Lode Gold Evaluates Underground Mining Potential at Dingman Gold Project (Ontario) & Initiates New Geological Model (MRE: 376,000 Oz Au M&I + 47,000 Oz Au Inferred)

Rhea-AI Summary

Lode Gold (OTCQB: LODFF) has initiated a new geological model for the Dingman Gold Project (Ontario) to test structurally controlled, higher‑grade shear zones and potential underground mining. Existing NI 43‑101 resources total 376,000 Oz Au M&I (0.94 g/t cutoff) and 47,000 Oz Au inferred (0.71 g/t). The company is exploring joint‑venture or spin‑out options and plans a revised MRE following the new interpretation. Historical data includes a 2013 PEA (US$1,800/oz) and >22,000 m of diamond drilling; tenure has no land payments and assessment filings are deferred until 2031.

Positive

- NI 43‑101 resource: 376,000 Oz Au measured and indicated

- NI 43‑101 inferred resource: 47,000 Oz Au

- Over 22,000 m of historical diamond drilling on Dingman

- Tenure with no land payments and assessment filings deferred until 2031

- Company intends a new NI 43‑101 MRE aligned with underground concepts

Negative

- Project remains undeveloped and has not progressed beyond the study stage

- Existing economic study is a 2013 PEA using US$1,800/oz (may be outdated)

- Prior work emphasized open‑pit envelopes that may not reflect underground geometry

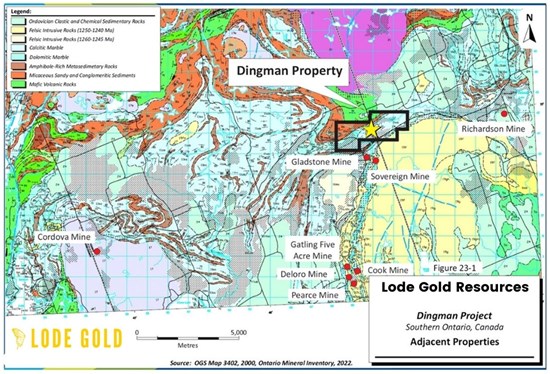

Vancouver, British Columbia--(Newsfile Corp. - February 2, 2026) - Lode Gold Resources Inc (TSXV: LOD) (OTCQB: LODFF) (the "Company" or "Lode Gold") is pleased to announce the initiation of a new geological model, including lithological and structural interpretations, for its wholly owned Dingman Gold Project located in Ontario, Canada, currently with a NI 43-101 resource of 376,000 Oz Au using 0.94 g/t Au cutoff in measured and indicated categories and 47,000 Oz Au in inferred category with a cutoff of 0.71 g/t Au. Lode Gold is evaluating options to advance Dingman project and unlock value for shareholders. Options being explored include seeking a joint venture partner or a spin out.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/282387_858ec6a834af6a8a_001full.jpg

This is a centrally located project in Hastings county, Ontario, 175 km northeast of Toronto. The project is road accessible with regional infrastructure in the prolific Timmins Ontario gold camp which has produced over 70 million ounces [1]gold historically and with projects in operations for 110 years. Timmins is known globally with worldclass mines deep mining heritage, strong government incentives, streamlined permitting, and strong local support and mining services sector and community nearby.

The Dingman Project has historically been evaluated using an open-pit mining concept, including a Preliminary Economic Assessment ("PEA") completed in 2013, which demonstrated positive project economics at a gold price of US

This is a brownfields project with an excess of 22,000 m of diamond drilling a previously completed NI 43-101 Technical Report and Mineral Resource Estimate completed in 2022. The project is road accessible, approximately 100 km from Belleville and 150 km from Kingston.

Based on a recent technical review, the Company believes that the geological framework of the deposit supports a re-evaluation focused on structurally controlled, higher-grade gold mineralization with potential application for underground mining methods.

Geological Modelling Approach

The new geological model will focus on defining shear-hosted gold structures that exhibit strong structural controls within the Dingman granite and associated alteration zones. These structures are interpreted to form continuous mineralized bands approximately 5 to 10 metres in width, which may be amenable to underground extraction.

This approach differs from previous interpretations that applied broader grade envelopes optimized for open-pit scenarios. The updated geological model aims to improve the understanding of mineralization controls, continuity, and geometry, and to better align the project with current gold prices and modern underground mining concepts.

The Company notes that this shift in geological focus at Dingman is conceptually similar to the evolution of its Fremont Gold Project in California. At Fremont, early evaluations emphasized open-pit concepts, while subsequent work demonstrated that structurally controlled, higher-grade mineralization was more appropriately assessed within an underground mining framework. Lode Gold believes that a comparable re-interpretation at Dingman may provide a more accurate representation of the deposit's geometry, grade distribution and development potential under current gold market conditions.

Future Mineral Resource Estimation

Upon completion of the new geological model, the Company intends to proceed with a new Mineral Resource Estimate ("MRE"), which will be completed in accordance with NI 43-101 standards and reviewed by independent Qualified Persons.

The forthcoming MRE will incorporate the updated geological interpretation and will form the technical foundation for future project evaluation and development studies at Dingman.

Technical Commentary

Jonathan Hill, Director and Chair of the Technical Committee of Lode Gold, commented:

"The geological model is the critical first step in re-evaluating Dingman. By focusing on the structural controls and higher-grade mineralization, we are building a framework that more accurately reflects the geometry and continuity of mineralization. This work will directly inform a future Mineral Resource Estimate aligned with underground mining concepts."

Next Steps

Work on the geological model is currently underway. Lode Gold will provide further updates as the interpretation advances and upon the completion of the revised Mineral Resource Estimate.

Dingman Gold Project (Ontario)

The Dingman Gold Project is an advanced exploration-stage brownfield gold project located in Ontario, Canada, with a history of technical evaluation and economic studies. The project was the subject of a Preliminary Economic Assessment completed in 2013, which demonstrated economic viability under an open-pit mining scenario at a gold price of US

Dingman is hosted within a large intrusive system and exhibits strong structural controls on gold mineralization. While historical work focused on broad grade envelopes suitable for open-pit mining, Lode Gold believes that, similar to its Fremont Gold Project, a modern geological reinterpretation emphasizing structurally controlled, higher-grade shear zones may better reflect the geometry and continuity of mineralization and support the evaluation of underground mining potential under current gold price conditions. The project benefits from a favorable tenure structure, with no land or option payments, and no required assessment work filings until 2031, providing flexibility as technical work advances.

Qualified Person

The technical information contained in this press release was reviewed and approved by Gary Wong, P.Eng., Vice President Exploration of Lode Gold Resources Inc., designated as a Qualified Person under National Instrument 43-101.

About Lode Gold

Lode Gold has key assets in Canada and United States.

Fremont Gold Project (Fremont Gold Mining LLC) is a brownfield project in Mariposa, California with 43,000 m drilled, 8,000 channel samples, 14 adits and 2 shafts. Mining halted in 1942 due to the gold mining prohibition during WW II. It was mined at 10.7 g/t when price was gold was

Gold Orogen (1475039 B.C. Ltd) is an early-stage exploration pure play with quality assets in the Yukon and New Brunswick, Canada. Optionality exists as assets are diversified on two mineral belts that are known to have prolific gold endowment.

A

The New Brunswick assets, McIntyre Brook and Riley Brook sit on a highly prospective belt that has seen many exciting discoveries including Dalradian, New Found Gold and Calibre Mining. Kinross- Puma surrounds McIntyre Brook.

In the Yukon, Golden Culvert/WIN sits on the southern end of the Tombstone Belt which in recent years has seen extensive exploration success. It has Reduced Intrusion (RIRGS) targets and sedimentary hosted orogenic mineralization. Over 4,500 m has been drilled with 50 gram meter intercepts.

The completion of Gold Orogen's spin out into a public company via an RTO is imminent, presenting a unique and compelling opportunity to unlock shareholder value as two standalone public companies with clear trajectory for growth will be created.

Dingman Property is an orogenic deposit in Ontario, Canada with over 22,000 m drilled, with a 2013 PEA, MRE (link to report): 376,000 oz (M&I) and 47,000 oz (Inferred).

ON BEHALF OF THE COMPANY

Wendy T. Chan

CEO & Director

info@lode-gold.com

+1-(604)-977-GOLD (4653)

Kevin Shum

Investor Relations

kevin@lode-gold.com

+1 (604) -977-GOLD (4653)

Cautionary Statement Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the use of proceeds, advancement and completion of resource calculation, feasibility studies, and exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company's interpretation of drill results; the geology, grade and continuity of the Company's mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; and currency fluctuations.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, business disruptions, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

[1] https://files.ontario.ca/ndmnrf-geotours-3/ndmnrf-geotours-timmins-en-2021-12-13.pdf

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282387