Critical One Acquires KCR Project – Historic Drill Hole Intersected Visible Gold Assaying 64.1 g/t Gold Within 20.4 Metre Interval Grading 3.54 g/t Gold

Rhea-AI Summary

Critical One Energy (OTCQB: MMTLF) has acquired the KCR Gold Project adjacent to its Howells Lake Antimony-Gold Project in Ontario's Thunder Bay Mining Division. The key highlight is the Slam Gold Zone discovery, where a historic drill hole intersected visible gold with assays up to 64.1 g/t gold over one metre within a broader interval of 3.54 g/t gold over 20.4 metres.

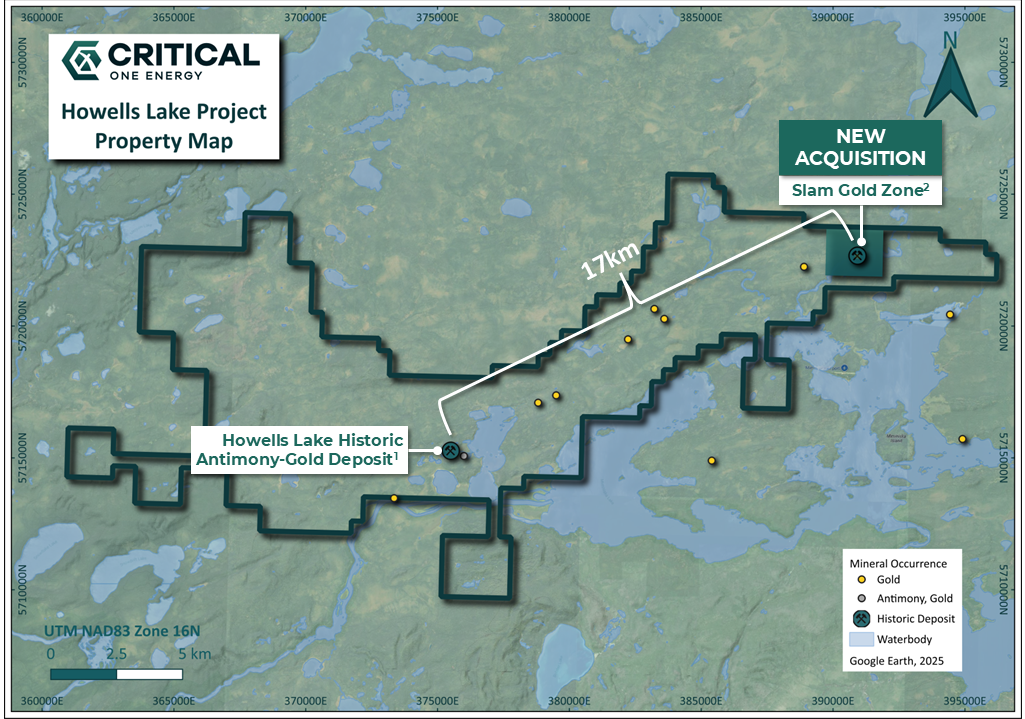

The acquisition, costing CDN$6,000 and 50,000 common shares, includes a 2% NSR. The company now controls over 30 km of geological trend and 25,000 hectares of land. The project area includes a historical resource of 1.7 million tons at 1.4% antimony with associated gold mineralization (non-43-101 compliant). Critical One is fully funded with CDN$3.3 million from a recent private placement for near-term exploration.

Positive

- Discovery hole intersected significant high-grade gold: 64.1 g/t over 1m within 20.4m of 3.54 g/t gold

- Strategic acquisition expands control to over 30km of geological trend and 25,000 hectares

- Company is well-funded with CDN$3.3M from recent private placement

- Historic trenching showed high-grade results: 16.42 g/t Au over 3.35m and 12.82 g/t Au over 4.11m

- Low acquisition cost of only CDN$6,000 and 50,000 shares for a promising gold property

Negative

- Historical resource is not NI 43-101 compliant and requires complete re-evaluation

- Discovery zone remains completely untested above, below, and along strike

- Some core intervals were not assayed in the historical drilling

- No outcrop is exposed in the discovery area, making surface exploration challenging

News Market Reaction

On the day this news was published, MMTLF gained 19.48%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TORONTO, Sept. 04, 2025 (GLOBE NEWSWIRE) -- Critical One Energy Inc. (formerly Madison Metals Inc.) (“Critical One” or the “Company”) (CSE: CRTL) (OTCQB: MMTLF) (FSE: 4EF0) is pleased to announce the acquisition of the KCR Gold Project (“KCR Project”) including the Slam Gold Zone discovery (Figure 1) contiguous to the Company’s extensive land holdings at the Howells Lake Antimony-Gold Project (“Howells Lake Project”), located approximately 200 kilometres (km) from the Ring of Fire corridor in the Thunder Bay Mining Division of Ontario, Canada1.

Table 1: Slam Gold Zone Highlights

| Highlight | Details |

| Compelling discovery | Visible gold (“VG”) mineralization discovered in a single historic drill hole – remains untested in all directions. |

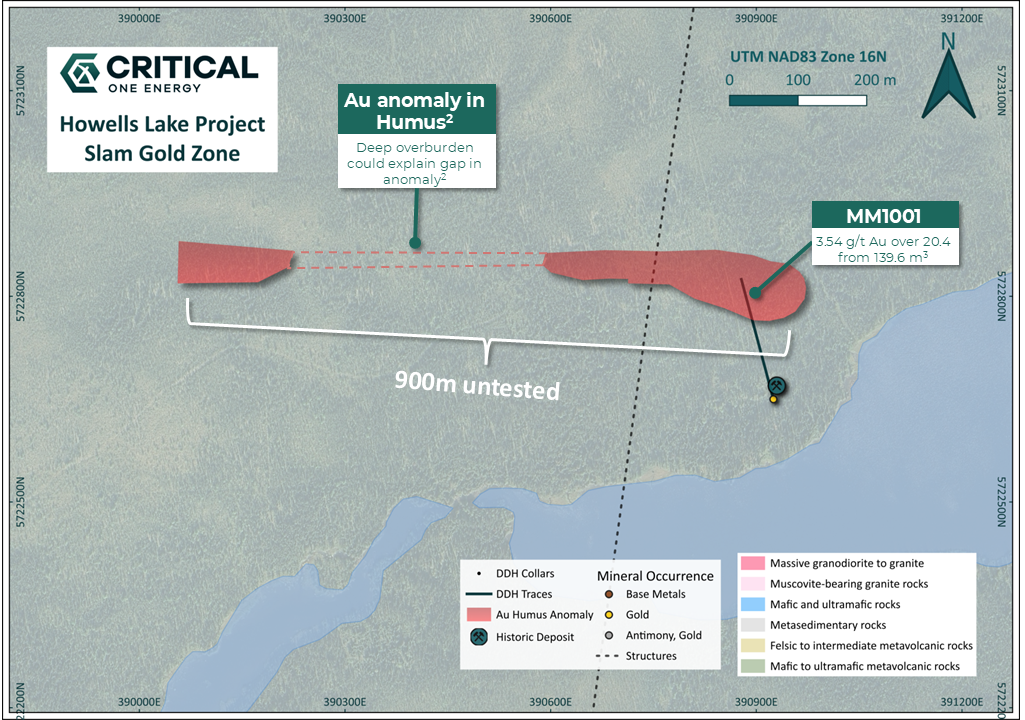

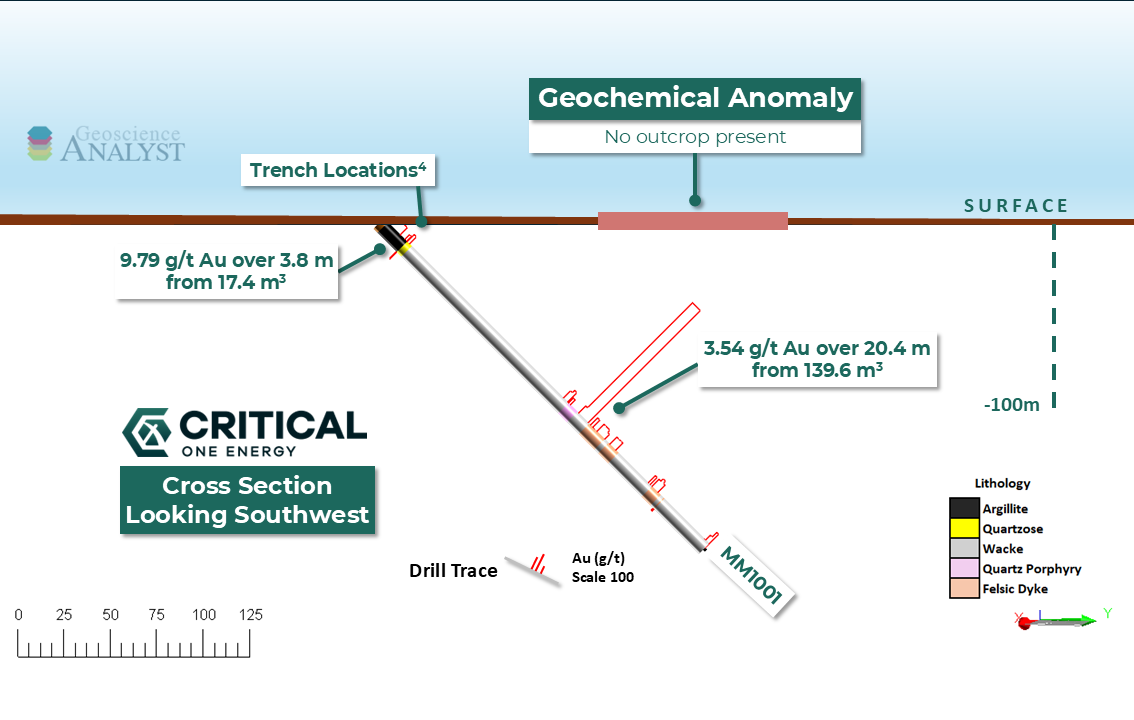

| Historic soil anomaly | Drill testing of a soil anomaly first identified in 1984, but only tested in 2010, resulted in alteration and VG with assays up to 64.1 g/t over one (1) metre (m) in the only hole drilled to date on the new Slam Gold discovery (Figures 2 and 3)³. |

| Discovery hole results | Slam Gold Zone discovery averaged 3.54 g/t Au over 20.4 m (Figure 3)³, 100 m below a gold geochemical target that showed more than 1 km of anomalous results². (Not all core assayed; unassayed intervals given zero grade for calculations. See note below.) |

| Follow-up work | Assays were received after drill demobilization, and no further work was completed. |

| Untested potential | Slam Gold Zone remains completely untested above, below, and along strike. No outcrop is exposed. |

| Geochemistry footprint (1984) | Anomalous results linked to Slam Gold Zone may have a surface expression >900 m² (Figure 2). |

| Historic gold identification | Gold was first identified on the KCR Property in the 1930s³. |

| Historic trenching results | • 1974 (New Jersey Zinc): 16.42 g/t Au over 3.35 m⁴. • 1980 (New Jersey Zinc): 12.82 g/t Au over 4.11 m⁴ (Figure 3). |

| Drill testing under trenches | Discovery hole (MM1001) intersected 9.79 g/t Au over 3.8 m from 17.4 m³ in upper Slam Gold Zone (Figure 3). |

| Strategic land position | Critical One now controls >30 km of the geological trend, covering all known strongly altered and underexplored antimony-gold targets. |

Figure 1: Howells Lake Project showing new KCR Property acquisition.

Critical One acquired

The gold mineralization on the KCR Property is related to strong carbonate, biotite alteration, minor quartz veining, moderate shearing, and various felsic intrusive rocks, as well as sericite alteration, fine pyrite and minor pyrrhotite. The KCR Property and the other extensive land positions now held

Prior to this acquisition, Critical One had already acquired all the prospective land adjacent to the KCR Property and was in the process of carrying out a new, state-of-the-art airborne geophysical survey of the Company’s property position. On the basis of the pending acquisition, Critical One ensured it collected detailed data in the area covering and proximal to the Slam Gold discovery.

“The acquisition of this key property covering a completely unevaluated VG-bearing discovery, which includes numerous gold values occurring over a drilled width of 20.4 metres, shows the camp-scale potential of our Howells Lake Project,” said Duane Parnham, Founder, Executive Chairman and CEO of Critical One. “With our land acquisition complete and the evaluation and interpretation of our new geophysical database being finalized, we will soon be in a position to determine where we can discover a lot more gold and antimony on our property, which now covers all significant antimony and gold targets over a 30-kilometre strike length.”

Parnham continued, “The presence of VG in the only hole to ever test this geochemical target speaks volumes about its potential to host a lot more gold mineralization. Not only was there VG with a very high gold assay, but there were several other significant gold values not far from the VG. There was even anomalous gold mineralization at the bottom of the drill hole. By securing

This strategic acquisition follows the Company’s ongoing review and analysis of historic work on and proximal to its extensive land holdings in the Howells-Miminiska area.

Critical One is awaiting results of the evaluation and review of its recently completed VTEM airborne geophysics completed by Geotech Ltd. over the Howells Lake Project. The geophysical data is currently being processed to provide details on specific target selection, definition and interpretation. Additional news will be released as this work progresses.

The Howells Lake Project hosts a historical resource of 1.7 million tons at a grade of

*Note: All geological and assay information contained in this document is historical in nature and the Qualified Person (“QP”) responsible for the technical disclosure in this release is unable to determine if any of that data would meet current NI 43-101 regulations regarding disclosure of scientific and technical information. Additionally, the QP has not done sufficient work to make the resource current. Drill intersections are reported as downhole intervals. No true width could be determined at this time. The information in the data recovered is considered of value and relevant to the Company’s project. However, the Issuer is not treating the estimate as current. The overall 20.4 metre interval grading 3.54 g/t was derived from the original assay certificates that were available in the public domain and included sections that were not assayed and were therefore averaged at 0 g/t in the weighted average for the interval.

Critical One is advancing its exploration program plans for follow-up drilling to further delineate and expand the antimony-gold resource. Supported by a recent private placement of CDN

Figure 2: KCR Property plan with results.

Figure 3: Cross section highlighting Slam Gold Zone discovery.

References:

1 Themistocleous, S.G., 1980. Miminiska Lake Project, Northwestern Ontario, Geological Report, New Jersey Zinc Exploration Company (Canada) Ltd.

2 Publicover, Sara GIT and Taylor, Michael, P.Geo 2010, Assessment Report on the 2010 Damon Drill Program Miminiska Property KCR Zone in the Fort Hope Area, NW Ontario Thunder Bay District.

3 Clark, D. P.Geo Assessment Report on the 2008 Diamond Drill Program Miminiska Property Baroque Zone & YMIR zone Fort Hope Area, NW Ontario Thunder Bay Area NW Ontario.

4 Clark, D. P.Geo 2005 Assessment Report Performed Reconnaissance Geological Mapping Miminiska-Keezhik Lakes Area Fort Hope, Ontario.

KCR Property Acquisition Terms

The Company acquired

Qualified Person

Bruce Durham, P.Geo, a Qualified Person (“QP”) under NI 43-101, who is independent of the Company, has reviewed and approved the technical content of this news release. All technical information in this release is based on historical data that cannot be verified by the QP.

About Critical One Energy Inc.

Critical One Energy Inc. (formerly Madison Metals Inc.) is a forward-focused critical minerals and upstream energy company, powering the future of clean energy and advanced technologies. The addition of the Howells Lake Antimony-Gold Project broadens the Company’s exposure to antimony, one of the most in-demand critical minerals. Backed by seasoned management expertise and prime resource assets, Critical One is strategically positioned to meet the rising global demand for critical minerals and metals. Its mine exploration portfolio is led by antimony-gold exploration potential in Canada and uranium investment interests in Namibia, Africa. By leveraging its technical, managerial, and financial expertise, the Company upgrades and creates high-value projects, thereby driving growth and delivering value to its shareholders.

Additional information about Critical One Energy Inc. can be found at criticaloneenergy.com and on the Company’s SEDAR+ profile at www.sedarplus.ca.

For further information, please contact:

Duane Parnham

Executive Chairman & CEO

Critical One Energy Inc.

+1 (416) 489-0092

ir@criticaloneenergy.com

Media inquiries:

Adam Bello

Manager, Media & Analyst Relations

Primoris Group Inc.

+1 (416) 489-0092

media@primorisgroup.com

Neither the Canadian Securities Exchange nor CIRO accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains “forward-looking information” within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking information. In some cases, forward-looking information can be identified by words or phrases such as “may”, “will”, “expect”, “likely”, “should”, “would”, “plan”, “anticipate”, “intend”, “potential”, “proposed”, “estimate”, “believe” or the negative of these terms, or other similar words, expressions, and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy. Forward-looking information contained in this press release includes, but is not limited to, statements relating to the Company’s business strategy and objectives.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. Such assumptions include, without limitation, that: the Company will have the resources required in order to conduct its business as currently operated.

However, forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected, or implied by such forward-looking statements. Such risks include, but are not limited to, risks relating to the mining industry in general, and other risks as described in the Company’s continuous disclosure record on SEDAR+.

Accordingly, undue reliance should not be placed on forward-looking statements and the forward-looking statements contained in this press release are expressly qualified in their entirety by this cautionary statement. The forward-looking statements contained herein are made as at the date hereof and are based on the beliefs, estimates, expectations, and opinions of management on such date. The Company does not undertake any obligation to update publicly or revise any such forward-looking statements or any forward-looking statements contained in any other documents whether as a result of new information, future events or otherwise or to explain any material difference between subsequent actual events and such forward-looking information, except as required under applicable securities law. Readers are cautioned to consider these and other factors, uncertainties, and potential events carefully and not to put undue reliance on forward-looking information.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/27b92960-5dd3-4e01-b2d3-707f15d2f533

https://www.globenewswire.com/NewsRoom/AttachmentNg/1184d229-9761-476b-8967-b64a9830fc37

https://www.globenewswire.com/NewsRoom/AttachmentNg/de699b82-5fb1-48f6-a9f2-163df5276b81