Is Debt-Free the New Luxury? KeyBank Survey Explores

KeyBank (NYSE: KEY) released its 2026 Financial Mobility Survey on Nov. 10, 2025, reporting that Americans are redefining financial success around debt-free living (74%) while financial stress rose to 68% from 50% in 2024. The survey polled 1,004 adults in July 2025.

Other findings: 35% feel in control of their money, 25% say they could not cover an unexpected $2,000 (up from 19% in 2024), Gen X is most exposed (36%), 66% have less savings year-over-year, and 58% use BNPL (Gen Z 79%, Millennials 68%). Key reported assets of approximately $187 billion at Sept. 30, 2025.

KeyBank (NYSE: KEY) ha pubblicato la sua Indagine sulla Mobilità Finanziaria 2026 il 10 novembre 2025, riportando che gli americani stanno ridefinendo il successo finanziario attorno a uno stile di vita senza debiti (74%) mentre lo stress finanziario è aumentato al 68% dal 50% nel 2024. L'inchiesta ha contattato 1.004 adulti nel luglio 2025.

Altre scoperte: 35% si sentono in controllo dei loro soldi, 25% dicono che non potrebbero coprire un'imprevista spesa di 2.000 dollari (in aumento dal 19% nel 2024), Gen X è la più esposta (36%), 66% hanno meno risparmi anno su anno, e 58% usano BNPL (Gen Z 79%, Millennials 68%). Le attività segnalate principali ammontavano circa $187 miliardi al 30 settembre 2025.

KeyBank (NYSE: KEY) publicó su Encuesta de Movilidad Financiera 2026 el 10 de noviembre de 2025, informando que los estadounidenses están redefiniendo el éxito financiero en torno a la vida libre de deudas (74%) mientras el estrés financiero subió al 68% desde el 50% en 2024. La encuesta encuestó a 1,004 adultos en julio de 2025.

Otros hallazgos: 35% se sienten en control de su dinero, 25% dicen que no podrían cubrir un imprevisto de 2.000 dólares (incremento desde 19% en 2024), Gen X es la más expuesta (36%), 66% tienen menos ahorros año tras año, y 58% usan BNPL (Gen Z 79%, Millennials 68%). Activos reportados por aproximadamente $187 mil millones al 30 de septiembre de 2025.

KeyBank (NYSE: KEY)가 2026년 재무 모빌리티 설문조사를 2025년 11월 10일 발표했으며, 미국인들이 재정적 성공을 빚 없이 살기(74%)를 중심으로 재정적 성공의 정의를 바꾸고 있는 한편 재정적 스트레스는 68%로 상승했다(2024년 50%에서), 이 설문은 2025년 7월에 1,004명의 성인을 대상으로 조사되었습니다.

다른 결과: 35%가 자신의 돈을 통제하고 있다고 느끼고, 25%는 예기치 못한 2,000달러를 커버할 수 없다고 말하며(2024년의 19%에서 상승), Gen X가 가장 노출되어 있습니다(36%), 66%는 연간 저축이 줄었고, 58%가 BNPL을 사용합니다(Gen Z 79%, Millennials 68%). 주요 보고 자산은 2025년 9월 30일 기준 약 $1870억입니다.

KeyBank (NYSE: KEY) a publié son enquête 2026 sur la mobilité financière le 10 novembre 2025, constatant que les Américains redécouvrent le succès financier autour de la vie sans dette (74%) tandis que le stress financier a augmenté à 68% contre 50% en 2024. L'enquête a interrogé 1 004 adultes en juillet 2025.

Autres résultats : 35% se sentent maîtres de leur argent, 25% disent qu'ils ne pourraient pas couvrir une dépense imprévue de 2 000 dollars (en hausse par rapport à 19% en 2024), la Génération X est la plus exposée (36%), 66% ont moins d'économies d'une année sur l'autre, et 58% utilisent le BNPL (Gen Z 79%, Millennials 68%). Les actifs signalés s'élèvent à environ $187 milliards au 30 sept. 2025.

KeyBank (NYSE: KEY) veröffentlichte seine Financial Mobility Survey 2026 am 10. November 2025 und berichtete, dass Amerikaner den finanziellen Erfolg neu definieren, rund um schuldloses Wohnen (74%), während finanzieller Stress auf 68% von 50% im Jahr 2024 gestiegen ist. Die Umfrage befragte 1.004 Erwachsene im Juli 2025.

Weitere Erkenntnisse: 35% fühlen sich in der Lage, die Kontrolle über ihr Geld zu behalten, 25% sagen, sie könnten eine unerwartete Ausgabe von 2.000 USD nicht decken (Anstieg von 19% im Jahr 2024), Gen X ist am stärksten betroffen (36%), 66% haben year-over-year weniger Ersparnisse, und 58% verwenden BNPL (Gen Z 79%, Millennials 68%). Vermeldete Vermögenswerte belaufen sich auf ungefähr $187 Milliarden zum 30. Sept. 2025.

KeyBank (بورصة نيويورك: KEY) نشرت مسح التنقل المالي لعام 2026 في 10 نوفمبر 2025، حيث أفاد بأن الأمريكيين يعيدون تعريف النجاح المالي حول العيش بلا ديون (74%) بينما ارتفع التوتر المالي إلى 68% من 50% في 2024. استطلعت المسودة 1,004 بالغين في يوليو 2025.

نتائج أخرى: 35% يشعرون بأنهم يتحكمون بأموالهم، 25% يقولون إنهم لا يستطيعون تغطية مصروف غير متوقع قدره 2,000 دولار (ارتفاع من 19% في 2024)، جيل إكس الأكثر تعرضاً (36%)، 66% لديهم مدخرات أقل سنة بعد أخرى، و 58% يستخدمون BNPL (جيل زد 79%، المايليين 68%). الأصول المُبلغ عنها تقارب $187 مليار حتى 30 سبتمبر 2025.

- None.

- None.

As financial stress rises, 3 in 4 define financial success as debt-free living. Still, 1 in 3 feel in control of their money management, finds the new survey.

KeyBank (NYSE: KEY) also found that -- even as

The KeyBank Financial Mobility Survey polled more than 1,000 Americans to gain insights into respondents' spending and savings habits, levels of financial confidence, stress, resiliency, economic sentiment, and the impacts of debt.

Highlights include:

-

Americans' emergency readiness drops as costs climb: Over the past six years, day-to-day price increases and financial stress have eroded Americans' confidence in their ability to cover an unexpected

$2,000 25% ) Americans are certain they cannot come up with$2,000 19% in 2024. The most affected generation is Gen X, with36% saying they could not come up with the money. -

Traditional milestones have taken a back seat … for now:

53% of consumers say that paying for experiences or a certain lifestyle was less of a priority than one year ago, and39% said both buying a home and getting married were less of a priority than one year ago. Still, more than half (55% ) consider homeownership a "very important" part of their definition of success. -

The feeling of success has decreased: Only

39% of Americans report feeling more financially successful than they did five years ago. For those who felt less successful (22% ), it was due to the rising cost of living and inflation (71% ), economic uncertainty (45% ), and job changes or career burnout (26% ). -

Younger generations are living on their own terms: Gen Z is rewriting the definition of success, with just

13% saying they're still pursuing traditional milestones. Additionally,33% of Gen Zers say they have decided against buying a home,33% have decided against getting married,34% have decided against having children, and34% have decided against pursuing a higher education because it no longer fits their definition of success. -

The kids are alright; the grandparents are not:

28% of Gen Zers say that their current approach to money is, "I'll figure it out," more than any other generation. On the flip side,16% of Gen Xers say, "I need a financial miracle," which is the highest of any generation.

"The financial landscape for Americans is shifting in profound ways," said Daniel Brown, EVP & Director, Consumer Product Management at KeyBank. "It's showing that the measure of success is not wealth alone, but also the ability to live debt free and prepare for what's ahead. As consumers face rising financial stress, our role as a trusted partner is to help clients navigate uncertainty, uncover new possibilities, and move forward with clarity and confidence."

Valuing Resilience over Riches

The rising cost of living and increased price of everyday items are putting a strain on wallets across households in America.

- Americans are most concerned about day-to-day expenses like groceries (

55% ), housing costs (35% ), and credit card debt (26% ). - Cost increases have led

49% of consumers to switch to less expensive brands or services and41% to reduce subscriptions or memberships. - Even with daily and weekly trade-offs, savings are shrinking year over year –

66% of consumers say they have less money in their savings account this year compared to last. - As rising expenses reshape household budgets, many Americans are cutting back where they can –

58% are spending less and40% are saving less compared to previous years.

Using BNPL for Near-term Relief

For some, however, pulling back isn't enough. To help sustain their desired lifestyle, many are increasingly relying on financial floats, like Buy Now, Pay Later (BNPL), that blur the line between control and strain.

- More than half (

58% ) of Americans say they are using BNPL programs, but particularly younger generations such as Gen Z (79% ) and Millennials (68% ). - BNPL users report having a slightly less negative personal financial outlook (

49% ) than non BNPL users (58% ). - In fact, only

10% of BNPL users cite BNPL payments as a top three financial concern. - Yet even as these tools offer short-term flexibility, nearly three in four (

73% ) BNPL users still report feeling financially stressed, underscoring the tension between near-term choice and long-term planning.

"For many Americans, rising costs aren't just numbers on a reciept; they represent difficult choices that shape everyday life," said Brown. "Whether it's prioritizing debt reduction or using new financial tools, people are looking for ways to stay in control while navigating an uncertain environment. We know that every financial journey is personal, and our role is to help clients find practical, meaningful steps that fit their circumstances and help them move forward on their financial journeys."

To learn more about the survey's findings, visit the KeyBank 2026 Financial Mobility Survey Executive Summary.

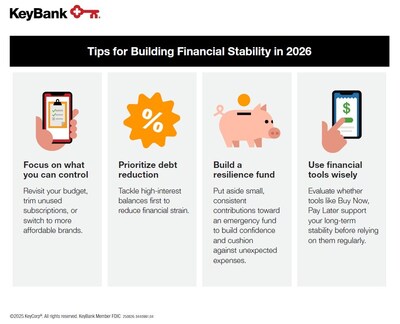

Access KeyBank's financial wellness online resources, including the Financial Wellness Center's Banking 101 curriculum, or meet with a local banker to complete a Key Financial Wellness Review for a more financially confident future.

Methodology

This survey was conducted online by Schmidt Market Research in July 2025, polling 1,004 Americans, ages 18-70. All respondents have sole or shared responsibility for household financial decisions and maintain a checking or savings account. The survey examined respondents' spending and savings habits, levels of financial confidence, stress and resiliency factors, economic sentiment, and debt impacts.

About KeyCorp

In 2025, KeyCorp celebrates its bicentennial, marking 200 years of service to clients and communities from

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout

CFMA #251103-3705828

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/is-debt-free-the-new-luxury-keybank-survey-explores-302606087.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/is-debt-free-the-new-luxury-keybank-survey-explores-302606087.html

SOURCE KeyBank