Magna Mining Announces Closing of Property Acquisition from NorthX Nickel Corp.

Rhea-AI Summary

Magna Mining (OTCQX: MGMNF) has completed its acquisition of a significant property portfolio from NorthX Nickel Corp in the Sudbury Basin. The acquisition adds 304 km² of mineral claims, bringing Magna's total holdings in the area to 584 km².

The portfolio includes several notable properties: the Parkin property with historical production of 157,000 tons at 1.5% Ni, 1.5% Cu, and 6.2 g/t precious metals; the Wisner property with historical production of 295,000 tonnes at 0.9% Cu and 4.1 g/t precious metals; and properties near significant deposits like Blezard and Creighton, which have substantial measured and indicated resources.

The transaction terms include Magna paying C$1.00, assuming approximately C$481,629 in mine closure liabilities, while receiving C$665,000 from NorthX for closure plan assurance and property maintenance costs.

Positive

- Significant expansion of property portfolio in Sudbury Basin from 280 km² to 584 km²

- Acquisition includes historically productive mines with high-grade mineralization

- Properties are strategically located near known major deposits

- Net positive cash flow from transaction with C$665,000 received vs C$481,629 in liabilities

- Multiple exploration targets identified with promising historical drill results

Negative

- Assumption of mine closure plan liabilities and financial assurance requirements

- Not all properties are 100% owned, with some subject to joint ventures and royalties

- Annual work commitments required for certain properties

- Advanced NSR royalty payment obligations assumed

News Market Reaction – MGMNF

On the day this news was published, MGMNF gained 4.68%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Sudbury, Ontario--(Newsfile Corp. - July 21, 2025) - Magna Mining Inc. (TSXV: NICU) (OTCQX: MGMNF) (FSE: 8YD) ("Magna" or the "Company") is pleased to report that further to its news release dated December 18, 2024, the Company has completed its acquisition of a portfolio of exploration properties located in the Sudbury Basin (the "Transaction") from NorthX Nickel Corp. (CSE: NIX) ("NorthX").

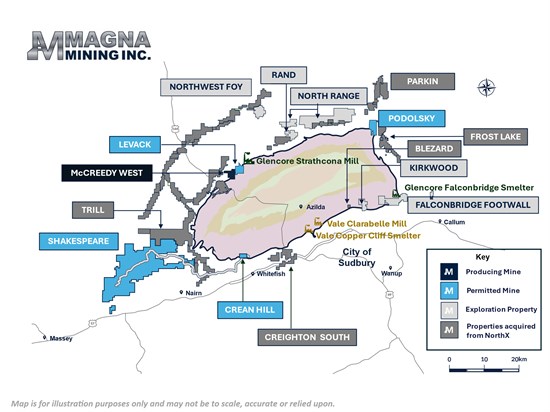

The NorthX properties being acquired represent 304 km2 of mineral claims, leases and patents in the Sudbury area. The acquisition of the NorthX property portfolio brings Magna's aggregate holdings in the Sudbury area to 584 km2 (see Figure 1).

Paul Fowler, Senior Vice President of Magna commented, "We are excited to complete this transaction and add a significant new portfolio of properties to our already strong pipeline of development and exploration projects in Sudbury. We believe that these assets have high potential for new discoveries, as many of these properties are in areas that would correspond to the footwall of known Sudbury deposits. We believe that they are deserving of more exploration capital, so we are looking forward to further evaluating these properties and applying our experience and knowledge of exploration in the Sudbury Basin."

Figure 1: Location of Magna Mining's Existing Properties, Operations and the NorthX Acquisition Properties

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/259404_ac42e6fb24bd1936_002full.jpg

Property Descriptions

The property portfolio includes past-producing properties (Parkin, Wisner), as well as several exploration properties mainly in the footwall of the Sudbury Igneous Complex (SIC) contact, and totaling >30,000 Ha. Magna believes these properties have significant exploration potential remaining, including offset dyke environments at Trill and Parkin, contact Ni-Cu mineralization at Windy Lake, and several properties in the footwall environment (Figures 1 and 2).

The Parkin property covers more than 9 kilometres of the Parkin offset, northeast of the Podolsky Mine property. The property hosts the historical Milnet mine with past production of 157,000 tons grading

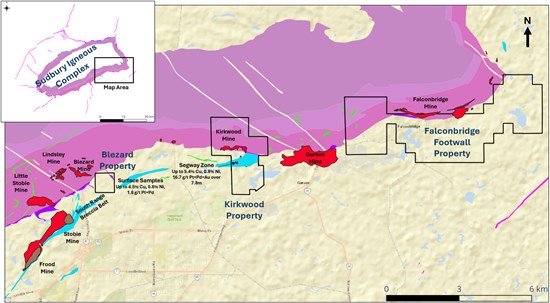

Several properties host known exploration targets within Sudbury Breccia units in the footwall of the Sudbury Igneous Complex (SIC), including the Wisner, Blezard, Frost Lake and Creighton South properties. The Wisner property historically produced 295,000 tonnes grading

The Magna exploration team will work to compile and interpret the immense amount of data that exists on these properties with the goal of identifying and testing the highest priority exploration targets. Not all properties are

Transaction Summary

The Transaction was structured as an asset purchase transaction whereby Magna acquired all of NorthX's legal and beneficial interest in the Sudbury Properties. The consideration for the Transaction consisted of the following:

Magna paying to NorthX ONE DOLLAR (C

$1.00) ;Magna assuming all liabilities of NorthX with respect to the Broken Hammer mine closure plan, including lodging financial assurance with the Ministry of Mines in an amount of approximately C

$481,629 ;NorthX paying to Magna C

$665,000 in cash to cover the Broken Hammer mine closure plan financial assurance and other costs incurred by Magna in maintaining the Broken Hammer property to the close of the Transaction; andMagna assuming certain liabilities with respect to the Sudbury Properties, including acting as the operator of joint ventures, advanced net smelter return (NSR) royalty payments, and annual work commitments.

Figure 2: Plan View Showing the Location of the South Range Breccia Belt in Relation to the Blezard, Kirkwood and Falconbridge Footwall Properties

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/259404_ac42e6fb24bd1936_003full.jpg

Qualified Person for Technical Information

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under National Instrument 43-101.

Cautionary Statement on Forward-Looking Statements

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities laws. Generally, these forward-looking statements can be identified by the use of forward-looking terminology, such as "may", "might", "potential", "expect", "anticipate", "estimate", "believe", "could", "should", "would", "will", "continue", "intend", "plan", "forecast", "prospective" or other similar words or phrases or variations thereof. For example, forward-looking statements include, but are not limited to, statements with respect to the exploration or discovery potential of the acquired NorthX properties.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, economic, technical and other risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements, including risks and uncertainties relating to the exploration or discovery potential of the acquired NorthX properties, if any potential for additional resources or reserves to the Company's existing portfolio of assets exists, and other risks disclosed in the Company's most recent management discussion and analysis. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Magna's filings with Canadian securities regulators, including the most recent management discussion and analysis, available on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important risks, uncertainties, contingencies and factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there can be no certainty or assurance that the Company has accurately or adequately captured, accounted for or disclosed all such risks, uncertainties, contingencies or factors. Readers should place no reliance on forward-looking statements as actual results, performance or achievements may be materially different from those expressed or implied by such statements. Resource exploration and development, and mining operations, are highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge will not eliminate. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update any forward-looking statements, whether as a result of new information or future events or otherwise, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

About Magna Mining Inc.

Magna Mining is a producing mining company with a portfolio of copper, nickel and PGM operating, exploration and development projects in the Sudbury Region of Ontario, Canada. The Company's primary assets are the producing McCreedy West copper mine and the past producing Levack, Podolsky, Shakespeare and Crean Hill mines. Additional information about the Company is available on SEDAR (www.sedar.com) and on the Company's website (www.magnamining.com).

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Senior Vice President

705-482-9667

Email: info@magnamining.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259404