Intercont (Cayman) Limited Announces Strategic Acquisition of Singapore-Based Web3 Innovator Starks Network Ltd, Strengthening Its Position in On-Chain Digital Asset Infrastructure

Rhea-AI Summary

Intercont (Cayman) Limited (Nasdaq: NCT) announced on December 8, 2025 that it signed a Memorandum of Understanding to acquire a less than 50% minority stake in Singapore-based Web3 provider Starks Network Ltd and to co-develop Project zCloak Network.

Starks Network offers AI identity, enterprise self-custodial wallets, stablecoin payment systems, and AI-powered crypto payment technologies, and has received Hong Kong Cyberport incubation support and investment from firms including Coinbase Ventures. The release cites industry context: BlackRock AUM $13.46T (Q3 2025) and digital asset market cap growth from $5B (2022) to $25.5B (July 2025).

Management highlighted potential high-margin enterprise revenue (cited US$30–40M annual ranges for comparable infrastructure providers) while noting the transaction currently rests on an MOU.

Positive

- MOU to acquire a minority stake in Starks Network

- Co-development of Project zCloak Network with Web3 expertise

- Access to technologies: AI identity, self-custodial wallets, stablecoin payments

- Third-party validation via Cyberport incubation and Coinbase Ventures investment

Negative

- Minority stake (<50%) limits NCT control over Starks Network

- Transaction under MOU, non-binding pending definitive agreement

News Market Reaction – NCT

On the day this news was published, NCT gained 6.19%, reflecting a notable positive market reaction. Argus tracked a peak move of +27.4% during that session. Argus tracked a trough of -4.3% from its starting point during tracking. Our momentum scanner triggered 13 alerts that day, indicating notable trading interest and price volatility. This price movement added approximately $985K to the company's valuation, bringing the market cap to $17M at that time.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Scanner shows marine peers like RUBI and TORO up about 4.91% and 4.83% with no news flagged, while NCT’s setup before this Web3 acquisition news was weak and at a 52-week low, suggesting stock-specific factors rather than a broad sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Ro-ro partnership | Positive | -26.9% | Announced large low-carbon ro-ro partnership with projected multi-year revenue and profit. |

| Jul 15 | Earnings update | Neutral | -4.4% | Reported H1 2025 revenue and gross profit growth but sharply lower net income. |

Recent positive or strategic announcements have been followed by weak to negative price reactions, including a sharp selloff after a large ro-ro partnership.

Over the last six months, NCT combined capital markets activity with strategic growth. A July 15, 2025 earnings update showed revenue up 8% to $13.4M but a 43% drop in net income to $0.9M, and the stock slipped 4.44%. On Dec 1, 2025, a ro-ro vessel partnership projected $118.25M revenue and $88.96M net profit, yet shares fell 26.87%. Today’s Web3-focused acquisition MOU marks another diversification step beyond core shipping operations.

Market Pulse Summary

The stock moved +6.2% in the session following this news. A strong positive reaction aligns with investors rewarding NCT’s attempt to diversify from a depressed base, with shares at $0.543, matching the 52-week low and sitting far below the $2.53 200-day MA. Historically, however, even constructive news like the $118.25M ro-ro partnership saw a -26.87% move, so any sharp rally could have faced profit-taking or skepticism about execution and capital needs around new digital infrastructure initiatives.

Key Terms

web3 technical

stablecoin financial

assets under management financial

digital asset financial

tokenizing financial

on-chain technical

self-custodial wallets technical

AI-generated analysis. Not financial advice.

HONG KONG, Dec. 08, 2025 (GLOBE NEWSWIRE) -- Intercont (Cayman) Limited (Nasdaq: NCT)(“NCT” or “the Group”), a global carbon-neutral shipping company, announced that, it has entered into a Memorandum of Understanding (MOU) to acquire a less than

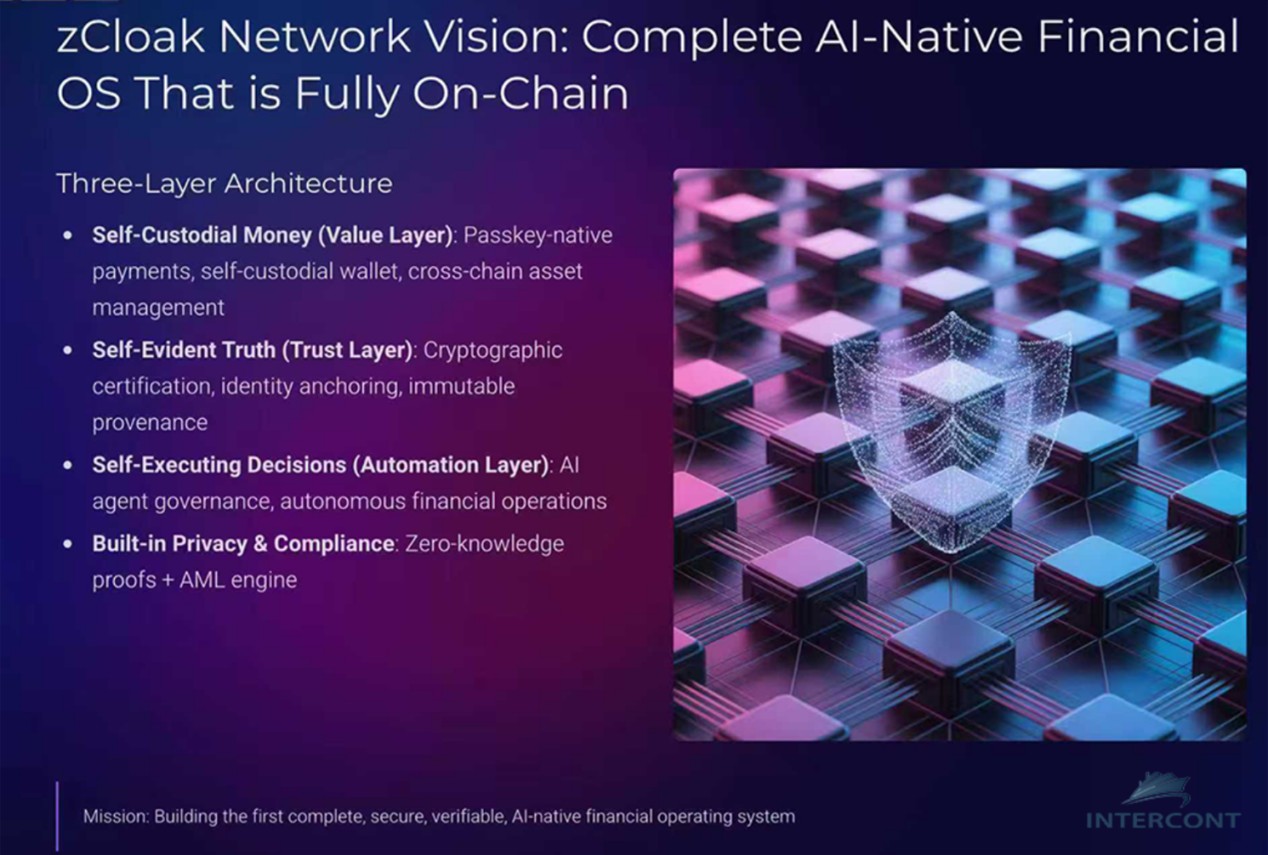

Starks Network, incorporated in the Cayman Islands with operational headquarters in Singapore, has established strong competitive advantages in the global Web3 ecosystem with Project zCloak Network. The company’s proprietary frameworks and compliance-forward infrastructure span AI identity, enterprise self-custodial wallets, stablecoin payment systems, and AI-powered crypto payment technologies. These differentiated capabilities create substantial barriers to entry and have earned zCloak grant by official Hong Kong Cyberport incubation programs, as well as investments from top-tier venture capital firms including Coinbase Ventures. zCloak is widely regarded as a high-growth technology leader with robust investor support.

zCloak Network Vision

The global adoption of stablecoin-based payment systems has accelerated rapidly. With the static by Stablecoin Insider, worldwide stablecoin transaction volume has surpassed the combined annual processing volume of Visa and Mastercard in 2024—an inflection point signaling stablecoins’ emergence as critical financial infrastructure.[1]

Meanwhile, McKinsey points out the growth rate of stablecoin transaction is in accelerating tendency and could surpass legacy payment volumes in less than a decade. On that basis, as on-chain payment matures, institutional and enterprise clients continue to demonstrate strong demand for secure, extensible, and compliant wallet solutions.[2]

BlackRock reported

Bitcoin image

NCT’s planned acquisition of zCloak represents a decisive step in its long-term strategy to expand into the digitization of real-world assets while reinforcing its leadership in global shipping services. The company will explore diversified pathways for tokenizing real-world assets across industries, leveraging zCloak’s technical infrastructure to deliver standardized, compliant, and scale up on-chain asset solutions. Together, both the NCT and Starks Network aim to accelerate enterprise adoption of Web3 technologies worldwide.

Ms. Muchun Zhu, Chief Executive Officer of NCT, and Dr. Xiao Zhang, Founder of Starks Network and zCloak, described this partnership as a bold convergence of tradition and innovation: “Four hundred years after Shakespeare, the Merchant of Venice sails again — on-chain.” Through this collaboration, timeless themes of contract, wealth, humanity, and justice will be re-imagined using Web3 technology.

Ms. Zhu added: “The markets zCloak operates in are already producing meaningful commercial outcomes. In privacy-preserving identity, compliance verification, and confidential computation, leading infrastructure providers routinely achieve the US

About Intercont (Cayman) Limited

Intercont (Cayman) Limited is a global shipping enterprise with plans for seaborne pulping operations. Under a visionary management team, Intercont is dedicated to providing customers with efficient and environmentally friendly transportation solutions through innovative business models and technology. For more information, please visit: https://www.intercontcayman.com.

Forward-Looking Statement

This press release contains statements of a forward-looking nature. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may, “will, “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement filed with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Contact information:

investorrelations@intercontcayman.com

+852-3848-1720

Data Source:

[1] Stablecoins Hit

Stablecoins Hit

[2] The stable door opens: How tokenized cash enables next-gen payments

Stablecoins payments infrastructure for modern finance | McKinsey

[3] BlackRock Inc. Q3 2025 Report

[4] Observer Financial News Report (2025.08.07)

RWA代币化规模激增

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/61bfa9e9-c6fc-47ce-b7ab-1c14f80d9209

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0917d90-f6b3-4649-b2ee-2c00ca6a03ff