In January 2025, the Company reported positive interim data from its ENERGY 1 trial and Expanded Access Program (EAP) evaluating INZ-701 in infants and young children with ENPP1 Deficiency demonstrating improvements from baseline in multiple measures of disease. The data were subsequently presented at the CHOP Cardiology 2025 Annual Meeting in February 2025.

Recent Scientific Presentations at ESPE/ESE 2025 Joint Congress

Inozyme recently featured new clinical insights and hosted an educational symposium at the Joint Congress of the European Society for Paediatric Endocrinology (ESPE) and the European Society of Endocrinology (ESE), held in May 2025 in Copenhagen, Denmark. Highlights included:

- New Poster Presentation: Leanne Ward, M.D. presented “Quantitative evaluation of hypophosphatemic rickets due to ENPP1 Deficiency,” a multi-center, retrospective analysis of children and adults with autosomal hypophosphatemic rickets type 2 (ARHR2). The data demonstrated that children with ENPP1 Deficiency under current standard of care exhibit persistent FGF23-mediated hypophosphatemia, with serum phosphate levels declining sharply in early childhood. Additional findings included rickets with clinical overlap with X-linked hypophosphatemia (XLH), impaired growth, delayed bone age, and decreased bone strength. These findings underscore the significant unmet need in ARHR2 and reinforce the value of genetic testing for accurate diagnosis.

- Data on Heterozygous ENPP1 Deficiency: David Weber, M.D., MSCE, presented emerging clinical observations in individuals with a single ENPP1 variant, contributing to the growing recognition that some ENPP1 carriers may exhibit clinically significant disease.

- Inozyme-Sponsored Symposium: On Sunday, May 11, Dr. Lothar Seefried led a symposium titled “Hypophosphatemic Rickets: Practical Tips for Distinguishing ARHR2 from XLH.” The session offered clinical and molecular insights into the differences between XLH and ARHR2, with an emphasis on improving diagnostic accuracy and guiding appropriate treatment strategies.

First Quarter 2025 Financial Results

- Cash Position and Financial Guidance. Cash, cash equivalents, and short-term investments were

$84.8 million as of March 31, 2025. Based on its current plans, the Company anticipates its cash, cash equivalents, and short-term investments as of March 31, 2025, will enable the Company to fund cash flow requirements into the first quarter of 2026. - Research and Development (R&D) Expenses. R&D expenses were

$20.4 million for the quarter ended March 31, 2025, compared to$19.1 million for the prior-year period. R&D increased$1.3 million primarily due to an increase in INZ-701-related research and development expense composed of a$2.2 million increase in CMC, offset by a$0.9 million decrease in clinical development and consulting costs. - General Administrative (G&A) Expenses. G&A expenses were

$5.4 million for the quarter ended March 31, 2025, compared to$5.2 million for the prior-year period. - Restructuring charges. Restructuring charges were

$1.9 million for the quarter ended March 31, 2025 with no comparable charge in the prior period. This increase relates to the Company’s reprioritization to focus resources on its ENPP1 Deficiency program, which resulted in a reduction of the Company’s workforce by approximately25% across all areas of the Company. These charges relate to severance, benefits, and other costs. - Net Loss. Net loss was

$28.0 million , or$0.44 loss per share, for the quarter ended March 31, 2025, compared to$23.3 million or$0.38 loss per share for the prior-year period.

About the ENERGY 3 Trial

The ENERGY 3 trial is a pivotal, multicenter, randomized (2:1) controlled, open-label pivotal clinical trial designed to evaluate the efficacy and safety of INZ-701 in children aged 1 to under 13 years with ENPP1 Deficiency. Based on recommendations from the U.S. Food and Drug Administration (FDA), the trial’s primary endpoint, plasma pyrophosphate (PPi), should be supported by consistent trends in clinical endpoints such as radiographic impression of change (RGI-C), a measure for progression or improvement of rickets. In alignment with the European Medicines Agency (EMA), plasma PPi and RGI-C serve as co-primary endpoints, with a relaxed statistical threshold (p<0.2) for RGI-C.

Enrollment in ENERGY 3 was completed in January 2025, with 27 pediatric patients enrolled. The trial’s 2:1 randomized design provides >

About ENPP1 Deficiency

ENPP1 Deficiency is a serious and progressive rare disease that affects blood vessels, soft tissues, and bones. Individuals who present in utero or in infancy are typically diagnosed with generalized arterial calcification of infancy (GACI Type 1), with about

About Inozyme Pharma

Inozyme Pharma is a clinical-stage biopharmaceutical company dedicated to developing innovative therapeutics that target the PPi-Adenosine Pathway, a key regulator of bone health and blood vessel function. Disruptions in this pathway underlie a range of severe diseases, including ENPP1 Deficiency, ABCC6 Deficiency, and calciphylaxis. Our lead investigational therapy, INZ-701, is an ENPP1 Fc fusion protein enzyme replacement therapy (ERT) designed to restore PPi and adenosine levels. INZ-701 is currently in late-stage clinical development in ENPP1 Deficiency, with the potential to expand into additional indications where deficiencies in the PPi-Adenosine Pathway contribute to disease pathology. Through our pioneering work, we aim to transform treatment options for patients affected by these devastating conditions.

For more information, please visit https://www.inozyme.com/ or follow Inozyme on LinkedIn, X, and Facebook.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute "forward-looking statements" within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements relating to the initiation, timing, and design of our planned clinical trials, availability of data from clinical trials, the potential benefits of INZ-701, the potential for INZ-701 to be the first approved therapy for ENPP1 Deficiency, our regulatory strategy, and the period over which we believe that our existing cash, cash equivalents, and short-term investments will be sufficient to fund our cash flow requirements. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would," and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements are based on management's current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements. These risks and uncertainties include, but are not limited to, risks associated with the Company's ability to realize the anticipated cost savings related to the recent strategic prioritization and workforce reduction; conduct its ongoing clinical trials of INZ-701 for ENPP1 Deficiency, ABCC6 Deficiency, and calciphylaxis; enroll patients in ongoing and planned trials; obtain and maintain necessary approvals from the FDA and other regulatory authorities; continue to advance its product candidates in preclinical studies and clinical trials; replicate in later clinical trials positive results found in preclinical studies and early-stage clinical trials of its product candidates; advance the development of its product candidates under the timelines it anticipates in planned and future clinical trials; obtain, maintain, and protect intellectual property rights related to its product candidates; manage expenses; comply with covenants under its outstanding loan agreement; and raise the substantial additional capital needed to achieve its business objectives. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company's actual results to differ from those contained in the forward-looking statements, see the "Risk Factors" section in the Company's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, as well as discussions of potential risks, uncertainties, and other important factors, in the Company's most recent filings with the Securities and Exchange Commission. In addition, the forward-looking statements included in this press release represent the Company's views as of the date hereof and should not be relied upon as representing the Company's views as of any date subsequent to the date hereof. The Company anticipates that subsequent events and developments will cause the Company's views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so.

| Condensed Consolidated Balance Sheet Data (Unaudited) (in thousands) | |||||||

| March 31, 2025 | December 31, 2024 | ||||||

| Cash, cash equivalents and investments | $ | 84,776 | $ | 113,087 | |||

| Total assets | $ | 95,164 | $ | 123,182 | |||

| Total liabilities | $ | 63,366 | $ | 65,356 | |||

| Additional paid-in-capital | $ | 447,790 | $ | 445,705 | |||

| Accumulated deficit | $ | (415,993 | ) | $ | (387,954 | ) | |

| Total stockholders' equity | $ | 31,798 | $ | 57,826 | |||

| Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited) (in thousands, except share and per share data) | ||||||||

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Operating expenses: | ||||||||

| Research and development | $ | 20,379 | $ | 19,111 | ||||

| General and administrative | 5,409 | 5,234 | ||||||

| Restructuring charges | 1,900 | — | ||||||

| Total operating expenses | 27,688 | 24,345 | ||||||

| Loss from operations | (27,688 | ) | (24,345 | ) | ||||

| Other income (expense): | — | — | ||||||

| Interest income | 1,117 | 2,374 | ||||||

| Interest expense | (1,406 | ) | (1,325 | ) | ||||

| Other expense, net | (62 | ) | (51 | ) | ||||

| Other (expense) income, net | (351 | ) | 998 | |||||

| Net loss | $ | (28,039 | ) | $ | (23,347 | ) | ||

| Other comprehensive income (loss): | ||||||||

| Unrealized losses on available-for-sale securities | (76 | ) | (156 | ) | ||||

| Foreign currency translation adjustment | 2 | 10 | ||||||

| Total other comprehensive loss | (74 | ) | (146 | ) | ||||

| Comprehensive loss | $ | (28,113 | ) | $ | (23,493 | ) | ||

| Net loss attributable to common stockholders—basic and diluted | $ | (28,039 | ) | $ | (23,347 | ) | ||

| Net loss per share attributable to common stockholders—basic and diluted | $ | (0.44 | ) | $ | (0.38 | ) | ||

| Weighted-average common shares outstanding—basic and diluted | 64,278,527 | 61,772,279 | ||||||

Contacts

Investors:

Inozyme Pharma

Stefan Riley, Senior Director of IR and Corporate Communications

(617) 461-2442

Stefan.riley@inozyme.com

Media:

Biongage Communications

Todd Cooper

(617) 840-1637

Todd@biongage.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/daff31dc-9507-47ff-98ef-67858da7835d