Noble Plains Uranium Closes on Duck Creek Project in the Heart of Powder River Basin

Rhea-AI Summary

Noble Plains Uranium (OTCQB: NBLXF) has finalized the acquisition of an 80% interest in the Duck Creek Project, a strategic uranium asset in Wyoming's Powder River Basin. A new NI 43-101 technical report highlights an Exploration Target of 2.37-5.45 million tons at grades between 0.03-0.05% U₃O₈.

The 4,133-acre project features over 4,000 historical drill holes and notable intercepts including 8.9 feet grading 0.75% U₃O₈. The property is strategically located among major uranium projects owned by Cameco, Uranium Energy Corp., and GTI Energy. The transaction involved issuing 1,250,000 common shares and paying US$250,000 to UNXE238 Corp.

[ "Extensive historical database with over 4,000 drill holes and proven mineralization", "Strategic location surrounded by major uranium producers in a proven production hub", "High-grade historical drill intercepts up to 0.75% U₃O₈", "Significant exploration upside in untested deeper Fort Union Formation", "Project suitable for ISR mining, which allows faster permitting and lower costs" ]Positive

- None.

Negative

- Exploration Target is conceptual with no defined mineral resource yet

- Further exploration required to confirm historical data

- Additional capital requirements for exploration and development

Exploration Target Range Supported by New NI 43-101 Technical Report

Vancouver, British Columbia--(Newsfile Corp. - August 14, 2025) - Noble Plains Uranium Corp. (TSXV: NOBL) (OTCQB: NBLXF) (FSE: INE0) ("Noble Plains" or the "Company") is pleased to announce that it has closed on the property option agreement to acquire an

The option closing coincides with a newly completed National Instrument 43-101 ("NI 43-101") technical report prepared for UNXE238 Corp. (the "Optionor") by independent firm Western Water Consultants, Inc d/b/a WWC Engineering of Sheridan, Wyoming ("WWC"). The report highlights an Exploration Target of between 2.37 million tons at

"This is a further example of our team executing on its strategy to identify high-quality brownfield assets in the best U.S. uranium districts, use strong historic data to accelerate de-risking, and advance them quickly toward compliant resources," said Drew Zimmerman, President of Noble Plains Uranium. "With Duck Creek now secured along with a new NI 43-101, we are positioned to rapidly deliver meaningful pounds in the ground, building real leverage for our shareholders as the uranium market continues to strengthen."

Duck Creek Project Highlights

- Scale & Location: 4,133 acres (6.5 sq. mi.) of mineral rights, surrounded by major uranium projects and production facilities owned by Cameco, Uranium Energy Corp., Global Uranium and Enrichment, and GTI Energy,

- Extensive Historical Work: Over 4,000 drill holes, including a 3-mile trend of shallow roll-front uranium mineralization,

- Historic Drill Intercepts: include 8.9 feet grading

0.75% U₃O₈ and 13.9 feet of0.47% U₃O₈, - Historic Production: Past open-pit mining evident along and beyond the mineralized trend,

- Significant Exploration Potential: untested deeper Fort Union Formation.

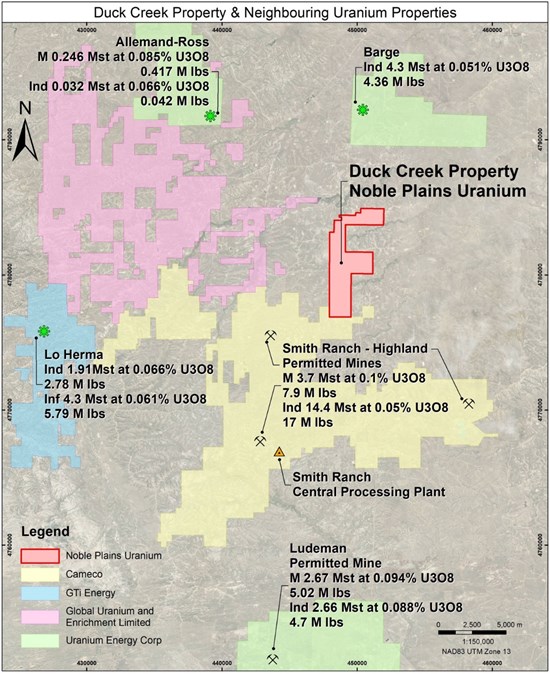

In the Heart of a Growing Production Corridor

Located in one of the most prolific in-situ recovery ("ISR") uranium districts in the United States, Duck Creek is directly surrounded by major deposits and production facilities owned by Cameco Corporation, Uranium Energy Corp., and GTI Energy Limited (see Figure 1). The Project's extensive historical database, favourable geology, and proximity to existing infrastructure present a rare opportunity to advance a uranium project in a proven production hub.

Figure 1: Duck Creek Project Surrounded by resource and production projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3717/262529_d14b0d58d45e5967_001full.jpg

Note: source of resource numbers in Figure 1: Allemand-Ross, Barge, and Ludeman projects, from 2022-09 technical report Exhibit 96.1. Smith Ranch Highland, from Cameco website. Lo Herma, from company website. Technical and scientific information disclosed from neighbouring properties does not necessarily apply to the Duck Creek Project.

"From a geological perspective, Duck Creek has all the hallmarks of a highly attractive ISR project," said Paul Cowley, CEO of Noble Plains Uranium. "It is in a proven roll-front uranium district, with drill spacing and mineralization continuity that provide a strong basis for confirmation and expansion. We plan to initiate a focused drilling campaign this fall. Design and magnitude of the drill program is in progress with a drill permit application at an advanced stage."

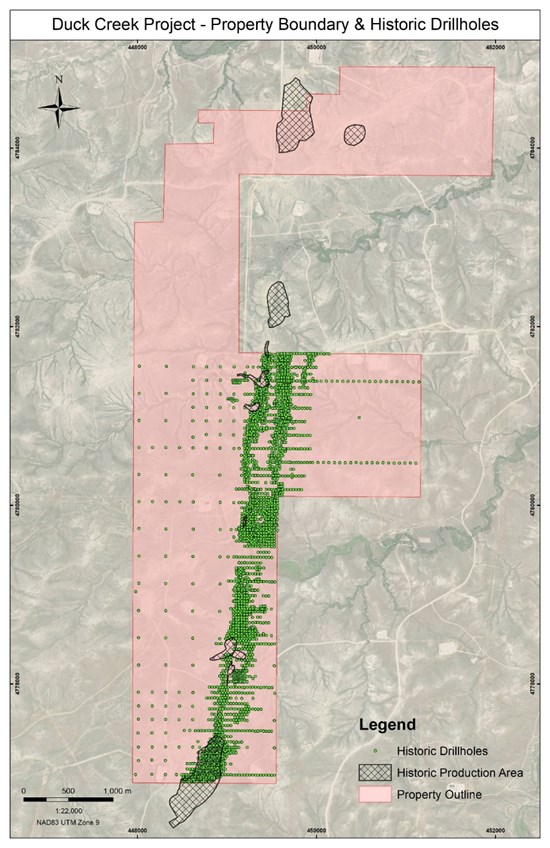

Duck Creek - A Strong Technical Foundation

The Project covers 4,133 acres (6.5 mi²) of mineral rights, including four State of Wyoming mineral leases (2,560 acres) and 78 lode mining claims (1,573 acres). The Project hosts a 3-mile-long corridor of high-density drilling completed by Kerr-McGee Nuclear Corporation in the 1970s. A total of 4,068 historical drill holes outline a consistent, shallow roll-front uranium system within the Eocene-aged Wasatch Formation, with mineralization occurring from less than 50 feet to 260 feet below surface (see Figure 2). Highlights of the historical drill intercepts include 8.9 feet grading

The technical report was completed for UNXE238 Corp. by independent WWC, dated August 13, 2025, entitled "NI 43-101 Technical Report Duck Creek Uranium Project" ("Technical Report") which states that the Project potentially contains an Exploration Target summarized in Table 1. The Technical Report will be Sedar filed today and made available on the Company website.

Table 1. Duck Creek Uranium Project Exploration Target

| Upper Range | ||||

| Estimate Methodology | Average Grade (% U3O8) | Median GT Sum (% U3O8-ft) | Area (ft2) | Tons (000s) |

| Mineral Outline | 0.05 | 0.598 | 5,895,866 | 4,241 |

| Extended Trend | 0.05 | - | - | 1,205 |

| Total | 5,446 | |||

| Lower Range | ||||

| Estimate Methodology | First Quartile Grade (% U3O8) | Minimum GT Sum (% U3O8-ft) | Area (ft2) | Tons (000s) |

| Mineral Outline | 0.03 | 0.201 | 5,895,866 | 2,373 |

| Total | 2,373 | |||

The potential quantity and grade at the Project are conceptual in nature, that it is uncertain if further exploration will result in the target being delineated as a mineral resource and there is insufficient data to estimate a mineral resource. Drill holes with intercepts with Grade-Thickness (GT) sum less than 0.2 %-ft were excluded. A bulk density of 16.6 ft3/ton was used. The average thickness of each intercept with GT greater than

Figure 2: 3-mile-long trend of high-density historic drilling and historic production areas

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3717/262529_d14b0d58d45e5967_002full.jpg

Untested Upside in the Fort Union Formation

The historical drilling at Duck Creek focused exclusively on shallow mineralization in the Wasatch Formation. The deeper Fort Union Formation remains completely untested on the property. This lower unit hosts the bulk of resources at several surrounding ISR projects in the Powder River Basin, including those operated by Cameco and Uranium Energy Corp. The absence of historic drilling into the Fort Union at Duck Creek presents a significant exploration upside to expand beyond the Wasatch mineralized zones.

Strategic Context

The acquisition of Duck Creek significantly strengthens Noble Plains' Wyoming portfolio, building on the Company's recent acquisition of Shirley Central and expansion of Shirley East in the Shirley Basin. Wyoming has produced over 238 million pounds of uranium since the 1950s, with the Powder River Basin and Shirley Basin's representing key districts in that legacy of production. ISR is now the dominant extraction method in Wyoming overall, because it allows for faster permitting, minimal surface disturbance, and lower capital and operating costs.

The Transaction

Further to the Company's June 19, 2025 news release announcing the execution of a property option agreement, between the Company, UNXE238 Corp., and Drakensberg Resources LLC, a wholly owned subsidiary of the Company, the Company has closed the first stage of its option to acquire up to an

About Noble Plains Uranium Corp.

Noble Plains Uranium (TSXV: NOBL) is focused on acquiring and advancing U.S.-based uranium projects amenable to In-Situ Recovery (ISR)-the most capital-efficient and environmentally responsible method of uranium extraction. The Company targets historically explored, geologically robust projects in uranium-friendly jurisdictions with the goal of rapidly delineating NI 43-101 resources and building out a pipeline of ISR-development opportunities.

On Behalf of the Board of Directors,

"Paul Cowley", CEO

"Drew Zimmerman", President

For further information, please contact: Drew Zimmerman: (778) 686-0973

Website: www.nobleplains.com

Technical disclosure of the Technical Report and Exploration Target estimate in this news release has been reviewed and approved by Christopher McDowell, P.G., Project Manager at WWC Engineering, a Qualified Person as defined by National Instrument 43-101.

Technical disclosure, excluding the Exploration Target estimate in this news release, has been reviewed and approved by Bradley Parkes, P.Geo., VP Exploration and Director of Noble Plains Uranium Corp., a Qualified Person as defined in National Instrument 43-101, who has read and approved the technical content of this news release.

Cautionary Statements Regarding Forward-Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating to the future operations and activities of Noble Plains, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, the acquisition of an

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262529