Kingfisher Announces Further Consolidation in Golden Triangle with Option to Acquire Forrest Kerr Project

Rhea-AI Summary

Kingfisher Metals (TSXV:KFR / OTCQB:KGFMF) signed a three-year option to acquire 100% of the 202 km2 Forrest Kerr Project in British Columbia's Golden Triangle, subject to TSXV approval. The project hosts multi-kilometre porphyry copper-gold and epithermal gold-silver targets at RDN, Boundary, and Forrest Creek and contains historical high-grade intercepts including 90.27 g/t Au over 4 m. Historical datasets include 36,000 m of drilling and extensive soil sampling. Option consideration comprises staged cash payments totaling $1.2M and share issuances valued at $1.5M, with follow-up desktop studies and targeted geophysics planned before drilling.

Positive

- 202 km2 strategic land consolidation in Golden Triangle

- Historical dataset: 36,000 m diamond drilling in 167 holes

- High-grade historical intercept: 90.27 g/t Au over 4 m

- Staged option consideration: $1.2M cash and $1.5M in shares

Negative

- Historical work focused on shallow vein drilling; limited modern porphyry targeting

- Option issues $1.5M in shares, creating potential dilution

- No immediate work commitments; exploration may be delayed

News Market Reaction

On the day this news was published, KGFMF declined 1.37%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

KGFMF fell 6.55% while peers were mixed: several (e.g., PGLDF +4.19%, PVGDF +2.86%) rose and WPGCF declined 3.85%, pointing to stock-specific pressure rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 04 | Property option deal | Positive | -1.4% | Three-year option to acquire 100% of Forrest Kerr Project with staged payments. |

| Nov 10 | Drill results update | Positive | -2.6% | Reported long gold intervals and soil anomaly expansion plus added claims at HWY 37. |

| Sep 23 | New porphyry system | Positive | +14.2% | Discovery of new porphyry copper system beneath Hank deposits with 429 m mineralization. |

| Sep 10 | High-grade CuEq hole | Positive | -13.8% | Reported 557.8 m at 0.64% CuEq including 234.35 m at 1.00% CuEq at HWY 37. |

| Aug 28 | Exploration program update | Positive | +1.2% | Exploration update outlining 6,850 m drilling and extensive surveys across HWY 37 targets. |

Recent positive technical and acquisition updates have produced mixed reactions, with both sharp gains and selloffs, suggesting inconsistent market confidence in exploration news.

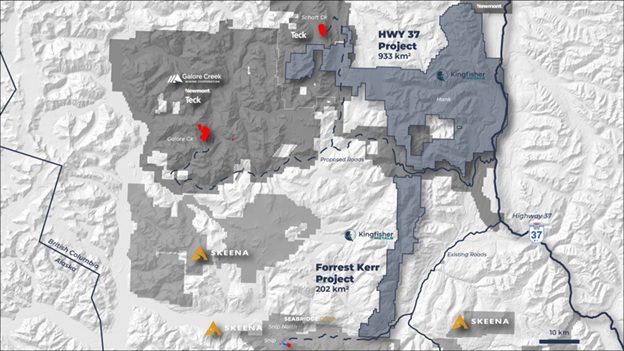

Over the last six months, Kingfisher has focused on building a large consolidated position in BC’s Golden Triangle. Exploration updates at HWY 37 highlighted long copper-gold intercepts, extensive drilling (up to 7,630 m), and broad geophysical and geochemical programs, while a prior Hickman acquisition expanded the land package to 849 km². Today’s Forrest Kerr option continues this consolidation theme, adding a 202 km² project with historical high-grade intercepts and substantial legacy datasets.

Market Pulse Summary

This announcement extends Kingfisher’s consolidation strategy in the Golden Triangle by adding the 202 km² Forrest Kerr Project via a staged option. The project brings historical high-grade gold-copper intercepts and sizeable datasets, which the company plans to refine through geophysical, geological, and LiDAR surveys before drilling. Investors may track TSXV approval timing, the staged cash and share commitments, and how Forrest Kerr is prioritized within the broader 1,135 km² landholding.

Key Terms

porphyry technical

epithermal technical

ip geophysics technical

lidar technical

net smelter returns financial

AI-generated analysis. Not financial advice.

VANCOUVER, BC / ACCESS Newswire / December 4, 2025 / Kingfisher Metals Corp. (TSXV:KFR)(FSE:970)(OTCQB:KGFMF) ("Kingfisher" or the "Company") is pleased to announce the signing of a three-year property option agreement to acquire the Forrest Kerr Project in the Golden Triangle, British Columbia (the "Forrest Kerr Option Agreement"), subject to the approval of the TSX Venture Exchange (the "TSXV"). The 202 km2 Forrest Kerr Project is located ~1 km south of the 933 km2 HWY 37 Project and stretches south for ~40 km (Figure 1).

Historical exploration on the Forrest Kerr Project largely focused shallow drilling targeting high-grade precious metal veins with limited use of modern exploration techniques (e.g. IP geophysics, 3D modeling, LiDAR) and without investigation of porphyry potential.

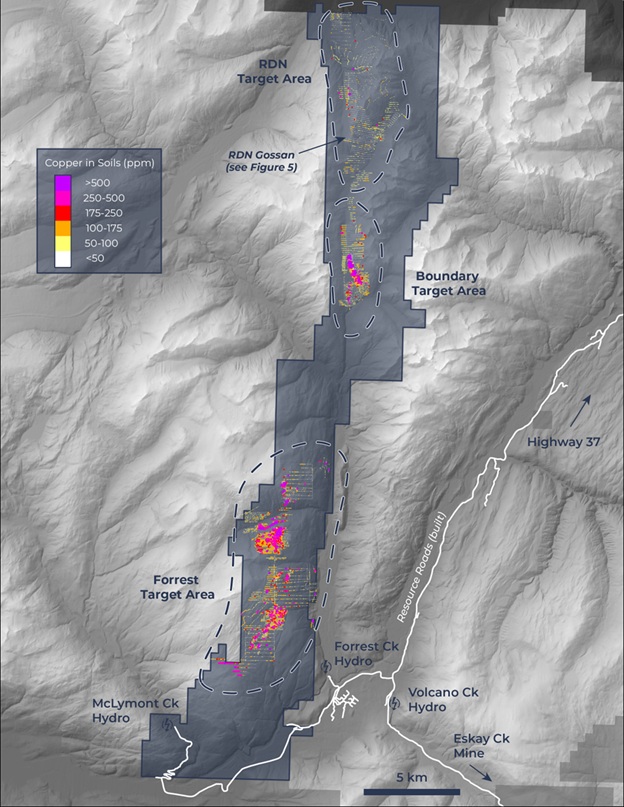

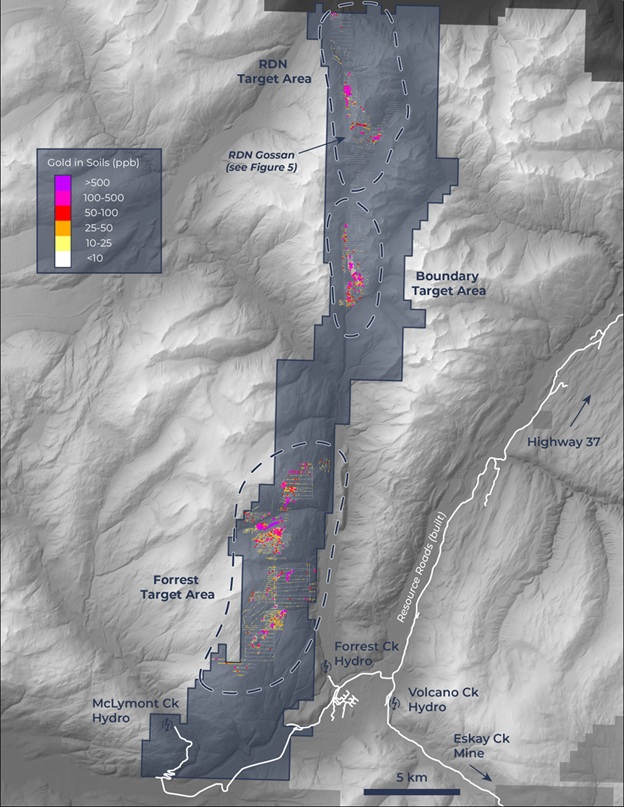

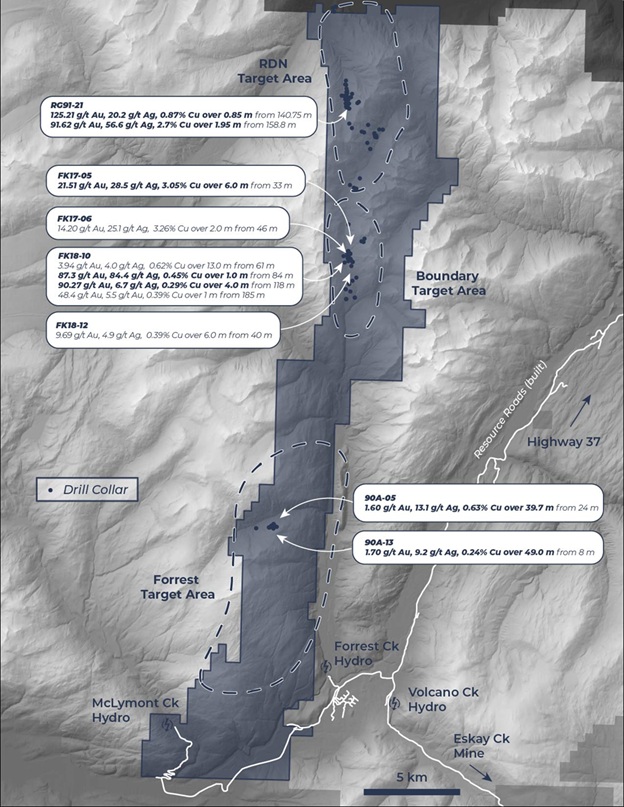

The Forrest Kerr Project is host to three large prospective porphyry copper-gold and epithermal gold-silver target areas that are located at RDN, Boundary, and Forrest Creek (Figure 2). Additional opportunities exist to improve upon high-grade gold intercepts such as 90.27 g/t Au over 4 m[1] through structural analysis and further exploration.

Forrest Kerr Project Highlights:

202 km2 project in the Golden Triangle with tenures in good standing until 2030

High-grade copper-gold mineralization (Table 1)

Multi-kilometer scale copper and gold soil anomalies (Figure 3 & 4)

Porphyry copper-gold targets have seen limited drilling/targeting

KSM-age Texas Creek intrusive rocks are present - similar geological setting to KSM and Brucejack porphyry-epithermal trend

Favourable erosional level - exposure of Triassic-Jurassic unconformity ('red line')

High-grade gold systems have not seen adequate structural modeling

Road networks - Galore Creek road to north and service roads for hydroelectric projects on claim in south

Dustin Perry, CEO of Kingfisher, states "The Forrest Kerr Project is highly prospective for both high-grade gold-silver mineralization as well as porphyry copper-gold mineralization. Historical exploration on the project has returned high-grade gold intercepts such as 4 m of 90.27 g/t Au and 1.95 m of 91.6 g/t Au[2]. The project spans one of the major long-lived structures within the Golden Triangle and is yet to see modern high-level geological targeting, which is something our experienced exploration team excels at. Efficient consolidation within the Golden Triangle has been our intention since moving into the region in 2023 and this deal further highlights our accretive growth strategy."

Table 1. Forrest Kerr Project significant historical drill results

Target Area | Hole | From (m) | To (m) | Interval[3] (m) | Au g/t | Ag g/t | Cu % |

|---|---|---|---|---|---|---|---|

RDN | RG91-21[4] | 140.75 | 141.60 | 0.85 | 125.31 | 20.2 | 0.87 |

and | 158.80 | 160.75 | 1.95 | 91.62 | 56.6 | 2.70 | |

Boundary | FK17-05[5] | 33.0 | 39.0 | 6.00 | 21.51 | 28.5 | 3.05 |

FK17-065 | 14.0 | 16.0 | 2.0 | 14.20 | 25.1 | 3.26 | |

FK18-101 | 61.0 | 74.0 | 13.0 | 3.94 | 4.0 | 0.62 | |

and | 84.0 | 85.0 | 1.0 | 87.30 | 84.4 | 0.45 | |

and | 118.0 | 122.0 | 4.0 | 90.27 | 6.7 | 0.29 | |

and | 185.0 | 186.0 | 1.0 | 48.40 | 5.5 | 0.39 | |

FK18-121 | 40.0 | 46.0 | 6.0 | 9.69 | 4.9 | 0.39 | |

Forrest | 90A-055 | 24.0 | 63.7 | 39.7 | 1.60 | 13.1 | 0.63 |

90A-13[6] | 8.0 | 57.0 | 49.0 | 1.70 | 9.2 | 0.24 | |

Forrest Kerr Project Overview

The Forrest Kerr Project straddles the north-trending Forrest Kerr shear zone with parallel trending copper and gold anomalism. Exploration on the project since 1988 includes over 36,000 m of diamond drilling in 167 holes, 16,311 soil samples, 1,781 rock samples and 259 stream sediment samples[7]. The majority of these collected during the exploration programs during the years from 2016 to 2021. The Forrest Kerr trend includes numerous Texas Creek intrusions which are regionally associated with porphyry and epithermal mineralization in Sulphurets (KSM, Treaty Creek, Brucejack), Iskut, and Hank-Mary areas. Numerous high-grade showings on the project are also associated with large copper-in-soil anomalies (Figure 3). Copper and gold anomalism is broadly coincident (Figure 4), a common relationship in porphyry regions.

The RDN Target Area

The RDN Target Area includes high-grade polymetallic vein prospects (Table 1) cored by a bright white-yellow core gossan body (Figure 5) interpreted to be a leached cap above a possible porphyry system. The total extent of both the gossan and the geochemical anomalies on surface is at least 10 km northerly and ranges 1.5 to 3 km wide (Figure 2). The core gossan target area in Figure 5 is marked by complete loss of original rock character, depressed copper-gold values compared to flanking domains, white colour (iron loss), and recessive nature. These features together in the heart of the alteration body can be indications of a leached cap, which is a common feature of porphyry copper-gold systems. Only three shallow historical holes test the outer margin of the core gossan target area, including hole RG90-11 with 18.19 g/t Au, 8.4 g/t Ag and

Boundary Target Area

The Boundary Target Area is approximately 2.5 km north south and 350-800 m wide. The target area includes both high-grade polymetallic veins as well as grassroots copper-gold porphyry targets. Previous targeting along the trend focused on tightly spaced drilling of gold-bearing veins flanking the broader copper-in-soil anomalism (Figure 2 & 3). Surface geological work and ground IP geophysical survey datasets are suggested to better identify porphyry copper-gold drill targets at Boundary. Visible gold has been noted in historical drill core (Figure 6).

Forrest Target Area

The Forrest Target Area is defined by an approximately 11 km north-south elongate copper-gold soil anomaly that measures approximately 1.5 to 2 km wide. The geochemical anomaly lies in a comparable structural position as the nearby KSM district with mineralization in the footwall of a west-dipping thrust fault mapped by the BC Geological Survey. The most advanced target in the trend is the Forrest Creek porphyry target with a 1.5 km west-east and 2.1 km north-south copper-gold soil anomaly (Figure 3). Historical work only focused on an area of 430 by 340 m with shallow drilling (less than 150 m downhole). Overall, the trend has seen very little modern exploration with very limited follow-up since good results in an early 90s drill campaign (e.g. 39.7 m at 1.6 g/t Au, 13.1 g/t Ag and

Transaction Terms

Option Terms to Acquire

The Company has entered into the Forrest Kerr Option Agreement with Aben Gold Corp. (TSX.V:ABN) ("Aben"), whereby Aben has granted Kingfisher the right to acquire a

Pursuant to the terms of the Forrest Kerr Option Agreement, Kingfisher has the right to earn a

a cash payment of

$150,000 and issuing common shares with a value of$500,000 on the date that the TSXV approve the Forrest Kerr Option Agreement (the "TSXV Approval Date");an additional cash payment of

$150,000 and issuing additional common shares with a value of$500,000 on or before the date that is 6 months from the TSXV Approval Date;an additional cash payment of

$200,000 and issuing additional common shares with a value of$500,000 on or before the date that is 12 months from the TSXV Approval Date; andan additional cash payment of

$700,000 t hat is 36 months from the TSXV Approval Date.

Future Steps

Given the project has no immediate work commitments the Company has no obligations to rush into exploration on the Forrest Kerr Project. Kingfisher will continue desktop studies on the project over the coming months and prioritize targets within the greater target pipeline across the 1,135 km2 landholding within the Golden Triangle. Kingfisher will focus on permitting the project and taking a staged approach to exploration, evaluating and improving the target areas before initiating any drill campaigns. It is anticipated that geophysical, geological, and LiDAR surveys will be the first priority. Additionally, Kingfisher intends to leverage the robust data set using Vrify's AI-Assisted Mineral Discovery Platform.

Qualified Person

Tyler Caswell P.Geo., Kingfisher's VP Exploration, is the Company's Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. Mr. Caswell has supervised, reviewed, and approved the technical information presented in this release.

About Kingfisher Metals Corp.

Kingfisher Metals Corp. (https://kingfishermetals.com/) is a Canadian based exploration company focused on copper-gold exploration in the Golden Triangle, British Columbia. Through outright purchases and option earn in agreements (Orogen Royalties, Golden Ridge Resources, and Aben Gold) the Company has quickly consolidated one of the largest land positions in the Golden Triangle region at with the 933 km2 HWY 37 Project and 202 km2 Forrest Kerr Project. Kingfisher also owns (

For further information, please contact:

Dustin Perry, P.Geo.

CEO and Director

Phone: +1 778 606 2507

E-Mail: info@kingfishermetals.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property. This news release contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements in this news release include, among others, statements relating to expectations regarding the projects, and other statements that are not historical facts. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; compliance with extensive government regulation; domestic and foreign laws and regulations could adversely affect the Company's business and results of operations; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company's securities, regardless of its operating performance.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

[1] Historical results extracted from McDowell, C. & Stacey, J.R., 2018 Geochemical and Diamond Drilling Report on the Forrest Kerr Property, ARIS report no. 38384. A QP has not verified these results; they are provided for context only and should not be relied upon.

[2] Historical results extracted from Savell, M. & Grill, E. Diamond Drilling Report on the RDN, GOZ and DPR Claims, ARIS report no. 22003. A QP has not verified these results; they are provided for context only and should not be relied upon.

[3] True widths not known.

[4] Historical results extracted from Savell, M. & Grill, E. Diamond Drilling Report on the RDN, GOZ and DPR Claims, ARIS report no. 22003. A QP has not verified these results; they are provided for context only and should not be relied upon.

[5] Historical results extracted from McDowell, C., 2017 Geochemical and Diamond Drilling Report on the Forrest Kerr Property, ARIS report no. 36955. A QP has not verified these results; they are provided for context only and should not be relied upon.

[6] Historical results extracted from Stammers, M.A. & Ikona, C.K. 1990 Assessment Report on the Geochemical, Geophysical, Prospecting, Trenching and Diamond Drilling Program Forrest 1-15 Mineral Claims, ARIS report no. 20562. A QP has not verified these results; they are provided for context only and should not be relied upon.

[7] The Forrest Kerr Project database includes historical information compiled from prior operators, consisting of 167 drill holes with 36,704 m of drilling, 16,311 soil, 259 silt samples, and 1,781 rock samples. The Company has verified a portion of this historical data through review of original assessment reports and supporting documentation; however, not all historic information has been fully verified and therefore should not be relied upon.

[8] Historical results compiled from Awmack, H.J., 2001. RDN: A Shallow Marine Volcanogenic Massive Sulphide Prospect. A QP has not verified these results; they are provided for context only and should not be relied upon.

SOURCE: Kingfisher Metals Corp.

View the original press release on ACCESS Newswire