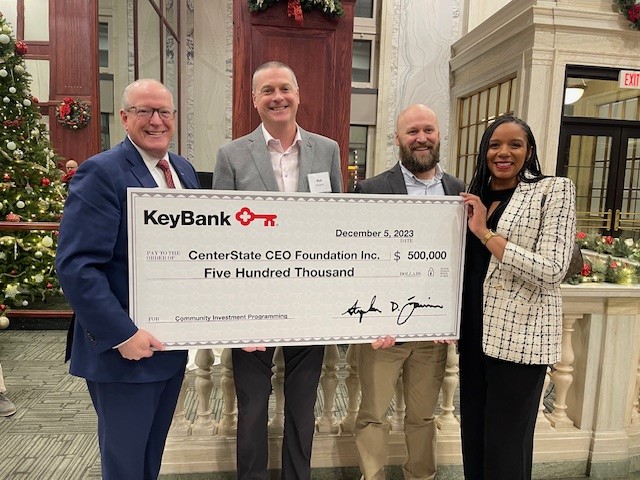

$500,000 Investment from KeyBank will Help CenterState CEO Expand Business Coaching and Technical Assistance Programs for BIPOC, Women and Veteran-owned Firms

Funding will support the launch and growth of underrepresented firms through training, coaching, and technical assistance and provide direct lending to and investment in undercapitalized firms

SYRACUSE, NY / ACCESSWIRE / February 6, 2024 / A

This funding will also play a significant role in helping CenterState CEO scale efforts to expand access to business financing for under-capitalized founders, for whom traditional business loans and investments are often challenging. It will support the launch and growth of underrepresented and BIPOC firms through training, coaching and technical assistance, through CenterState CEO's Up Start program and other small business development programming, including a real estate developer-in-residence pilot. It will also provide direct lending to and investment in undercapitalized firms via CenterState CEO's Growth + Equity Fund.

"This unique approach to equitable growth by CenterState CEO will help entrepreneurs from all backgrounds have access to assistance and financing they need that will help our region grow," said Stephen Fournier, KeyBank Central New York Market President. "We are proud to invest in their efforts that will make it possible for marginalized entrepreneurs to build successful futures and generational wealth."

"Systemic barriers have often left the talent of many entrepreneurs in our community untapped and their potential under supported," said Dominic Robinson, senior vice president of Inclusive Growth at CenterState CEO. "This investment from KeyBank will support important tools like the Growth + Equity Fund and Up Start that address these equity gaps and scale their economic impact on entrepreneurs from historically disinvested populations and neighborhoods."

Ultimately, as participants in these programs build successful businesses, they will achieve financial sustainability and begin to build generational wealth. As drivers of the local economy, they will gain stronger voices in local leadership, participate in the regeneration of the built environment, and drive economic growth and revitalization in these neighborhoods.

"Building generational wealth is key to building strong neighborhoods and strong economies," said Tamika Otis, corporate responsibility officer for KeyBank in Central New York. "This investment by Key will kelp CenterState CEO continue the important work they are doing to level the playing field and make our community more accessible, equitable and successful."

Since 2017, KeyBank has followed through on community commitments totaling more than

ABOUT KEYBANK

KeyBank's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, KeyCorp is one of the nation's largest bank-based financial services companies, with assets of approximately

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank is Member FDIC.

ABOUT CENTERSTATE CEO & THE CENTERSTATE CEO FOUNDATION

CenterState CEO is Central New York's premier business leadership and economic development organization, committed to creating a region where business thrives, and all people prosper. Its vision is to be recognized as a visionary leader, effective advocate, exceptional employer and a force for positive outcomes for the community.

The mission of the CenterState CEO Foundation is to attract philanthropic support for CenterState CEO programs that remove barriers to economic prosperity for people and places. These programs help residents access quality jobs, inclusive workplaces and entrepreneurship opportunities, as well as build vibrant neighborhood business centers. Supported activities are designed in collaboration with community partners and focus on engaging historically marginalized populations including women, people of color, Indigenous people, veterans, New Americans and individuals with low-to-moderate incomes.

View additional multimedia and more ESG storytelling from KeyBank on 3blmedia.com.

Contact Info:

Spokesperson: KeyBank

Website: https://www.3blmedia.com/profiles/keybank

Email: info@3blmedia.com

SOURCE: KeyBank

View the original press release on accesswire.com