Japan Gold Announces the Conclusion of the Barrick Alliance and Reports Ebino Drill Results

Rhea-AI Summary

Japan Gold (OTCQB: JGLDF) announced the termination of its strategic alliance with Barrick Mining Corporation, effective October 31, 2025. The alliance, established in 2020, received total funding of $23.15 million from Barrick for exploring potential Tier 1 or Tier 2 gold deposits across Japan Gold's 3,000 sq km portfolio.

The company also reported results from its three-hole diamond drill program at the Ebino Project in the Hokusatsu District. While the drilling confirmed the extension of a regional alteration system and intersected strong zones of hydrothermal clay alteration, no significant gold mineralization was found. The Hokusatsu District historically produced over 12 million ounces of gold through various mines, including the currently active Hishikari Mine.

Japan Gold remains well-funded and will continue advancing its projects independently or through new partnerships.Positive

- Received substantial funding of $23.15 million from Barrick for comprehensive exploration

- Company retains full control of entire portfolio including previously Barrick-controlled projects

- Successfully confirmed extension of regional alteration system in gold-rich Hokusatsu District

- Company remains well-funded to continue exploration activities

Negative

- Strategic alliance with major mining company Barrick terminated

- Drill program at Ebino Project did not intersect significant gold mineralization

- Scale of work conducted was insufficient to fully evaluate projects' potential

News Market Reaction 1 Alert

On the day this news was published, JGLDF declined 45.12%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - September 29, 2025) - Japan Gold Corp. (TSXV: JG) (OTCQB: JGLDF) ("Japan Gold" or the "Company") announces that Barrick Mining Corporation ("Barrick") and the Company have mutually agreed to terminate the strategic alliance agreement dated February 23, 2020, as amended (the "Barrick Alliance") in accordance with its terms, with such termination to be effective as of October 31, 2025 (the "Effective Date").

The Barrick Alliance was established in 2020 with the aim to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan which have the potential to host Tier 1 or Tier 2 gold deposits.

Japan Gold received total funding of

As of the Effective Date, Barrick will no longer hold any right to or interest in any of Japan Gold's portfolio of mineral rights in Japan, including the Barrick Alliance Projects, Hakuryu, Togi and Ebino.

"Barrick's involvement with Japan Gold over the last five years reflects the growing international interest in Japan as an emerging country with the potential for the discovery of new gold deposits, and we thank Barrick for their participation in this journey," said John Proust, Chairman and CEO of Japan Gold. "Japan's exceptional geology, rich history of high-grade gold mining, underexplored district-scale opportunities and stable mining regulatory environment continue to attract industry participants seeking a new, highly prospective geopolitically safe jurisdiction." He added, "Japan Gold remains well-funded and committed to advancing its projects, and the geological prospectivity of Japan remains unchanged. With full operational control, our experienced management team is well-positioned to prioritize our high potential assets and implement a tailored exploration strategy."

Barrick Mining's Vice President of Exploration, Joe Holliday said, "Japan Gold consistently demonstrated exceptional in-country expertise and operational excellence. We thank them for their dedication and professionalism throughout our alliance."

Japan Gold will continue to advance 2 district scale-areas in Kyushu and Hokkaido, as well as several individual projects including the former Barrick Alliance Projects, independently or through new joint ventures or partnerships. The Company is actively engaged in ongoing discussions with parties expressing interest in Japan Gold's exploration opportunities.

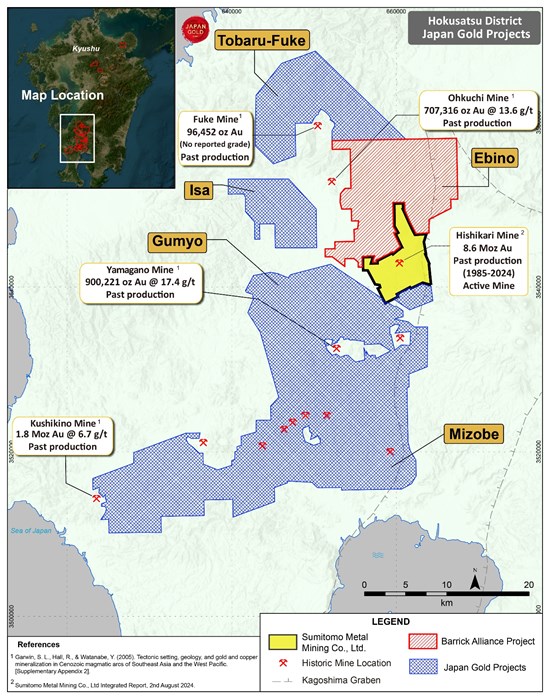

Ebino Project Drill Results

The Company also announces the completion of its three-hole diamond drill program at the Barrick Alliance Ebino Project ("Ebino"), located in the Hokusatsu District of southern Kyushu (Figure 1). This program confirms the extension of a regional alteration system in the 40 km x 20 km Hokusatsu District which hosts past and present major gold mines, including the only active large-scale gold producer in Japan, the Hishikari Mine, as well as the historic Kushikino, Yamagano and Ohkuchi gold mines. Together these mines have produced more than 12 million ounces of gold[1]. Japan Gold holds the majority of all prospective mineral rights in the Hokusatsu District and surrounds the Sumitomo Metal Mining Co. Ltd., Hishikari Mine area.

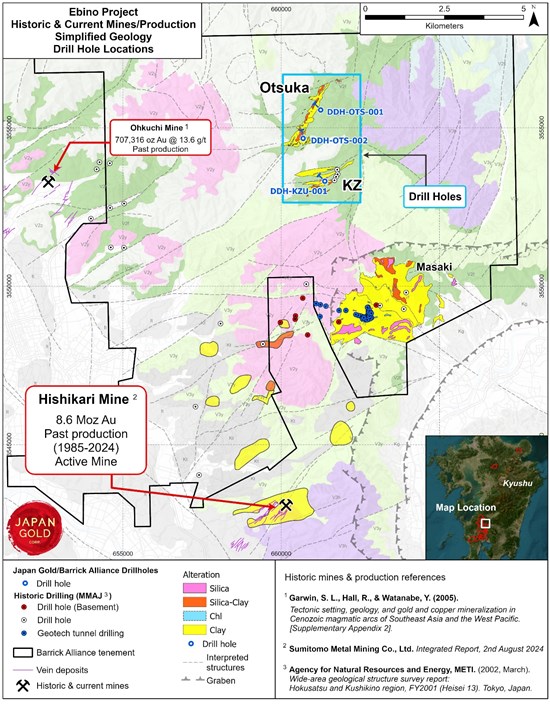

The drilling program, totalling 1,528m tested targets at the Otsuka and Kuwanoki-zuru ("KZ") prospects for gold mineralization within a highly prospective and historically underexplored area. All three drillholes successfully intersected strong zones of hydrothermal clay alteration including structurally controlled kaolinite and dickite zones, characteristic of a shallow environment in an epithermal system. While the drilling did not intersect significant gold mineralization, the results are encouraging, as broad zones of alteration were intersected and can be used to help vector into potential epithermal targets within the vicinity of Ebino. The next phase of exploration will comprise additional target generation work within the Masaki, KZ and Otsuka alteration zones.

The Ebino drill program was funded by the Barrick Alliance. Drill sites were fully rehabilitated to their original condition, with work completed in alignment with environmental best practices.

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold's Vice President of Exploration, Jason Letto, B.Sc., P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

Figure 1 - Hokusatsu District of Southern Kyushu

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5665/268335_a0f1d92564533ba7_001full.jpg

Figure 2 - Ebino Drill Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5665/268335_a0f1d92564533ba7_002full.jpg

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral company focused on the exploration and discovery of high-grade epithermal gold deposits across the main islands of Japan. The Company holds a significant portfolio of tenements covering areas with known gold occurrences, history of mining and prospective for high-grade epithermal gold mineralization in one of the most stable and under explored countries in the world. The Japan Gold leadership and operational team of geologists, drillers and technical advisors have extensive experience exploring and operating in Japan and have a track record of discoveries world-wide. Significant shareholders include Equinox Partners Investment Management LLC and Newmont Corporation.

On behalf of the Board of Japan Gold Corp.

John Proust

Chairman & CEO

For further information, please contact:

Alexia Helgason

Vice President, Corporate Communications

Phone: +1(604) 417-1265

Email: ahelgason@japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results or benefits related to potential new joint ventures or partnerships and the Company's 2025 gold exploration program, whether independently or through such joint ventures or partnerships. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions, the Company's ability to arrange or conclude a joint venture or partnership on acceptable terms or at all; the stability of the financial and capital markets; the timing and granting of prospecting rights; the Company's ability to convert prospecting rights into digging rights within the timeframe prescribed by the Mining Act; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable laws.

[1] Garwin, S. L., Hall, R., & Watanabe, Y. (2005). Tectonic setting, geology, and gold and copper mineralization in Cenozoic magmatic arcs of Southeast Asia and the West Pacific [Supplementary Appendix 2].

Sumitomo Metal Mining Co., Ltd Integrated Report, 2nd August 2024

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268335