Latin Metals Signs Definitive Option Agreement for Huachi Copper-Gold Project, San Juan Province, Argentina

Rhea-AI Summary

Positive

- Strategic expansion of property portfolio adjacent to existing Esperanza project

- Flexible acquisition structure with staged payments over 4 years reducing immediate financial burden

- Option to acquire 100% ownership through Top-Up Right

- Protection through JV structure if full acquisition not pursued

Negative

- Significant total cash commitment of US$3 million required for full ownership

- Environmental permit approval required before work can commence

- Substantial exploration expenditure commitment of US$1 million required

News Market Reaction

On the day this news was published, LMSQF gained 3.73%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, June 23, 2025 (GLOBE NEWSWIRE) -- Latin Metals Inc. ("Latin Metals" or the "Company") - (TSXV: LMS) (OTCQB: LMSQF) is pleased to announce that it has entered into a definitive option agreement (the "Agreement") with Golden Arrow Resources Corp. ("Golden Arrow") to acquire up to a

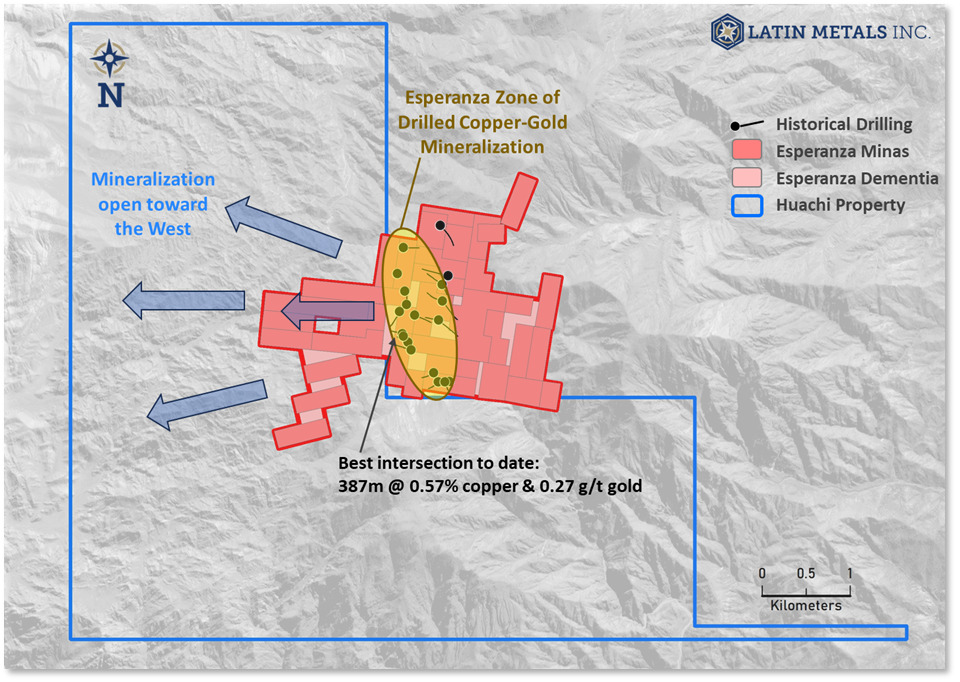

Figure 1: Location of the Huachi property, located immediately west of the Company’s Esperanza property, San Juan Province, Argentina.

Definitive Agreement Terms

Latin Metals has the right to acquire an initial

Upon earning the

Should Latin Metals choose not to exercise the Top-Up Right, the parties will form a joint venture (JV) with Latin Metals holding

Work commitments and cash payments commence on the first anniversary of approval of the environmental permit (Declaración de Impacto Ambiental or DIA), approving the start of exploration activities including drilling (the "Commencement Date").

Table 1: Commercial Terms to Acquire up to

| Anniversary Following the Commencement Date | Work Commitment USD | Cash Payments USD | Vesting |

| First Anniversary | - | ||

| Second Anniversary | - | ||

| Third Anniversary | - | ||

| Fourth Anniversary | |||

| Top-Up Right | - | ||

| Total | |||

About the Esperanza and Huachi Projects

The Esperanza project hosts a partially defined copper-gold porphyry system, with surface expression of a pyrite halo measuring 1,400m x 850m. Historical drilling by Latin Metals returned 387m @

Latin Metals previously entered into an option agreement regarding the Esperanza and Huachi properties with Atlantic Metals Limited, a wholly owned subsidiary of Moxico Resources plc., a private copper mining company with producing and development assets in Zambia and the Kingdom of Saudi Arabia, made as of October 7, 2024 (see previous news release dated October 8, 2024)

About Latin Metals

Latin Metals Inc. is a copper, gold and silver exploration company operating in Peru and Argentina under a prospect generator model, minimizing risk and dilution while maximizing discovery potential. With 18 projects, the company secures option agreements with major mining companies to fund exploration. Current option holders include AngloGold Ashanti (Organullo Gold Project) and Moxico Resources (Esperanza & Huachi Copper-Gold Projects). This approach provides early-stage exposure to high-value mineral assets. Latin Metals is actively seeking new strategic partners to advance its portfolio.

Recent and Upcoming Conferences

Latin Metals recently presented and met with investors at three investor events:

- 121 Mining Investment Conference – London (May 12–13, 2025)

- Deutsche Goldmesse – Frankfurt (May 16–17, 2025)

- THE Mining Event – Quebec City (June 3–5, 2025)

Upcoming investor conferences include:

- The Rule Symposium on Natural Resource Investing 2025 - Florida (July 7-11, 2025)

These events provide key opportunities to showcase Latin Metals’ progress and introduce its high-quality portfolio to new strategic and institutional audiences.

Stay Connected

Follow Latin Metals on YouTube, X, Facebook, LinkedIn and Instagram to stay informed on our latest developments, exploration updates, and corporate news.

Qualified Person

Eduardo Leon, QP, is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Leon is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

On Behalf of the Board of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company, readers are referred to the Company's website (www.latin-metals.com) and its Canadian regulatory filings on SEDAR+ at www.sedarplus.com.

For further information, please contact:

Keith Henderson

Suite 890 - 999 West Hastings Street,

Vancouver, BC, V6C 2W2

E-mail: info@latin-metals.com

Elyssia Patterson, VP Investor Relations

Email: elyssia@latin-metals.com

Phone: 778-683-4324

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the anticipated content, commencement, timing and cost of exploration programs in respect of the Property and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading as well as those factors discussed under the heading “Risk Factors” in the Company’s annual management’s discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ebb9b220-7d72-4316-ab0a-9c668fc537d1