Pine Ridge Uranium Project Continues to Deliver Excellent Drill Results

Rhea-AI Summary

Snow Lake Energy (NASDAQ: LITM) reported additional assay results from 45 drill holes at the Pine Ridge uranium project in the Powder River Basin, Wyoming, a 50/50 joint venture with Global Uranium and Enrichment Limited.

Key highlights include 2.6m at 0.101% U3O8 (1,010 ppm) in PR25-093 including 2.0m at 0.124% U3O8, multiple other intercepts (e.g., 2.6m at 0.048%, 0.8m at 0.117%), and confirmation of stacked roll-front mineralization hosted in two major sandstone units at depths of ~200–300m and ~335–400m.

The 2025 drill program has been completed with 114 holes totaling 38,000m; final assay results for the remaining holes will be announced shortly. Technical data reviewed by Qualified Person Ron Scott PhD, PGeo.

Positive

- Highest reported intercept: 2.6m at 0.101% U3O8 (PR25-093)

- Drill program completed: 114 holes, 38,000m

- Mineralization hosted in two sandstone units at ~200–300m and ~335–400m

- Project adjacent to Cameco Smith Ranch mill (~15km)

Negative

- Significant intercepts are generally narrow, maximum reported interval 2.6m

- Final assay set pending for remaining holes, creating near-term data uncertainty

News Market Reaction

On the day this news was published, LITM declined 6.80%, reflecting a notable negative market reaction. Argus tracked a trough of -3.5% from its starting point during tracking. Our momentum scanner triggered 5 alerts that day, indicating moderate trading interest and price volatility. This price movement removed approximately $4M from the company's valuation, bringing the market cap to $59M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

LITM fell 9.95% while key peers FMST (-7.98%), ELBM (-6.12%) and GTI (-18.18%) also traded lower, but no sector-wide momentum signal was flagged.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Regulatory approval | Positive | +7.3% | FIRB approval for acquiring 100% of GUE and Ubaryon interest. |

| Nov 10 | Policy development | Positive | -0.3% | U.S. designates uranium a critical mineral, potentially aiding domestic players. |

| Oct 21 | New business launch | Positive | -3.7% | Launch of Kadmos Energy Services to develop small modular reactors. |

| Oct 06 | Acquisition deal | Positive | +3.4% | Binding deal to acquire remaining GUE shares, creating fuel cycle company. |

| Oct 02 | Project drilling update | Positive | +0.2% | Encouraging Pine Ridge drilling confirming 24 mineralized roll fronts. |

Recent company-specific milestones (acquisitions, project updates) more often saw share price gains, but some positive uranium-themed news has produced muted or negative reactions.

Over the last few months, Snow Lake has advanced a vertically integrated nuclear fuel strategy. It moved to acquire 100% of GUE with a pro forma market cap of ~US$76.7m, gained FIRB approval, and launched Kadmos Energy Services with up to US$10M committed. Pine Ridge has delivered multiple encouraging drill updates, confirming 24 continuous roll fronts and a 125-hole program. The latest Pine Ridge drilling fits this pattern of steadily de‑risking the project while the stock sometimes reacts unevenly to positive uranium and policy news.

Regulatory & Risk Context

Snow Lake has an effective Form F-3 shelf filed on 2025-11-14 to offer up to US$1,000,000,000 in various securities over a 36‑month period, giving it substantial flexibility to raise capital for working capital and corporate purposes when it chooses.

Market Pulse Summary

The stock moved -6.8% in the session following this news. A negative reaction despite strong drill intercepts would fit prior instances where positive uranium or strategic news did not always translate into gains. At $3.53, the stock sat well below the $4.36 200‑day MA and 85.56% under its $24.44 52‑week high, leaving sentiment fragile. The sizeable US$1,000,000,000 shelf registration also framed expectations around potential future financing, which could weigh on risk perceptions.

Key Terms

u3o8 technical

ppm technical

in-situ recovery technical

isr technical

roll front technical

regulation s-k 1300 regulatory

AI-generated analysis. Not financial advice.

Winnipeg, Manitoba--(Newsfile Corp. - December 15, 2025) - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (NASDAQ: LITM) ("Snow Lake"), a nuclear fuel cycle company, announces that it has received the next set of drill results from an additional 45 drill holes (out of a total of 93 holes) that have been completed on the Pine Ridge Uranium Project ("Pine Ridge"), located in the prolific Powder River Basin in Wyoming, a 50/50 joint venture (the "Joint Venture") with Global Uranium and Enrichment Limited ("GUE").

Highlights

Fourth set of drill results continue to demonstrate the strong development opportunity at the Pine Ridge Uranium Project in the Powder River Basin, Wyoming

Drilling continues to focus on defining roll front mineralization and has returned excellent results, including:

2.6m at

0.101% (1,010 ppm) U3O8 from 257.6m in PR25-093 including:2.0m at

0.124% (1,240ppm) U3O8 at 257.9m

2.6m at

0.048% (480 ppm) U3O8 from 260.3m in PR25-080 and:1.2m at

0.079% (790 ppm) U3O8 from 292.3m

4.1m at

0.030% (300 ppm) U3O8 from 337.3m in PR25-0670.8m at

0.117% (1,170 ppm) U3O8 from 249.3m in PR25-0792.4m at

0.030% (300 ppm) U3O8 from 323.5m in PR25-051 and2.0m at

0.047% (470 ppm) U3O8 from 328.7m including:0.9m at

0.063% (630 ppm) U3O8 from 329.5m

1.7m at

0.045% (450 ppm) U3O8 from 333.3m in PR25-062

Drilling program has just been completed with a total of 114 holes over 38,000m (125,000 ft). The final set of drill results will be announced shortly.

Snow Lake CEO Remarks

"We continue to receive positive drill results from our Pine Ridge uranium project as we wrap up our drill program for 2025," said Frank Wheatley, CEO of Snow Lake. "Pine Ridge is a very large project with large unexplored areas, and we have merely scratched the surface of Pine Ridge with this drill program. Drill results to date give us good reason to continue our work at Pine Ridge as we await the final set of drill results from this program.

We see Pine Ridge as a key asset in developing our U.S. focused capabilities across the front end of the nuclear fuel cycle, directly aligning with the U.S. Administration's policies underpinning the development of a domestic nuclear industry to enhance and ensure U.S. national, economic and energy security," Mr. Wheatley continued.

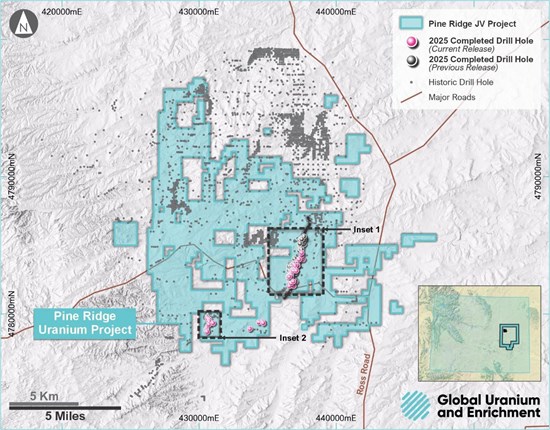

Figure 1: Drilling at Pine Ridge in the Powder River Basin of Wyoming, U.S.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_001full.jpg

Drill Program

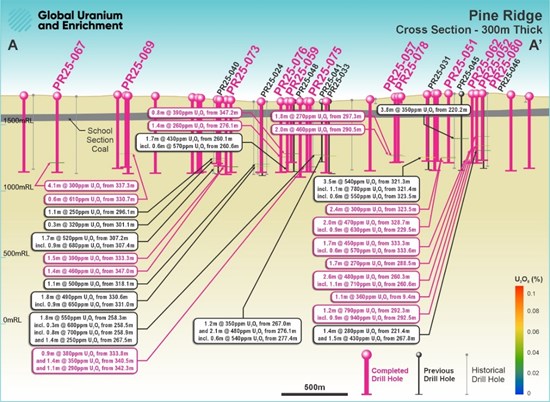

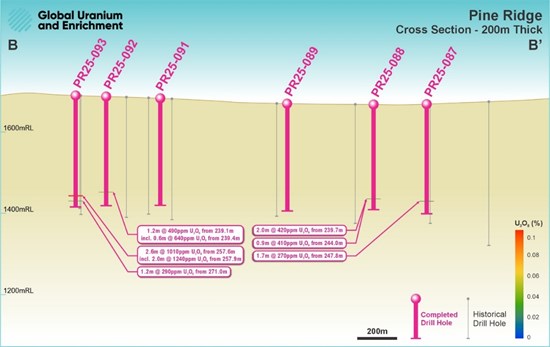

Recent results from the Pine Ridge drill program further illustrate the continuous nature of the stacked roll fronts noted in previous press releases. The mineralization is hosted in at least two major sandstone units within the Tertiary Ft. Union Formation in the eastern flank of Pine Ridge. The units, generally 200m to 300m deep and 335m to 400m deep, appear to be geologically and hydrologically isolated, allowing for future ISR development.

Figure 2: Current land package showing the new drilling at the Pine Ridge Uranium Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_002full.jpg

Drill results in the new area shown in Inset 2 (Figure 2 above) has further supported this geologic interpretation while returning the most significant assay results to data with 2.6m at

Details of drill results and drill collars are set out in Schedule A.

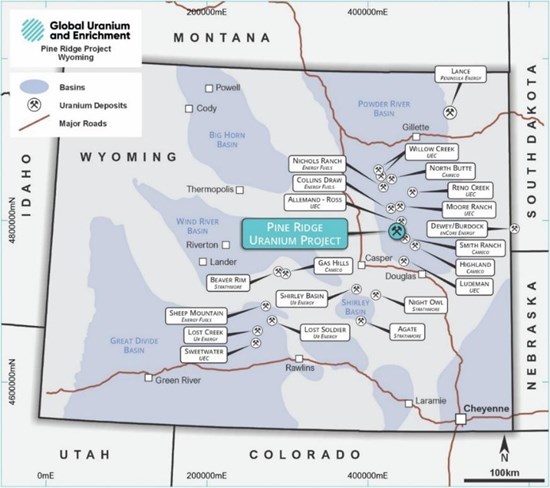

Pine Ridge Uranium Project - Overview

Pine Ridge is an In-Situ Recovery (ISR) uranium exploration project located in the southwestern Powder River Basin of Wyoming, the premier U.S. uranium basin. The Project is surrounded by existing uranium projects held by UEC and Cameco and is located only ~15km from Cameco's Smith Ranch Mill, which has a licensed capacity of 5.5Mlbs U3O8 p.a. The Smith Ranch mill is one of the largest uranium production facilities in the U.S.

Qualified Person

Technical information in this news release has been reviewed and approved by Ron Scott PhD, PGeo, who is a Qualified Person as defined by the Securities and Exchange Commission's Regulation S-K 1300.

About Snow Lake Resources Ltd.

Snow Lake Resources Ltd. is a Canadian nuclear fuel cycle and critical minerals company listed on Nasdaq:LITM, with a portfolio of U.S. focused uranium projects, together with interests in next-generation uranium enrichment and small modular reactors. The Pine Ridge uranium project is an exploration stage project located in Wyoming, United States and the Engo Valley uranium project is an exploration stage project located on the Skeleton Coast of Namibia. Snow Lake also holds a portfolio of additional exploration stage critical minerals projects located in Manitoba, as well as investments in a number of public companies with critical minerals assets, including rare earths and lithium, in North America. Learn more at www.snowlakeenergy.com.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

For Further Information:

| Frank Wheatley | Investor Relations |

| Chief Executive Officer | ir@snowlakelithium.com |

| fw@snowlakelithium.com |

Schedule A

The recent drill results are shown in Table 1 below and the collar details are shown in Table 2.

| Hole ID | From (m) | To (m) | Thickness (m) | Avg U3O8 (%) | U3O8 (ppm) | GxT (m%) |

| PR25-049 | 233.9 | 234.7 | 0.8 | 0.041 | 410 | 0.03 |

| and | 270.8 | 272.0 | 1.2 | 0.032 | 320 | 0.04 |

| and | 273.6 | 275.4 | 1.8 | 0.033 | 330 | 0.06 |

| PR25-051 | 323.5 | 326.0 | 2.4 | 0.030 | 300 | 0.07 |

| and | 328.7 | 330.7 | 2.0 | 0.047 | 470 | 0.09 |

| including | 329.5 | 330.4 | 0.9 | 0.063 | 630 | 0.06 |

| PR25-052 | 288.5 | 290.2 | 1.7 | 0.027 | 270 | 0.05 |

| PR25-057 | 290.5 | 292.5 | 2.0 | 0.046 | 460 | 0.09 |

| PR25-058 | 357.8 | 358.6 | 0.8 | 0.049 | 490 | 0.04 |

| PR25-059 | 347.2 | 347.9 | 0.8 | 0.039 | 390 | 0.03 |

| PR25-062 | 333.3 | 335.0 | 1.7 | 0.045 | 450 | 0.08 |

| including | 333.6 | 334.2 | 0.6 | 0.057 | 570 | 0.03 |

| PR25-063 | 286.5 | 288.0 | 1.5 | 0.036 | 360 | 0.05 |

| PR25-066 | 276.5 | 278.6 | 2.1 | 0.034 | 340 | 0.07 |

| PR25-067 | 337.3 | 341.4 | 4.1 | 0.030 | 300 | 0.12 |

| PR25-069 | 330.7 | 331.3 | 0.6 | 0.061 | 610 | 0.04 |

| PR25-073 | 333.3 | 334.8 | 1.5 | 0.039 | 390 | 0.06 |

| and | 347.0 | 348.4 | 1.4 | 0.046 | 460 | 0.06 |

| PR25-075 | 333.8 | 334.7 | 0.9 | 0.038 | 380 | 0.03 |

| and | 340.5 | 341.8 | 1.4 | 0.035 | 350 | 0.05 |

| and | 342.3 | 343.4 | 1.1 | 0.029 | 290 | 0.03 |

| PR25-076 | 276.1 | 277.5 | 1.4 | 0.026 | 260 | 0.04 |

| PR25-078 | 297.3 | 299.2 | 1.8 | 0.027 | 270 | 0.05 |

| PR25-079 | 249.3 | 250.1 | 0.8 | 0.117 | 1170 | 0.09 |

| PR25-080 | 9.4 | 10.5 | 1.1 | 0.036 | 360 | 0.04 |

| and | 260.3 | 262.9 | 2.6 | 0.048 | 480 | 0.12 |

| including | 260.6 | 261.7 | 1.1 | 0.071 | 710 | 0.08 |

| and | 292.3 | 293.5 | 1.2 | 0.079 | 790 | 0.10 |

| including | 292.5 | 293.4 | 0.9 | 0.094 | 940 | 0.09 |

| PR25-087 | 247.8 | 249.5 | 1.7 | 0.027 | 270 | 0.05 |

| PR25-088 | 239.7 | 241.7 | 2.0 | 0.042 | 420 | 0.08 |

| and | 244.0 | 244.9 | 0.9 | 0.041 | 410 | 0.04 |

| PR25-092 | 239.1 | 240.3 | 1.2 | 0.049 | 490 | 0.06 |

| including | 239.4 | 240.0 | 0.6 | 0.064 | 640 | 0.04 |

| PR25-093 | 257.6 | 260.1 | 2.6 | 0.101 | 1010 | 0.26 |

| including | 257.9 | 259.8 | 2.0 | 0.124 | 1240 | 0.25 |

| and | 271.0 | 272.2 | 1.2 | 0.029 | 290 | 0.04 |

Table 1: Uranium intercepts from the recently completed holes. Minimum reported thicknesses are >0.3m and grade

| HoleID | Easting (83_13) | Northing (83_13) | Elev. (m) | Azi. (top of hole) | Dip (top of hole) | TD (m) |

| PR25-049 | 436890 | 4782434 | 1646 | 0 | -90 | 360 |

| PR25-050 | 436907 | 4782251 | 1640 | 0 | -90 | 360 |

| PR25-051 | 436749 | 4782471 | 1660 | 0 | -90 | 354 |

| PR25-052 | 436745 | 4782317 | 1658 | 0 | -90 | 354 |

| PR25-053 | 436669 | 4782165 | 1651 | 0 | -90 | 384 |

| PR25-054 | 436755 | 4782099 | 1660 | 0 | -90 | 341 |

| PR25-055 | 437042 | 4782434 | 1626 | 0 | -90 | 341 |

| PR25-056 | 436890 | 4782586 | 1636 | 0 | -90 | 354 |

| PR25-057 | 436746 | 4782773 | 1637 | 0 | -90 | 329 |

| PR25-058 | 436670 | 4782925 | 1642 | 0 | -90 | 372 |

| PR25-059 | 436824 | 4783304 | 1619 | 0 | -90 | 354 |

| PR25-060 | 436518 | 4782773 | 1649 | 0 | -90 | 372 |

| PR25-061 | 436723 | 4782550 | 1656 | 0 | -90 | 341 |

| PR25-062 | 436635 | 4782395 | 1657 | 0 | -90 | 354 |

| PR25-063 | 436755 | 4782251 | 1657 | 0 | -90 | 354 |

| PR25-064 | 436605 | 4782092 | 1649 | 0 | -90 | 372 |

| PR25-065 | 436907 | 4782099 | 1646 | 0 | -90 | 347 |

| PR25-066 | 437574 | 4784016 | 1629 | 0 | -90 | 366 |

| PR25-067 | 437488 | 4784318 | 1645 | 0 | -90 | 390 |

| PR25-068 | 437478 | 4784508 | 1657 | 0 | -90 | 396 |

| PR25-069 | 437297 | 4784021 | 1650 | 0 | -90 | 366 |

| PR25-070 | 437059 | 4783713 | 1631 | 0 | -90 | 372 |

| PR25-071 | 436896 | 4783713 | 1624 | 0 | -90 | 256 |

| PR25-072 | 437197 | 4783558 | 1625 | 0 | -90 | 323 |

| PR25-073 | 437004 | 4783568 | 1622 | 0 | -90 | 366 |

| PR25-074 | 436977 | 4783304 | 1618 | 0 | -90 | 360 |

| PR25-075 | 436856 | 4783195 | 1619 | 0 | -90 | 360 |

| PR25-076 | 437083 | 4783199 | 1613 | 0 | -90 | 305 |

| PR25-077 | 436716 | 4782925 | 1637 | 0 | -90 | 372 |

| PR25-078 | 436708 | 4782773 | 1639 | 0 | -90 | 329 |

| PR25-079 | 436579 | 4782773 | 1646 | 0 | -90 | 372 |

| PR25-080 | 436716 | 4782302 | 1659 | 0 | -90 | 341 |

| PR25-081 | 436875 | 4782434 | 1648 | 0 | -90 | 341 |

| PR25-082 | 434389 | 4779479 | 1634 | 0 | -90 | 189 |

| PR25-083 | 434631 | 4779536 | 1625 | 0 | -90 | 189 |

| PR25-084 | 434709 | 4779416 | 1626 | 0 | -90 | 189 |

| PR25-085 | 433730 | 4779012 | 1640 | 0 | -90 | 171 |

| PR25-086 | 430669 | 4779788 | 1674 | 0 | -90 | 274 |

| PR25-087 | 430822 | 4779670 | 1670 | 0 | -90 | 280 |

| PR25-088 | 430793 | 4779538 | 1669 | 0 | -90 | 268 |

| PR25-089 | 430775 | 4779315 | 1671 | 0 | -90 | 274 |

| PR25-090 | 431076 | 4779425 | 1668 | 0 | -90 | 274 |

| PR25-091 | 430608 | 4779029 | 1680 | 0 | -90 | 268 |

| PR25-092 | 430606 | 4778886 | 1685 | 0 | -90 | 274 |

| PR25-093 | 430661 | 4778789 | 1694 | 0 | -90 | 287 |

Table 2: Drill collar details for drillholes

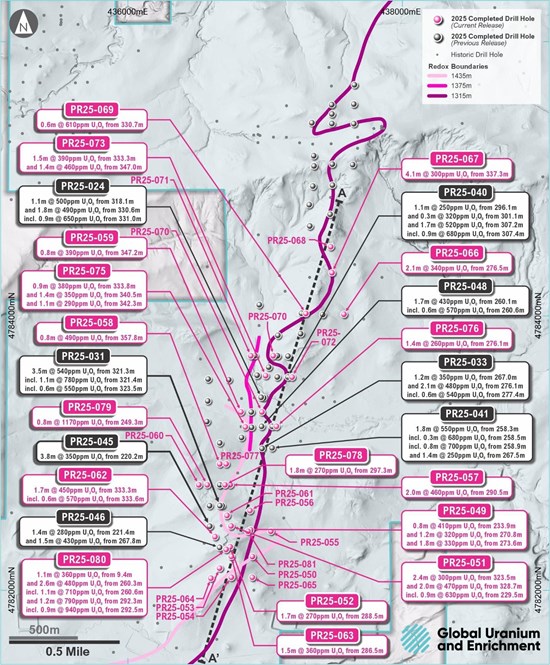

Figure 3: Inset map 1 showing the locations and results of the most recent holes drilled at the Pine Ridge Project. Intervals reported at a cutoff Intervals reported at a cutoff of 200 ppm and a thickness of >0.3m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_003full.jpg

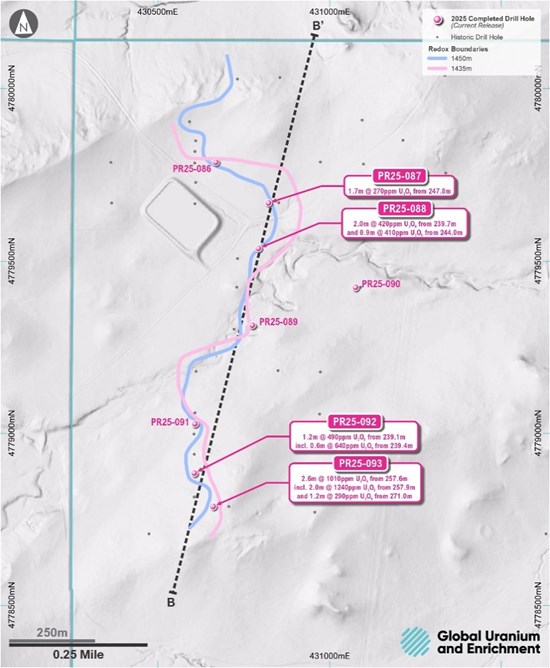

Figure 4: Inset map 2 showing the locations and results of the most recent holes drilled at the Pine Ridge Project. Intervals reported at a cutoff Intervals reported at a cutoff of 200 ppm and a thickness of >0.3m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_004full.jpg

Figure 5: Cross section, looking west, from A to A'. Significant results from the newly-reported drilling are highlighted while previously-reported holes are coloured gray.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_005full.jpg

Figure 6: Cross section, looking west, from B to B'. Significant results from the newly-reported drilling are highlighted.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_006full.jpg

Figure 7: Pine Ridge Uranium Project and Adjacent Properties.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9547/278029_1d7b6244c4c8cafc_007full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278029