Mako Mining Reports Q3 2025 Financial Results, Current Cash Balance of Approximately US$ 66.0 Million, Debt Free and On Track for a Record Q4 2025

Rhea-AI Summary

Mako Mining (OTCQX:MAKOF) reported Q3 2025 results with $27.6M revenue (vs. $15.7M in Q3 2024), $8.9M Mine Operating Cash Flow, $9.3M Adjusted EBITDA and $1.2M net income. The company sold 7,830 oz at an average realized price of $3,454/oz, with consolidated cash cost $2,115/oz and AISC $2,561/oz. Mako holds approximately $66.0M cash and is debt free after repaying $6.5M.

Operationally, San Albino returned to high‑grade production in late October while Moss restarted mining in August with steady state production expected in late Q1 2026. The company entered a binding term sheet to acquire Mt. Hamilton, including a gold stream delivering ~342 oz/month for 60 months. Subsequent financings raised gross proceeds of approximately C$55.3M.

Positive

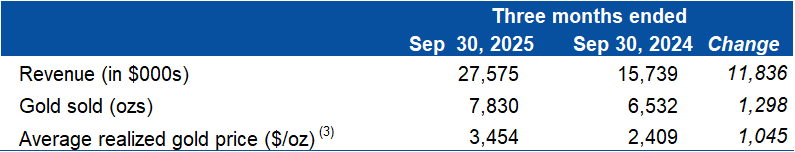

- Revenue $27.6M in Q3 2025 (vs $15.7M Q3 2024)

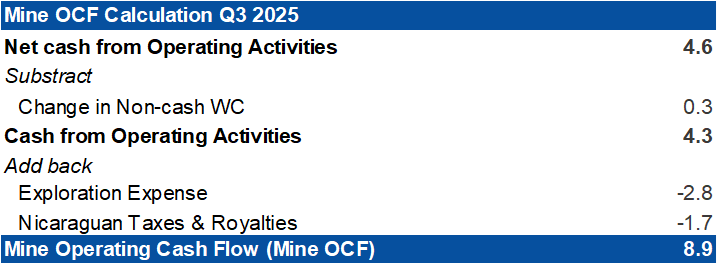

- Mine OCF $8.9M in Q3 2025

- Cash approximately $66.0M and debt free

- Binding term sheet to acquire Mt. Hamilton with 342 oz/month stream for 60 months

- Completed equity financings raising gross proceeds of C$55.3M

Negative

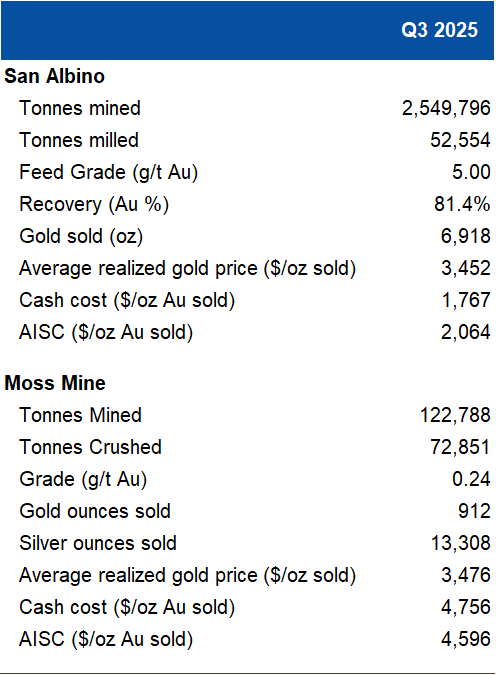

- Consolidated cash cost $2,115/oz and AISC $2,561/oz elevated in Q3

- Low Q3 production: San Albino mined low grade; Moss sales of 912 oz from residual leach

- Moss mine restarted after a 12‑month hiatus, steady state not expected until late Q1 2026

News Market Reaction

On the day this news was published, MAKOF declined 5.34%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / November 20, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three and nine months ended September 30, 2025 ("Q3 2025"). All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q3 2025 reflect revenues of

The third quarter mine plan at San Albino was scheduled to be relatively low grade, with high grade production recommencing towards the end of October, which is expected to persist for the foreseeable future.

At the Moss mine, third quarter sales of 912 oz were almost exclusively from residual leaching activities. Cash Costs and AISC were elevated, as operating costs were allocated to a relatively low number of ounces sold. Mining recommenced in August 2025, after a 12-month hiatus, initially with a single shift with a second shift added in mid-October. Consistent with the start of mining and stacking of mineralization to heap leaching, gold production is beginning to ramp up, with steady state production anticipated towards the latter half of Q1 2026.

Since the Company anticipates substantially higher gold production for both the San Albino and Moss mines in Q4 2025, we expect record financial results for the quarter.

The Company's current cash position is approximately

Q3 2025 Mako Mining Highlights

Financial

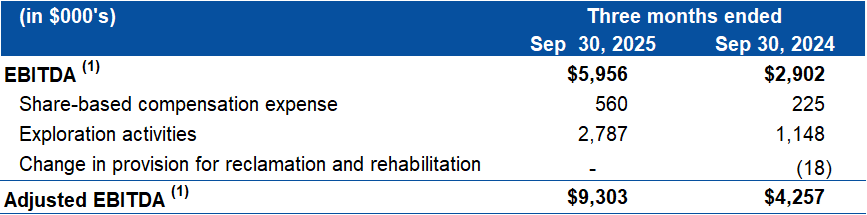

$27.6 million in Revenue$8.9 million in Mine Operating Cash Flow ("MineOCF") (1) (4)$9.3 million in Adjusted EBITDA (1)$1.2 million Net Income$2,115 consolidated Cash Costs ($/oz sold) (1) (2)$2,561 consolidated AISC ($/oz sold) (1) (2)Twelve Trailing Months ("TTM") Return on Equity ("ROE") (1) of

28.4% and Return on Assets ("ROA") of19.2% (1)

Growth

$2.8 million in exploration and evaluation expenses ($0.3 million at San Albino and Las Conchitas,$0.7 million at El Jicaro Concession in Nicaragua,$1.1 million at Eagle Mountain in Guyana,$0.1 million for Moss Mine and$0.5 million in other areas).

On September 30, 2025, the Company entered into a binding term sheet with Sailfish to acquire

100% of Mt. Hamilton LLC, owner of the Mt. Hamilton Gold-Silver Project (the "Mt. Hamilton Project") in Nevada. In exchange, Sailfish will receive a secured gold stream and a2% net smelter return ("NSR") royalty. The stream provides for monthly delivery of approximately 342 oz of gold over 60 months at20% of the spot price. Upon stream completion, the NSR royalty will apply to all mineral production from the Mt. Hamilton Project.

Subsequent to September 30th, 2025

On October 28, 2025, the Company completed a brokered private placement issuing 4.4 million common shares at a price of C

$8.00 per share (the "Issue Price"), for gross proceeds of C$35.0 million . In addition, the underwriters purchased 0.7 million common shares at the Issue Price, for additional gross proceeds of C$5.3 million . The Company also completed a non-brokered private placement with funds managed by Wexford Capital LP, issuing 1.9 million common shares at the Issue Price, for gross proceeds of C$15.0 million .

On October 28, 2025, the Company fully repaid the outstanding balance of the Revised Wexford Loan totaling

$6.5 million . The repayment consisted of principal of$6.3 million and accrued interest of$0.2 million .

On October 22, 2025, Elevation Gold Mining Corp. ("Elevation") was unsuccessful in invalidating Patriot Gold Corporation's ("Patriot") royalty agreement. The ruling for Royal Gold Inc.'s royalty is still pending. The Company is evaluating its options in the Arizona Court's Bankruptcy proceedings.

Akiba Leisman, Chief Executive Officer, states that "Q3 was scheduled to be the lowest production quarter of the year, as we mined through relatively low-grade material at San Albino and Moss production was almost exclusively from residual leach operations. Consolidated Cash Costs and AISC were elevated as production costs were allocated to a lower number of gold ounces sold. Importantly, despite only recovering gold from the residual leach operations at Moss since the beginning of the year, other than a recoverable

Table 1 - Revenue Mako Mining Corp.

Table 2 - Detailed Operating Results Mako Mining Corp.

Table 3 - EBITDA Reconciliation Mako Mining Corp.

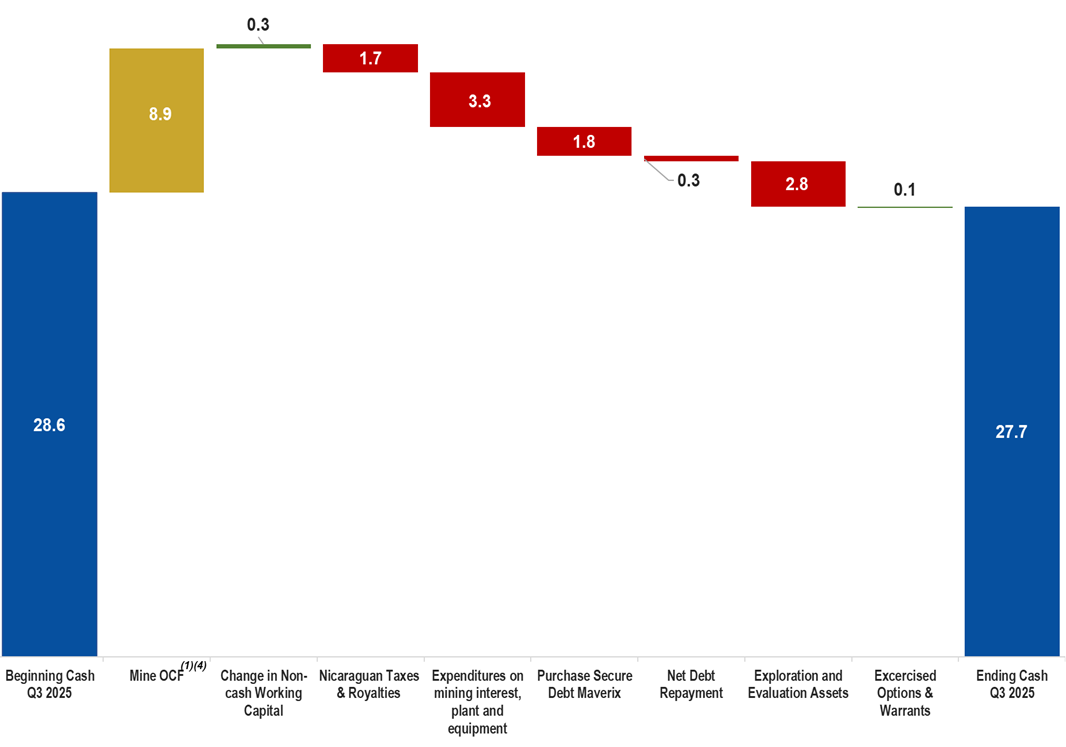

Chart 1

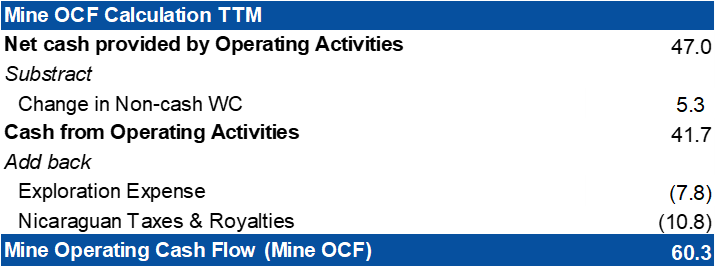

Q3 2025 - Mine OCF Calculation and Cash Reconciliation (in $ million)

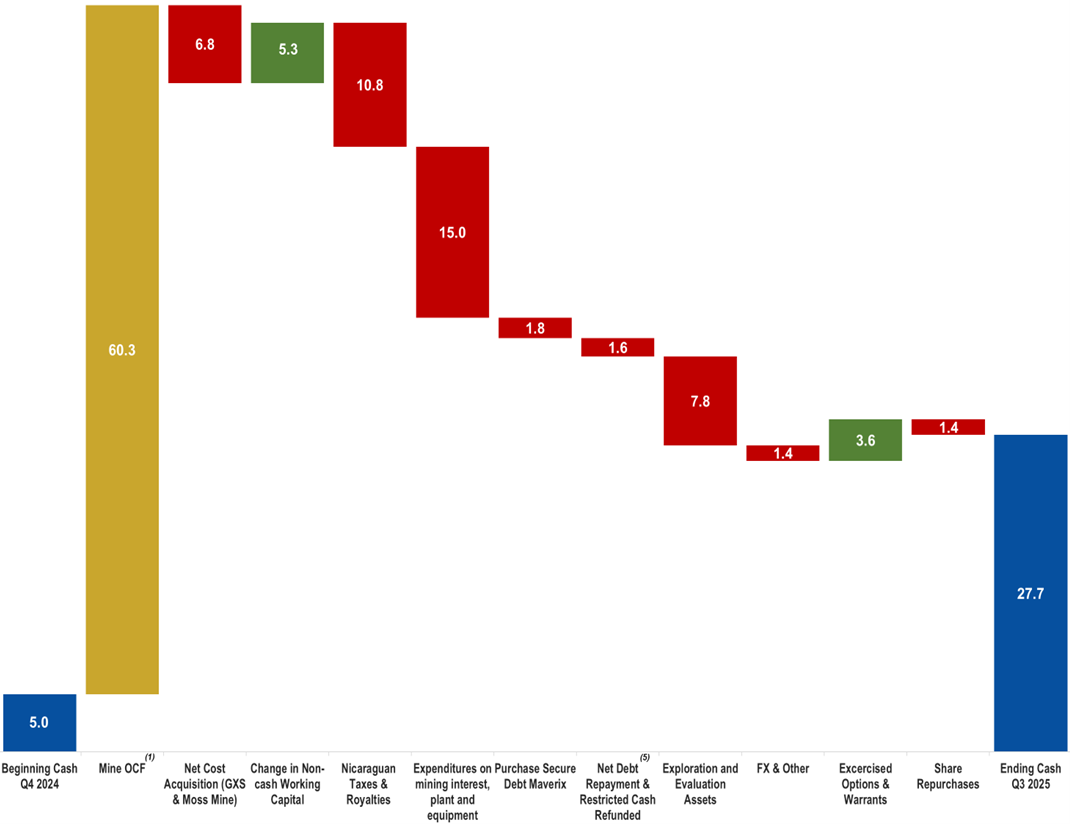

Twelve Trailing Months (TTM) - Mine OCF Calculation and Cash Reconciliation (in $ million)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price after deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan,, ther lease payments and a release of US

$1.5 million from Trisura Guarantee insurance Company held as collateral for various environmental bonds held at the Moss Mine

For complete details, please refer to unaudited condensed interim consolidated financial statements and the associated management's discussion and analysis for the three and nine months ended September 30, 2025, available on SEDAR+ (www.sedarplus.ca) and on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of General and Administrative expenses, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of metal production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. In addition, Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona currently undergoing restart and ramp-up activities. Mako also holds a

For further information on Mako Mining Corp., contact Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and the Company's profile on the SEDAR+ website at www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that the Moss mine will be a substantial cash flowing mine when full scale mining operations begin in Q1 2026 and the expectation that 2026 will show the results from the work performed by the Company in 2025 Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24, 2022 measures having impacts on business operations not currently expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q3 2025 and full year 2025 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on ACCESS Newswire