MoonFox Data Launches New Financial Alternative Data Solution to Empower Investment Decisions Across Multiple Scenarios

Rhea-AI Summary

MoonFox Data (NASDAQ: JG) launched its Financial Alternative Data Solution on November 14, 2025 to support investment decision-making across earnings forecasting, real-time monitoring, subsector discovery, and competitive benchmarking.

The platform integrates online (APP/mini-program DAU, retention) and offline (store foot traffic, factory workforce) signals, updates key metrics on a T+2 basis, and claims revenue-predictive models that can anticipate trends up to one month ahead. Coverage includes historical traces back to 2019, data across 22 primary/205 secondary industries, >300 listed companies and >1,000 brands across A-share, Hong Kong and US markets. Named clients include BlackRock, Goldman Sachs, Sequoia Capital, and CITIC Securities. Trial access is available via the MoonFox Data website.

Positive

- Predictive revenue models forecasting up to 1 month ahead

- Data updates on a T+2 cadence for near-real-time monitoring

- Coverage across 22 primary and 205 secondary industries

- Historical data available from 2019

- Dataset spans >300 listed companies and >1,000 brands

Negative

- Forecast horizon limited to up to 1 month, not long-term guidance

- Operational latency of T+2 may miss intraday signals

- Coverage limited to >300 listed companies, not full market universes

News Market Reaction

On the day this news was published, JG declined 2.00%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

SHENZHEN, China, Nov. 14, 2025 (GLOBE NEWSWIRE) -- MoonFox Data, a subsidiary of Nasdaq-listed Aurora Mobile (NASDAQ: JG), has officially launched its Financial Alternative Data Solution. Designed to address the core challenges faced by investment institutions in corporate analysis and industry evaluation, MoonFox Data delivers real-time, precise data support to enhance the efficiency and accuracy of investment decision-making.

Addressing Four Core Investment Analysis Pain Points

Investment institutions often struggle with delayed and incomplete data during research and decision-making processes. MoonFox Financial Alternative Data provides targeted solutions to these industry challenges, including:

| Pain Point Type | Real-World Institutional Challenge | Application Scenario |

| Reliance on Financial Reports | 1. Delayed Performance Forecasting: Funds and investment banks struggle to predict listed companies’ revenues and trends in a timely manner due to a 1–1.5 month information lag, making it difficult to capture performance fluctuations. | Earnings forecasting for funds and investment banks |

| Single-Dimensional Data | 2. Limited Data Coverage: Research and consulting institutions can only access either online or offline data, hindering comprehensive evaluation of corporate operations and industry competition. | Enterprise and industry analysis |

| Weak Correlation Verification | 3. Difficulties in Validating Data-Financial Linkages: PE/VCs find it challenging to accurately assess enterprise value and investment potential due to unclear relationships between business data and financial metrics. | PE/VC due diligence and investment assessment |

| Difficulty Identifying Growth Sectors | 4. Hard to Identify High-Growth Sectors: Investment institutions struggle to quickly pinpoint high-potential industries and targets, risking missed investment opportunities. | Sector discovery and target screening |

Four Core Application Scenarios Covering the Full Investment Process

MoonFox Financial Alternative Data is designed to support the entire investment workflow, from corporate analysis and industry insights to risk alerts and decision support. Key application scenarios include:

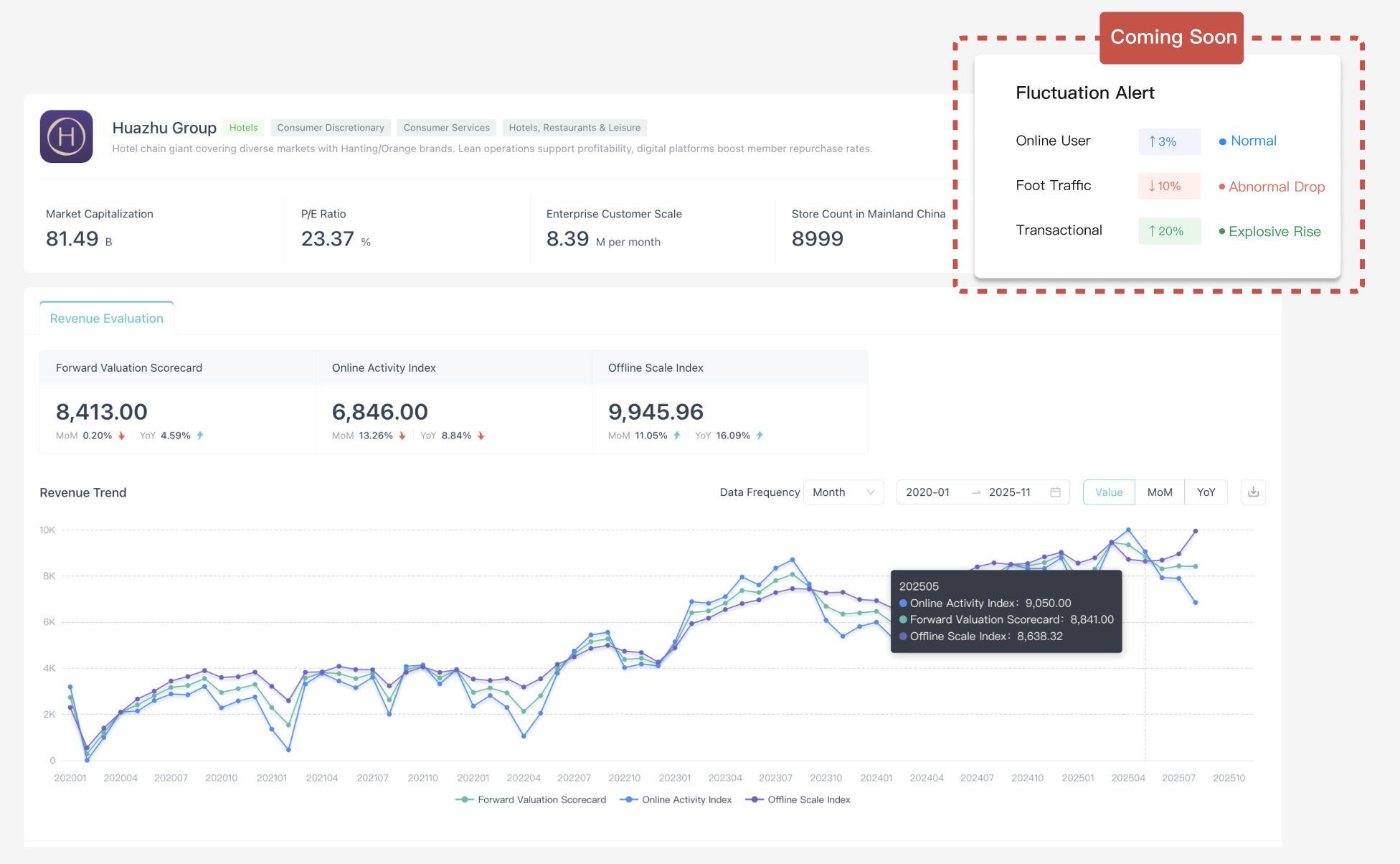

1. Earnings Forecasting for Public Companies (For Funds/Investment Banks)

- Funds and investment banks can predict corporate revenues ahead of earnings releases and adjust investment strategies accordingly.

- By integrating online data (APP/mini-program DAU, retention rates) with offline data (store foot traffic, factory workforce indices), MoonFox builds financial models that predict revenue trends up to one month in advance.

Case Study: For companies like Huazhu Group, MoonFox’s composite operational index closely tracks reported revenue figures.

For XPeng, linear analysis of app activity, offline traffic, and factory population showed only two divergences over 20 quarters (2020–2024), with trends otherwise highly consistent.

2. Real-Time Corporate Performance Monitoring (For All Investment Institutions)

- Track operational dynamics in real time to identify performance risks or growth signals.

- Key metrics are updated on a T+2 basis, with “online activity indices” and “offline scale indices” providing comprehensive monitoring. For example, Huazhu Group’s offline traffic index moves in sync with revenue, enabling early warning of performance shifts.

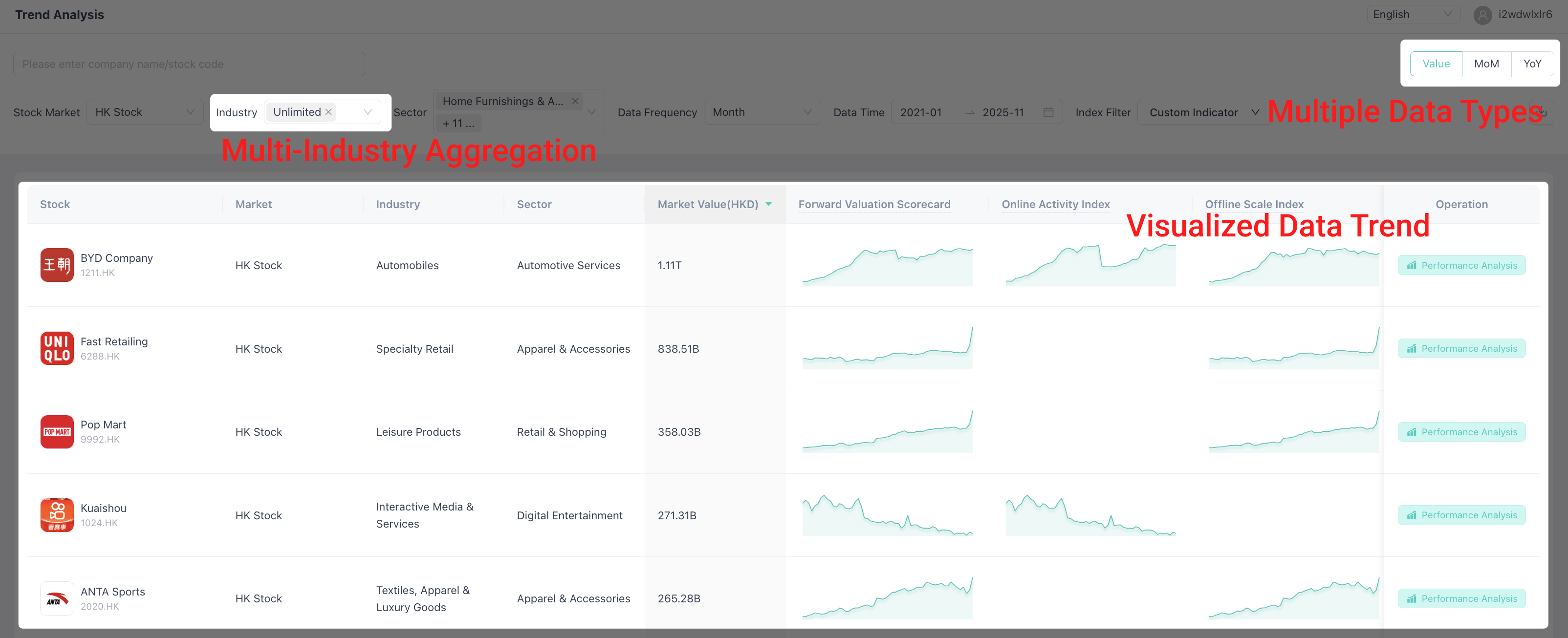

3. Subsector Opportunity Discovery (For VC/PE and Research Institutions)

- Rapidly identify high-growth sectors and screen for top-performing targets.

- Coverage spans 22 primary and 205 secondary industries, with trend rankings available. For instance, foot traffic and mini-program data in the tea beverage sector help institutions pinpoint leading brands.

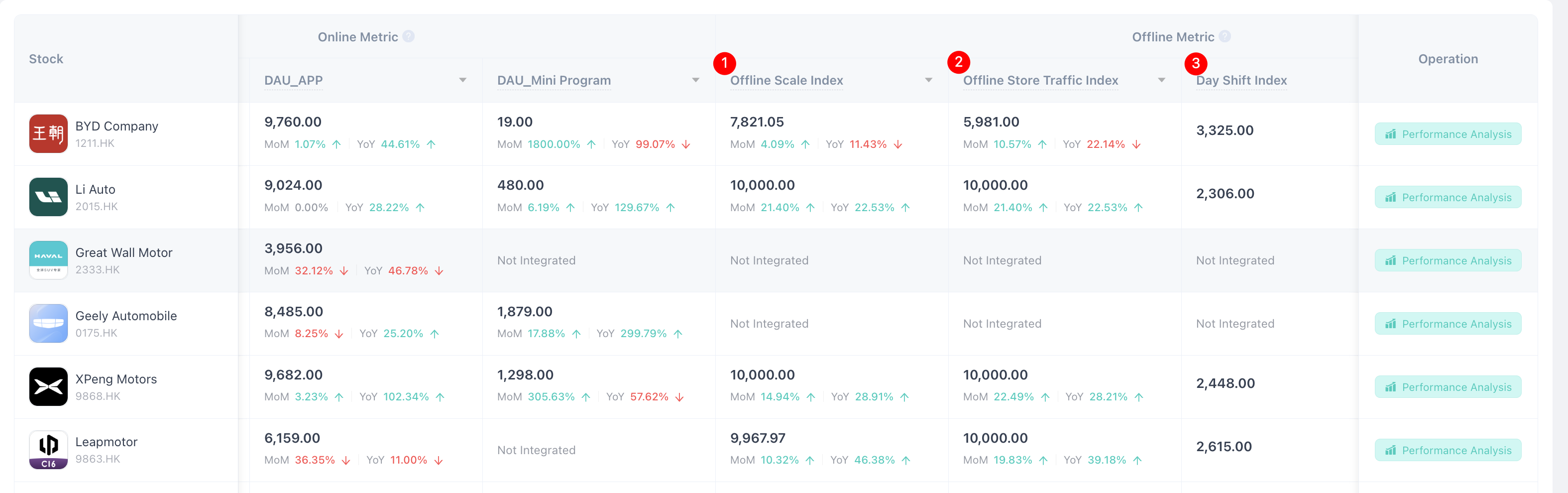

4. Competitive Benchmarking (For Corporate Strategy and Research Teams)

- Compare operational performance of competitors and assess market positioning.

- Enables benchmarking across multiple companies within an industry. For example, comparing BYD and Li Auto’s store traffic and factory capacity data reveals clear competitive advantages and gaps.

Compliance and Data Advantages Ensuring Practical Application

MoonFox Financial Alternative Data is fully compliant with industry-leading data security and privacy standards. The platform supports historical data tracing (dating back to 2019) and provides flexible, multi-granularity outputs (daily, weekly, monthly) to meet a wide range of analytical needs.

Currently, MoonFox Financial Alternative Data covers over 300 listed companies and 1,000+ brands across A-shares, Hong Kong, and US markets. Clients include leading global investment institutions such as BlackRock, Goldman Sachs, Sequoia Capital, and CITIC Securities. Interested institutions can apply for a trial via the MoonFox Data website (www.moonfox.cn).

Register for a Free Trial: https://www.moonfox.cn/en/financial

About MoonFox Data:

As a sub-brand of Aurora Mobile (NASDQ: JG), MoonFox Data is a leading expert in data insights and analysis services across all scenarios. With a comprehensive, stable, secure, and compliant mobile big data foundation, as well as professional and precise data analysis technology and AI algorithms, MoonFox Data has launched iAPP, iBrand, iMarketing, Alternative Data and professional research and consulting services of MoonFox Research, aiming to help companies gain insights into market growth and make accurate business decisions.

For Media Inquiries:

Contact: zhouxt@jiguang.cn | Website: http://www.moonfox.cn/en

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6238cc6a-1c8a-40a2-a810-3de87087c433

https://www.globenewswire.com/NewsRoom/AttachmentNg/a34c1aa4-4774-43ae-b790-05014606b79a

https://www.globenewswire.com/NewsRoom/AttachmentNg/155c9998-1685-40e2-8789-7e51c6c4bbda

https://www.globenewswire.com/NewsRoom/AttachmentNg/bcbd4e86-429e-467e-b85e-edea685dfc22

https://www.globenewswire.com/NewsRoom/AttachmentNg/50e76de7-e005-4f78-8034-08b866656328