Lode Gold Receives Conditional Approval from Exchange; Listing January 2026

Rhea-AI Summary

Lode Gold (symbol LODFF) received conditional approval to list a spin‑out subsidiary, Gold Orogen (OROG), on the Canadian Stock Exchange with an Effective Date in January 2026.

Registered shareholders the day before listing will receive a tax‑free distribution of 0.5739 Gold Orogen shares per Lode Gold share. Gold Orogen will list via a reverse takeover of CSE‑listed Great Republic Mining (CSE:GRM) and new OROG shares are expected to begin trading 3–5 business days after the Effective Date.

In August 2025 partner Fancamp acquired 19.9% of Gold Orogen and invested $3.5M ($3.0M to Gold Orogen, $0.5M to Lode Gold). Gold Orogen holds early‑stage exploration assets in Yukon and New Brunswick, including a 445 km2 New Brunswick land package via joint venture Acadian Gold.

Positive

- CSE conditional approval to list Gold Orogen in Jan 2026

- Tax‑free distribution of 0.5739 Gold Orogen shares per Lode share

- Fancamp invested $3.5M (Aug 2025) supporting Gold Orogen and listing

- Gold Orogen controls a 445 km2 New Brunswick land package

Negative

- Spin‑out creates a separate public company, increasing outstanding public equity

- Gold Orogen described as early‑stage exploration, carrying high exploration risk

News Market Reaction

On the day this news was published, LODFF gained 5.40%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - December 18, 2025) - Lode Gold Resources Inc (TSXV: LOD) (the "Company" or "Lode Gold") is pleased to announce it has received conditional approval from the Canadian Stock Exchange ("CSE"). The effective date of listing on the CSE will occur during the month of January 2026 ("Effective Date").

Registered shareholders up to the day before the Effective Date, will be entitled to receive shares of Spin Co, Lode Gold's subsidiary 1475039 B.C. Ltd ("Gold Orogen"). For each one common share of Lode Gold held by a Lode Gold shareholder the day before the Effective Date, they will receive a tax-free distribution of 0.5739 shares of Gold Orogen.

Gold Orogen shares will to be listed on CSE under the symbol "OROG", pursuant to a reverse take over ("RTO") of CSE-listed Great Republic Mining (CSE:GRM), and the new shares will commence trading 3-5 business days from the Effective Date.

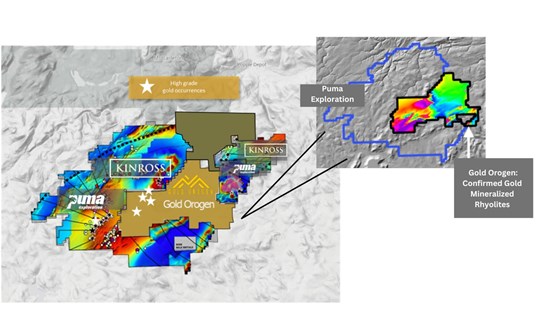

During October 2024, Gold Orogen added a

Figure 1 New Brunswick McIntyre Brook property

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/278568_7d12aa8254823928_004full.jpg

Fancamp invested

The listing of Gold Orogen on the CSE presents a unique and compelling opportunity to unlock shareholder value by creating two standalone companies with clear growth trajectories.

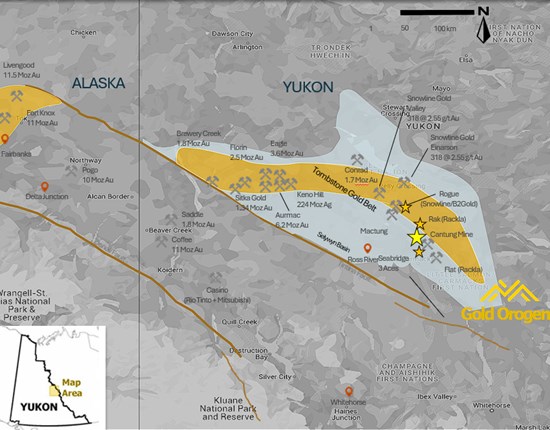

Figure 2 Yukon Golden Culvert/WIN project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/278568_7d12aa8254823928_005full.jpg

Gold Orogen is an early-stage exploration play with quality assets in Yukon and New Brunswick. Optionality exists as assets are diversified on two mineral belts that are known to have prolific gold endowment.

About Lode Gold

Lode Gold has key assets in Canada and United States.

Fremont Gold Project (Fremont Gold Mining LLC) is a brownfield project in Mariposa, California with 43,000 m drilled, 8,000 channel samples, 14 adits and 2 shafts. Mining halted in 1942 due to the gold mining prohibition during WW II. It was mined at 10.7 g/t when price was gold was

Gold Orogen (1475039 B.C. Ltd) is an early-stage exploration pure play with quality assets in the Yukon and New Brunswick, Canada. Optionality exists as assets are diversified on two mineral belts that are known to have prolific gold endowment.

A

The New Brunswick assets, McIntyre Brook and Riley Brook sit on a highly prospective belt that has seen many exciting discoveries including Dalradian, New Found Gold and Calibre Mining. Kinross-Puma surrounds McIntyre Brook.

In the Yukon, Golden Culvert/WIN sits on the southern end of the Tombstone Belt which in recent years has seen extensive exploration success. It has Reduced Intrusion (RIRGS) targets and sedimentary hosted orogenic mineralization. Over 4,500 m has been drilled with 50 gram meter intercepts.

The completion of Gold Orogen's spin out into a public company via an RTO is imminent, presenting a unique and compelling opportunity to unlock shareholder value as two standalone public companies with clear trajectory for growth will be created.

Dingman Property is an orogenic deposit in Ontario, Canada with over 22,000 m drilled, with a 2013 PEA, MRE (link to report) : 376,000 oz (M&I) and 47,000 oz (Inferred).

ON BEHALF OF THE COMPANY

Wendy T. Chan

CEO & Director

Information Contact:

Wendy Chan

CEO

info@lode-gold.com

+1-(604)-977-GOLD (4653)

Kevin Shum

Investor Relations

kevin@lode-gold.com

+1 (604) -977-GOLD (4653)

Cautionary Statement Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the use of proceeds, advancement and completion of resource calculation, feasibility studies, and exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company's interpretation of drill results; the geology, grade and continuity of the Company's mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; and currency fluctuations.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, business disruptions, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278568