HIVE Announces Fiscal Q1 2026 Record Revenue of $45.6 Million and Adjusted EBITDA of $44.6 Million with an Average of 8.9 EH/s Representing 45% Quarter over Quarter Growth in Hashrate

Rhea-AI Summary

HIVE Digital Technologies (NASDAQ: HIVE) reported exceptional fiscal Q1 2026 results, with record revenue of $45.6 million and Adjusted EBITDA of $44.6 million. The company achieved a 45% quarter-over-quarter increase in average hashrate to 8.9 EH/s.

Key highlights include digital currency mining revenue of $40.8 million, up 44.9% sequentially, and 406 Bitcoin mined, a 34% increase from Q4 2025. BUZZ HPC revenue reached a record $4.8 million, growing 59.8% sequentially. The company reported GAAP net income of $35.0 million and gross operating margins of $15.8 million (34.7%).

HIVE is on track to reach 25.0 EH/s by Thanksgiving, having already achieved 15.0 EH/s by July's end, representing an annualized Bitcoin mining revenue run rate of approximately $315 million based on current conditions.

Positive

- Record revenue of $45.6M and Adjusted EBITDA of $44.6M

- 45% quarter-over-quarter increase in average hashrate to 8.9 EH/s

- Bitcoin production up 34% to 406 BTC

- BUZZ HPC revenue grew 59.8% to record $4.8M

- Strong net income of $35.0M with improved gross margins of 34.7%

- Robust financial position with $71.9M in cash and digital currencies

- On track for significant expansion to 25 EH/s by Thanksgiving

Negative

- Operating costs increased with G&A expenses rising to $5.8M from $5.3M

- Direct mining costs represent 90% of mining revenue at $26.8M

- Network difficulty increased 10.2% quarter over quarter

Insights

HIVE's Q1 shows remarkable 45% hashrate growth driving record financial performance across all key metrics.

HIVE has delivered an exceptional quarter with record-breaking financial performance across all key metrics. Revenue surged to

The company's operational efficiency remains impressive with a gross operating margin of

HIVE's GAAP net income reached

The company mined 406 Bitcoin during the quarter, a

Most significantly, HIVE has already grown to 15 EH/s as of July 2025, which at current Bitcoin prices translates to an annualized revenue run rate of approximately

This news release constitutes a "designated news release" for the purposes of the Company's amended and restated prospectus supplement dated May 14, 2025, to its short form base shelf prospectus dated September 11, 2024.

San Antonio, Texas--(Newsfile Corp. - August 15, 2025) - HIVE Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0) (referred to as the "Company" or "HIVE"), a global leader in sustainable data center infrastructure, announces its results for the first quarter ended June 30, 2025 (all amounts in US dollars, unless otherwise indicated). Driven by a

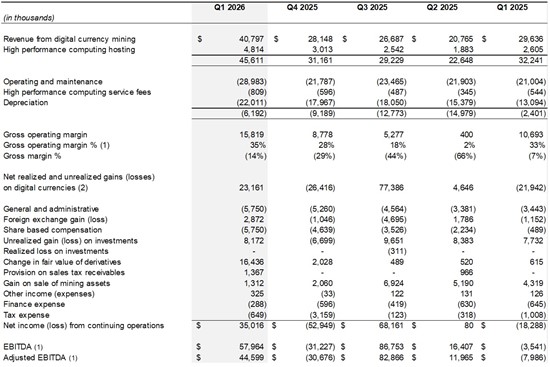

Q1 FY2026 Financial Highlights:

- Total Revenue:

$45.6 million , a sharp increase compared to its previous quarter, reflecting strong contributions from both of its digital currency mining and high-performance computing (HPC) hosting services. This revenue was achieved against direct costs of$29.8 million which, overall represents a gross operating margin of35% 3. See the calculation of direct costs and mining margin included below in this press release.

- Digital currency mining revenue:

$40.8 million , up44.9% sequentially from fiscal Q4 2025 mainly due to higher average digital currency mining hashrate (from 5.9 EH/s in fiscal Q4 2025 to 8.7 EH/s in fiscal Q1 2026), a47% increase in quarter over quarter hashrate, and slightly higher Bitcoin prices. This mining revenue was achieved against direct costs of$26.8 million of which90% represents electric power cost. See the Calculation of direct costs included below in this press release.

- Bitcoin Production: Mined 406 Bitcoin, up

34% sequentially from fiscal Q4 2025 due to increased self-mining hashrate, while average Difficulty increased10.2% quarter over quarter.

- HPC Revenue: Buzz HPC revenue was a record

$4.8 million during the quarter, up59.8% sequentially, driven by strong demand for high-performance computing markets. This revenue was achieved against direct costs of$2.1 million .

- G&A:

$5.8 million , up slightly from$5.3 million in Q4 FY2025 primarily as a result of increased staff to support HIVE's global expansion in digital currency mining, particularly in Paraguay, and the growth of its BUZZ HPC business.

- Gross Operating Margins:

$15.8 million in gross operating margin or34.7% , up from$8.8 million or28.2% in fiscal Q4 2025. See the Calculation of gross operating margins included below in this press release.

- Net Income: GAAP net income of

$35.0 million primarily from net realized and unrealized gains of$23.2 million on digital currencies2,$8.2 million non-cash unrealized gain related to its equity investments, and$16.4 million gain on change in fair value of derivative assets.

Webcast Presentation Now Available

A pre-recorded earnings webcast is now available, featuring insights from HIVE Digital's leadership team: Co-Founder and Executive Chairman Frank Holmes, President and CEO Aydin Kilic, Chief Financial Officer Darcy Daubaras, and Craig Tavares, President and COO of BUZZ.

The team walks through the quarterly results, discusses the broader macro environment, and explores how HIVE and BUZZ are strategically aligned for future growth.

Watch the full webcast on our YouTube channel by clicking here, and access the accompanying presentation on HIVE's Investor Relations site under the "Presentations" section.

Management Insights

Frank Holmes, HIVE's Executive Chairman, stated, "HIVE's performance this quarter demonstrates its commitment to supporting Bitcoin network security, decentralization, and geographic diversification in operations over 9 time zones and in 3 countries. With over 15 EH/s as of August 2025-producing approximately 7.5 Bitcoin per day-HIVE plays a pivotal role in reinforcing the network while generating consistent value for shareholders. Our fiscal Q1 2026 results are a testament to our transformative growth strategy and our team's dedicated execution on our key strategic priorities. We delivered record revenue in both our digital currency mining and BUZZ HPC businesses, which grew approximately

Aydin Kilic, President & CEO, stated, "This was a phenomenal quarter, we grew our production by

Darcy Daubaras, HIVE's CFO, stated, "We are very pleased with our performance to start fiscal year 2026, mining 406 Bitcoin during this period, up

Financial Statements and MD&A

The Company's Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three months ended June 30, 2025 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE's profile and on the Company's website at www.HIVEdigitaltechnologies.com.

1 Non-GAAP measure. Adjusted EBITDA (net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization) adjusted for by removing other non-cash items, including share-based compensation, non-cash effect of the revaluation of digital currencies and one-time transactions. Gross mining profit, gross mining margin, Adjusted EBITDA, Direct Cost per BTC and Total Cash Cost per BTC are non-GAAP financial measures or ratios and should be read in conjunction with, and should not be viewed as alternatives to or replacements of measures of operating results and liquidity presented in accordance with GAAP. Readers are referred to the reconciliations of non-IFRS measures included in the Company's MD&A in the Company's Quarterly Report for the Quarter ended June 30, 2025.

2 Net realized and unrealized gains (losses) on digital currencies is calculated as the change in fair value (gain or loss) on the coin inventory, and the gain (loss) on the sale of digital currencies which is the net difference between the proceeds and the carrying value of the digital currency.

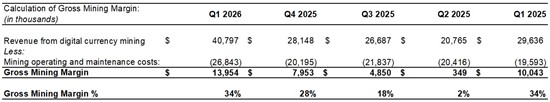

3 The following represents the Revenue and related costs that comprise the gross mining margin. We note Gross Mining Margin encompasses all direct costs included in the operations, with the majority cost being electrical consumption, however other costs can include including any staff, real estate costs, ASIC repair and maintenance, internet connectivity, security, data center maintenance, and electrical equipment maintenance. Electrical costs may vary quarter over quarter.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/262628_hive8152025t1.jpg

*Average revenue per BTC is for mining operations only and excludes HPC operations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5335/262628_hive8152025t2.jpg

4 References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

About HIVE Digital Technologies Ltd.

Founded in 2017, HIVE Digital Technologies Ltd. builds and operates sustainable blockchain and AI infrastructure powered by renewable hydroelectric energy. With a global footprint across Canada, Sweden, and Paraguay offering scalable AI and cloud compute services, HIVE is committed to operational excellence, green energy leadership, and creating long-term value for its shareholders and host communities.

For more information, visit hivedigitaltech.com, or connect with us on:

X: https://x.com/HIVEDigitalTech

YouTube: https://www.youtube.com/@HIVEDigitalTech

Instagram: https://www.instagram.com/hivedigitaltechnologies/

LinkedIn: https://linkedin.com/company/hiveblockchain

On Behalf of HIVE Digital Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information, please contact:

Nathan Fast, Director of Marketing and Branding

Frank Holmes, Executive Chairman

Aydin Kilic, President & CEO

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian and United States securities legislation and regulations that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes but is not limited to: the acquisition of the new sites in Paraguay and Toronto and their potential, the timing of it becoming operational; business goals and objectives of the Company, including its target hashrate milestones and the costs to achieve the milestones; the results of operations for the three months ended June 30, 2025; the expected costs of maintaining and growing its operations; financial information related to annualized run rate; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; the receipt of government consents; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to: the inability to complete the construction of the Paraguay acquisition on an economic and timely basis and achieve the desired operational performance; the ongoing support and cooperation of local authorities and the Government of Paraguay; the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's ATM Program and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of pandemics on the business of the Company, including but not limited to the effects of pandemics on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedarplus.ca.

The forward-looking information in this news release reflects the Company's current expectations, assumptions, and/or beliefs based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance, and accordingly, undue reliance should not be put on such information due to its inherent uncertainty. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262628