Nortec to Acquire the Barker Bay Gold Property and Appoints Mr. Ryan Hrkac, P. Geo to the Position of Chief Executive Officer

Nortec (NMNZF) agreed to acquire a 100% interest in the Barker Bay Gold Property in northwest Ontario and appointed Ryan Hrkac, P.Geo as CEO effective immediately.

Consideration for the acquisition includes 1,250,000 common shares issuable four months and one day after closing, $5,300 cash payable after completion of a ≥$500,000 non-flow-through financing, and a 2% NSR royalty (Nortec may buy 50% of the NSR for $1,000,000). Closing is subject to a minimum equity financing of $175,000 (≥$75,000 non-flow-through) and TSX Venture Exchange approval. Two prior small-scale mines and multi-gram historic samples are reported on the 2,000-hectare property.

Nortec (NMNZF) ha accettato di acquisire il 100% dell'interesse nella Barker Bay Gold Property nel nord-ovest dell'Ontario e ha nominato Ryan Hrkac, P.Geo come CEO con effetto immediato.

La controparte per l'acquisizione comprende 1.250.000 azioni ordinarie emesse quattro mesi e un giorno dopo la chiusura, 5.300 dollari in contanti pagabili al completamento di un finanziamento non-flow-through di ≥$500.000, e una royalty NSR del 2% (Nortec può acquistare il 50% della NSR per $1.000.000). La chiusura è soggetta a un finanziamento azionario minimo di $175.000 (≥$75.000 non-flow-through) e all'approvazione della TSX Venture Exchange. Due precedenti miniere di piccola scala e campioni storici multi-grammi sono riportati sulla proprietà di 2.000 ettari.

Nortec (NMNZF) acordó adquirir un interés del 100% en la Barker Bay Gold Property en el noroeste de Ontario y nombró a Ryan Hrkac, P.Geo como director ejecutivo con efecto inmediato.

La contraprestación por la adquisición incluye 1.250.000 acciones comunes emitibles cuatro meses y un día después del cierre, 5.300 dólares en efectivo pagaderos tras la finalización de un financiamiento no-flow-through de ≤$500.000, y una regalía NSR del 2% (Nortec puede comprar el 50% de la NSR por $1.000.000). El cierre está sujeto a un financiamiento mínimo de capital de $175.000 (≥$75.000 no-flow-through) y a la aprobación de la TSX Venture Exchange. En la propiedad de 2.000 hectáreas se reportan dos antiguas minas de pequeña escala y muestras históricas de varios gramos.

Nortec (NMNZF)는 북서부 온타리오에 위치한 Barker Bay Gold Property의 지분 100%를 취득하기로 합의하고 즉시 발효되는 Ryan Hrkac, P.Geo를 CEO로 임명했습니다.

취득 대가에는 1,250,000주 보통주가 클로징 후 4개월째 및 1일째에 발행되며, 5,300달러 현금은 ≥$500,000의 비-플로우-through 자금조달 완료 후 지급되고, NSR 2% 로열티가 포함되며 (Nortec는 NSR의 50%를 $1,000,000에 매입할 수 있습니다). 클로징은 최소 주식 자금조달 $175,000 (≥$75,000 비-플로우-through) 및 TSX Venture Exchange의 승인을 조건으로 합니다. 2,000헥타르 규모의 이 부지에는 소규모 과거 광산 두 곳과 다그램급의 역사적 샘플이 보고되어 있습니다.

Nortec (NMNZF) a accepté d'acquérir une participation de 100% dans la Barker Bay Gold Property dans le nord-ouest de l'Ontario et a nommé Ryan Hrkac, P.Geo comme PDG avec effet immédiat.

La contrepartie de l'acquisition comprend 1 250 000 actions ordinaires émises quatre mois et un jour après la clôture, 5 300 dollars en espèces payables après la réalisation d'un financement non-flow-through d'au moins 500 000 $, et une redevance NSR de 2% (Nortec peut acheter 50% de la NSR pour 1 000 000 $). La clôture est soumise à un financement par actions minimum de 175 000 $ (≥75 000 non-flow-through) et à l'approbation de la TSX Venture Exchange. Deux anciennes petites mines et des échantillons historiques multi-grammes sont signalés sur la propriété de 2 000 hectares.

Nortec (NMNZF) einigte sich darauf, 100% des Eigentumsanteils an der Barker Bay Gold Property in Nordwestontario zu erwerben und ernannte Ryan Hrkac, P.Geo mit sofortiger Wirkung zum CEO.

Gegenleistung für den Erwerb umfasst 1.250.000 Stammaktien, die vier Monate und einen Tag nach dem Closing ausgegeben werden, 5.300 USD Bargeld nach Abschluss einer mindestens 500.000 USD großen Non-Flow-Through-Finanzierung, und eine NSR-Rente von 2% (Nortec kann 50% der NSR für 1.000.000 USD erwerben). Der Closing unterliegt einer Mindestkapitalfinanzierung von 175.000 USD (≥75.000 Non-Flow-Through) und der Genehmigung der TSX Venture Exchange. Auf dem 2.000 Hektar großen Grundstück sind zwei frühere Kleinstminen sowie mehrgrammige historische Proben gemeldet.

Nortec (NMNZF) وافقت على الاستحواذ على نسبة 100% من Barker Bay Gold Property في شمال غرب أونتاريو وتعيين Ryan Hrkac, P.Geo كرئيس تنفيذى تنفيذي، اعتباراً من الآن.

يشمل المقابل مقابل الاستحواذ 1,250,000 سهم عادي تصدر بعد أربعة أشهر ويوم من الإغلاق، و5,300 دولار نقداً مستحقاً عند إتمام تمويل غير تقليدي (non-flow-through) بقيمة ≥500,000 دولار، وحقوق امتياز NSR بنسبة 2% (يمكن لشركة Nortec شراء 50% من NSR مقابل 1,000,000 دولار). الإغلاق يخضع لتمويل أسهم بحد أدنى قدره 175,000 دولار (≥75,000 غير مخصص للflow-through) وموافقة TSX Venture Exchange. وعلى الملكية التي تبلغ مساحتها 2,000 هكتار هناك منجمين صغيرين سابقين وعينات تاريخية متعددة الغرام على المقاطعة.

- Acquisition of 100% interest in Barker Bay via Asset Purchase Agreement

- Consideration includes 1,250,000 common shares issued post-closing

- 2% NSR royalty with option to buy 50% for $1,000,000

- Appointment of Ryan Hrkac P.Geo as CEO effective immediately

- Transaction closing requires minimum equity financing of $175,000 and TSXV approval

- $5,300 cash payment contingent on a ≥$500,000 non-flow-through financing

- Issuance of 1,250,000 shares may dilute existing shareholders

- Resignation of CFO and a director creates near-term management turnover

Toronto, Ontario--(Newsfile Corp. - November 5, 2025) - NORTEC MINERALS CORP. (TSXV: NVT) ("Nortec" or the "Company") is pleased to announce that it has entered an asset purchase agreement (the "Asset Purchase Agreement") with Ryan Hrkac, P. Geo to acquire the Barker Bay Gold Property (as described below) (the "Property"), located in Ontario, Canada (the "Transaction").

Additionally effective immediately, the Company is pleased to announce the appointment of Mr. Hrkac to the position of Chief Executive Officer of the Company replacing Derrick Weyrauch (formerly interim CEO) who continues in his role as Chairman of the Board of Directors. Sara Hills and P. Mark Smith have resigned from the Company as CFO and Director, respectively. Michael Malana has been appointed interim CFO to succeed Ms. Hills. The Company thanks Ms. Hills and Mr. Smith for their contributions to the Company.

BARKER BAY GOLD PROPERTY

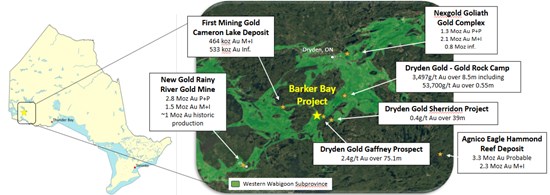

The Barker Bay Gold Property is located in the Kenora Mining division, northwest Ontario, Canada (South of Dryden). (Figure 1)

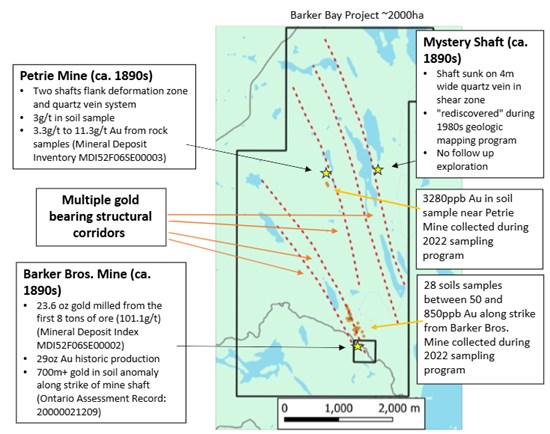

Recent prospecting and historic exploration identified at least three (3) gold bearing sub-parallel structures on the 2,000-hectare property. Two historic small-scale mining operations are located on the property, namely the Barker Bros Mine and the Petrie Mine. Additionally, a third shaft was identified during geologic mapping in the 1980's located on a parallel structure east of the Petrie Mine. Historic records indicated the Barker Bros. Mine returned 23.6 oz in the first 8 tons of ore milled, an average grade of 101.1g/t Au (see Ontario Mineral Deposit Index MDI52F06SE00002) while production records for the Petrie Mine (see Ontario Mineral Deposit Index MDI52F06SE00003) and the undocumented shaft are unavailable.

Historic prospecting has returned grab samples ranging from 1.4 to 24.5 g/t Au at the Barker Bros Mine ((see Ontario Assessment Report: 52F06NE0003) 3.3 to 11.3 g/t Au at the Petrie Mine Mineral Deposit Inventory MDI52F06SE00003)).

Gold is hosted in quartz veins and in wall rock of shear zones which are up to 10 meters wide. Feldspar porphyry intrusives have also been identified in close proximity to the historic gold mines and may be an integral part of the mineralizing system. A gold-in-soil anomaly was outlined during a 2022 field program which extends more than 700m along strike of the Barker Bros. Mine. This anomaly closely follows the historic trenching and projected extent of the structure hosting gold mineralization (see Ontario Assessment Record: 20000021209).

The geologic similarities to the Kenwest Deposit (25 kilometers to the east) operated by Dryden Gold Corp. (TSXV: DRY) where a gold intercept of 3,497 g/t over 8.5 m including 53,700 g/t gold over 0.55 meters in hole KW-11-26 underscore the potential for ultra-high grade gold mineralization (see Ontario Mineral Deposit Inventory MDI52F07NE00002).

Figure 1 - Regional Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4874/273275_62f1dd5674695842_001full.jpg

Figure 2 - Barker Bay Gold Property

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4874/273275_62f1dd5674695842_002full.jpg

CHIEF EXECUTIVE OFFICER

Effective immediately, Ryan Hrkac P.Geo, has been appointed to the position of Chief Executive Officer of the Company. He is the founder of Shear Gold Exploration Corp, a private prospect generator and geological consultancy, specializing in gold exploration across the Precambrian Shield of Ontario. A lifelong resident of Thunder Bay, Ontario, Ryan graduated from Lakehead University in 2016 with an Honours Bachelor of Science in Geology and is a registered Professional Geologist (P. Geo) in Ontario.

"Following successfully optioning multiple early-stage exploration project to listed issuers including Dryden Gold Corp's (TSXV: DRY) Sherridon expansion and Kenorland Minerals Ltd. (TSXV: KDL) Stormy property, Ryan has established a reputation for technical expertise, curating exploration properties of merit, and a hands-on approach to exploration, all coupled with a deep understanding of the challenges and opportunities within the mineral exploration industry.

"We are very pleased to welcome Ryan, his enthusiasm and desire to advance Nortec via a disciplined scientific approach to exploration," stated Derrick Weyrauch, Chairman.

TRANSACTION DETAILS

The Asset

Purchase Agreement was entered into on November 4, 2025 between Mr. Hrkac, who holds a

(a) an aggregate of 1,250,000 common shares in the authorized share structure of Nortec, which common shares are to be issued four months and one day following the date of closing of the Transaction (the "Closing Date");

(b)

(c) a

CLOSING

The closing of the acquisition of the Asset Purchase Agreement (the "Transaction") is subject to a number of conditions, including, but not limited to, Nortec having completed an equity financing to raise a minimum of

QUALIFIED PERSON

The scientific and technical information in this news release has been reviewed, verified and approved by Neil Pettigrew, M.Sc., P.Geo., a Qualified Person under National Instrument 43-101, and a consultant to Nortec.

About Nortec Minerals Corp.

Nortec is a mineral exploration company that holds

On behalf of the Company,

"Derrick Weyrauch"

Chairman

info@nortecminerals.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273275