Kuya Silver Reports Third Quarter 2025 Results

Rhea-AI Summary

Kuya Silver (OTCQB: KUYAF) reported Q3 2025 results showing operational progress at the Bethania Silver Project and a stronger balance sheet following a Q3 financing.

Key facts: Q3 throughput 1,841 tonnes processed producing concentrate sold equivalent to 16,983 oz silver; a single-day underground mining record of 102.5 tonnes; sustained ~90 tpd throughput in Oct–Nov; cash of $6.63M and net working capital $6.30M after a $6.57M private placement; Q3 revenue of $771,084 and Q3 net loss of $1,523,898.

Positive

- Cash $6.63M after Q3 financing

- Net working capital $6.30M surplus at Sept 30, 2025

- Private placement $6.57M (18,140,000 units) completed

- Processing 1,841 tonnes in Q3 and 16,983 oz silver sold

- Single-day underground record of 102.5 tonnes mined

Negative

- Q3 net loss of $1,523,898

- Nine-month net loss of $3,155,443

- Q3 production costs of $1,165,790 during ramp-up

- Temporary reduced mining rate in Q3 due to infrastructure upgrades

News Market Reaction

On the day this news was published, KUYAF gained 1.68%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Toronto, Ontario--(Newsfile Corp. - November 21, 2025) - Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (FSE: 6MR1) (the "Company" or "Kuya Silver") is pleased to announce financial and operating results for the three and nine months ended September 30, 2025. The third quarter marked another period of meaningful progress at the Bethania Silver Project in Peru, highlighted by record tonnes processed, significant upgrades to infrastructure, and a strengthened balance sheet following a successful Q3 financing.

Production Ramp-Up at Bethania Mine

The Company is currently achieving a consistent average throughput of approximately 90 tonnes per day (tpd), comprised of a blend of freshly-mined mineralized material and lower grade mineralized stockpile material. Most notably, the mining team has successfully validated the mine's higher-capacity potential, achieving a single-day mining record, earlier in November, of approximately 102.5 tonnes of mineralized material from the underground mine.

To continue this positive momentum in Q4 2025 and beyond, Kuya Silver has purchased additional mining equipment which is currently pending delivery and is expanding its workforce. These investments are designed to stabilize underground production at higher rates in the coming months.

Q3 2025 Highlights

Record concentrate sales from the Bethania mine: Kuya Silver processed 1,841 tonnes at the toll milling facility during the quarter-Bethania's strongest performance to date-resulting in the sale of 16,983 ounces of silver as processing caught up from the previous quarter.

Mine development supports initial 100 tpd production target: Recent underground development on the 640 level of the Española vein system advanced substantially, with sufficient working faces complete to support output above 100 tonnes per day.

Major Improvements to mine infrastructure: Key improvements included 11.6 kilometres of road maintenance, reinforcement of underground supports, installation of a new compressor and higher-capacity generator, and upgrades to camp accommodations-strengthening long-term operational reliability.

Q3 financing strengthened balance sheet and supports ramp-up: The Company completed a

$6.57 million (CAD$9.07 million ) private placement during the quarter, increasing cash to$6.63 million and net working capital to$6.30 million as at September 30, 2025, providing ample liquidity to advance the Bethania ramp-up.Revenue Generation: The Company generated

$2.16 million in revenue from the sale of concentrate from Silver Kings and the Bethania Silver Project during the nine-month period.

Christian Aramayo, Kuya Silver's Chief Operating Officer remarked, "We successfully executed the necessary operational upgrades in Q3 to clear the path for growth. The recent record of 102.5 tonnes of fresh mineralized material mined in a single day is the clearest indicator yet of the Bethania mine's inherent capacity. Our team is now moving rapidly to integrate the new equipment and new staff to secure a minimum 100-tpd baseline for our operations."

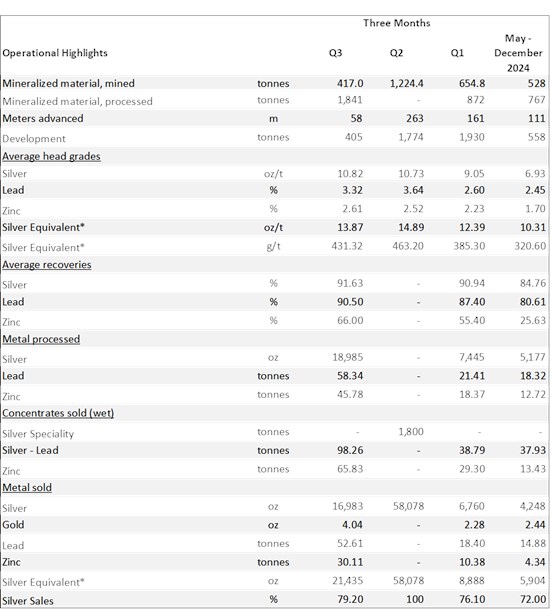

Operational Results

Bethania Silver Project (Peru)

Reconditioning and mine development advanced significantly throughout the nine months ended September 30, 2025, with activity concentrated on the 640 level of the Española vein system. By quarter-end, the Company had completed sufficient planned operating faces to establish the underground access required to support mining rates above 100 tonnes per day. This capacity was validated subsequent to the quarter end, when the mine achieved a single-day underground production record of 102.5 tonnes of fresh mineralized material.

Year-to-date, the mine has produced 2,296 tonnes of mineralized material, including 417 tonnes in Q3. The reduced mining rate during the quarter reflects a temporary pause while the Company completed infrastructure upgrades. During this period, Kuya Silver completed 11.6 kilometres of road maintenance, reinforced key underground supports, installed a new compressor and an upgraded electrical generator, and improved camp accommodations. Underground operations resumed in late September, with production continuing to increase through October and November. Subsequent to the end of Q3, additional development has been completed to prepare seven drilling chambers for underground diamond drilling.

Kuya Silver delivered its strongest processing performance from the Bethania Project to date in Q3 2025 as the toll mill processed 1,841 tonnes of mineralized material, resulting in the sale of 16,983 ounces of silver. This performance marks a significant step toward consistent production.

Production has continued to ramp-up during October and November. For the past two weeks, the mine has sustained production of 90 tonnes per day by combining fresh underground material with lower-grade stockpiled material. Given the significantly higher silver prices, the Company expects that it should be economically feasible to process low-grade stockpiled material, given the Company's experience processing this same material in late 2024. By adding stockpiled material to our current production scheme, it allows production crews to focus on additional development to continue the ramp-up underground over the coming months.

*prices for silver equivalent calculations use period ending spot prices and are as follows: Sept. 30, 2025 period; silver

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/275409_ce994a1724574895_001full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/275409_ce994a1724574895_002full.jpg

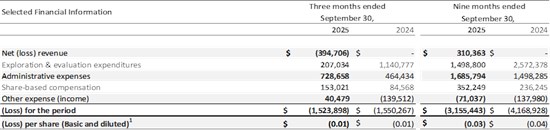

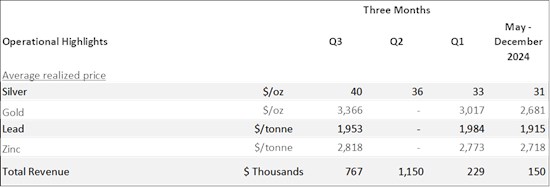

Financial Highlights

For the three months ended September 30, 2025, the Company recorded revenue of

For the nine months ended September 30, 2025, Kuya Silver recorded a net loss of

1 In periods when the Company has a loss, diluted loss per share is the same as basic loss per share.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5945/275409_ce994a1724574895_003full.jpg

Corporate Overview

Kuya Silver ended the quarter with a significantly improved financial position. Cash increased to

The improvement was primarily driven by the Company's Q3 financing, in which it issued 18,140,000 units for gross proceeds of

Subsequent to quarter-end, 3,502,528 warrants have been exercised for proceeds of CAD

During Q3, 2025, the Company strengthened its management and operational capabilities through the addition of Dr. Osbaldo Zamora, P.Geo as Vice President of Exploration and Gerardo Acuña (FAusIMM) as Mine Superintendent at the Bethania mine. These new team members bring extensive international experience in mining operations, supporting the Company's ongoing growth.

Kuya Silver entered into a research sponsorship agreement with Noble Capital Markets ("Noble"), a FINRA and SEC registered broker-dealer headquartered in Florida, USA. Noble recently initiated coverage of Kuya Silver, and the report can be found on Noble's research platform, ChannelChekTM (https://www.channelchek.com/) or through their website https://www.noblecapitalmarkets.com. Under the terms of the agreement Noble will provide independent, in-depth analysis of the Company's historic and present market position, financial position, corporate governance practices, among other services. The agreement has a one year term with a total value of

Outlook

Kuya Silver's primary near-term objective remains achieving stable production of 100 tonnes per day at the Bethania Silver Project as a pathway to reaching its phase one production target of 350 tonnes per day in 2026. With sufficient working faces currently developed to sustain 100 tpd production and major infrastructure upgrades now in place, the Company is well positioned to reach this milestone. Kuya Silver is also implementing a modernization program focused on improving underground haulage and material handling efficiency to support higher and more consistent throughput.

The Company is also commencing a 5,000 metre underground drilling program on the Santa Elena concession to enhance geological understanding at depth and assist with future mine planning. Kuya Silver continues to evaluate potential capital needs associated with the planned and fully-permitted on-site processing plant and may consider separate financing options as required.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Mr. Gerardo Acuña, Registered Professional Engineer of Queensland (Australia, RPEQ #29598), a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM(CP)), Mine Superintendent at Minera Toro de Plata S.A.C. a wholly-owned subsidiary of Kuya Silver and a Qualified Person as defined by National Instrument 43-101.

About Kuya Silver Corporation

Kuya Silver is a Canadian‐based mineral exploration and development company with a focus on acquiring, exploring, and advancing precious metals assets in Peru and Canada.

For further information, please contact:

David Stein, President & Chief Executive Officer

Telephone: (604) 398-4493

Email: info@kuyasilver.com

Website: www.kuyasilver.com

Reader Advisory

This news release contains statements that constitute "forward-looking information," including statements regarding the plans, intentions, beliefs, and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words "may," "would," "could," "will," "intend," "plan," "anticipate," "believe," "estimate," "expect," "must," "next," "propose," "new," "potential," "prospective," "target," "future," "verge," "favorable," "implications," and "ongoing," and similar expressions, as they relate to the Company or its management, are intended to identify such forward-looking information. Investors are cautioned that statements including forward-looking information are not guarantees of future business activities and involve risks and uncertainties, and that the Company's future business activities may differ materially from those described in the forward-looking information as a result of various factors, including but not limited to fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing, and general economic, market, and business conditions. There can be no assurances that such forward-looking information will prove accurate, and therefore, readers are advised to rely on their own evaluation of the risks and uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/275409