Minaurum Launches 25,000 Meter Phase 2 Resource Expansion Drill Program at Alamos Silver Project

Rhea-AI Summary

Minaurum (OTCQX: MMRGF) completed a 10,000 m Phase I infill drill program at the Alamos silver project and has launched a ~25,000 m Phase II resource expansion program (Nov 27, 2025). Phase II will step out on Europa, Travesia, Promontorio Sur, Quintera, Minas Nuevas, Pulpito, Cotera and San Jose vein zones toward a major resource update in 2026. The project area contains 26 vein zones across an 11 km x 6 km area; 13 of 19 drilled zones returned high-grade intercepts. Minaurum has 263 permitted drill pads and disclosed marketing agreements totaling $220,000 over 12 months.

Positive

- Phase II drilling planned at ~25,000 m

- 263 drill pads already permitted across the project

- 26 vein zones identified within an 11 km x 6 km area

- 13 of 19 drilled vein zones returned high-grade intercepts

Negative

- Initial resource estimate pending; assays still outstanding from Phase I

- Only 3 of 13 recent discoveries will be included in the inaugural resource

- Assay results have not been re‑analyzed, per company verification statement

Key Figures

Market Reality Check

Peers on Argus

While MMRGF gained 3.26%, several gold peers also traded higher (e.g., NXGCF +12.43%, NCAUF +3.77%, MFGCF +2.98%), with one minor decliner (STLRF -0.25%). The move appears more company-specific than a broad sector momentum event.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 05 | Drill program expansion | Positive | +3.7% | Phase II expansion to 50,000 m and stock option grant at $0.36. |

| Oct 29 | Drill results update | Positive | +3.2% | Additional high-grade silver intercepts from 35 holes at Alamos. |

| Oct 16 | Initial drill results | Positive | -8.2% | Strong initial high-grade silver results feeding maiden resource estimate. |

| Sep 03 | Asset and marketing update | Neutral | -3.8% | Adelita interest restructured into royalty plus shares and marketing renewals. |

| Aug 25 | Drill acceleration | Positive | -2.5% | Mobilization of four drill rigs for 10,000 m infill at Alamos. |

Exploration and drilling updates have produced mixed reactions: some positive drill releases aligned with gains, while other strong technical updates coincided with short-term pullbacks.

Over the last six months, Minaurum has consistently advanced the Alamos project. On Aug 25, it accelerated drilling with additional rigs for the 10,000 m infill program. High-grade assay results on Oct 16 and Oct 29 supported the forthcoming maiden resource estimate. On Dec 5, the company doubled its Phase II program to 50,000 m, reinforcing its growth focus. Today’s announcement of the completed Phase I program and 25,000 m Phase II launch fits this steady resource‑building trajectory and continued marketing efforts.

Market Pulse Summary

This announcement details completion of the 10,000 m Phase I infill program and launch of a 25,000 m Phase II resource‑expansion campaign at Alamos, supported by 263 permitted drill pads and multiple high‑grade vein zones. It follows earlier 2025 drill updates and the later expansion to 50,000 m. Investors may focus on forthcoming assay results, the maiden resource estimate, and the effectiveness of renewed marketing agreements in broadening market awareness of these technical milestones.

Key Terms

silver-equivalent technical

hanging wall technical

national instrument 43-101 regulatory

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - November 27, 2025) - Minaurum Gold Inc. (TSXV: MGG) (OTCQX: MMRGF) ("Minaurum") is pleased to announce the successful completion of its Phase I -10,000-meter (m) infill maiden resource drill program and the commencement of a Phase II - approximately 25,000 m resource expansion drill program at the Alamos Silver Project in Sonora, Mexico.

"With Phase I of our resource-definition drilling now complete, we're excited to move toward a key milestone — the delivery of our inaugural resource estimate," stated Darrell Rader, President and CEO. "Once we receive assays from the Phase I program, we will complete the resource estimate. We're confident that the initial estimate will represent only a fraction of the project's full potential, as numerous high-priority discoveries remain outside the resource. The 25,000-metre Phase II drill program is specifically designed to test and expand both existing targets and additional zones toward a major resource update in 2026."

Minaurum has identified 26 vein zones in an 11 km x 6 km region covering only one fifth of the Alamos project. Thirteen of the nineteen vein zones drilled returned high-grade silver intercepts demonstrating the abundant mineralization that occurs throughout the vein zones. Only three of the thirteen discoveries will be included in the initial resource estimate.

Phase I Drilling targeted three high-grade vein zones — Promontorio, Europa, and Travesia — which will form the basis of the inaugural resource. Initial results have been released and continue to demonstrate continuity of high-grade silver mineralization (see Minaurum news release dated October 16, 2025). Once received, the remaining assays will be incorporated into the resource model in advance of the announcement of the resource estimate.

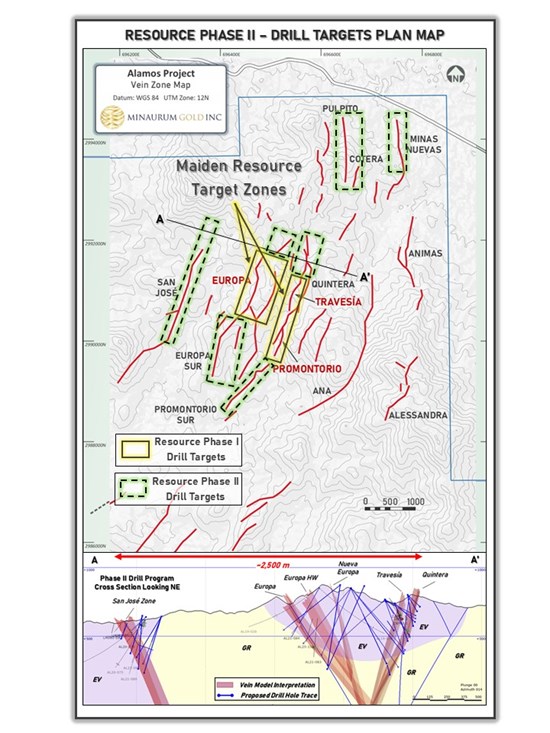

Phase II Drilling will build on the results of phase I with a planned 25,000 meters of drilling. The program will include step-out holes at the Europa and Travesia silver shoots, as well as additional drilling at the historic Quintera and Minas Nuevas mines and the more recent discoveries at Promontorio Sur, Cotera, Pulpito, and San Jose vein zones. Minaurum is well positioned to advance this next phase, with 263 drill pads already permitted across the project.

Figure 1. Phase II drilling will step out along strike and down-dip of the Phase I-defined resource and test additional vein zones. The map illustrates vein zones, drill collars, and permitted drill pads across the Alamos project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_003full.jpg

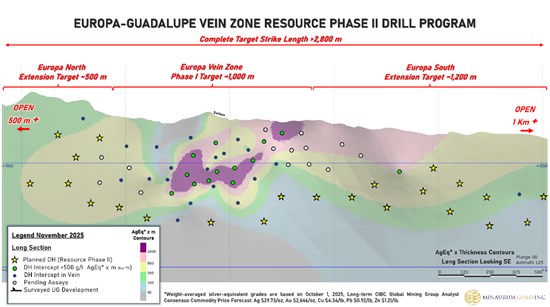

Europa Vein Zone

The cumulative strike length of the vein zone totals 2.8 km and is open more than 1 km along strike to the south and 0.5 km in the northern extension of the vein zone (Figure 2). Average vein thickness is 3.00 m with a grade of 454 g/t AgEq* (358 g/t Ag,

Figure 2. Europa vein zone longitudinal section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_004full.jpg

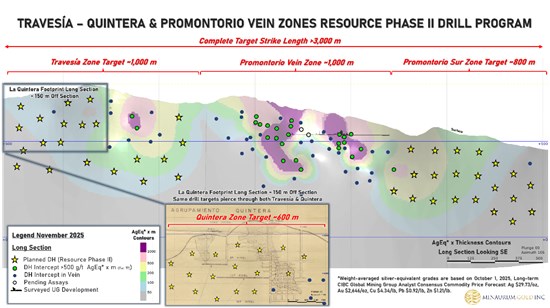

Travesia, Promontorio Sur, and Quintera Vein Zones

The cumulative strike length of the vein zones totals 3.2 km and is open more than 1 km along strike which includes more than 5 sub parallel veins (Figure 3). Average vein thickness is 5.40 m with a grade of 338 g/t AgEq* (170 g/t Ag,

Figure 3. Travesia, Quintera and Promontorio vein zone longitudinal section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_005full.jpg

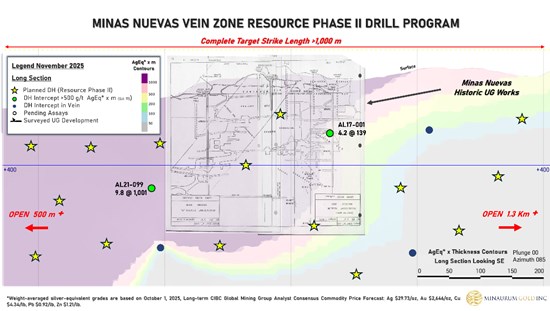

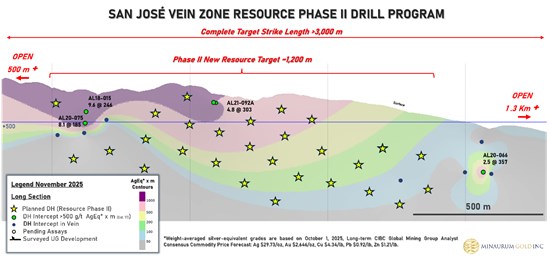

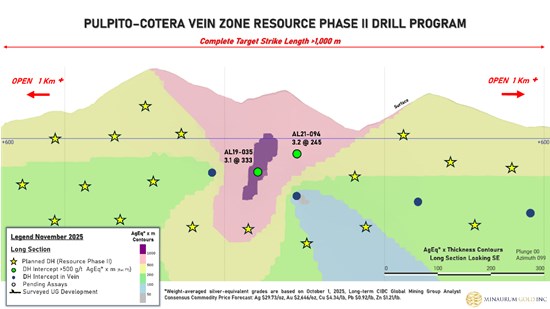

Minas Nuevas, San Jose, Pulpito, and Cotera Vein Zones

The cumulative strike length of the vein zones totals 5 km and all are open along strike and at depth (Figures 4-6). Drill targeting will focus on the 1.2 km strike length at Minas Nuevas at the Zambona and Purisima veins, targeting secondary veins that have reported grades through historical drilling. Testing at San Jose will focus on a 1.5 km long section where previous drilling intercepted a wide vein system with secondary veins and splays. Drilling will also test the stacked veins at the Pulpito/Cotera vein zone.

Figure 4. Minas Nuevas vein zone longitudinal section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_006full.jpg

Figure 5. San Jose vein zone longitudinal section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_007full.jpg

Figure 6. Pulpito and Cotera vein zone longitudinal section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/276164_f3df8cbe4434ba36_008full.jpg

*Weight-averaged silver-equivalent grades are based on October 1, 2025 Long-term CIBC Global Mining Group Analyst Consensus Commodity Price Forecast: Ag

Marketing Agreements

The Company is pleased to announce it has entered into agreements with Capital Analytica ("Capital") and National Inflation Association ("NIA") to extend its marketing and communications services agreements.

The Company has entered into a marketing services agreement with Capital dated November 10, 2025, for a twelve-month term and subject to renewal. The Company agreed to pay Capital

Jeff French is the principal of Capital and will be responsible for all activities related to the Company. Capital and its principal are arm's length to the Company and, as of the date hereof, to the Company's knowledge, Capital does not own any securities of the Company. Capital is based in British Columbia, Canada and can be reached via email: jeff@capitalanalytica.com and phone: 778 872 4551.

The Company has entered into a marketing services agreement with NIA dated November 10, 2025, for a twelve-month term and subject to renewal. The Company agreed to pay NIA US

Gerard Adams is the principal of NIA and will be responsible for all activities related to the Company. NIA and its principal are arm's length to the Company and, as of the date hereof, to the Company's knowledge, NIA does not own any securities of the Company. NIA is based in North Carolina, USA and can be reached via email: ga@gerardadams.com and phone: 973 277 7674.

Follow us and stay updated:

YouTube: @MinaurumGold

X: @minaurumgold

LinkedIn: Minaurum

Subscribe to our email list at www.minaurum.com

Minaurum Gold Inc. (TSXV: MGG) (OTCQX: MMRGF) (FSE: 78M) is an Americas-focused explorer concentrating on the high-grade

ON BEHALF OF THE BOARD

"Darrell A. Rader"

Darrell A. Rader

President and CEO

For more information, please contact:

Sunny Pannu - Investor Relations and Corporate Development Manager

(778) 330 0994 or via email at pannu@minaurum.com

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this news release.

___________________________________________________________________________

| 1570- 200 Burrard Street | Telephone: 1 778 330-0994 |

| Vancouver, BC V6C 3L6 | www.minaurum.com info@minaurum.com |

Data review and verification: Stephen R. Maynard, Vice President of Exploration of Minaurum and a Qualified Person (QP) as defined by National Instrument 43-101, reviewed and verified the assay data, and has approved the disclosure in this News Release. Verification was done by visual inspection of core samples and comparison to assay results. Assay results have not been checked by re-analysis. No factors were identified that could materially affect the accuracy or reliability of the data presented in this news release.

Cautionary Note Regarding Forward-Looking Information: This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future, including but not limited to: the Company's expectations regarding the completion of an inaugural resources estimate at the Alamos Project and the anticipated timing thereof; the Company's belief that that the initial resource estimate will represent only a fraction of the full potential of the Alamos Project, the Company's expectations around drill targets for the Phase II program as well as the anticipated completion of an updated mineral resource estimate. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

In making the forward-looking information in this release, Minaurum has applied certain factors and assumptions that are based on Minaurum's current beliefs as well as assumptions made by and information currently available to Minaurum, including, but not limited to: that the initial resource estimate will be completed and that it will be completed on the timeline contemplated; that increased drilling will yield a larger resource estimate; and that the Company can complete the anticipated Phase II drill program and updated mineral resource estimate. Although Minaurum considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release is subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information, including, but not limited to: the risk that the Company is unable to complete the inaugural mineral resource estimate on the timelines anticipated; the risk that the Company is unable to complete the Phase II drill program; the risk that further drill results on the Alamos Project will not yield a larger mineral resource estimate; the risk that the Company is unable to complete an upgraded mineral resource estimate.

Readers are cautioned not to place undue reliance on forward-looking information. Minaurum does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276164