Magna Mining Reports Mineral Resource Estimate for the Levack Mine in Sudbury, Ontario

Rhea-AI Summary

Magna Mining (OTCQX: MGMNF) released a NI 43-101 Mineral Resource Estimate for the Levack Mine with an effective date of August 31, 2025. The MRE reports 6.1 Mt Indicated at 3.5% CuEq and 5.2 Mt Inferred at 3.6% CuEq, plus a high‑grade footwall Indicated block of 178,000 t at 15.5% CuEq and Inferred footwall tonnes grading up to 9.4% CuEq. The estimate uses 10,525 drill holes and will be the basis for a PEA in 2026 and work to re‑establish hoisting and ramp access in early 2026.

Positive

- Indicated resource of 6.1 million tonnes at 3.5% CuEq

- High‑grade Morrison footwall: 178,000 t at 15.5% CuEq

- Large drill database: 10,525 holes totaling 4,382,756 ft

- PEA contract awarded and scheduled for completion in 2026

Negative

- 5.2 million tonnes reported as Inferred (lower confidence)

- Mineral resources are not mineral reserves and lack demonstrated economic viability

- Certain intercepts excluded pending geological correlation, needing more drilling

News Market Reaction

On the day this news was published, MGMNF gained 7.76%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

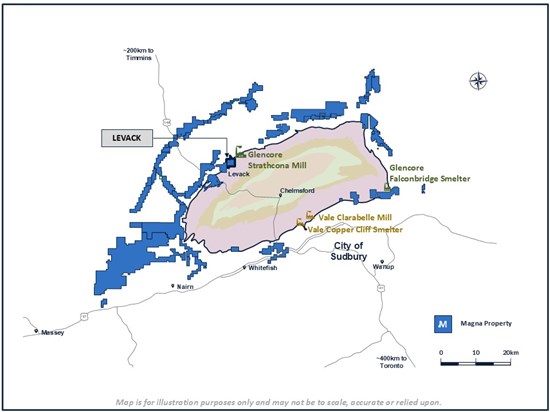

Sudbury, Ontario--(Newsfile Corp. - November 18, 2025) - Magna Mining Inc. (TSXV: NICU) (OTCQX: MGMNF) (FSE: 8YD) ("Magna" or the "Company") is pleased to announce the results of a Mineral Resource Estimate ("MRE") prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects for the past-producing Levack Mine, located in the North Range of the Sudbury Basin, Ontario, Canada (Figure 1). The Levack Mine MRE is comprised of both footwall-type deposits, which contain copper ("Cu") and precious metals including gold ("Au"), platinum ("Pt"), palladium ("Pd") and silver ("Ag"), and contact-type deposits hosting mineralization rich in nickel ("Ni") and Cu.

Levack Mineral Resource Estimate Highlights (as of August 31, 2025, the cut-off for diamond drill data incorporated in the MRE):

- Current mineralization in the Levack Mine includes 6.1 million tonnes in the Indicated category at

3.5% copper equivalent ("CuEq"), comprised of1.1% Cu,1.4% Ni, 0.6 grams per tonne (g/t) Pt, 0.7 g/t Pd, 0.1 g/t Au, and 2.0 g/t Ag, as well as 5.2 million tonnes in the Inferred category at3.6% CuEq (1.2% Cu,1.4% Ni, 0.6 g/t Pt, 0.8 g/t Pd, 0.2 g/t Au, 2.1 g/t Ag). - The high grade footwall-type deposits contain 368,000 tonnes in the Inferred category at

9.4% CuEq (5.4% Cu,0.75% Ni, 2.9 g/t Pt, 5.4 g/t Pd, 1.5 g/t Au, and 21.0 g/t Ag), as well as 178,000 tonnes in the Indicated category at the previously-mined Morrison Footwall Cu-PGE deposit grading15.5% CuEq (9.1% Cu,2.4% Ni, 3.6 g/t Pt, 6.6 g/t Pd, 1.6 g/t Au, 34.2 g/t Ag), which remains open at depth. - The No. 3 Footwall deposit is particularly rich in precious metals, containing 76,000 tonnes in the Inferred category grading 7.9 g/t Pt, 15.7 g/t Pd, 3.1 g/t Au and 30.3 g/t Ag, as well as

4.5% Cu and0.7% Ni (13.4% CuEq) with important potential implications for ongoing exploration in the footwall environment. - The zones of contact-type mineralization generally occur at depths of less than 750 metres (approximately 2,460 feet) and contain 5.9 million tonnes in the Indicated category grading

0.9% Cu,1.4% Ni, and 2.1 g/t precious metals (Pt+Pd+Au+Ag), or3.2% CuEq, as well as 4.8 million tonnes in the Inferred category at3.2% CuEq (0.9% Cu,1.5% Ni, 1.5 g/t precious metals (Pt+Pd+Au+Ag)).

Dave King, SVP Exploration and Geoscience, stated, "Today's announcement of Magna's initial mineral resource estimate for our flagship Levack Mine in Sudbury represents an important milestone as it confirms the presence of significant mineralization, much of which can be accessed using existing infrastructure. Importantly, in addition to over 5.9 million tonnes of contact-type mineralization in the Indicated category, 178,000 tonnes of mineralization grading

Jason Jessup, CEO, stated, "The results of Magna's first mineral resource estimate for the Levack Mine exceeded our expectations, particularly in terms of the grade of the remaining mineralization at the Morrison Footwall Cu-PGE deposit, and the significant tonnage of relatively shallow, contact-type nickel-copper mineralization. This resource estimate will now be used to complete a Preliminary Economic Assessment ("PEA") with the vision of utilizing a new ramp from surface to access the shallower deposits, as well as the existing shaft and loading pocket infrastructure to hoist higher grade footwall copper-precious metals ore from deeper within the mine. The contract to complete the PEA will be awarded prior to the end of the year and will be completed during 2026. In addition, we have already engaged a contractor to begin developing the scope of work to re-establish hoisting capabilities, and this work could potentially begin in early 2026. At present, there is a contract mining company working on the 3900 Level ramp to develop access to the 3600 Level between the No.2 and No.3 shaft stations. This connection is expected to be completed in Q2 2026 and will provide many benefits for footwall exploration and synergies with a neighbouring mine. The Levack Mine has quickly become the flagship project within our company and 2026 will be an exciting year as we continue to move towards a production restart while at the same time exploring for new copper-precious metals deposits in the footwall environment at the mine."

The MRE was completed by Jonathan Cirelli, P.Geo, Senior Geologist of Orix Geoscience Inc. and incorporates diamond drill data up to a cut-off of August 31, 2025. Both the Indicated and Inferred resources in the Morrison Footwall Cu-PGE deposit have been constrained geologically as discrete veins that have either been defined by previous mining operations, or by multiple diamond drill intercepts. Certain mineralized intercepts around the Morrison deposit have been excluded from this MRE where their relationship to known veins has not yet been established. Follow up drilling in these areas will be incorporated into the Company's ongoing exploration program, with the goal of including these intercepts in a future MRE update. The Morrison deposit also remains open at depth, with underground drilling to test for potential extensions planned for 2026 once drill platforms have been established. Diamond drilling to target the expansion of the Inferred resource at the No. 3 Footwall deposit will also be a focus during 2026, given the significant precious metal grades outlined in the MRE (see Table 3).

This MRE will serve as the basis for the completion of a PEA study by a third-party consultant. This study will further refine the potential to access the shallow, contact-type mineralization via a new ramp from surface, as was previously investigated by the Company's internal work. In addition, the PEA will also evaluate a re-start of production from the Morrison Footwall Cu-PGE deposit via the No.2 Shaft. The No.2 Shaft is currently being used to move personnel and materials in support of underground drilling, rehabilitation and new development work at Levack Mine. Work is currently underway to determine what is required to re-establish ore and waste hoisting capabilities at the No.2 Shaft. The results of the evaluation of the hoisting system could support a decision to begin the recommissioning work as early as Q1 2026.

Figure 1: Location of Magna's Existing Properties, Location of Levack Mine and Key Sudbury Infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/274933_674abd1ab4c4f937_002full.jpg

Table 1: Levack Mineral Resource Estimate1 - Indicated Category, August 31, 2025

| Deposit Type | Category | Cut-off Grade | Short Tons | Metric Tonnes | Cu % | Ni % | Co % | Pt (g/tonne) | Pd (g/tonne) | Au (g/tonne) | Ag (g/tonne) | CuEq % | |

| Contact | Indicated | CuEq | 6,535,000 | 5,928,000 | 0.89 | 1.41 | 0.05 | 0.46 | 0.56 | 0.07 | 0.99 | 3.18 | |

| Footwall | Indicated | CuEq | 197,000 | 178,000 | 9.06 | 2.37 | 0.02 | 3.60 | 6.58 | 1.56 | 34.15 | 15.52 | |

| Total | Indicated | 6,732,000 | 6,106,000 | 1.13 | 1.44 | 0.04 | 0.56 | 0.74 | 0.11 | 1.95 | 3.54 | ||

Table 2: Levack Mineral Resource Estimate1 - Inferred Category, August 31, 2025

| Deposit Type | Category | Cut-off Grade | Short Tons | Metric Tonnes | Cu % | Ni % | Co % | Pt (g/tonne) | Pd (g/tonne) | Au (g/tonne) | Ag (g/tonne) | CuEq % | |

| Contact | Inferred | CuEq | 5,288,000 | 4,797,000 | 0.87 | 1.46 | 0.04 | 0.39 | 0.40 | 0.05 | 0.68 | 3.15 | |

| Footwall | Inferred | CuEq | 406,000 | 368,000 | 5.42 | 0.75 | 0.01 | 2.91 | 5.40 | 1.53 | 21.00 | 9.35 | |

| Total | Inferred | 5,694,000 | 5,165,000 | 1.19 | 1.41 | 0.04 | 0.57 | 0.76 | 0.16 | 2.13 | 3.59 | ||

Table 3: Levack Mineral Resource Estimate1 - Footwall Zones, August 31, 2025

| Deposit Type | Zone | Category | Cut-off Grade | Short Tons | Metric Tonnes | Cu % | Ni % | Co % | Pt (g/tonne) | Pd (g/tonne) | Au (g/tonne) | Ag (g/tonne) | CuEq % |

| Footwall | Keel | Indicated | CuEq | - | - | ||||||||

| Footwall | Morrison | Indicated | CuEq | 197,000 | 178,000 | 9.06 | 2.37 | 0.02 | 3.60 | 6.58 | 1.56 | 34.15 | 15.52 |

| Footwall | No.3 FW | Indicated | CuEq | - | - | ||||||||

| Total | Indicated | CuEq | 197,000 | 178,000 | 9.06 | 2.37 | 0.02 | 3.60 | 6.58 | 1.56 | 34.15 | 15.52 | |

| Footwall | Keel | Inferred | CuEq | 229,000 | 208,000 | 4.36 | 0.48 | 0.01 | 1.41 | 1.88 | 1.10 | 17.74 | 6.44 |

| Footwall | Morrison | Inferred | CuEq | 93,000 | 85,000 | 8.83 | 1.47 | 0.01 | 2.16 | 4.87 | 1.20 | 20.67 | 12.88 |

| Footwall | No.3 FW | Inferred | CuEq | 83,000 | 76,000 | 4.49 | 0.68 | 0.01 | 7.86 | 15.66 | 3.08 | 30.32 | 13.36 |

| Total | Inferred | CuEq | 406,000 | 368,000 | 5.42 | 0.75 | 0.01 | 2.91 | 5.40 | 1.53 | 21.00 | 9.35 |

Table 4: Levack Mineral Resource Estimate1, Sensitivity to Cut-off Grade, August 31, 2025

| Cut-off Grade | Type | Category | Short Tons | Metric Tonnes | Cu % | Ni % | Co % | Pt (g/tonne) | Pd (g/tonne) | Au (g/tonne) | Ag (g/tonne) | CuEq % |

CuEq | Contact | Indicated | 9,767,000 | 8,861,000 | 0.75 | 1.20 | 0.04 | 0.40 | 0.49 | 0.06 | 0.88 | 2.70 |

CuEq | Contact | Indicated | 7,951,000 | 7,213,000 | 0.82 | 1.31 | 0.04 | 0.43 | 0.53 | 0.06 | 0.93 | 2.95 |

CuEq | Contact | Indicated | 6,535,000 | 5,928,000 | 0.89 | 1.41 | 0.05 | 0.46 | 0.56 | 0.07 | 0.99 | 3.18 |

CuEq | Contact | Indicated | 5,348,000 | 4,852,000 | 0.97 | 1.52 | 0.05 | 0.49 | 0.60 | 0.07 | 1.04 | 3.42 |

CuEq | Contact | Indicated | 4,350,000 | 3,946,000 | 1.04 | 1.62 | 0.05 | 0.52 | 0.63 | 0.08 | 1.10 | 3.66 |

CuEq | Footwall | Indicated | 200,000 | 181,000 | 8.94 | 2.34 | 0.02 | 3.55 | 6.48 | 1.53 | 33.74 | 15.30 |

CuEq | Footwall | Indicated | 198,000 | 180,000 | 9.00 | 2.35 | 0.02 | 3.57 | 6.53 | 1.55 | 33.94 | 15.40 |

CuEq | Footwall | Indicated | 197,000 | 178,000 | 9.06 | 2.37 | 0.02 | 3.60 | 6.58 | 1.56 | 34.15 | 15.52 |

CuEq | Footwall | Indicated | 195,000 | 177,000 | 9.13 | 2.38 | 0.02 | 3.63 | 6.63 | 1.57 | 34.37 | 15.63 |

CuEq | Footwall | Indicated | 193,000 | 175,000 | 9.21 | 2.40 | 0.02 | 3.66 | 6.69 | 1.58 | 34.60 | 15.76 |

| Cut-off Grade | Type | Category | Short Tons | Metric Tonnes | Cu % | Ni % | Co % | Pt (g/tonne) | Pd (g/tonne) | Au (g/tonne) | Ag (g/tonne) | CuEq % |

CuEq | Contact | Inferred | 7,625,000 | 6,917,000 | 0.75 | 1.25 | 0.04 | 0.34 | 0.35 | 0.05 | 0.70 | 2.72 |

CuEq | Contact | Inferred | 6,384,000 | 5,791,000 | 0.82 | 1.35 | 0.04 | 0.36 | 0.38 | 0.05 | 0.70 | 2.93 |

CuEq | Contact | Inferred | 5,288,000 | 4,797,000 | 0.87 | 1.46 | 0.04 | 0.39 | 0.40 | 0.05 | 0.68 | 3.15 |

CuEq | Contact | Inferred | 4,378,000 | 3,971,000 | 0.93 | 1.56 | 0.05 | 0.42 | 0.43 | 0.06 | 0.70 | 3.36 |

CuEq | Contact | Inferred | 3,498,000 | 3,173,000 | 1.01 | 1.66 | 0.05 | 0.46 | 0.47 | 0.06 | 0.75 | 3.61 |

CuEq | Footwall | Inferred | 448,000 | 406,000 | 5.01 | 0.69 | 0.01 | 2.75 | 5.02 | 1.42 | 19.84 | 8.68 |

CuEq | Footwall | Inferred | 425,000 | 386,000 | 5.23 | 0.72 | 0.01 | 2.83 | 5.22 | 1.48 | 20.45 | 9.03 |

CuEq | Footwall | Inferred | 406,000 | 368,000 | 5.42 | 0.75 | 0.01 | 2.91 | 5.40 | 1.53 | 21.00 | 9.35 |

CuEq | Footwall | Inferred | 387,000 | 352,000 | 5.60 | 0.77 | 0.01 | 3.00 | 5.60 | 1.58 | 21.58 | 9.67 |

CuEq | Footwall | Inferred | 364,000 | 330,000 | 5.86 | 0.80 | 0.01 | 3.13 | 5.86 | 1.65 | 22.39 | 10.10 |

1 Footnotes to the Levack Mineral Resource Estimate

- The effective date of the Levack Mine Mineral Resource Estimate (MRE) is August 31, 2025. This is the close out date for the final mineral resource models and mine out models (as-builts)

- The mineral resources are reported at a cut-off grade of

2.00% CuEq for Contact deposits and2.50% CuEq for Footwall deposits. Values in this table reported above and below the cut-off grades should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade. - CuEq is calculated using metal prices of

$4.50 /lb Cu,$7.31 /lb Ni,$15.00 /lb Co,$1,291 /oz Pt,$1,031 /oz Pd ,$3,324 /oz Au, and$37.40 /oz Ag. Metal recoveries considered are91% for Cu,85% for Ni,68% for Co,64% for Pt,69.5% for Pd,70.5% for Au, and70% for Ag - The mineral resource was estimated by Jonathan Cirelli, P.Geo. of Orix Geoscience Inc. and is an independent Qualified Person as defined by NI 43-101. A site visit was conducted on July 9th, 2025.

- The classification of the current Mineral Resource Estimate (MRE) into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The mineral resources are presented undiluted and in situ, constrained by diamond drillhole information and previous underground geological mapping, and are considered to have reasonable prospects for eventual economic extraction. The mineral resource is exclusive of mined out material. The drillhole database includes data from 10,525 surface and underground diamond drill holes completed between 1911 and 2025. The drilling totals 4,382,756 ft (1,335,864 m) including 341,394 assay intervals representing 1,393,512 ft (424,742 m) of data.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Grades for Ni, Cu, Co, Pt, Pd, Au, and Ag are estimated for each mineralization domain using ~2.0 ft (0.61 m), 2.5 ft (0.76 m), or 5.0 ft (1.52 m) composites assigned to that domain, depending on the style of mineralization. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains. Samples were capped before compositing when required.

- Reliable density measurements were available for

21% of the samples in the drillhole database (71,712 measured samples) allowing for zone-specific Ni and Cu-based regression formulas to be created and applied to estimate missing densities.

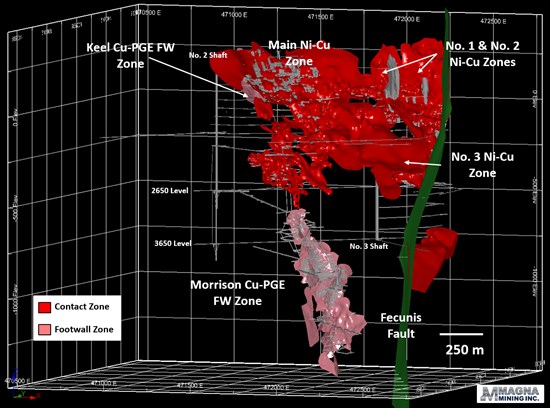

Figure 2: Levack Mine Underground Development and Mineralized Zones. Oblique 3D View Looking Northwest.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/274933_674abd1ab4c4f937_007full.jpg

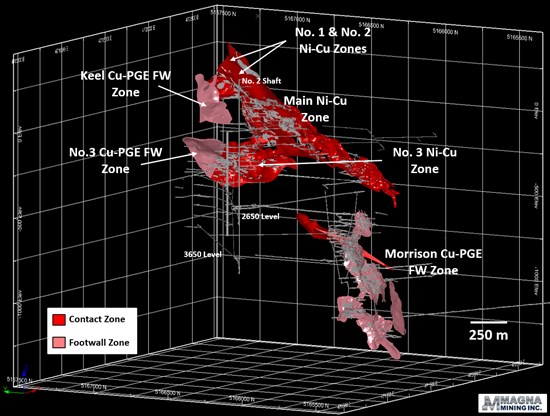

Figure 3: Levack Mine Underground Development and Mineralized Zones. Oblique 3D View Looking Southeast.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8002/274933_674abd1ab4c4f937_008full.jpg

The technical report in support of the above noted mineral resource estimates will be filed by Magna within 45 days of this press release.

Announcement of Filing of Q3 Financials and Conference Call

The Company is scheduled to release its Q3 2025 financial results and MD&A after the market close on Tuesday November 25, 2025. In addition, the Company will be holding a conference call and webcast on Wednesday November 26, 2025 at 8:00am EST.

To register for the conference call, please use the following link to obtain a Dial-in Number and PIN: https://register-conf.media-server.com/register/BIfc83dc419540403380a832570e704494

To attend the webcast in listen-only mode, please use the following link: https://edge.media-server.com/mmc/p/xxh36742

Qualified Person for Technical Information

The scientific and technical information in this press release has been reviewed and approved by both Jonathan Cirelli, P.Geo, Senior Geologist of Orix Geoscience Inc., independent of the Company, and David King, M.Sc., P.Geo, Senior Vice President, Exploration and Geoscience for the Company. Both Mr. Cirelli and Mr. King are qualified persons under National Instrument 43-101.

Cautionary Statement on Forward-Looking Statements

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities laws. Generally, these forward-looking statements can be identified by the use of forward-looking terminology, such as "may", "might", "potential", "expect", "anticipate", "estimate", "believe", "could", "should", "would", "will", "continue", "intend", "plan", "forecast", "prospective", "significant" or other similar words or phrases or variations thereof. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, economic, technical and other risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements, including risks and uncertainties relating to the failure of additional drilling to support assumptions, expectations or estimates of potential mineralization, metal tonnes or grade, such as those related to the Morrison Deposit, the failure of additional drilling to support additional expansion or delineation of estimated resources, the failure of additional drilling to support production planning, the lack of availability of drill rigs to implement exploration or other programs or the failure to proceed as quickly as planned with additional exploration or other drilling, continued delays for assay results, the failure to proceed as quickly as planned with or to complete additional development as anticipated, such as the development of a ramp from the surface of, or recommissioning of the hoisting plant at, the Levack Mine, the failure to proceed as quickly as planned with a restart of mining at the Levack Mine, assuming there will be any restart, and other risks disclosed in the Company's annual management discussion and analysis, available on the SEDAR+ website (at: www.sedarplus.ca). Although the Company has attempted to identify important risks, uncertainties, contingencies and factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there can be no certainty or assurance that the Company has accurately or adequately captured, accounted for or disclosed all such risks, uncertainties, contingencies or factors. Readers should place no reliance on forward-looking statements as actual results, performance or achievements may be materially different from those expressed or implied by such statements. Resource exploration and development, and mining operations, are highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge will not eliminate. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update any forward-looking statements, whether as a result of new information or future events or otherwise, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

About Magna Mining Inc.

Magna Mining Inc. is a producing mining company with a strong portfolio of copper, nickel, and platinum group metals (PGM) assets located in the world-class Sudbury mining district of Ontario, Canada. The Company's primary asset is the McCreedy West Mine, currently in production, supported by a pipeline of highly prospective past-producing properties including Levack, Crean Hill, Podolsky, and Shakespeare.

Magna Mining is strategically positioned to unlock long-term shareholder value through continued production, exploration upside, and near-term development opportunities across its asset base.

Additional corporate and project information is available at www.magnamining.com and through the Company's public filings on the SEDAR+ website at www.sedarplus.ca.

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Executive Vice President

705-482-9667

Email: info@magnamining.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274933