Madrigal Expands its MASH Pipeline with Exclusive Global Licensing Agreement for Six Preclinical siRNA Programs

Rhea-AI Summary

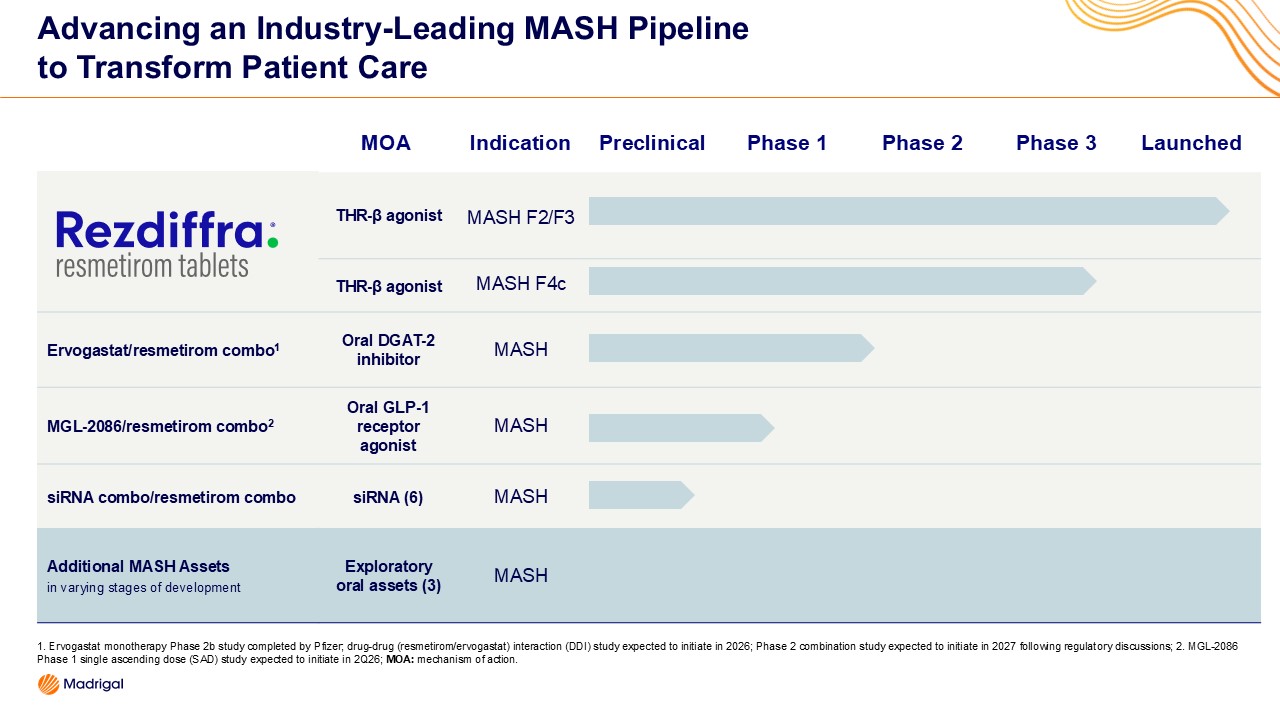

Madrigal (NASDAQ: MDGL) signed an exclusive global license with Ribo for six preclinical siRNA programs to expand its MASH pipeline, which now exceeds 10 programs and is anchored by Rezdiffra.

Key terms include a $60 million upfront payment, up to $4.4 billion in program milestones, royalties on net sales, and IND-enabling activities beginning in 2026.

Positive

- Exclusive global license for 6 preclinical siRNA programs

- Upfront payment of $60 million with up to $4.4 billion milestones

- Pipeline now >10 programs, anchored by Rezdiffra and F4c study

- IND-enabling activities for initial siRNA candidates to start in 2026

Negative

- Potential development cost exposure from up to $4.4 billion in milestone obligations

- All six siRNA programs are preclinical, carrying high clinical-development risk

- IND-enabling start in 2026 implies multi-year path before human efficacy data

News Market Reaction

On the day this news was published, MDGL gained 0.45%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

MDGL fell 1.93% while close biotech peers showed mixed, mostly modest moves. Notably, MRNA was down ~8%, but no broad, same-direction move across multiple peers points to stock-specific trading rather than a sector-wide shift.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Feb 05 | Inducement equity grants | Neutral | +3.1% | Granted 5,861 RSUs to 21 new employees under 2025 Inducement Plan. |

| Feb 02 | Earnings call scheduled | Neutral | +0.1% | Set Feb 19, 2026 date for Q4 and full-year 2025 results webcast. |

| Jan 22 | Inducement awards | Neutral | +0.2% | Granted options and 13,145 RSUs to 40 hires at $495.88 exercise price. |

| Jan 21 | Executive inducement grant | Neutral | +0.2% | New CAO received 2,398 RSUs and 1,826 options at $495.88 per share. |

| Jan 09 | Pipeline license deal | Positive | -7.6% | Licensed Pfizer’s Phase 2 ervogastat and early-stage MASH assets with $50M upfront. |

Recent MDGL news has mostly produced small, aligned moves, with a prior positive MASH licensing deal on ervogastat followed by a notable negative divergence.

Over the past month, Madrigal’s news flow has centered on equity inducement grants, insider-related filings, and pipeline expansion. Routine inducement and scheduling announcements around Jan 21–Feb 5 saw small, generally aligned price moves. In contrast, the Jan 9 global license for Phase 2 ervogastat and early-stage MASH assets coincided with a -7.58% reaction, showing that sizeable pipeline upgrades have not always been rewarded in the short term, a useful backdrop for assessing today’s siRNA deal.

Market Pulse Summary

This announcement adds six preclinical siRNA programs to Madrigal’s MASH pipeline, complementing Rezdiffra and existing assets like Phase 2 ervogastat and the GLP-1 agonist MGL-2086. The deal includes an upfront US $60 million payment and up to US $4.4 billion in milestones, highlighting both opportunity and financial commitments. Investors may watch upcoming IND-enabling work in 2026, progress of the fully enrolled Phase 3 Rezdiffra study, and how combination strategies in MASH evolve over time.

Key Terms

siRNA medical

small interfering RNA medical

GLP-1 receptor agonist medical

DGAT-2 inhibitor medical

GalNAc ligand medical

hepatocytes medical

mRNA-knockdown medical

AI-generated analysis. Not financial advice.

- Company advances its leadership in MASH with an expanded pipeline, which now includes more than 10 programs at multiple stages of development, anchored by Rezdiffra® (resmetirom) as the foundational treatment

- Madrigal will develop next-generation siRNA therapies that silence genes implicated in MASH

CONSHOHOCKEN, Pa., Feb. 11, 2026 (GLOBE NEWSWIRE) -- Madrigal Pharmaceuticals, Inc. (NASDAQ: MDGL), a biopharmaceutical company focused on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH), today announced an exclusive global license agreement with Suzhou Ribo Life Science Co. Ltd. (Ribo) and its subsidiary Ribocure Pharmaceuticals AB (Ribocure) for six preclinical small interfering RNA (siRNA) programs. siRNAs offer a precision approach to gene silencing in MASH by selectively reducing the production of disease-driving proteins.

“We believe meeting future patient needs in MASH will require combination approaches and treatments tailored to genetic drivers of disease. Madrigal is uniquely positioned to shape the future treatment landscape in this rapidly expanding market,” said Bill Sibold, Chief Executive Officer of Madrigal. “At the start of 2025, Madrigal was a single-product company launching the first medication for MASH. Today, we have the foundational therapy in Rezdiffra, a fully enrolled F4c outcomes study, and an industry-leading MASH pipeline with more than 10 programs targeting different drivers of the disease.”

“Our R&D strategy is focused on developing innovative compounds targeting validated mechanisms of disease, so we can deliver better outcomes for more patients with MASH,” said David Soergel, M.D., Chief Medical Officer of Madrigal. “siRNAs are highly liver targeted, and there are several genes implicated in MASH that could be addressed with an mRNA-knockdown approach. The precision of siRNA gene silencing, combined with Rezdiffra, has the potential to create the next generation of MASH treatment: genetically targeted therapies for patients with unmet needs.”

In addition to a fully enrolled Phase 3 study of Rezdiffra in compensated MASH cirrhosis (F4c), Madrigal’s MASH pipeline includes:

- MGL-2086, an oral GLP-1 receptor agonist entering first-in-human studies in the second quarter of 2026.

- Ervogastat, a Phase 2 oral DGAT-2 inhibitor. The Company plans to conduct a drug-to-drug interaction study with Rezdiffra and consult with the FDA on the design of a Phase 2 combination trial this year.

- Six innovative siRNA programs, providing the potential for a genetically targeted treatment approach.

- Additional exploratory assets in various stages of development.

siRNA: Potential for an Effective, Genetically Targeted Treatment Approach

Small interfering RNAs (siRNAs) offer a precision approach to gene silencing in MASH by selectively reducing the production of disease-driving proteins. When linked to a GalNAc ligand, siRNA molecules are delivered directly into hepatocytes, where they silence genes that have been identified as key risk factors for MASH by breaking down targeted mRNA. By pairing this precise gene-silencing approach with Rezdiffra, the company aims to explore whether reducing drivers of disease at the genetic level can complement Rezdiffra’s therapeutic effects. IND-enabling activities in initial candidates will begin in 2026.

Ribo has granted Madrigal an exclusive global license to develop, manufacture and commercialize six siRNA compounds. Ribo will receive an upfront payment of US

About MASH

Metabolic dysfunction-associated steatohepatitis (MASH), formerly known as nonalcoholic steatohepatitis (NASH), is a serious liver disease that can progress to cirrhosis, liver failure, liver cancer, need for liver transplantation and premature mortality. MASH is the leading cause of liver transplantation in women and the second leading cause of all liver transplantation in the U.S., and the fastest-growing indication for liver transplantation in Europe.

Once patients progress to MASH with moderate to advanced liver fibrosis (consistent with stages F2 to F3 fibrosis), the risk of adverse liver outcomes increases dramatically: these patients have a 10-17 times higher risk of liver-related mortality as compared to patients without fibrosis. Those who progress to cirrhosis face a 42 times higher risk of liver-related mortality, underscoring the need to treat MASH before complications of cirrhosis develop. MASH is also an independent driver of cardiovascular disease, the leading cause of mortality for patients.

As MASH disease awareness improves and disease prevalence increases, the number of diagnosed patients with MASH with moderate to advanced fibrosis or compensated MASH cirrhosis (F2-F4c) is expected to grow.

About Rezdiffra

What is Rezdiffra?

Rezdiffra is a prescribed medicine used along with diet and exercise to treat adults with metabolic dysfunction-associated steatohepatitis (MASH) with moderate to advanced liver scarring (fibrosis), but not with cirrhosis of the liver.

This indication is approved based on improvement of MASH and liver scarring (fibrosis). There are ongoing studies to confirm the clinical benefit of Rezdiffra.

Before you take Rezdiffra, tell your healthcare provider about all of your medical conditions, including if you:

- have any liver problems other than MASH.

- have gallbladder problems or have been told you have gallbladder problems, including gallstones.

- are pregnant or plan to become pregnant. It is not known if Rezdiffra will harm your unborn baby.

- A pregnancy safety study for women who take Rezdiffra during pregnancy collects information about the health of you and your baby. You or your healthcare provider can report your pregnancy by visiting https://pregnancyregistry.madrigalpharma.com/ or calling 1-800-905-0324.

- are breastfeeding or plan to breastfeed. It is not known if Rezdiffra passes into your breast milk. Talk to your healthcare provider about the best way to feed your baby if you take Rezdiffra.

Tell your healthcare provider about all the medicines you take, including prescription and over-the-counter medicines, vitamins and herbal supplements.

- Rezdiffra and other medicines may affect each other, causing side effects. Rezdiffra may affect the way other medicines work, and other medicines may affect how Rezdiffra works.

- Especially tell your healthcare provider if you take medicines that contain gemfibrozil to help lower your triglycerides, because Rezdiffra is not recommended in patients taking these medicines.

- Tell your healthcare provider if you are taking medicines such as clopidogrel to thin your blood or statin medicines to help lower your cholesterol.

- Know the medicines you take. Keep a list of them to show your healthcare provider and pharmacist when you get a new medicine.

What are the possible side effects of Rezdiffra?

Rezdiffra may cause serious side effects, including:

- liver injury (hepatotoxicity). Stop taking Rezdiffra and call your healthcare provider right away if you develop the following signs or symptoms of hepatotoxicity: tiredness, nausea, vomiting, fever, rash, your skin or the white part of your eyes turns yellow (jaundice) or stomach pain/tenderness.

- gallbladder problems. Gallbladder problems such as gallstones, or inflammation of the gallbladder, or inflammation of the pancreas from gallstones can occur with MASH and may occur if you take Rezdiffra. Call your healthcare provider right away if you develop any signs or symptoms of these conditions including nausea, vomiting, fever, or pain in your stomach area (abdomen) that is severe and will not go away. The pain may be felt going from your abdomen to your back and the pain may happen with or without vomiting.

- The most common side effects of Rezdiffra include: diarrhea, nausea, itching, stomach pain, vomiting, dizziness and constipation.

These are not all the possible side effects of Rezdiffra. For more information, ask your healthcare provider or pharmacist.

Call your doctor for medical advice about side effects. You may report side effects to FDA at 1-800-FDA-1088 or www.fda.gov/medwatch. You may also report side effects to Madrigal at 1-800-905-0324.

Please see the full Prescribing Information, including Patient Information, for Rezdiffra.

About Madrigal

Madrigal Pharmaceuticals, Inc. (Nasdaq: MDGL) is a biopharmaceutical company focused on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH), a liver disease with high unmet medical need. Madrigal’s medication, Rezdiffra (resmetirom), is a once-daily, oral, liver-directed THR-β agonist designed to target key underlying causes of MASH. Rezdiffra is the first and only medication approved by both the FDA and European Commission for the treatment of MASH with moderate to advanced fibrosis (F2 to F3). An ongoing Phase 3 outcomes trial is evaluating Rezdiffra for the treatment of compensated MASH cirrhosis (F4c). For more information, visit www.madrigalpharma.com and follow us on LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended, including statements related to Madrigal’s development goals and timelines for its pipeline candidates, the potential benefit of siRNAs in the treatment of MASH and Madrigal’s ability to advance its leadership position in MASH treatment. Forward-looking statements are subject to a number of risks and uncertainties including, but not limited to: the assumptions underlying the forward-looking statements; Madrigal’s ability to successfully commercialize Rezdiffra; risks of obtaining and maintaining regulatory approvals, including, but not limited to, potential regulatory delays or rejections; the challenges with the commercial launch of a new product; Madrigal’s history of operating losses and the possibility that it may never achieve or maintain profitability; risks associated with meeting the objectives of Madrigal’s clinical trials, including, but not limited to Madrigal’s ability to achieve enrollment objectives concerning patient numbers (including an adequate safety database), outcomes objectives and/or timing objectives for Madrigal’s trials; any delays or failures in enrollment, and the occurrence of adverse safety events; risks related to the effects of Rezdiffra’s (resmetirom’s) or any product candidate’s mechanism of action; market demand for and acceptance of Rezdiffra; Madrigal’s ability to service indebtedness and otherwise comply with debt covenants; outcomes or trends from competitive trials; future topline data timing or results; Madrigal’s ability to prevent and/or mitigate cyber-attacks; the uncertainties inherent in clinical testing; uncertainties concerning analyses or assessments outside of a controlled clinical trial; Madrigal’s ability to protect its intellectual property; and changes in laws and regulations applicable to Madrigal’s business and its ability to comply with such laws and regulations. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Madrigal undertakes no obligation to update any forward-looking statements to reflect new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events. Please refer to Madrigal’s submissions filed with the U.S. Securities and Exchange Commission (“SEC”), for more detailed information regarding these risks and uncertainties and other factors that may cause actual results to differ materially from those expressed or implied. Madrigal specifically discusses these risks and uncertainties in greater detail in the sections appearing in Part I, Item 1A of its Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 26, 2025, and as updated from time to time by Madrigal’s other filings with the SEC.

Madrigal may use its website to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor Madrigal’s website in addition to following its press releases, filings with the SEC, public conference calls, and webcasts.

Investor Contact

Tina Ventura, IR@madrigalpharma.com

Media Contact

Christopher Frates, media@madrigalpharma.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/eae07852-7d32-4636-8970-951b98f0a1c0