Movella Holdings Inc. Announces Completion of Corporate Restructuring

Rhea-AI Summary

Movella Holdings Inc. (MVLA) has completed a major corporate restructuring in response to defaults under its Note Purchase Agreement. The company transferred 100% equity of its subsidiary Movella Inc. to Movella Holdings NewCo, LP (New Parent), affiliated with FP Credit Partners. Key restructuring elements include:

- Release from Note Purchase Agreement guaranty obligations - Exchange of outstanding obligations for a new $50M replacement note - Implementation of a 7-year Earnout Agreement allowing potential payments if New Parent is sold - Company name change to MVLA Holdings - Delisting from Nasdaq and termination of SEC reporting obligations

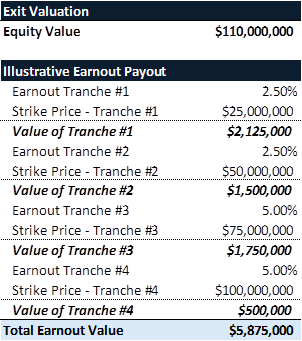

The company's sole remaining asset is the Earnout Agreement, which could provide payments based on New Parent's sale value thresholds ranging from $25M to $100M+, with earnout percentages of 2.5-5% of net proceeds.

Positive

- Restructuring eliminates company's guaranty obligations under the Note Purchase Agreement

- Potential future value through 7-year Earnout Agreement if New Parent is sold

- No residual liabilities passed to equity holders post-restructuring

Negative

- Company lost its main operating subsidiary Movella Inc.

- Stock delisted from Nasdaq and no longer publicly traded

- Company holds no material assets except the Earnout Agreement

- No guaranteed payout under the Earnout Agreement

- Board resigned and replaced with single director

News Market Reaction – MVLA

On the day this news was published, MVLA gained 69.23%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

LOS ANGELES, CA / ACCESS Newswire / May 6, 2025 / Movella Holdings Inc. (the "Company") today announced the completion of a restructuring transaction involving its wholly-owned subsidiary, Movella Inc. ("Movella"), and its existing secured lenders.

In connection with the transaction, Movella, the Company, certain of its subsidiaries, FP Credit Partners II AIV, L.P. and FP Credit Partners Phoenix II AIV, L.P. (the "FP Noteholders"), and FP Credit Partners II, L.P. and FP Credit Partners Phoenix II, L.P. (the "FP Shareholders") entered into a Restructuring Agreement (the "Restructuring Agreement") in response to continuing events of default under the Note Purchase Agreement, dated as of November 14, 2022 (the "Note Purchase Agreement"), pursuant to which Movella had previously issued secured promissory notes to the FP Noteholders with the Company as a guarantor of the secured promissory notes.

Pursuant to the Restructuring Agreement and related transactions (the "Restructuring Transactions"), the Company was released from its guaranty of obligations under the Note Purchase Agreement and the FP Noteholders exchanged the outstanding Note Purchase Agreement obligations for the issuance and transfer of

The Restructuring Transactions were completed in accordance with Section 272(b)(2) of the Delaware General Corporation Law.

In connection with the restructuring, the Company registered the trade name MVLA Holdings, Inc. and will do business under this name after the completion of the Restructuring Transactions. The Restructuring Transactions did not affect ownership interests in the Company: all equity holders of the Company immediately prior to the completion of the Restructuring Transactions remain equity holders of MVLA Holdings, Inc. immediately after the completion of the Restructuring Transactions. As a result of the Restructuring Transactions, the Company's sole material asset is the Earnout Agreement, which provides for potential future earnout payments to be received by the Company from New Parent in the event of the sale of New Parent by the FP Shareholders, subject to the achievement of certain thresholds related to any sale of New Parent during the Earnout Period. The Earnout Agreement covers a 7-year period from the date of the completion of the Restructuring Transactions (the "Earnout Period") and, should any earnout payments be received by the Company thereunder, it is intended that those earnout payments, net of related costs, would be distributed to equity holders of the Company. As part of the Restructuring Transactions, the members of the board of directors of the Company resigned and a new sole director of the Company was appointed.

As previously disclosed, on January 30, 2025, the Company filed a Form 15 with the Securities and Exchange Commission ("SEC") to suspend its reporting obligations under the Securities Exchange Act of 1934, as amended. The filing became effective on April 30, 2025 and the Company is no longer a public company. In addition, as previously disclosed, the Company delisted its common stock and warrants from the Nasdaq Global Market, effective April 9, 2024.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believe," "continue," "could," "intend," "may," "would," variations of such words, and similar expressions or the negative thereof, are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to statements regarding the potential earnout payments to which the Company may be entitled. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks related to the conditions for the earnout payments under the Earnout Agreement, the fact that New Parent may or may not be sold during the Earnout Period and the ability for certain thresholds set forth in the Earnout Agreement related to any sale of New Parent during the Earnout Period to be achieved upon which the earnout payments, if any, would be based. These forward-looking statements speak only as of the date on which they are made. Except as required by law, the Company undertakes no obligation to update or revise any forward-looking statements.

Contact:

Lawrence R. Perkins,

Chief Executive Officer of SierraConstellation Partners, LLC

MVLA@scpllc.com | (213) 289-9060

MOVELLA HOLDINGS INC. RESTRUCTURING

FAQ

What Happens to the Assets of Movella Holdings Inc. After the Restructuring?

The assets of Movella Holdings Inc. (the "Company") which consisted of the direct or indirect ownership of Movella Inc. ("Movella") and all of the Company's subsidiaries were transferred through a series of intermediate transaction steps to Movella Holdings NewCo, LP, a Delaware limited partnership ("New Parent") in partial payment of Movella's debt obligations owed to FP Credit Partners II AIV, L.P. and FP Credit Partners Phoenix II AIV, L.P. (together, "FP"). New Parent is a newly formed limited partnership that is affiliated with FP. After the transfer of the Movella shares, the Company will have no assets except for a potential future earnout payment under the Earnout Agreement and a minimal amount of cash to support the entity through the Earnout period

In connection with the restructuring, the Company entered into an Earnout Agreement with New Parent, pursuant to which the Company may be entitled to certain future earnout payments conditioned on the sale of New Parent and calculated based on the achievement of certain sale values of New Parent (the "Earnout"). The Earnout period is up to 7 years from the close of the restructuring.

Are there any Residual Liabilities of the Company that are the Obligation of the Equityholders?

There should be no residual liabilities of the Company that are the obligation of the Equityholders of the Company. The Equityholders will not assume or be responsible or liable for any liabilities or obligations of the Company. The Company received a full release in connection with the Restructuring, subject to limited exceptions (e.g., commission of intentional fraud by the Company in connection with the Restructuring).

What are the Equityholders Entitled to After the Restructuring?

The potential payout under the Earnout could lead to a distribution to Equityholders of the Company.

In the event of a sale of more than

For a Sale Event where New Parent's equity value is over

Below is an example calculation of the Company's Earnout proceeds in a Sale Event where New Parent's equity value is

In the event the Earnout amount is due and paid out by New Parent to the Company in accordance with the Earnout Agreement, the Company will distribute the Earnout amount (less expenses) to its Equityholders in accordance with their pro rata ownership in the Company promptly after such amounts are paid to the Company. The Equityholder must be an Equityholder of the Company at the time the earnout is paid in order to receive proceeds under the Earnout Agreement.

Note that the New Parent equity value thresholds are after the repayment of all debts and any other liabilities at New Parent and Movella. As part of the Restructuring, pursuant to an amendment to Movella's existing Note Purchase Agreement, Movella issued FP a takeback note in the amount of

What is the Expected Timing of a Payout under the Earnout?

First, there is no guaranteed payout under the Earnout. The Earnout Agreement lasts for 7 years from the closing of the Restructuring, so if there is a Sale Event for New Parent during the 7-year period that exceeds the applicable thresholds noted above, a payment to Equityholders will be made in accordance with the terms of the Earnout Agreement.

What are my Tax Obligations?

Each Equityholder of the Company is solely responsible for its own tax obligations, including in connection with any Earnout payment. This document does not constitute tax advice, and Equityholders are strongly encouraged to seek independent tax advice from a qualified professional regarding the tax consequences of their ownership, distributions, or any transactions related to their equity in the Company (including in connection with any Earnout payment).

Can I Take a Write Off for the Price I Paid for my Equity?

Each Equityholder should consult their own tax advisor with respect to this question.

Who are the Board Members of the Company?

The prior board of directors of the Company resigned as part of the Restructuring and a sole director has been appointed. The sole director of the Company is an experienced restructuring professional named Larry Perkins, CEO of SierraConstellation Partners LLC.

What is the Impact on the Operations of Movella?

Movella will continue to operate under the ownership of New Parent with no anticipated changes. The Company has no material ongoing relationship with Movella other than the Earnout, described above.

Does the Company have any Obligations to Release Financial Information to Equityholders After the Restructuring?

The Company is no longer a public reporting company and therefore is no longer required to file or release quarterly or annual financial information.

How will I be Notified if the Company Distributes Proceeds from the Earnout?

The Company will maintain its Equityholder records which will be used to distribute proceeds if and when received. If you change address or transfer your shares, you must notify Larry Perkins of SierraConstellation Partners LLC to update the Equityholder records.

Will the shares of the Company trade?

No, the shares and warrants are no longer publicly traded.

SOURCE: Movella Holdings Inc.

View the original press release on ACCESS Newswire