Netflix Welcomes Warner Bros. Discovery Board Recommendation

Rhea-AI Summary

Netflix (NFLX) welcomed the Warner Bros. Discovery Board recommendation that stockholders approve Netflix's agreed acquisition of Warner Bros. The fully negotiated cash-and-stock transaction values WBD at $27.75 per share (equity value $72.0B, enterprise value ~$82.7B), and includes planned separation of Discovery Global in Q3 2026.

Netflix said the deal has committed financing, a $5.8B reverse termination fee, and a targeted close in 12–18 months, and emphasized theatrical windows, global distribution, and combined content scale.

Positive

- Deal values WBD at $27.75 per share

- Transaction equity value of $72.0B and EV ~$82.7B

- Committed financing and a $5.8B reverse termination fee

Negative

- Transaction conditional on regulatory approvals with a 12–18 month close timeline

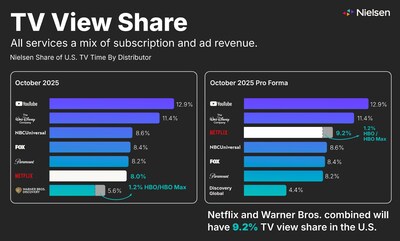

- Combined Netflix-HBO pro forma TV view share only rises to 9.2%, trailing top competitors

- Potential competitive alternative (PSKY) would raise combined share to 14%

News Market Reaction – NFLX

On the day this news was published, NFLX gained 0.23%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

While NFLX was up 0.85%, key peers showed mixed moves: DIS and NWS were modestly positive, whereas WBD, FOX, and LYV declined. This points to a stock-specific reaction rather than a uniform entertainment sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 15 | Earnings date notice | Neutral | -1.5% | Announcement of Q4 2025 results release and earnings interview timing. |

| Dec 11 | Experiential venue news | Neutral | +1.5% | Opening of Netflix House Dallas as a large, permanent venue. |

| Dec 10 | Rival bid commentary | Neutral | +1.5% | Paramount letter detailing $30 WBD tender offer versus Netflix proposal. |

| Dec 08 | Competing WBD offer | Neutral | -3.4% | Paramount launches all-cash $30 per share tender for WBD. |

| Dec 01 | Conference participation | Neutral | +1.4% | Co-CEO Ted Sarandos scheduled for UBS Global TMT Conference fireside chat. |

Over the past few weeks, Netflix news has focused on corporate events and the competitive landscape. Items included an upcoming Q4 2025 earnings release, experiential expansion via Netflix House Dallas, and multiple communications about Paramount’s competing bid for Warner Bros. Discovery. Price reactions to these headlines have been modest in either direction, suggesting investors have been digesting strategic updates without extreme volatility.

Market Pulse Summary

This announcement highlights Warner Bros. Discovery’s board reaffirming Netflix’s agreed transaction, valuing WBD at $27.75 per share and an $82.7 billion enterprise value, plus a $5.8 billion reverse termination fee. It underscores a fully negotiated, financed structure and contrasts it with a rival cash tender offer. Investors may track regulatory milestones, the planned Discovery Global separation in Q3 2026, and any further communications from competing bidders.

Key Terms

tender offer regulatory

reverse termination fee financial

HSR filing regulatory

Committee on Foreign Investment in the United States (CFIUS) regulatory

collar mechanism financial

AI-generated analysis. Not financial advice.

After Careful Review, Warner Bros. Discovery Board Urges Stockholders to Approve Netflix Agreement, Calling it the Best Option for Long-Term Value

Ted Sarandos and Greg Peters Send Letter to Warner Bros. Discovery Stockholders

Visit NetflixWBtogether.com for More Information on How Netflix and Warner Bros. Will Define the Next Century of Storytelling

---------------

On December 5, Netflix and WBD announced a fully negotiated and financed definitive agreement under which Netflix will acquire Warner Bros., including its film and television studios, HBO Max and HBO. The cash and stock transaction is valued at

"The Warner Bros. Discovery Board reinforced that Netflix's merger agreement is superior and that our acquisition is in the best interest of stockholders," said Ted Sarandos, Netflix co-CEO. "This was a competitive process that delivered the best outcome for consumers, creators, stockholders and the broader entertainment industry. Netflix and Warner Bros. complement each other, and we're excited to combine our strengths with their theatrical film division, world-class television studio, and the iconic HBO brand, which will continue to focus on prestige television. We're also fully committed to releasing Warner Bros. films in theaters, with a traditional window, so audiences everywhere can enjoy them on the big screen."

Netflix co-CEO Greg Peters continued: "By acquiring Warner Bros., we'll be able to offer audiences and creators around the world even more choice, value and opportunity. This transaction is fundamentally pro-consumer, pro-innovation, pro-creator and pro-growth. Together we will deliver an even broader selection of great series and films that audiences can watch at home and in theaters, while driving long-term value for our stockholders. We're excited to begin this new chapter and continue to entertain and delight fans around the world."

Netflix has a long history of investing in creativity and partnering with top talent, and we're committed to honoring and growing Warner Bros.' incredible brands and franchises. By joining forces to combine our strengths and our passion for great storytelling, we'll strengthen the entertainment industry.

Our focus remains on creating outstanding films and shows, investing in the future of entertainment, and delivering more of what audiences love around the world.

The full text of Netflix's letter to WBD stockholders is below.

December 17, 2025

Dear Warner Bros. Discovery Stockholders,

Today the Warner Bros. Discovery ("WBD") Board sent a clear message to you, their stockholders. The WBD Board urges you to reject Paramount Skydance's ("PSKY") unsolicited, inferior and illusory tender offer.

After a robust and highly competitive strategic review process, the WBD Board had already recommended the transaction with Netflix. Today they have reaffirmed that this transaction is the best and most certain path forward for WBD and its stockholders and therefore recommend you vote to approve the Netflix Merger when the WBD stockholder meeting is convened.

We want to reiterate why we believe the agreed-upon transaction with Netflix is the right deal, with the right partner, at the right time – and to set the record straight on some key points. Here's why our transaction is superior on multiple fronts:

- Superior financing certainty and clear funding structure: Our deal structure is clean and certain, with committed debt financing from leading institutions. There are no contingencies, no foreign sovereign wealth funds, and no stock collateral or personal loans. We are a scaled company with a

+ market cap and a strong investment grade balance sheet. As WBD said, the PSKY offer has "numerous risks and uncertainties" associated with it, among which are PSKY's financial condition and creditworthiness.$400 billion - Confidence in regulatory approvals: We plan to close the transaction in 12-18 months, after completing customary regulatory approvals. Netflix has submitted its HSR filing and is engaging with competition authorities, including the DOJ and EU Commission. Our financing structure is not subject to review by the Committee on Foreign Investment in

the United States (CFIUS). Our$5.8 billion - Less risk and greater flexibility for WBD stockholders: Our offer provides flexibility for WBD to run its business between now and close, as well as facilitate the separation of Discovery Global quickly, as previously determined by the WBD board to be the right strategic direction that ensures continued stockholder value creation. In contrast, PSKY's offer puts substantial limitations on WBD's operations between sign and close and requires WBD to abandon its planned separation of Discovery Global. As a result, if PSKY's offer ultimately fails to close, WBD's stockholders will have lost the opportunity to reposition the company and realize substantial benefits of the separation for a prolonged period.

- Fully negotiated agreement designed for execution: This agreement is the result of thoughtful, collaborative work between our two companies. Together, we will work cooperatively to ensure a smooth and stable transition for our creators, employees, partners, and stockholders. Because of this preparation and our shared commitment to excellence, we're moving forward with clarity, accountability, and real momentum.

More Value for Stockholders

Our transaction is superior, with a total equity value per share for WBD stockholders of

Clear, Timely Path to Close

We are highly confident that regulators will see this deal for what it is: pro-consumer, pro-innovation, pro-worker, pro-creator, pro-growth, and pro-competition.

The global entertainment market is highly competitive and dynamic. Consumers have more ways than ever to spend their time, whether it's with streaming services, linear TV, cable, gaming, social media, user-generated content, or all the big tech video platforms. And creators have more choices than ever for how to bring their vision to life.

You don't have to take our word for it:

- In the

U.S. ,1 Netflix is in sixth place in TV view share, trailing Google/YouTube, Disney, Comcast NBCU, Fox, and Paramount. - YouTube and Disney lead by a wide margin -

12.9% and11.4% respectively - while Netflix sits at8.0% . - Pro forma, a combined Netflix-HBO/HBO Max would be

9.2% share (only up from8% ), still below both YouTube and Disney. - If PSKY acquired WBD, its share would increase to

14% . - In major markets outside of the U.S., Netflix's TV view share is also less than

10% .

25+ Year Track Record of Stockholder Value Creation, Operational Excellence, and Trusted Creative Partnerships

Netflix has a demonstrated track record of disciplined investment, creative collaboration, and responsible ownership of a global entertainment company. We believe enduring value in this industry is built through sustained commitment to storytelling, talent, and brand integrity, and this transaction reflects those principles. We built Netflix through continuous improvement, innovation, consumer focus, and bold ambition - whether it was going from DVDs to streaming; licensing to originals; or

We're fans first. We love film and television, and the creative talent that fuel this industry, which is why we've built a reputation for encouraging creative freedom. With Warner Bros., our track record of launching careers and supporting the creative community will continue.

More Value for Consumers Worldwide

Together, Netflix and Warner Bros. have some of the greatest shows and movies in the world, from The Big Bang Theory and The Sopranos to Game of Thrones, The Wizard of Oz, the DC Universe, Wednesday, Squid Game, Bridgerton, Adolescence and KPop Demon Hunters.

At Netflix, we can help Warner Bros.' iconic franchises generate even more value by connecting them to audiences in over 190 countries. And it's not just about reach: with approximately

More Opportunity for the Entertainment Industry

Unlike any other potential combination, Netflix and Warner Bros. truly complement each other.

Warner Bros. has three core businesses that Netflix doesn't: a successful theatrical film division, a world-class television studio that is a leading supplier to the industry, and HBO – the gold standard in prestige television. By combining them with Netflix's innovation, IP, global reach, and best-in-class streaming service, we'll be able to offer more opportunities to creators and strengthen the entire entertainment industry.

With Netflix, there is minimal overlap with the existing Warner Bros. business. In fact, it's almost entirely incremental and additive. With Warner Bros.' studio capabilities, we'll be able to ramp up our investment in original programming and production in the

There's been a lot of talk about theatrical distribution, so we want to set the record straight: we are

Netflix is the Right Home for Warner Bros.

For all these reasons, we believe Netflix is the right home for Warner Bros. and the legacy it has built over the last century.

As we move forward, we are committed to working closely with WBD, regulators, and all stakeholders to ensure a smooth and successful transaction. Our focus will remain on execution, delivering exceptional storytelling, investing in creative talent, and strengthening a vibrant, competitive global entertainment industry.

We are dedicated to preserving Warner Bros.' incredible library, keeping movies on the big screen, and introducing their iconic films and series to even more audiences around the world. Together, we have the opportunity to inspire and entertain the world like never before. We look forward to partnering with David Zaslav and his team to make this vision a reality.

Sincerely,

Ted Sarandos, co-CEO Greg Peters, co-CEO

A dedicated website providing ongoing information and resources about the transaction is available at netflixwbtogether.com.

About Netflix, Inc.

Netflix (NASDAQ:NFLX) is one of the world's leading entertainment services with over 300 million paid memberships in over 190 countries enjoying TV series, films and games across a wide variety of genres and languages. Members can play, pause and resume watching as much as they want, anytime, anywhere, and can change their plans at any time.

IMPORTANT INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction (the "Merger") between Netflix, Inc. ("Netflix") and Warner Bros. Discovery, Inc. ("WBD"), Netflix intends to file with the

INVESTORS AND SECURITY HOLDERS OF NETFLIX AND WBD ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING NETFLIX, WBD, THE MERGER AND RELATED MATTERS.

The documents filed by Netflix with the SEC also may be obtained free of charge at Netflix's website at https://ir.netflix.net/home/default.aspx. The documents filed by WBD with the SEC also may be obtained free of charge at WBD's website at https://ir.wbd.com.

PARTICIPANTS IN THE SOLICITATION

Netflix, WBD and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of WBD in connection with the Merger under the rules of the SEC.

Information about the interests of the directors and executive officers of Netflix and WBD and other persons who may be deemed to be participants in the solicitation of stockholders of WBD in connection with the Merger and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement/Prospectus, which will be filed with the SEC.

Information about WBD's directors and executive officers is set forth in WBD's proxy statement for its 2025 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 23, 2025, WBD's Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent filings with the SEC. Information about Netflix's directors and executive officers is set forth in Netflix's proxy statement for its 2025 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 17, 2025, and any subsequent filings with the SEC. Additional information regarding the direct and indirect interests of those persons and other persons who may be deemed participants in the Merger may be obtained by reading the Proxy Statement/Prospectus regarding the Merger when it becomes available. Free copies of these documents may be obtained as described above.

NO OFFER OR SOLICITATION

This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This document contains "forward-looking statements" within the meaning of the federal securities laws, including Section 27A of the

1 Nielsen Share of

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/netflix-welcomes-warner-bros-discovery-board-recommendation-302644653.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/netflix-welcomes-warner-bros-discovery-board-recommendation-302644653.html

SOURCE Netflix, Inc.