Snow Lake Completes Highly Successful Drill Program at the Pine Ridge Uranium Project in Wyoming

Rhea-AI Summary

Snow Lake Energy (NASDAQ: LITM) completed a 2025 drill program at the Pine Ridge uranium project in Wyoming, a 50/50 joint venture with Global Uranium and Enrichment. The program drilled 114 holes (38,000 m) and confirmed widespread, continuous roll-front uranium mineralization across multiple sandstone packages, identifying at least 25 mineralized roll fronts. Best assays included 2.6m at 0.101% U3O8 (including 2.0m at 0.124%). Mineralization occurs in stacked sandstones 200–400m deep, appears hydrologically isolated, and is potentially amenable to in-situ recovery (ISR).

Positive

- Completed 114 holes totaling 38,000 m in 2025

- Confirmed continuity across at least 25 roll fronts

- Best assay: 2.6m at 0.101% U3O8 (PR25-093)

- Mineralization hosted in isolated sandstones 200–400m deep, enabling ISR potential

- Project is ~15km from Smith Ranch Mill (5.5Mlbs licensed capacity)

Negative

- Many intercepts are low grade (e.g., 0.026%–0.045% U3O8)

- Drill testing covered only a small portion of the large land package

- Mineralization depths of 200–400m may raise ISR development costs

News Market Reaction – LITM

On the day this news was published, LITM gained 15.59%, reflecting a significant positive market reaction. Argus tracked a peak move of +12.0% during that session. Our momentum scanner triggered 41 alerts that day, indicating elevated trading interest and price volatility. This price movement added approximately $10M to the company's valuation, bringing the market cap to $72M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

LITM’s pre-news move of -4.76% contrasts with mixed peers: FMST -1.35%, ELBM -3.11%, GTI -18.18%, while scanner momentum only flagged NVA at +6.07%. No broad, coordinated sector move is evident.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 23 | Acquisition update | Positive | -5.2% | GUE Scheme Booklet dispatched outlining fair and reasonable acquisition terms. |

| Dec 22 | Regulatory milestone | Positive | -0.8% | GUE Scheme Booklet registered with ASIC and key approval dates set. |

| Dec 19 | Court hearing result | Positive | +9.9% | Australian court orders scheme meetings enabling GUE acquisition to proceed. |

| Dec 19 | Technology update | Positive | +9.9% | Ubaryon enrichment progress, TRL advancement plans, and strategic stakes reaffirmed. |

| Dec 15 | Drill results | Positive | -6.8% | Strong Pine Ridge intercepts and completion of a 114‑hole, 38,000m program. |

Recent positive strategic and exploration updates have often seen mixed-to-negative next‑day price reactions, especially around Pine Ridge drilling and GUE acquisition steps.

Over the past month, Snow Lake reported multiple developments. Pine Ridge drill results on Dec 15 highlighted strong U3O8 intercepts from 114 holes totaling 38,000m, yet the stock fell 6.8%. A series of updates on the proposed acquisition of Global Uranium and Enrichment around Dec 19–23 showed court progress and a favourable independent expert view but drew mixed reactions, including a 9.88% rise and a 5.22% decline. Today’s completion of the Pine Ridge drill program extends that narrative of technically positive, but market‑skeptical, exploration news.

Regulatory & Risk Context

An effective Form F-3 shelf filed on Nov 14, 2025 enables Snow Lake to issue up to US$1,000,000,000 in various securities over a 36‑month period, with proceeds for working capital and general corporate purposes. No usage has been disclosed yet (usage_count 0).

Market Pulse Summary

The stock surged +15.6% in the session following this news. A strong positive reaction aligns with the technically encouraging Pine Ridge results, including multiple high‑grade U3O8 intercepts and confirmation of stacked roll fronts across at least three sandstone packages. However, prior drill and acquisition news saw mixed reactions, and the presence of a US$1,000,000,000 shelf registration could overhang sentiment if used for equity issuance. Investors watching sustainability might track future resource estimates, permitting steps, and any capital‑raising under the shelf.

Key Terms

u3o8 technical

in-situ recovery (isr) technical

roll fronts technical

ppm technical

regulation s-k 1300 regulatory

AI-generated analysis. Not financial advice.

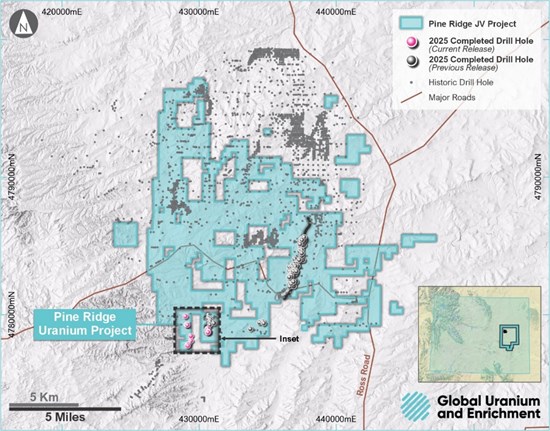

Winnipeg, Manitoba--(Newsfile Corp. - January 12, 2026) - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (NASDAQ: LITM) ("Snow Lake"), a nuclear fuel cycle company, announces that it has received the final set of drill results from an additional 21 drill holes (out of a total of 114 holes) that have been completed on the Pine Ridge Uranium Project ("Pine Ridge"), located in the prolific Powder River Basin in Wyoming, a 50/50 joint venture (the "Joint Venture") with Global Uranium and Enrichment Limited ("GUE").

This successful drill program confirmed the presence of widespread uranium mineralization at Pine Ridge, while testing only a very small percentage of the large land package, and established the continuity of mineralization in multiple areas and identified at least 25 mineralized roll fronts contained within three major sandstone packages.

Highlights

Final 2025 program drill results continue to highlight multiple zones of mineralization at Pine Ridge

Highly successful drill program was completed with 114 holes and 38,000m (125,000 ft)

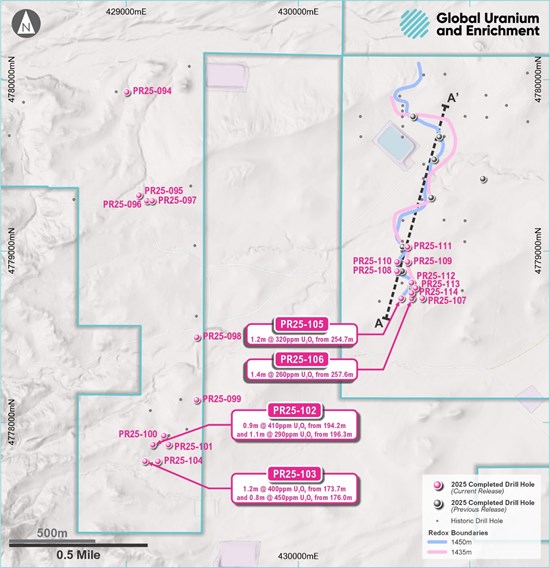

Drilling results have continued to define roll front mineralization and have increased the number of mineralized horizons. New results include:

1.2m at

0.040% (400 ppm) U3O8 from 173.7m in PR25-103 and:0.8m at

0.045% (450 ppm) U3O8 from 176.0m

0.9m at

0.041% (410 ppm) U3O8 from 194.2m in PR25-102 and:1.1m at

0.029% (290 ppm) U3O8 from 196.3m

1.2m at

0.032% (320 ppm) U3O8 from 254.7 in PR25-1051.4m at

0.026% (260 ppm) U3O8 from 257.6m in PR25-106

- Best results from the drill program include:

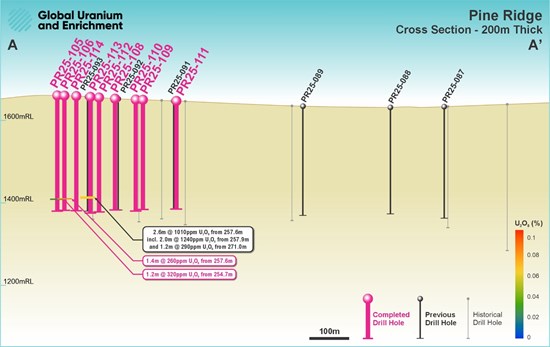

2.6m at

0.101% (1,010 ppm) U3O8 from 257.6m in PR25-093 including2.0m at

0.124% (1,240ppm) U3O8 at 257.9m

2.0m at

0.092% (920 ppm) U3O8 from 314.8m in PR25-017, including1.2m at

0.132% (1,320 ppm) U3O8 from 315.0m

3.5m at

0.054% (540 ppm) U3O8 from 321.3m in PR25-031, including1.1m at

0.078% (780 ppm) U3O8 from 321.4m

Snow Lake CEO Remarks

"We are extremely pleased with the results of our 2025 drill program," said Frank Wheatley, CEO of Snow Lake. "Pine Ridge is a very large land package in the heart of U.S. domestic uranium production and has demonstrated widespread and continuous uranium mineralization across multiple sand packages. Having only test a small portion of Pine Ridge, we will now analyze the results of our 2025 drill program with a view to planning the next significant drill program." Mr. Wheatley continued.

Drill Program

The latest results from the Pine Ridge drill program further illustrate the continuous nature of the stacked roll fronts noted in previous press releases. The mineralization is hosted in at least two major sandstone units within the Tertiary Ft. Union Formation in the eastern and southwestern portions of Pine Ridge. The sandstone units, generally 200m to 300m deep, and 335m to 400m deep, appear to be geologically and hydrologically isolated, allowing for future ISR development.

Importantly, the mineralization that has been intersected in the southwest portion of the project appears to be hosted in a stratigraphically lower sandstone package than the mineralization hosted by the two sand packages on the eastern portion of the project area. This suggests additional areas and horizons for exploration efforts.

Figure 1: Drilling at Pine Ridge in the Powder River Basin of Wyoming, U.S.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/280020_df45f676f41ea8b9_001full.jpg

Drill Results

Drilling reported in the most recent area drilled (Figure 1 above) has further supported this geologic interpretation while returning the most significant assay results to date with the previously reported 2.6m at

New results from this area are highlighted by PR25-103 with 1.2m at

Details of the drill results and drill collars are set out in Schedule A.

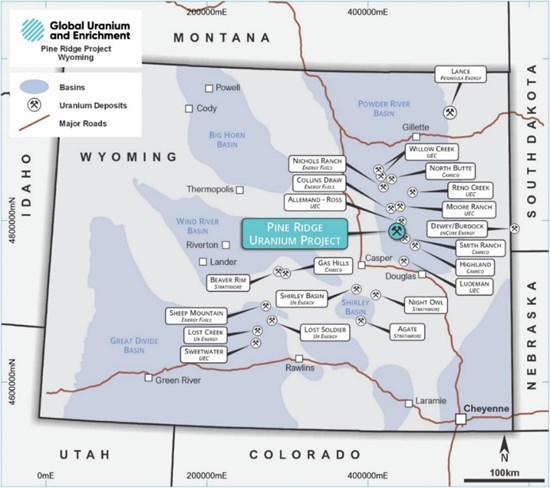

Pine Ridge Uranium Project - Overview

Pine Ridge is an In-Situ Recovery (ISR) uranium exploration project located in the southwestern Powder River Basin of Wyoming, the premier U.S. uranium basin. The Project is surrounded by existing uranium projects held by UEC and Cameco and is located only ~15km from Cameco's Smith Ranch Mill, which has a licensed capacity of 5.5Mlbs U3O8 p.a. The Smith Ranch mill is one of the largest uranium production facilities in the U.S.

Qualified Person

Technical information in this news release has been reviewed and approved by Ron Scott PhD, PGeo, who is a Qualified Person as defined by the Securities and Exchange Commission's Regulation S-K 1300.

About Snow Lake Resources Ltd.

Snow Lake Resources Ltd. is a Canadian nuclear fuel cycle and critical minerals company listed on NASDAQ: LITM, with a portfolio of U.S. focused uranium projects, together with interests in next-generation uranium enrichment and small modular reactors. The Pine Ridge uranium project is an exploration stage project located in Wyoming, United States and the Engo Valley uranium project is an exploration stage project located on the Skeleton Coast of Namibia. Snow Lake also holds a portfolio of additional exploration stage critical minerals projects located in Manitoba, as well as investments in a number of public companies with critical minerals assets, including lithium, in North America. Learn more at www.snowlakeenergy.com.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

For Further Information:

| Frank Wheatley | Investor Relations |

| Chief Executive Officer | ir@snowlakelithium.com |

| fw@snowlakelithium.com |

Schedule A

The recent drill results are shown in Table 1 below and the collar details are shown in Table 2.

Table 1: Uranium intercepts from the recently completed holes. Minimum reported thicknesses are >0.3m and grade 200 ppmU3O8. "Including" intervals are compiled at a cutoff of

| HoleID | From (m) | To (m) | Thickness (m) | Avg U3O8 (%) | U3O8 (ppm) | GxT (m%) |

| PR25-102 | 194.2 | 195.1 | 0.9 | 0.041 | 410 | 0.04 |

| and | 196.3 | 197.4 | 1.1 | 0.029 | 290 | 0.03 |

| PR25-103 | 173.7 | 175.0 | 1.2 | 0.040 | 400 | 0.05 |

| and | 176.0 | 176.8 | 0.8 | 0.045 | 450 | 0.03 |

| PR25-105 | 254.7 | 255.9 | 1.2 | 0.032 | 320 | 0.04 |

| PR25-106 | 257.6 | 258.9 | 1.4 | 0.026 | 260 | 0.04 |

Table 2: Drill collar details for drillholes.

| HoleID | Easting (83_13) | Northing (83_13) | Elev. (m) | Azi. (top of hole) | Dip (top of hole) | TD (m) |

| PR25-094 | 429001 | 4779931 | 1680 | 0 | -90 | 213 |

| PR25-095 | 429072 | 4779329 | 1700 | 0 | -90 | 226 |

| PR25-096 | 429118 | 4779297 | 1700 | 0 | -90 | 226 |

| PR25-097 | 429149 | 4779297 | 1699 | 0 | -90 | 226 |

| PR25-098 | 429409 | 4778501 | 1691 | 0 | -90 | 219 |

| PR25-099 | 429408 | 4778136 | 1698 | 0 | -90 | 219 |

| PR25-100 | 429217 | 4777927 | 1708 | 0 | -90 | 219 |

| PR25-101 | 429244 | 4777876 | 1705 | 0 | -90 | 213 |

| PR25-102 | 429153 | 4777875 | 1708 | 0 | -90 | 213 |

| PR25-103 | 429107 | 4777779 | 1708 | 0 | -90 | 207 |

| PR25-104 | 429183 | 4777778 | 1704 | 0 | -90 | 213 |

| PR25-105 | 430601 | 4778728 | 1695 | 0 | -90 | 287 |

| PR25-106 | 430662 | 4778728 | 1698 | 0 | -90 | 287 |

| PR25-107 | 430723 | 4778729 | 1697 | 0 | -90 | 287 |

| PR25-108 | 430576 | 4778886 | 1684 | 0 | -90 | 274 |

| PR25-109 | 430637 | 4778940 | 1686 | 0 | -90 | 274 |

| PR25-110 | 430576 | 4778940 | 1682 | 0 | -90 | 274 |

| PR25-111 | 430638 | 4779028 | 1681 | 0 | -90 | 268 |

| PR25-112 | 430661 | 4778819 | 1693 | 0 | -90 | 287 |

| PR25-113 | 430684 | 4778789 | 1696 | 0 | -90 | 293 |

| PR25-114 | 430661 | 4778759 | 1696 | 0 | -90 | 287 |

Figure 2: Inset map 1 showing the locations and results of the most recent holes drilled at Pine Ridge. Intervals are reported at a cutoff of 200 ppm U3O8 and a thickness of >0.3m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/280020_df45f676f41ea8b9_002full.jpg

Figure 3: Cross section, looking west, from A to A'. Significant results from the newly-reported drilling are highlighted while previously reported holes are coloured grey.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/280020_df45f676f41ea8b9_003full.jpg

Figure 4: Pine Ridge Uranium Project and Adjacent Properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/280020_df45f676f41ea8b9_004full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280020