MarketWise, Inc. Reports Preliminary Selected Unaudited Fourth Quarter Results with Billings Up 42% YoY; CFFO for FY 2025 of $45 Million; Beats FY 2025 Guidance for Both Billings and Cash Flow; Cash Balances Increase $20 Million in the Quarter to $70 Million

Rhea-AI Summary

MarketWise (NASDAQ: MKTW) reported preliminary unaudited Q4 2025 results: Q4 billings ~$79M (up 42% YoY; +23% sequential) and FY 2025 billings ~$271M (beat $250M guidance). Cash from operations (CFFO) was ~$24M in Q4 and ~$45M for FY 2025 (beat $30M guidance; ~ $65M improvement vs FY 2024). Cash and equivalents rose to $70.1M at Dec 31, 2025. Paid subscribers were 374k and total active subscribers 2.4M. Board-authorized buybacks paused Oct 30, 2025 after a $17.25/share acquisition proposal; FY 2025 partnership tax distributions totaled $49.8M.

Positive

- FY 2025 billings of ~$271M, beating $250M guidance

- Q4 2025 billings of ~$79M, +42% year-over-year

- FY 2025 CFFO of ~$45M, beating $30M guidance

- Cash balance increased to $70.1M at Dec 31, 2025

- CFFO improvement of ~ $65M vs FY 2024

Negative

- Paid subscribers flat at 374k vs Sep 30, 2025

- Paid subscriber count declined over two years (company note)

- Partnership tax distributions of $49.8M in FY 2025

- Share repurchases suspended effective Oct 30, 2025

Key Figures

Market Reality Check

Peers on Argus

MKTW is up about 2.2% while key peers like BTOG and FMY are down and DNB/LRFC are nearly flat. This points to a stock-specific reaction rather than a broader sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Nov 20 | Advisors to committee | Neutral | +1.1% | Special Committee names financial and legal advisors for acquisition proposal review. |

| Nov 06 | Earnings & dividends | Positive | +1.9% | Q3 beat on Billings, solid net income, strong dividends and FY2026 targets issued. |

| Nov 03 | Dividend declaration | Positive | -2.3% | Board declares quarterly and special dividend, lifting total FY2025 payouts. |

| Oct 29 | Acquisition proposal | Positive | -1.9% | Unsolicited cash proposal at $17.25 per share for remaining equity interests. |

| Aug 07 | Earnings & dividend | Positive | -6.1% | Strong Q2 revenue, Billings and CFFO with combined quarterly and special dividend. |

Strong fundamental or dividend news has previously seen mixed price reactions, with several positive updates followed by short-term declines.

Over the last six months, MarketWise has combined operational improvement with active capital returns. Q2 and Q3 2025 results highlighted growing Billings, rising net income, and increasing cash, alongside regular and special dividends that totaled $1.90 per share for FY 2025. The company also received a $17.25 per-share acquisition proposal and later detailed advisors for the Special Committee reviewing it. Today’s preliminary FY 2025 figures, which beat prior Billings and CFFO guidance, extend that trend of operational strengthening under strategic refocusing.

Market Pulse Summary

This announcement highlights preliminary FY 2025 Billings of roughly $271M, CFFO of $45M, and a cash balance rising to about $70M, all exceeding prior Billings and cash-flow guidance. Management continues emphasizing higher-value subscribers and strong cash generation, while also reminding investors of the outstanding $17.25 per-share proposal under Special Committee review. Key items to watch include final audited results by March 2026, trends in paid subscriber quality, and any updates on the strategic review process.

Key Terms

cash from operating activities financial

tax receivable agreement regulatory

stock repurchase program financial

special dividend financial

AI-generated analysis. Not financial advice.

BALTIMORE, Jan. 22, 2026 (GLOBE NEWSWIRE) -- MarketWise, Inc. (NASDAQ: MKTW) (“MarketWise” or the “Company”), a leading multi-brand digital subscription services platform that provides premium financial research, software, education, and tools for self-directed investors, today reported preliminary selected unaudited financial and operational updates for fourth quarter 2025 below. Consistent with past practice, and as we did in January of last year, we are providing investors with selected information on recent directional trends in advance of issuing our usual earnings press release announcing full year 2025 financial results, which we expect to release in March 2026.

The selected unaudited results in this press release are preliminary and subject to the Company’s normal quarter and year-end accounting procedures and external audit by the Company’s independent registered public accounting firm. Therefore, these preliminary unaudited results are subject to adjustment. In addition, these preliminary unaudited results are not a comprehensive statement of the Company’s financial results for the year ended December 31, 2025 and should not be viewed as a substitute for full, audited financial statements prepared in accordance with generally accepted accounting principles.

Q4 2025 Preliminary Selected Unaudited Financial and Operational Updates:

- Consolidated Paid subscribers at December 31, 2025 were 374 thousand. Active Free subscribers were 2.0 million at December 31, 2025.

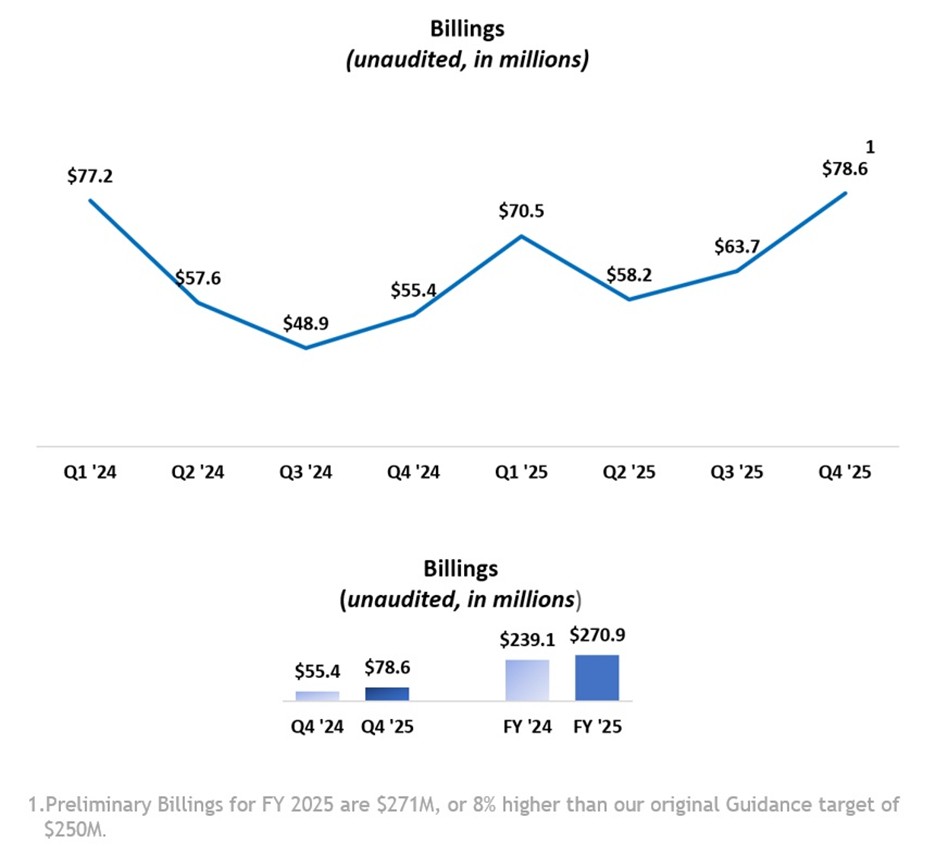

- Billings, or Net Sales1, for fourth quarter 2025 totaled approximately

$79 million , representing over a23% sequential increase compared with Q3 2025, and a year-over-year increase of42% . - Billings for FY 2025 totaled approximately

$271 million , beating guidance of$250 million . - CFFO for fourth quarter 2025 was approximately

$24 million , or$45 million for the full year beating guidance of$30 million . This represents an approximately$65 million improvement in CFFO compared to FY 2024. - Cash and cash equivalents balance increased to

$70 million at December 31, 2025 from$51 million at September 30, 2025. - Cumulative dividends paid by the Company to Class A Shareholders over the last twelve months equates to a cash dividend yield of

13% , based on the share price as of December 31, 2025.2

_________________

1 The Company uses Net Sales and Billings interchangeably, which represents amounts invoiced to customers.

2 Dividends paid in the last twelve months totaled

"I am pleased to report that the strategic roadmap we laid out one year ago continues to deliver clear, measurable results with fourth quarter Net Sales up more than

Eifrig continued, "This past year marked a special milestone for MarketWise as we celebrated 25 years dedicated to educating, empowering, and enriching self-directed investors. What began as a mission to level the playing field for the individual investor has grown into a community of more than 2 million subscribers who trust us to help them navigate the complexities of the financial markets. Our #1 priority remains steadfast: providing unparalleled value to our members, ensuring they have the institutional-grade insights and tools necessary to take control of their financial futures."

Eifrig concluded, "Our success is a direct reflection of the talent and heart of our organization. I am grateful to the more than 400 employees whose dedication and tireless service to our customers drives our company forward every day. The strong foundation we have built over the past year has not only stabilized our trajectory but has positioned us well for 2026. We enter this next chapter with momentum, a lean and efficient structure, and a renewed commitment to providing high-quality financial research and software tools to our customers."

Selected Operational and Financial Supplemental Information

We are providing the additional information below to provide further context on results and trends.

Subscriber Composition Trends

As of December 31, 2025, the Company has 2.4 million active free and paid subscribers. Part of the Company’s acquisition strategy is to convert active free subscribers to paid subscribers. As of December 31, 2025, the Company had 374 thousand paid subscribers, which is relatively flat compared to September 30, 2025.

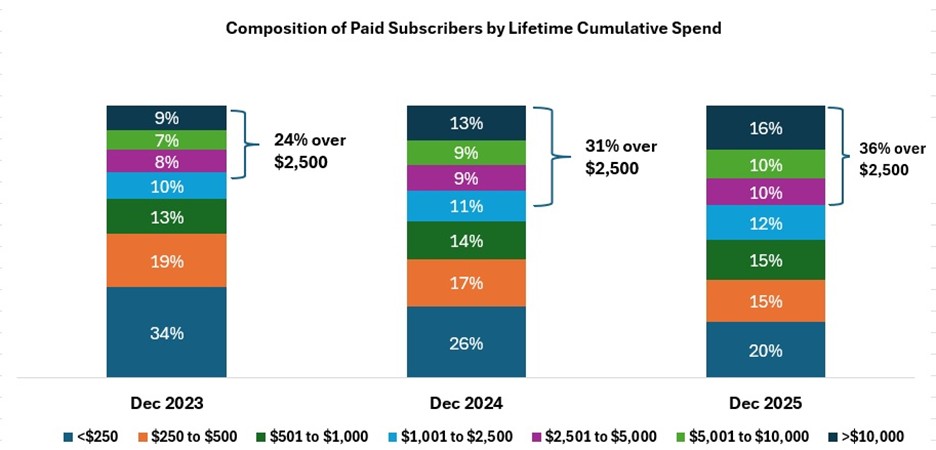

As previously disclosed, the Company’s strategy has pivoted since mid-2024 to focus on higher priced products. Thus, while the paid subscriber count has declined over the last 2-years in absolute terms, the quality and lifetime value of the subscribers have increased.

As illustrated in the chart below, the customer mix has steadily improved with

This positive mix shift and improvement in customer quality has contributed to the sales growth and margin expansion experienced over the last several quarters.

Billings

After several quarters of Net Sales, or Billings declines, the Company experienced an inflection point in 4Q 2024 with a return to sequential Billings growth. Other than the favorable spike in Billings in 1Q 2025, Billings have continued a steady increase with 4Q 2025 Billings representing more than a

For FY 2025, Billings were approximately

Cash from Operating Activities

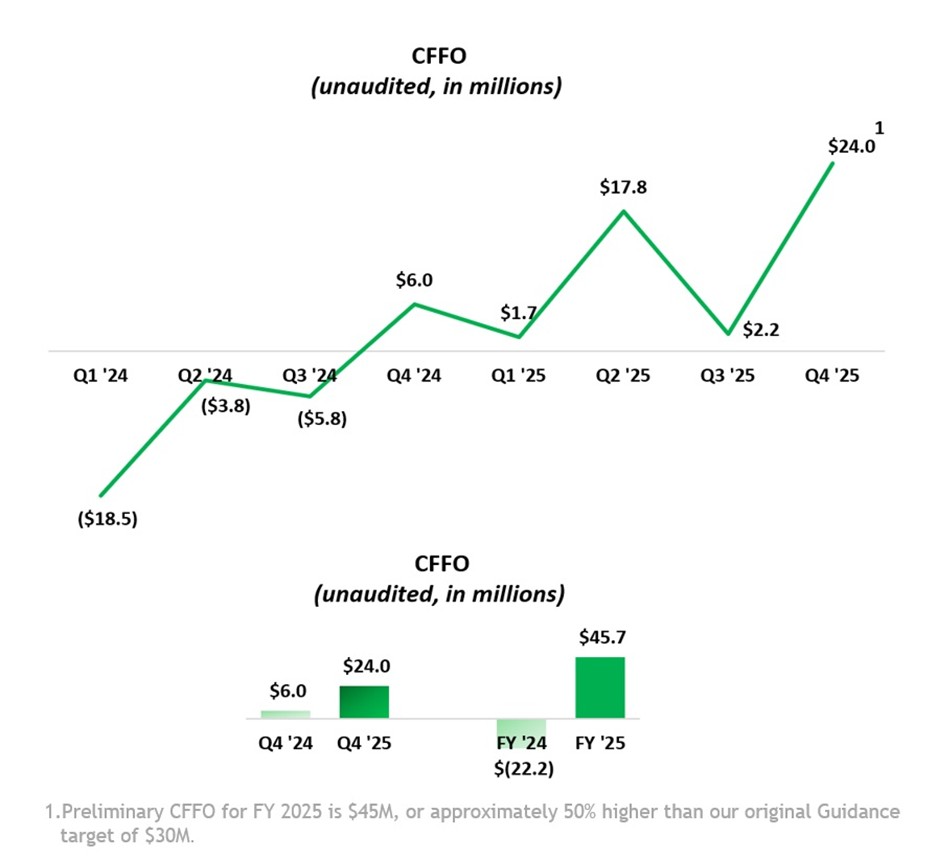

Cash from Operating Activities (“CFFO”) was approximately

Based on the nature of our business, and as illustrated in the chart below, CFFO will fluctuate from quarter to quarter. Specifically, Q2 and Q4 tend to have higher CFFO while Q1 and Q3 tend to have lower CFFO. The amount of CFFO in any given quarter can be impacted by the timing of product launches, marketing campaigns, and discrete working capital items.

Given this variability, we believe it is useful to evaluate CFFO trends over multiple quarters, or a full year.

Balance Sheet and Capital Structure

As of December 31, 2025, the Company holds cash and cash equivalents of

Partnership tax distributions to MarketWise, LLC’s partners, which arise from our corporate structure, totaled

Tax distribution payments were significant in FY 2025 due to the timing of taxable income which arose from the higher Net Sales in prior years.

For FY 2026, we expect these tax distributions to decline significantly, at approximately

MarketWise Inc.’s Class A common stock trades on the Nasdaq Global Market under the symbol "MKTW." As of December 31, 2025, the Company had 2,434,407 Class A common shares and 13,612,641 Class B common shares issued and outstanding, totaling 16,047,048 Class A and Class B common shares. When determining the market capitalization or equity value of the Company, we believe it is appropriate to include the total of the Class A and Class B common shares. Net Income attributable to noncontrolling interests on the Income Statement is primarily associated with these B shares and is a result of our corporate structure.

As previously announced, the Board of Directors authorized a stock repurchase program of our Class A common stock. Since April, the Company has repurchased 209,726 shares for

On October 29, 2025, the Company announced that it had received a proposal from Monument & Cathedral Holdings, LLC (collectively with its affiliates, “M&C”) to acquire all of the outstanding equity interests of the Company and MarketWise, LLC that are not owned by M&C, for cash consideration of

As previously announced, on October 30, 2025, the Board of Directors declared a quarterly cash dividend to holders of Class A common stock of

Note that the special dividends referenced above arise from the previously mentioned tax distribution payments to noncontrolling interests, and represent the proportionate payment to Marketwise, Inc. and Class A shareholders.

Upcoming Events

The Company plans to report full and audited results for the fourth quarter and year ended December 31, 2025 no later than March 31, 2026.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the financial position, business strategy, and the plans and objectives of management for future operations of MarketWise. These forward-looking statements generally are identified by the words “estimate,” “believe,” “project,” “expect,” “anticipate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: our ability to attract new subscribers and to persuade existing subscribers to renew their subscription agreements with us and to purchase additional products and services from us; our ability to adequately market our products and services, and to develop additional products and product offerings; our ability to manage our growth effectively, including through acquisitions; failure to maintain and protect our reputation for trustworthiness and independence; our ability to attract, develop, and retain capable management, editors, and other key personnel; our ability to grow market share in our existing markets or any new markets we may enter; adverse or weakened conditions in the financial sector, global financial markets, and global economy; current macroeconomic events, including heightened inflation, rise in interest rates and the potential for an economic recession; failure to comply with laws and regulations or other regulatory action or investigations, including the Advisers Act; our ability to respond to and adapt to changes in technology and consumer behavior; failure to successfully identify and integrate acquisitions, or dispose of assets and businesses; our public securities’ potential liquidity and trading; the impact of the regulatory environment and complexities with compliance related to such environment; our future capital needs; our ability to maintain an effective system of internal control over financial reporting, and to address and remediate existing material weaknesses in our internal control over financial reporting; and other factors beyond our control.

The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of our filings with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. We do not give any assurance that we will achieve our expectations.

MarketWise Investor Relations Contact Information

Email: ir@marketwise.com

MarketWise Media Contact

Email: media@marketwise.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c650d4cc-5e9c-4022-a998-11cee6ee13ec

https://www.globenewswire.com/NewsRoom/AttachmentNg/f495bafc-8713-4644-8991-2a31ca9546cb

https://www.globenewswire.com/NewsRoom/AttachmentNg/e0f1234d-287e-455d-a3a9-54f3d53a40f4