Kenorland Identifies Significant Gold-In-Till Geochemical Anomalies at the Western Wabigoon and Flora Projects in Northwestern Ontario

Rhea-AI Summary

Kenorland Minerals (OTCQX: KLDCF) reported 2024–2025 geochemical and prospecting results at its Western Wabigoon and Flora projects in northwestern Ontario under an option with a Centerra subsidiary.

Key findings include a ~19 km gold-in-till trend at Western Wabigoon, a 4 km continuous gold-grain anomaly at W2 with up to 251 normalized grains per sample, rock samples to 7.75 g/t Au, and Flora’s F1 target showing a 7 km gold-in-till anomaly with rock samples to 31.70 g/t Au. Kenorland completed infill soils, HMC till sampling, mapping, and heliborne surveys in 2025 and is planning up to 5,000 m diamond drilling in 2026, prioritizing W2.

Positive

- ~19 km gold-in-till trend defined at Western Wabigoon

- W2 gold-grain anomaly continues 4 km with up to 251 grains

- Flora F1 shows 7 km high-tenor gold-in-till anomaly

- Rock samples up to 31.70 g/t Au in Flora central zone

- Planned up to 5,000 m diamond drilling in 2026

Negative

- No historical drilling in Flora F1 target

- W2 and F1 remain untested by significant diamond drilling

News Market Reaction

On the day this news was published, KLDCF declined 3.31%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves, with CVVUF up 4.53% and XTPT up 2.27%, while HUSIF, QUEXF, and DMXCF declined between about -0.96% and -2.49%, suggesting stock-specific rather than broad sector momentum.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Exploration & corporate update | Positive | -0.7% | Company-wide exploration, partner programs and financial position update. |

| Dec 02 | Ontario exploration results | Positive | -3.3% | Gold-in-till anomalies and drilling plans at Western Wabigoon and Flora. |

| Nov 26 | Regnault MRE timing | Positive | +13.4% | Upcoming maiden Mineral Resource Estimate for Regnault gold deposit. |

| Nov 11 | O'Sullivan drilling start | Positive | -1.1% | Commencement of funded diamond drilling at O'Sullivan in Quebec. |

| Nov 03 | South Uchi drill completion | Positive | +1.0% | Completion of Phase 2 drilling at South Uchi with assays pending. |

Recent positive exploration and resource updates often saw mixed to negative next-day reactions, with 3 divergences versus 2 aligned moves.

This announcement adds to a busy period of exploration and resource-related news for Kenorland. In early November, the company reported drilling at O'Sullivan and completion of a fall drill program at South Uchi. Late November brought an update on the upcoming Regnault Mineral Resource Estimate using 127,217 metres of drilling. On Dec 9, 2025, Kenorland outlined a robust exploration and financial position. Against this backdrop, today’s Western Wabigoon and Flora anomalies further expand the greenfield pipeline with planned 5,000 m of drilling in 2026.

Market Pulse Summary

This announcement detailed early-stage exploration success at Western Wabigoon and Flora, including a 19 km gold-in-till trend, a 4 km gold-grain anomaly at W2, and rock samples up to 31.70 g/t Au. The company also outlined plans for up to 5,000 m of diamond drilling in 2026. In light of recent drilling and resource-related updates across its portfolio, key factors to monitor include follow-up drill results, conversion of anomalies to defined mineralization, and timing of future program decisions.

Key Terms

gold-in-till technical

orogenic gold systems technical

heavy mineral concentrate technical

heliborne magnetic technical

VLF-EM technical

radiometric survey technical

sheared diorite technical

diamond drilling technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 2, 2025) - Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) ("Kenorland" or the "Company") is pleased to announce results from its 2025 geochemical and prospecting surveys targeting gold systems at the Western Wabigoon and Flora projects (the "Projects") in northwestern Ontario. The Projects are currently held under an option agreement with a subsidiary of Centerra Gold Inc. ("Centerra").

Western Wabigoon and Flora Highlights:

- Multiple km-scale gold-in-till anomalies across both Projects (see Figures 2 and 3)

- Complex structural and geologic settings, prospective for orogenic gold systems

- Limited historical exploration within the target areas

- Maiden drill program planning for 2026 underway

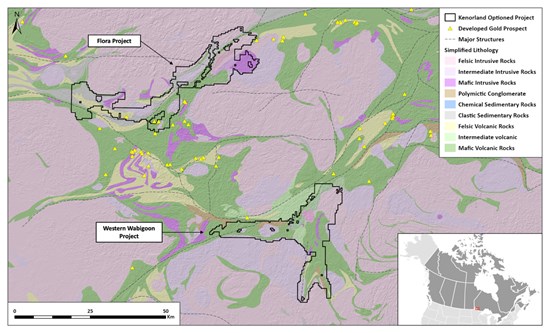

Figure 1. Regional geology of the Western Wabigoon subprovince with Western Wabigoon and Flora Project locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/276578_a1841cb5b48f292d_001full.jpg

Western Wabigoon Project

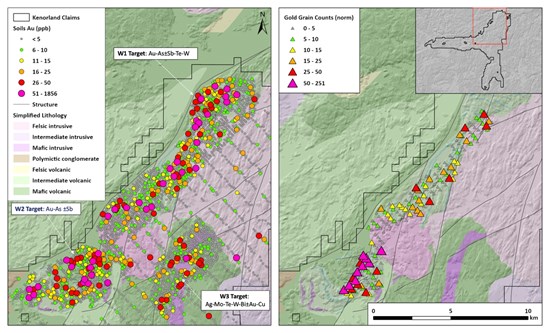

Large-scale systematic geochemical surveys have defined a ~19 kilometre gold-in-till trend along a major structural corridor. Within this corridor, infill sampling completed in 2025 further refined multiple coherent, high-tenor gold-in-till anomalies across the W1, W2 and W3 target areas. Gold grain analysis from heavy mineral concentrate (HMC) till sampling has reinforced this interpretation, with the W2 target producing a strong, continuous gold-grain anomaly, including normalised counts of up to 251 grains per sample, along a 4km trend open to the southwest. Together, these results highlight W2 as a priority for follow-up exploration in 2026 including diamond drilling. The W2 Target area encompasses an area of numerous multi-gram per tonne Au showings from trenching and shallow drilling within an area historically known as the Sorry Mac trend. Surface work conducted by Kenorland has confirmed gold mineralisation along the trend with rock samples up to 7.75 g/t Au, and significantly expanded the historical footprint into what is now referred to as the W2 Target.

During the 2025 program, the Company completed an infill soil sample survey on a 100 m x 200 m grid, HMC till samples collected at 250 m x 500 m spacing, mapping and prospecting, and a heliborne magnetic, VLF-EM, and radiometric survey to enhance structural interpretation and guide ongoing target development.

Figure 2. Map of the W1, W2 and W3 target areas of the Western Wabigoon Project: Left hand side - Au in fine fraction soil geochemistry; right hand side - normalized gold grain counts from HMC till sampling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/276578_a1841cb5b48f292d_002full.jpg

Flora Project

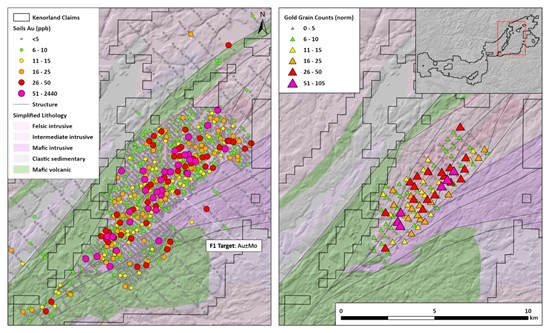

Geochemical surveys completed in 2024 and 2025 have outlined the F1 target as a large-scale, high-tenor gold-in-till anomaly extending over 7 kilometres within a sheared diorite, coincident with a coherent 7 kilometre trend of strong gold grain results from HMC till sampling. Mapping and prospecting within the F1 area identified high-grade gold mineralisation, with rock samples returning up to 31.70 g/t Au in the central portion of the target area and up to 17.40 g/t Au approximately 3 kilometres to the northeast. No historical drilling has been completed in the F1 area.

The Company completed extensive follow-up work during the 2025 exploration program, including infill soil samples on a 100 m x 200 m grid across both the F1 and F2 target areas, along with mapping and prospecting. In addition, HMC till samples were collected at 250 m x 500 m spacing for gold grain analysis, and a heliborne magnetic, VLF-EM, and radiometric survey was flown over the F1 target to refine structural and lithological interpretation and support ongoing target development.

Figure 3. Map of the F1 target area within the Flora Project: Left hand side - Au in fine fraction soil geochemistry; right hand side - normalised gold grain counts from HMC till sampling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/276578_a1841cb5b48f292d_003full.jpg

2026 Exploration Program Planning

Planning for the 2026 field campaign is under way with up to 5,000m of diamond drilling proposed, designed as a series of fences to test key structural intersections associated with strong gold-in-till and gold grain anomalies, focusing on the priority W2 target of the Western Wabigoon Project.

At the Flora Project, 2026 work will focus on additional surface exploration, including mapping and prospecting to help refine targets intended to position Flora for a future drill program.

About The Projects

The Western Wabigoon Project is situated within the Western Wabigoon subprovince and covers key intersections of major deformation zones within the Archean greenstone belt. In the northern portion of the property, the Pipestone-Cameron Deformation Zone (PCdz) intersects both the Manitou-Dinorwic Deformation Zone (MDdz) and the Helena-Pipestone Deformation Zone (HPdz). The PCdz hosts the Cameron orogenic gold deposit 30 km to the northwest, while the HPdz hosts the Rainy River deposit 50 km to the southwest. These high-strain structural corridors also host numerous gold showings associated with iron carbonate veins, altered shear zones, and porphyry dykes.

The Flora Project is located within the Western Wabigoon subprovince of the Archean Superior Province. The major Wabigoon Fault (WF) transects the 80-km strike length of the property, juxtaposing Warclub assemblage rocks in the north against Populus Lake Group mafic volcanic and ultramafic intrusive rocks to the south. The region hosts multiple mineralisation styles, including orogenic gold deposits such as the Cameron deposit 15 km to the south along the northwest-trending Pipestone-Cameron Deformation Zone (PCdz) and the Goliath deposit 50 km to the northeast along the Wabigoon Fault, as well as magmatic Ni-Cu sulphide systems such as the Kenbridge deposit located 3 km east of the property.

The Projects are held under an earn-in agreement with a subsidiary of Centerra Gold (see press release dated June 25, 2025), whereby Centerra can earn up to a

In addition to its carried interest, Kenorland retains a

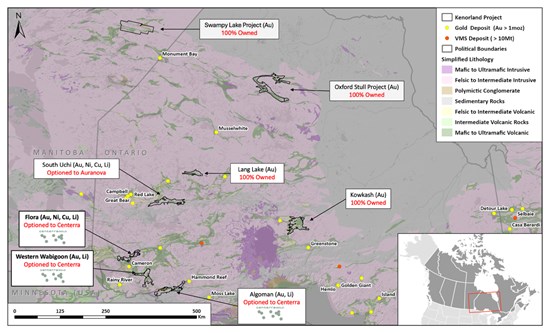

Figure 4. Kenorland western Superior Province gold project portfolio overview

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6489/276578_a1841cb5b48f292d_004full.jpg

QA/QC and Sampling Protocols

Soil Samples

All 2025 soil samples were collected under the supervision of Kenorland employees. Soil samples were hand dug in the field targeting the 'C' or 'B' horizon soil, bagged and then transported from the field to the crew facilities where blanks and certified reference materials were inserted at regular sample intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported to Bureau Veritas Commodities ("BV") laboratory in Timmins, Ontario.

Sample preparation and analytical work for this soil sampling program were carried out by BV. Samples were prepared for analysis according to BV method SS230: individual samples were dried at 60oC, and then sieved up to 100g to -230 mesh (-63 µm) for analysis. Samples were analyzed using BV method AQ252_EXT where a 30g split is analyzed by Aqua Regia digestion with ultratrace ICP-MS finish for both gold and multi-element geochemistry (52 elements). All results passed the QA/QC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Gold Grain Counts

All 2025 HMC till samples were collected under the supervision of Kenorland employees. 10kg of C-horizon till was extracted using augers and shovels and placed into Hubco bags. Groups of samples were placed in large bags and sealed with numbered tags to maintain a chain-of-custody and transported to Overburden Drilling Management (ODM) in Ottawa, Ontario.

ODM weighed the till samples, and then removed a 300-gram split for archive. Samples were sieved to +/- 2mm: the +2mm fraction was logged for pebble lithology and the -2mm size fraction was sent to a shaker table for heavy mineral concentration. After the shaker table, concentrates were micro-panned for additional concentration of the heavy minerals. At this point, visible gold grains were counted by ODM staff, as well as other metallic minerals.

Qualified Person

Mr. Janek Wozniewski, B.Sc., P.Geo. (EGBC #172781, APEGS #77522, EGMB #48045, PGO #3824, APEGNB #L7273), Vice President of Operations at Kenorland, a "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals Ltd.

Kenorland Minerals Ltd. (TSXV: KLD) is a well-financed mineral exploration company focused on project generation and early-stage exploration in North America. Kenorland's exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a

Further information can be found on the Company's website www.kenorlandminerals.com

On behalf of the Board of Directors,

Zach Flood

President, CEO & Director

For further information, please contact:

Alex Muir, CFA

Corporate Development and Investor Relations Manager

Tel +1 604 568 6005

info@kenorlandminerals.com

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (together, "forward-looking statements") within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as "plans", "expects", "estimates", "intends", "anticipates", "believes" or variations of such words, or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". Forward-looking statements involve risks, uncertainties and other factors disclosed under the heading "Risk Factors" and elsewhere in the Company's filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276578