LaFleur Minerals Announces High-Grade Gold Assay Results and Provides Update on Beacon Gold Mill and Swanson Gold Deposit Ramp-Up Activities

Rhea-AI Summary

LaFleur Minerals (OTCQB:LFLRF) reported significant progress in its gold mining operations in Quebec's Abitibi Gold Belt. The company announced high-grade gold assay results from its Swanson Gold Project drilling program, including notable intersections of 7.47 g/t Au over 1.35 metres and 17.80 g/t Au over 1.0 metres.

The company is advancing the restart of its Beacon Gold Mill, with an estimated budget of $5 million. An independent evaluation valued the replacement cost of the mill and tailings storage facility at C$71.5 million. The company has completed 24 drill holes totaling 5,283 metres at the Swanson Gold Project, with plans to extend the current drilling program to approximately 7,500 metres.

Positive

- None.

Negative

- Only 6 out of 24 drill holes have assay results available

- True widths of mineralized zones are currently unknown

- Pending completion of PEA for full mining economic viability assessment

News Market Reaction

On the day this news was published, LFLRF gained 3.27%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - September 24, 2025) - LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) ("LaFleur Minerals" or the "Company") is pleased to provide an update on ramp-up activities at the Beacon Gold Mill and Swanson Gold Deposit located in the Abitibi Gold Belt, near Val-d'Or, Québec, Canada.

Kal Malhi, Chairman of LaFleur Minerals commented, "LaFleur Minerals is blessed to have the fully updated and permitted Beacon Gold Mill, tailings storage facility (TSF), and nearby Swanson Gold Deposit with an open-pit constrained mineral resource estimate. This puts LaFleur Minerals in a unique category of a full-fledged near-term gold producer in the prolific Abitibi Gold District. This summer was a great period of development for the Beacon Gold Mill restart and the Swanson Gold Deposit ramp-up. The Beacon Gold Mill ramp-up is about completing maintenance of mill equipment, planning exploration and drilling near the historical Beacon Mine, and identifying the logistics and operational efficiency to restart gold production at the fully permitted and primed for restart Beacon Gold Mill, using mineralized material initially from our nearby Swanson Gold Deposit once permitting is complete. We also continue to drill aggressively on the Swanson Project and assay results are starting to come back from the lab."

BEACON MILL RESTART

LaFleur Minerals is quickly advancing to restart the Beacon Gold Mill and recently held a site visit of the Beacon Gold Mill, tailings storage facility (TSF), and the Swanson Gold Deposit on August 12, 2025, attended by Company Executives, Consultants, Institutional Investors and Mining Analysts. Response to the state of the Beacon Gold Mill, its proximity to within 20 minutes from the town of Val-d'Or, and the size of the TSF were extremely positive.

Earlier this year, LaFleur Minerals engaged Bumigeme Inc. to conduct an independent evaluation, who confirmed the state of readiness at the Beacon Gold Mill and the ability to restart within the estimated

In addition, LaFleur Minerals is finalizing the engagement of a full-service geological and mining consulting firm to provide a comprehensive PEA by the end of October 2025 that covers the full mining and economic viability of restarting gold production at the Beacon Gold Mill with mineralized material from the Swanson Gold Deposit.

SWANSON GOLD DEPOSIT DRILLING RESULTS

LaFleur Minerals is also pleased to report the receipt of the first high-grade gold assay results from its ongoing exploration diamond drilling program at its Swanson Gold Project ("Swanson"), strategically situated within the prolific Abitibi Gold Belt near Val-d'Or, Québec. To date, 24 drill holes totalling 5,283 metres have been completed with assay results available for six (6) of these drill holes. Several drill holes exhibit high-grade, near-surface assay intercepts which highlight the strong potential to expand shallow, open-pit mineral resources at the Swanson Gold Deposit. Results also indicate step-out drilling success that has extended mineralization significantly along strike, reinforcing both the scale and continuity of the system at Swanson.

The Swanson Gold Project is a district-scale, consolidated land package that stretches over 18,000 hectares and hosts extensive historical work with over 36,000 metres of historical drilling, and is potentially an ideal source of mineralized material for the Beacon Gold Mill, the Company's near-term producing asset located only 60 km away. The large strike length, multiple high-grade targets and the potential to increase mineral resources suggest upside for growth at Swanson, validated by these initial assay results from the ongoing drilling program.

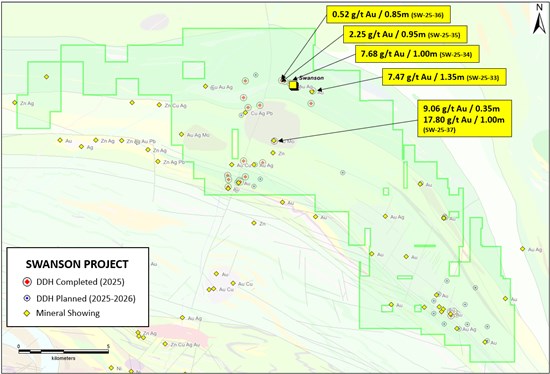

HIGHLIGHTS OF SWANSON DRILLING PROGRAM

High-grade, near-surface gold along strike of Swanson Gold Deposit:

7.47 g/t Au over 1.35 metres (SW-25-033), located 1 km along strike southeast of the Swanson Gold Deposit

7.68 g/t Au over 1.0 metres (SW-25-034), located 300 metres along strike northwest of the Swanson Gold Deposit

New high-grade gold discovery in the Bartec target area:

17.80 g/t Au over 1.0 metres (SW-25-037) in addition to anomalous molybdenum (Mo) and copper (Cu) hosted in the Laflamme intrusion in the Bartec target area

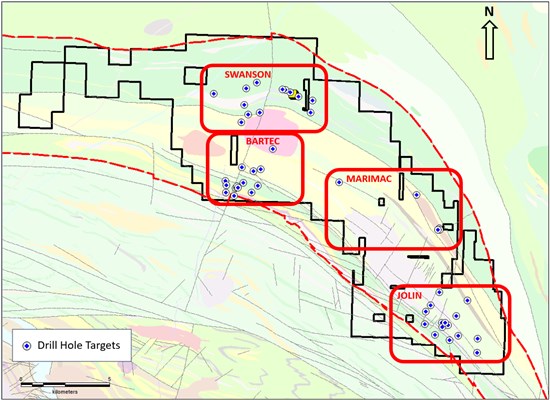

The Company has completed its initial 5,000 metre drilling program, targeting priority areas identified through extensive historical data compilation and recent exploration work by the Company at the Swanson Gold Deposit, and Bartec, Jolin, and Marimac target areas (Figure 1). This includes priority drilling targets from over 50 promising areas identified to date. Based on these initial and encouraging drilling results, including both analytical and visual core observations, the Company is extending the current drilling program to approximately 7,500 metres.

Recent high-grade gold assay drilling results testing the strike extension of the Swanson deposit include 7.47 g/t Au over 1.35 metres near surface at a hole depth of 29.55 metres in hole SW-25-033 confirming gold mineralization approximately 1 km along strike to the southeast of the Swanson Gold Deposit. Hole SW-25-034 returned 7.68 g/t Au over 1.00 metre at a hole depth of 181.15 metres representing a step-out intersection 300 metres to the northwest and along strike of the Swanson Gold Deposit.

High-grade gold mineralization of 17.80 g/t Au over 1.0 metres with anomalous Mo and Cu hosted within the syenite/monzonite rocks of the Laflamme intrusion was intersected in hole SW-25-037 in the northern part of the Bartec target area. This represents a significant and different style of mineralization than that observed at the Swanson Gold Deposit, located 3 km to the northeast, opening up a new target type for exploration.

Paul Ténière, CEO of LaFleur Minerals stated, "Near-surface grades such as 7.47 g/t Au over 1.35 metres and 7.68 g/t Au over 1.0 metre reinforce the strong opportunity for additional shallow mineralization along strike to the Swanson Gold Deposit. With multiple mineralized zones intersected across both targets, we are building confidence in the scale and continuity of the gold system at Swanson. These assay results represent important step-outs at Swanson, extending known mineralization significantly along strike in both directions. The very encouraging intercept of 17.80 g/t Au over 1.0 metre with anomalous molybdenite and copper mineralization in the Laflamme intrusion demonstrates the high-grade gold potential and different style of mineralization in a new area near the Bartec target."

DRILLING PROGRAM SUMMARY AND SIGNIFICANT ASSAY RESULTS

The collar details for the 24 completed drill holes totalling 5,283 metres are shown in Table 1, and the significant assay results and drill hole locations are shown in Table 2 and Figure 2. True widths of the mineralized zones are unknown at this time. The Qualified Person (QP) is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the assay data disclosed in this news release.

In addition to assays pending from recently completed holes, the Company reports encouraging visual observations from the ongoing drilling program. Hole SW-25-038 intersected 17.9 metres of massive to semi-massive sulphides (predominantly pyrite) from 217.65 m to 235.55 m, bordered on both sides by tuffs with strong sericite alteration. Hole SW-25-043 cut zones of disseminated to stringer pyrite within dark grey quartz veinlets hosted in altered basalt with carbonate and sericite alteration between 144.20-145.75 m and 147.00-151.05 m downhole. Hole SW-25-046 intersected disseminated, stringer, and locally massive sulphides associated with graphitic shear zones between 126.6 m and 139.5 m downhole. Reported intervals represent core lengths, not true widths.

The Company cautions that visual estimates of sulphide abundance should not be considered a proxy for mineral content or grade. Laboratory assays are required to determine the presence and concentrations of gold or other metals, and assay results from these intervals are still pending.

The Company's maiden diamond drilling program progresses with continued focus on testing regional exploration targets across the vast Swanson property including the Swanson, Bartec, Jolin, and Marimac targets. Additional holes are currently being logged, sampled, and submitted to the laboratory for assay testing. Additional drilling assay results will be reported as they become available.

Figure 1: Swanson drilling target regions and proposed drill holes (in blue)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/267694_45dcfa6bc454c84d_001full.jpg

Figure 2: Significant assay results from recent drilling at the Swanson and Bartec targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6526/267694_45dcfa6bc454c84d_002full.jpg

Table 1: Drill Collar Locations (holes completed to date)

| Hole-ID | Azimuth | Dip | Length (m) | Easting (m) | Northing (m) |

| SW-25-032 | 215 | -50 | 200 | 311565 | 5380111 |

| SW-25-033 | 215 | -50 | 200 | 311693 | 5380807 |

| SW-25-034 | 180 | -50 | 200 | 310434 | 5381275 |

| SW-25-035 | 180 | -50 | 200 | 310153 | 5381390 |

| SW-25-036 | 180 | -50 | 200 | 309981 | 5381440 |

| SW-25-037 | 180 | -50 | 200 | 309459 | 5378085 |

| SW-25-038 | 210 | -50 | 285 | 308759 | 5376922 |

| SW-25-039 | 200 | -50 | 240 | 307363 | 5375867 |

| SW-25-040 | 200 | -50 | 204 | 307424 | 5375893 |

| SW-25-041 | 200 | -50 | 201 | 307483 | 5375900 |

| SW-25-042 | 200 | -50 | 231 | 307445 | 5375972 |

| SW-25-043 | 200 | -50 | 225 | 307782 | 5376159 |

| SW-25-044 | 200 | -50 | 207 | 307693 | 5377050 |

| SW-25-045 | 200 | -50 | 201 | 306789 | 5376269 |

| SW-25-046 | 200 | -50 | 240 | 306831 | 5376033 |

| SW-25-047 | 200 | -50 | 201 | 306806 | 5375641 |

| SW-25-048 | 180 | -50 | 237 | 308710 | 5380121 |

| SW-25-049 | 180 | -50 | 234 | 308056 | 5380009 |

| SW-25-050 | 180 | -50 | 237 | 307831 | 5380568 |

| SW-25-051 | 180 | -50 | 201 | 307946 | 5381496 |

| SW-25-052 | 225 | -50 | 282 | 319313 | 5368164 |

| SW-25-053 | 225 | -50 | 204 | 318986 | 5368052 |

| SW-25-054 | 225 | -50 | 216 | 319076 | 5368177 |

| SW-25-055 | 225 | -50 | 237 | 319142 | 5368298 |

| Drill collar coordinates in UTM NAD83, Zone 18 | |||||

Table 2: Significant assay results table from recent drilling at the Swanson and Bartec targets

| Hole-ID | From (m) | To (m) | Length (m) | Grade (Au g/t) | Target Area | |

| SW-25-032 | No Significant Results | Swanson | ||||

| SW-25-033 | 29.55 | 30.90 | 1.35 | 7.47 | Swanson | |

| SW-25-033 | 184.85 | 185.4 | 0.55 | 0.60 | Swanson | |

| SW-25-033 | 185.40 | 186.70 | 1.30 | 1.96 | Swanson | |

| SW-25-034 | 51.45 | 52.55 | 1.10 | 1.87 | Swanson | |

| SW-25-034 | 181.15 | 182.15 | 1.00 | 7.68 | Swanson | |

| SW-25-035 | 56.45 | 57.40 | 0.95 | 2.25 | Swanson | |

| SW-25-035 | 168.60 | 169.45 | 0.85 | 0.56 | Swanson | |

| SW-25-036 | 196.25 | 197.10 | 0.85 | 0.52 | Swanson | |

| SW-25-037 | 132.55 | 136.10 | 3.55 | 1.15 | Bartec | |

| SW-25-037 | Incl. | 132.55 | 132.90 | 0.35 | 9.06 | Bartec |

| SW-25-037 | 158.00 | 159.00 | 1.00 | 17.80 | Bartec | |

| SW-25-037 | 178.30 | 178.90 | 0.60 | 0.50 | Bartec | |

| SW-25-037 | 187.50 | 188.90 | 1.40 | 0.76 | Bartec | |

| Reported intervals are drilled core lengths (true widths have not yet been determined) | ||||||

SAMPLING, QAQC, AND LABORATORY ANALYSIS SUMMARY

All core logging and sampling completed by LaFleur Minerals as part of its diamond drilling program is subject to a strict standard for Quality Control and Quality Assurance (QAQC), which include the insertion of certified reference materials (standards), blank materials, and field duplicate analysis. NQ-diameter sawed half-core samples from the drilling program at Swanson were securely sent by Company geologists to AGAT Laboratories Ltd. (AGAT), with sample preparation in Val-d'Or, Québec and analysis in Thunder Bay, Ontario, where samples were processed for gold analysis by 50-gram fire assay with an atomic absorption finish. Samples from selected holes were securely sent to AGAT in Calgary, Alberta, for multi-element analysis (including silver) by inductively coupled plasma (ICP) method with a four-acid digestion. AGAT sample preparation and laboratory analysis procedures conform to requirements of ISO/IEC Standard 17025 guidelines and meet the requirements under NI 43-101 and CIM best practice guidelines. AGAT is independent of LaFleur Minerals.

ENGAGEMENT OF MARKETING AND INVESTOR RELATIONS FIRMS

The Company is also pleased to announce various strategic marketing and investor relations engagements (the "Engagements") with arms-length independent contractors and agencies, with the aim of developing the Company's communication strategy and strengthening exposure to a wider audience.

A service agreement dated August 6, 2025 has been executed by the Company with CEO.CA Technologies Ltd. ("CEO.CA"), a subsidiary of EarthLabs Inc. and a leading investor social network in junior resource and venture stocks (the "CEO.CA Agreement"). Pursuant to the terms and conditions of the CEO.CA Service Agreement, CEO.CA has agreed to provide advertising services, news distribution and promotional content through digital channels to a targeted investor audience for the Company. The services may include company profile, banner advertisements served on desktop and mobile, news features, placements, videos, email sponsorships and Inside The Boardroom Video Interviews. The CEO.CA Service Agreement remains in effect for 12 months ending on August 6, 2026, the campaign period, and will not automatically renew. In accordance with the terms and conditions of the CEO.CA Service Agreement and as consideration for the services provided by CEO.CA, the Company has agreed to provide CEO.CA with a cash fee of CAD

A service agreement dated September 10, 2025 has been executed by the Company with Maximus Strategic Consulting Inc. ("Pinnacle Digest") (the "Pinnacle Service Agreement"). Pursuant to the terms and conditions of the Pinnacle Service Agreement, Pinnacle Digest will conduct, produce, edit and distribute, via PinnacleDigest.com's weekly email newsletter, YouTube channel and website at www.PinnacleDigest.com, a video about the Company which will include an interview with the Company's CEO or Chairman, b-roll and additional footage related to the Company and the gold industry. The Pinnacle Service Agreement remains in effect for 4 months, with services commencing October 1, 2025, through February 1, 2026, and will not automatically renew. In accordance with the terms and conditions of the Pinnacle Service Agreement and as consideration for the services provided by Pinnacle Digest, the Company has agreed to provide Pinnacle Digest with a cash fee of CAD

The Company's common shares are now cross listed on the Canadian Securities Exchange (CSE) and the Frankfurt Stock Exchange (FSE). The FSE is one of the world's leading international stock exchanges by revenue, profitability, and market capitalization and is the largest of Germany's stock exchanges.

Having been admitted to the FSE, LaFleur Minerals is making submission for listing on Tradegate, which, upon acceptance, will increase trading access for investors in Australasia and Asia amongst others.

QUALIFIED PERSON STATEMENT AND DATA VERIFICATION

All scientific and technical information in this news release has been prepared and approved by Louis Martin, P.Geo. (OGQ), Exploration Manager and Technical Advisor of the Company and considered a Qualified Person (QP) for the purposes of NI 43-101. The QP has verified the analytical data underlying the drilling assay results disclosed in this release by reviewing the Company's QAQC protocols, core and sample logs, original assay certificates, and assay database.

About LaFleur Minerals Inc.

LaFleur Minerals Inc. (CSE: LFLR) (OTCQB: LFLRF) (FSE: 3WK0) is focused on the development of district-scale gold projects in the Abitibi Gold Belt near Val-d'Or, Québec. Our mission is to advance mining projects with a laser focus on our resource-stage Swanson Gold Project and the Beacon Gold Mill, which have significant potential to deliver long-term value. The Swanson Gold Project is approximately 18,304 hectares (183 km2) in size and includes several prospects rich in gold and critical metals previously held by Monarch Mining, Abcourt Mines, and Globex Mining. LaFleur has recently consolidated a large land package along a major structural break that hosts the Swanson, Bartec, and Jolin gold deposits and several other showings which make up the Swanson Gold Project. The Swanson Gold Project is easily accessible by road allowing direct access to several nearby gold mills, further enhancing its development potential. Lafleur Minerals' fully-refurbished and permitted Beacon Gold Mill is capable of processing over 750 tonnes per day and is being considered for processing mineralized material at Swanson and for custom milling operations for other nearby gold projects.

ON BEHALF OF LAFLEUR MINERALS INC.

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

E: info@lafleurminerals.com

LaFleur Minerals Inc.

1500-1055 West Georgia Street

Vancouver, BC V6E 4N7

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding "Forward-Looking" Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this news release include, without limitation, statements related to the use of proceeds from the Offering. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267694