Impact Silver Intersects 18.83% ZnEq Over 4.95m Including 25.57% ZnEq Over 1.33m at the Plomosas Mine

Rhea-AI Summary

3iQ Corp announced that three of its ETFs — BTCQ (Bitcoin ETF), ETHQ (Ether Staking ETF) and SOLQ (Solana Staking ETF) — were added to the Ball Metaverse Index on Sept 22, 2025. As a result, Roundhill's Ball Metaverse ETF (NYSE: METV) has allocated over $40 million across those three 3iQ ETFs, creating increased exposure to leading crypto assets in METV's portfolio.

The release highlights ETHQ as North America’s first ETF to incorporate staking rewards into Ether strategies and notes distribution restrictions in the United States and prospectus risk disclosures.

Positive

- Inclusion in Ball Metaverse Index increases ETF visibility

- Roundhill allocated $40 million+ across BTCQ, ETHQ, SOLQ

- ETHQ first North American ETF to include staking rewards

Negative

- Securities not registered for offer or sale in the United States

- ETFs are not guaranteed; values change frequently per prospectus

News Market Reaction – METV

On the day this news was published, METV gained 0.20%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - December 9, 2025) - IMPACT Silver Corp. (TSXV: IPT) (OTCQB: ISVLF) (FSE: IKL) ("IMPACT" or the "Company") is pleased to announce further results from its underground drill program in the Santo Domingo Zone at its Plomosas zinc (lead-silver) Mine in northern Mexico.

SANTO DOMINGO ZONE DRILLING

New IMPACT drill intersections from the Santo Domingo Zone of the Plomosas Mine are as follows:

| TABLE 2: SANTO DOMINGO ZONE DRILL RESULTS | ||||||||

| Hole No. | From (metres) | To (metres) | Interval (metres) | Estimated True Width (metres) | Zinc (%) | Lead (%) | Silver (g/t) | ZnEq* (%) |

| UGSD-2509 | 13.10 | 13.60 | 0.50 | 0.47 | 12.75 | 0.82 | 9.50 | 13.63 |

| And | 71.60 | 72.00 | 0.40 | 0.38 | 15.65 | 1.54 | 11.90 | 17.02 |

| And | 81.55 | 81.95 | 0.40 | 0.38 | 3.67 | 8.26 | 20.30 | 8.98 |

| UGSD-2511 | 36.25 | 37.10 | 0.85 | 0.84 | 26.30 | 6.45 | 34.70 | 31.33 |

| UGSD-2512 | 29.40 | 31.47 | 2.07 | 2.07 | 10.60 | 9.43 | 24.00 | 16.70 |

| And | 55.05 | 60.00 | 4.95 | 4.95 | 13.83 | 7.43 | 22.99 | 18.83 |

| Including | 56.37 | 57.70 | 1.33 | 1.33 | 18.25 | 11.30 | 29.10 | 25.57 |

| UGSD-2513 | 19.68 | 20.30 | 0.62 | 0.58 | 20.30 | 18.25 | 45.30 | 32.05 |

| And | 25.98 | 26.60 | 0.62 | 0.58 | 16.90 | 7.76 | 26.20 | 22.22 |

| And | 56.60 | 59.95 | 3.35 | 3.15 | 5.04 | 5.06 | 8.85 | 8.12 |

| Including | 56.60 | 57.63 | 1.03 | 0.97 | 12.45 | 7.89 | 20.10 | 17.55 |

| UGSD-2515 | 50.84 | 51.60 | 0.76 | 0.54 | 9.16 | 4.98 | 10.70 | 12.29 |

*Zinc Equivalent (ZnEq) is calculated using recent metal prices of US

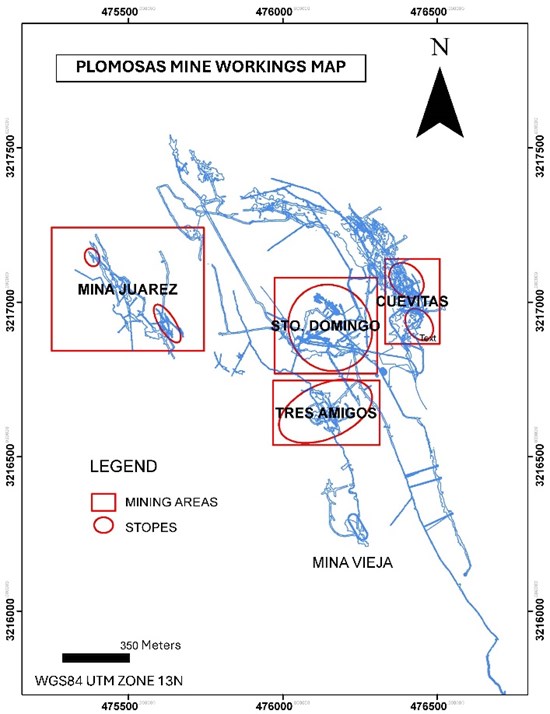

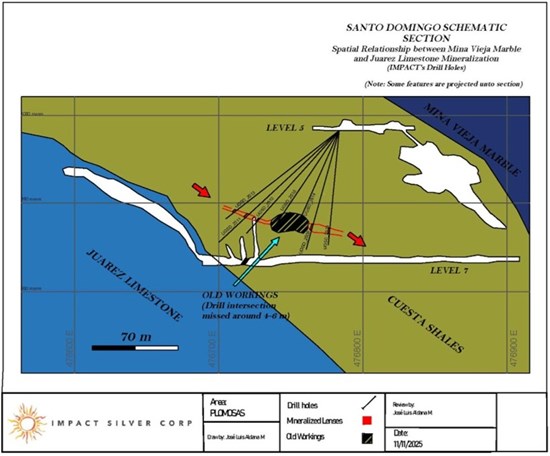

True width estimates are interpreted from current geological models. These drill holes are in the Santo Domingo area of IMPACT's active mine workings in the Plomosas Mine (see Figures 2&3). Drill holes UGSD-2510 and UGSD-2514 report no results because they encountered 4-6m of open space through previously unknown old mine workings where the Santo Domingo Zone was anticipated (see Figure 3). All these Santo Domingo drill intersections lie outside the JORC mineral resource blocks published by the previous operator (see IMPACT news release dated April 3, 2023 for details). Santo Domingo Zone mineralization remains open for exploration.

CEO STATEMENT

President and CEO Frederick Davidson commented, "Drilling on the Santo Domingo Zone continues to return exceptional high-grade results extending the zone to the northeast. The location of these new intersections on extensions of current active mine workings allows for rapid and low-cost access and mine development. Drilling is continuing with the aim to define additional mineralization in the Plomosas mine area as well as nearby greenfields exploration targets."

PLOMOSAS MINE GEOLOGY AND MINERALIZATION

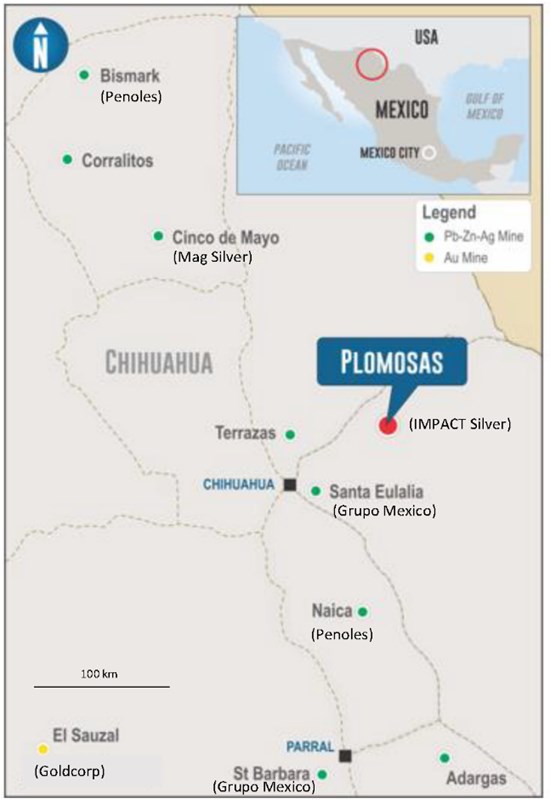

The Plomosas mine, a historic high-grade zinc producer in northern Mexico (Figure 1), was acquired in 2023 by the Company. Recent drill programs have been undertaken on extensions of active mine areas in the Tres Amigos Zone, the Juarez Zone and Santo Domingo Zone (see Figure 2). Mineralization at the Plomosas mine occurs as zinc-rich Carbonate Replacement zones in three bedrock units - the Mina Vieja marble (Tres Amigos Zone), the Juarez limestone (Juarez Zone) and in carbonate layers within the Cuesta Shale (Santo Domingo Zone) - where structural ground preparation along these units accommodated concentrations of zinc, lead, and silver (see Figure 3).

ABOUT IMPACT SILVER

IMPACT Silver Corp. (TSXV: IPT) is a successful producer-explorer with two mining projects in Mexico.

- Royal Mines of Zacualpan Silver-Gold District: IMPACT owns

100% of the 211 km2 Zacualpan project in central Mexico where four producing underground silver mines and one open pit mine feed the central 500 tpd Guadalupe processing plant. To the south, the Capire Project includes a 200 tpd processing pilot plant adjacent to an open pit silver mine with an NI 43-101 inferred mineral resource of over 4.5 million oz silver, 48 million lbs zinc and 21 million lbs lead (see IMPACT news release dated January 18, 2016, for details and QP statement). Company engineers are reviewing Capire for a potential restart of operations to leverage improving commodity prices. Over the past 19 years, IMPACT has developed multiple exploration zones into commercial production and has produced over 13.5 million ounces of silver, generating revenue of more than$307 million , with no long-term debt.

- Plomosas Zinc-Lead-Silver District: Plomosas is a high-grade zinc producer in northern Mexico with extensive exploration upside potential. In late 2023, the Company restarted mining operations and is ramping up production toward design capacity levels. Exploration potential at Plomosas is exceptional along the 6 km-long structure. This is in addition to other exploration targets on the 3,019-hectare property including untested copper-gold targets with indications of high-grade material at surface. Regionally, Plomosas lies in the same belt as some of the largest carbonate replacement deposits in the world (see Figure 1).

Quality Control/Quality Assurance

Drill core was NTW size (5.71 cm diameter). Half core samples were collected with a rock saw and tagged for identification. All samples were securely stored at the Plomosas Mine until shipment. A total of

Qualified Person and NI 43-101 Disclosure

Silvia Kohler, P. Geo., a Senior Geologist employed by IMPACT Silver Corp. and a "Qualified Person" within the meaning of NI-43101, has approved the technical information contained in this news release.

Additional information about IMPACT and its operations can be found on the Company website at www.IMPACTSilver.com. Follow us on X (formerly Twitter) @IMPACT_Silver and LinkedIn at https://www.linkedin.com/company/impactsilver

On behalf of IMPACT Silver Corp.

"Frederick W. Davidson"

President & CEO

For more information, please contact:

Jerry Huang

CFO | Investor Relations

O: (604) 664 7707 or inquiries@impactsilver.com

C: (778) 867 7909 Direct

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking and Cautionary Statements

This IMPACT News Release may contain certain "forward-looking" statements and information relating to IMPACT that is based on the beliefs of IMPACT management, as well as assumptions made by and information currently available to IMPACT management. Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Such statements include, but are not limited to, statements regarding interpretation of drill results, activity at the projects and estimated timing thereof, the potential for defining and extending the known mineralization, exploration potential on the properties, and plans for drilling and future operations at the Company's projects or plans for financing.

Such forward-looking information involves known and unknown risks and assumptions, including with respect to, without limitation, exploration and development risks, expenditure and financing requirements, title matters, operating hazards, extreme weather events, criminal activity, metal prices, political and economic factors, community relations, competitive factors, general economic conditions, relationships with vendors and strategic partners, governmental regulation and supervision, seasonality, technological change, industry practices, pandemics and one-time events. Should any one or more risks or uncertainties materialize or change, or should any underlying assumptions prove incorrect, actual results and forward-looking statements may vary materially from those described herein. IMPACT does not assume the obligation to update any forward-looking statement or beliefs, opinions, projections or other factors, except as required by law.

The Company's decision to place a mine into production, expand a mine, make other production related decisions or otherwise carry out mining and processing operations, is largely based on internal non-public Company data and reports based on exploration, development and mining work by the Company's geologists and engineers. The results of this work are evident in the discovery and building of multiple mines for the Company at Zacualpan and in the track record of mineral production and financial returns of the Company since 2006. Under NI 43-101, the Company is required to disclose that it has not based its production decisions on NI 43-101 mineral resources or reserve estimates, preliminary economic assessments or feasibility studies, and historically such projects have increased uncertainty and risk of failure.

303-543 Granville Street

Telephone 604 664-7707

Vancouver, BC, Canada V6C 1X8

www.impactsilver.com

X (Twitter)

LinkedIn

Figure 1: Location map of Plomosas Mine and nearby mines and infrastructure. References to nearby projects are for information purposes only and there are no assurances that Plomosas will achieve similar results.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4729/277450_96c75f19a4809822_001full.jpg

Figure 2: Plan map of the Plomosas Mine workings.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4729/277450_96c75f19a4809822_002full.jpg

Figure 3: Schematic cross section of the Santo Domingo Zone geology and mineralization showing new drill intersections.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4729/277450_96c75f19a4809822_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277450