Namibia Critical Metals Inc. Announces Positive Pre-Feasibility Study for the Lofdal Heavy Rare Earths Project

Rhea-AI Summary

Namibia Critical Metals (OTCQB:NMREF) announced a positive Pre-Feasibility Study for the Lofdal Heavy Rare Earths Project dated December 3, 2025. Key Base Case metrics include after-tax NPV (5%) US$275.5M, after-tax IRR 19.0%, pre-production capex US$273.4M and total capex US$347.9M (US$57.4M contingency). The Project plans a 13-year mine life with 32 Mt Proven and Probable reserves and average annual production of 1,478 t TREO (including 119 t Dy, 17.8 t Tb, 841 t Y).

Measured & Indicated resources total 58.5 Mt at 0.16% TREO containing 4,503 t Dy2O3 and 692 t Tb2O3. A Divergent pricing case raises after-tax NPV to US$747.9M and after-tax IRR to 34.8%, showing high project sensitivity to REE pricing. The Project is in a JV with JOGMEC and holds a 25-year mining license valid to May 10, 2046.

Positive

- After-tax NPV (5%) of US$275.5M (Base Case)

- After-tax IRR of 19.0% (Base Case)

- Average annual production of 1,478 t TREO including 119 t Dy

- Measured & Indicated resources of 58.5 Mt at 0.16% TREO

- Mining license valid to May 10, 2046 and JV with JOGMEC

Negative

- Total capital cost of US$347.9M including US$57.4M contingency

- Project economics highly price-sensitive: after-tax NPV rises from US$275.5M to US$747.9M under Divergent pricing

- Capital payback period of 4.2 years (after-tax, Base Case) may be lengthy for some investors

- Average recoveries in pilot work ~55–70%, indicating metallurgical losses vs head grade

News Market Reaction

On the day this news was published, NMREF gained 0.77%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

NMREF gained 6.97% alongside mixed peer moves: NGPHF up 7.1%, CBULF up 4%, CAMZF up 0.78%, LBNKF up 0.82%, while RBMNF fell 54.52%, suggesting stock-specific factors rather than a unified sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Project economics update | Positive | +0.8% | Released positive PFS with strong NPV, IRR and 13-year mine plan. |

| Oct 29 | IR engagement | Positive | -5.8% | Hired Renmark for investor relations on a paid monthly retainer. |

| Jul 28 | Stock option grant | Negative | -8.8% | Granted 4,350,000 options at $0.105, adding potential dilution. |

| Jul 18 | IR/marketing deal | Positive | +3.9% | Engaged Proactive Investors on a 15‑month C$28,000 communications contract. |

Positive operational news often aligned with gains, while some promotional/IR updates saw mixed or negative reactions.

Over recent months, Namibia Critical Metals issued several corporate and project updates. The current PFS news highlights after-tax NPV and IRR metrics, a 13-year mine life and 32 Mt of Proven and Probable reserves at Lofdal. Earlier, the company expanded investor outreach via Proactive Investors and Renmark, with mixed share-price reactions. A mid-year stock option grant at $0.105 added potential dilution. Overall, the new PFS results build on prior technical work and licensing progress, reinforcing Lofdal’s advancement from exploration toward potential development.

Market Pulse Summary

This announcement details a positive PFS for Lofdal, outlining after-tax NPV of US$275.5M, after-tax IRR of 19.0%, a 13-year mine life and 32 Mt of Proven and Probable reserves. It builds on prior resource work showing 58.5 Mt of Measured & Indicated resources and substantial Dy/Tb content. Investors may track future updates on financing for the US$273.4M pre-production capex, project execution milestones, and how REE price assumptions evolve versus the Base and Divergent cases.

Key Terms

pre-feasibility study technical

net present value financial

internal rate of return financial

xenotime technical

flotation technical

hydrometallurgical technical

open pit mining technical

ion exchange technical

AI-generated analysis. Not financial advice.

HALIFAX, NS / ACCESS Newswire / December 3, 2025 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI)(OTCQB:NMREF) is pleased to announce the results of its Pre-Feasibility Study ("PFS") for the Lofdal Heavy Rare Earths Project "Lofdal 2B-4" ("Lofdal" or the "Project") in Namibia.

The Lofdal deposit has the potential for significant production of dysprosium ("Dy"), terbium ("Tb") and yttrium ("Y") which are the main economic drivers for the Lofdal project. The PFS presents a Base Case - representing a conservative but realistic post-normalization scenario, assuming partial easing of China's recent export bottlenecks and a Divergent Case - consistent with consensus divergence pricing logic and the geopolitical reality of prolonged export controls, slow non-Chinese separation build-out and rising strategic demand from OEMs.

The Project is being developed in joint venture with Japan Organization for Metals and Energy Security ("JOGMEC") targeting a long term, sustainable supply of heavy rare earths to Japan.

Highlights:

Metric | Base Case | Divergent Case |

Net Present Value (NPV, discount rate | Pre-tax: US After-tax: US | Pre-tax: US After-tax: US |

Internal Rate of Return (IRR) | Pre-tax: After-tax: | Pre-tax: After-tax: |

Life-of-Mine Nominal Cash Flow | Pre-tax: US After-tax: US | Pre-tax: US After-tax: US |

Pre-Production Capital Costs | US | Same as Base Case |

Total Capital Costs | US | Same as Base Case |

Capital Payback Period (after-tax) | 4.2 years | 2.75 years |

Average Annual Production | 1,478 tonnes TREO (ex La, Ce), including: 119 t Dy, 17.8 t Tb, 841 t Y | Same as Base Case |

Mine Plan | 32 million tonnes Proven and Probable Reserves | Same as Base Case |

Estimated Life of Mine | 13-year mine life | Same as Base Case |

Metric | Base Case | Divergent Case |

Rare Earth Oxide Prices Used (average Life of Mine) | Dy203:US Tb203: US Y203: US Nd203: US Pr6011: US | Dy203:US Tb203: US Y203: US Nd203: US Pr6011: US |

Basket Price (average Life of Mine pricing) | US | US |

Pricing assumptions used in this study include Base Case Y₂O₃ USD

$60 /kg and Divergence Case Y₂O₃ USD$130 /kg, together with independently benchmarked pricing for Dy₂O₃, Tb₄O₇ and Nd2O3 and Pr6O11.The Divergence Case differs from the Base Case only in pricing assumptions. Mining, processing and capital parameters are identical.

Darrin Campbell, President of Namibia Critical Metals, stated:

"Lofdal is well positioned as one of very few advanced major Dy/Tb- and Y projects outside China, with a supportive jurisdiction, a mining license, fully environmentally permitted, an excellent relationship with the communities and a key strategic JV partner (JOGMEC). The Project's economic case is now underpinned by three value pillars: Dy/Tb high-temperature magnet demand, Yttrium demand from aerospace, semiconductors and turbine industry and Nd/Pr magnet demand. This diversified critical-material exposure increases the strategic attractiveness of Lofdal for OEMs and governments."

Introduction

Location: Lofdal is located approximately 450 kilometers (km) northwest of the capital city of Windhoek and 25 km northwest of the town of Khorixas in the Kunene Region of the Republic of Namibia. The project area is linked to the regional port of Walvis Bay via 390 km of well-maintained main roads.

License: The Lofdal Project is licensed with a Mining License ("ML200") which was issued by the Ministry of Mines and Energy in May 2021 and is valid for 25 years to May 10, 2046. The Mining License was issued to the Company's

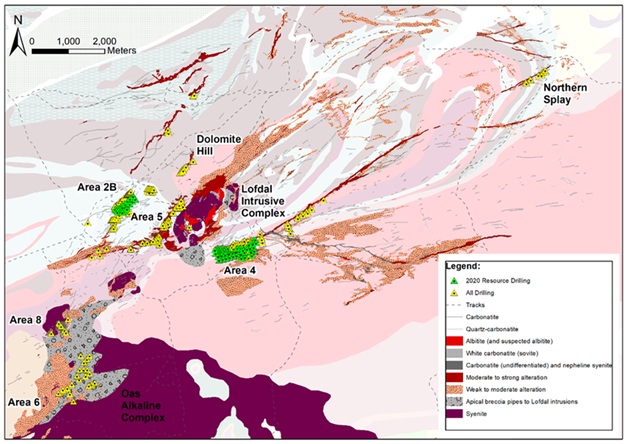

Geological setting: The Lofdal property is centered on the Neoproterozoic Lofdal Intrusive Complex associated with regional-scale occurrences of rare earth element (REE) mineralization. The REE mineralization is bound to multiple structurally-controlled zones of hydrothermal alteration, predominantly albitization and carbonatization which stretch in northeasterly directions over a prospective area of about 20 km by 10 km Figure 1).

Mineralogy: The major REE-mineral is xenotime, a heavy rare earths element (HREE[1]), phosphate, which occurs disseminated throughout all mineralized zones.

Exploration: The Company conducted extensive exploration programs over the past 15 years including geophysical surveys and drilling of a total of 58,039 meters (m) in 411 boreholes. The two mineralized zones that underly the PFS for the project "Lofdal 2B-4" are "Area 4" and "Area 2B", (Figure 1). At Area 4, the zone of mineralization has been traced for over 1,100 m at surface, where it is characterized by an intensely altered core zone of 15 m to 30 m thickness with a less altered halo of 50 m to 60 m that may extend up to 100 m in thickness. The alteration zone at Area 2B has a strike length of 600 m and its thickness ranges from 20 m to 35 m.

Regional sampling, mapping and reconnaissance drilling suggest that the HREE-mineralization extends over several kilometers in parallel structural zones with major splays forming mineralized zones such as the 4-kilometer-long zone "Area 5" in the central project area (Figure 1).

Mineral Resources: The MSA Group (Pty) Ltd ("MSA") updated the Mineral Resource Statement for the project "Lofdal 2B-4" in 2024 ("NI 43-101 Technical Report - 05 April 2024 Mineral Resource Estimate" dated May 21, 2024) with the following key results:

Combined Measured and Indicated Mineral Resources of 58.5 million tonnes at

0.16% TREO for the combined Area 4 and Area 2B deposits based on a cut-off grade of0.1% TREO (including Y2O3)Contained tonnages of Dysprosium and Terbium - the most valuable heavy rare earth elements - amount to 4,503 tonnes Dysprosium oxide and 692 tonnes Terbium oxide in the combined Measured and Indicated Resource categories;

Total Rare Earth Oxide (including Y2O3) tonnage in the combined Measured and Indicated Resource categories of 93,730 tonnes.

Table 1 Lofdal Mineral Resource Estimates (MRE) April 2024 at a

2024 MRE | |||||||

Area | Million tonnes | Grade | Content (tonnes) | ||||

(Mt) | TREO (%) | Dy2O3 (ppm) | Tb2O3 (ppm) | TREO (t) | Dy2O3 (t) | Tb2O3 (t) | |

Measured Resource Area 4 | 6.6 | 0.21 | 130 | 19 | 13,650 | 855 | 124 |

Indicated Resource Area 4 | 49.2 | 0.15 | 69 | 11 | 75,730 | 3,391 | 528 |

Indicated Resource Area 2B | 2.7 | 0.16 | 97 | 15 | 4,350 | 257 | 40 |

Total Measured & Indicated Resources | 58.5 | 0.16 | 77 | 12 | 93,730 | 4,503 | 692 |

Inferred Resource Area 4 | 10.5 | 0.14 | 58 | 9 | 14,950 | 611 | 97 |

Inferred Resource Area 2B | 4.4 | 0.15 | 75 | 13 | 6,650 | 326 | 56 |

Total Inferred Resources | 14.9 | 0.14 | 63 | 10 | 21,600 | 937 | 153 |

Notes:

All tabulated data have been rounded and as a result minor computational errors may occur.

The Mineral Resource was reported from within a Whittle optimised pit she

Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

TREO = Total Rare Earth Oxides and includes Y2O3

Mineral Resources are inclusive of those converted to Mineral Reserves.

Summary of Processing Results

Starter pit at Area 4 and bulk sample extraction

The Company developed an open pit in the central part of the Area 4 deposit. A first box cut of 60 m x 20 m to 15 m depth was excavated in 2022 and 30,000 t of material removed. A blended ore sample of 550 t was produced with a grade of

A significant extension and deepening of the open pit took place in February 2025 (Figure 2) and a total of 15,000 t of material was excavated to a depth of 17 m. A total of 500 t bulk samples from 5 different ore zones were selected and crushed and screened. Three different bulk samples were prepared representing the hanging wall zone, main ore zone and footwall zone for bulk XRT and XRF sorting tests and subsequent flotation tests.

Ore Sorting

Mineralization at Lofdal is amenable to XRT sorting by detection of higher density minerals which are co-genetic with xenotime. Results indicate that XRT sorting technology can provide significant upgrades to the run of mine ("ROM") by rejecting waste in form of albitite, gneisses, muscovite and chlorite schists.

Ore sorting tests were part of the company's value engineering during the PFS process "Lofdal 2B-4". The tested flowsheet for the PFS aimed at upgrading a low-grade stream by XRT sorting prior to flotation, with high-grade ore supplied directly to flotation.

Initial tests with TOMRA's new AI based and deep learning application OBTAIN, yielded improved XRT sorting results as compared to previous test programs. This formed the basis for bulk sample test programs carried out by Gecko Namibia with the upgraded TOMRA sorter at the Ondoto LREE Mine in northern Namibia. The pilot-scale XRT test program was conducted on about 300 tons of ROM in July-August 2025. Sorting tests were conducted separately on bulk samples from the hanging wall, the main ore zone and the footwall zone as these three zones are characterized by different host lithologies (gneisses, pegmatites, amphibolites) and mineralization pattern.

A total of 200 different test runs were conducted on a TOMRA COM Tertiary XRT at Gecko Namibia's facilities. The test work was conducted as a combination of two different image processing methods, Dual Energy and Inclusion Detection. A special Multi Density Class Model was applied to distinguish between six different sensitivities. For the inclusion detection TOMRA's deep learning-based classification CONTAINTM was tested to detect visual patterns and textures to recover finely disseminated mineralization within the low contrast Lofdal material. The test results were steadily improved through 27 test settings by systematically adapting the multivariate test principles, parameters and algorithms based on the results as the program advanced. While the nature of mineralization with fine veins of xenotime is not the ideal type of material for XRT sorting, the test results exceeded the targeted upgrade and recoveries. The overall test results on low-grade (0.10

Flotation test program

Flotation is the key step in beneficiation of Lofdal's xenotime ore. Flotation test work was carried out at SGS Lakefield and other international laboratories with over 170 individual flotation tests using several types of collectors, depressants and considered thrifting of physical flotation conditions. The Company built on SGS Lakefield's extensive experience in mineral processing of rare earth deposits. Earlier test programs compared upgrades and recoveries of XRF and XRT products through direct flotation followed by magnetic separation, and through magnetic separation followed by flotation. The test program was further amended to include flotation tests directly on the fresh, low-grade samples representing future run-of-mine grades.

The impact of high intensity conditioning ahead of flotation yielded improved flotation performance. Best flotation results regarding upgrade, recoveries and operating costs were achieved using moderate dosages of the collector Florrea 3900 and Calgon as depressant. Considering the better performing flotation tests, cleaner flotation concentrates yielded overall mass pulls of 2.7

The objective of the 2023-2024 test program was to scale up tests, including locked-cycle testing for a high level of confidence in metallurgy, and confirmation of engineering design criteria for PFS capital and operating cost estimation. The locked cycle tests were completed and confirmed a steady circuit. No significant detrimental effect was observed due to the recirculation.

A 5 tons run of mine ore sample, at head grade of

Hydrometallurgical test work and results

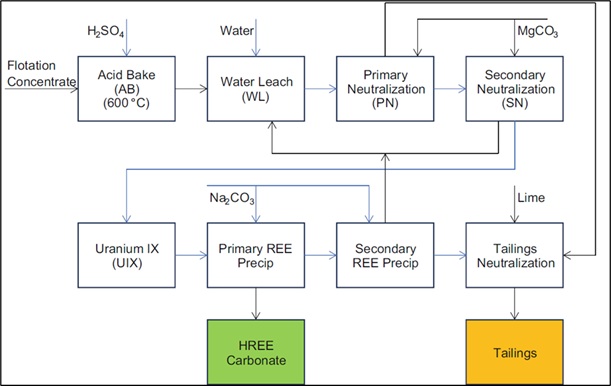

The PFS test program has shown that a simplified acid bake and liquor treatment flow sheet consisting of a high temperature acid bake, two stage (primary and secondary) impurity removal, followed by UIX and two stages (primary and secondary) of HREE carbonate precipitation is able to produce a high grade HREE carbonate. The flow sheet developed in this program (Figure 3) has eliminated several unit operations from the original flowsheet in the PEA. The removal of crude REE precipitation, re-leach and thorium solvent extraction forms a significant simplification and overall reduced reagent demand.

The following conclusions summarize key findings of the test program:

• Under optimum operating periods, continuous high (600°C) temperature sulfation in a pilot rotary kiln yielded high HREE dissolution (

• Batch tests were used to show that two stages of impurity removal using magnesium carbonate was able to remove practically all thorium, scandium, iron, aluminium and some of the uranium at minimum losses of HREE (~

• Uranium was removed by ion exchange using a conventional strong base anion resin (Puromet MTA4601PF). Uranium levels were reduced to below detection limit (0.02 mg/L U) with negligible co-extraction of HREE.

• The U IX barren liquor was used in a mini pilot plant where a HREE carbonate was produced. The circuit consisted of two stages (primary and secondary) of precipitation using sodium carbonate.

Mine Plan and Mine Schedule

The proposed mining method is conventional open pit mining. Mineralized rock and waste will be drilled, blasted, loaded with hydraulic shovels and excavators onto off-highway dump trucks, and hauled to the processing plant or designated waste rock dumps.

The pit design and production scheduling by QUBEKA Namibia is based on the mineral resource models developed by MSA, appropriately modified for mining dilution and losses. The pits are designed at 10 m benches and 2.5 m flitches where selective mining is required. The proposed mining method allows for simultaneous selective mining of ore and waste in the incremental pit phases. A mining contractor will provide the full mining services under direction from an Owners' technical services team.

Mineral Reserves for Area 4 and Area 2B are summarized in Table 3 below. The pit designs delineated total Proven and Probable Reserves of 32 Mt at

The target ROM feed is 1.10 Mt/a of high-grade material along with 1.91 Mt/a of low-grade material, for a total of 3.01 Mt/a ROM feed.

Mining involves stripping ratios for Area 4 pit of 6.4:1 and 8.7:1 for Area 2B pit for a total Life-of-Mine stripping ratio of 6.8:1, with supplemental pits improving grade continuity.

The initial Life-of-Mine for this PFS is 13 years. The overall average mining rate is approximately 20 Mt/a.

Table 2: Lofdal Mineral Reserves as of December 01st 2025

Reserve | Mineral Deposit | Tonnage | Rare Earths Grades | Contained Rare Earths Metal | ||||

LREO | HREO | TREO | LREO | HREO | TREO | |||

(Mt) | (%) | (%) | (%) | (t) | (t) | (t) | ||

Proven | Area 2B | - | - | - | - | - | - | - |

Area 4 | 6.19 | 0.068 | 0.144 | 0.211 | 4,194.0 | 8,893.2 | 13,087.1 | |

Total Proven | 6.19 | 0.068 | 0.144 | 0.211 | 4,194.0 | 8,893.2 | 13,087.1 | |

Probable | Area 2B | 1.90 | 0.075 | 0.094 | 0.169 | 1,430.3 | 1,792.8 | 3,223.1 |

Area 4 | 23.91 | 0.076 | 0.091 | 0.167 | 18,269.3 | 21,761.6 | 40,030.7 | |

Total Probable | 25.81 | 0.076 | 0.091 | 0.168 | 19,699.7 | 23,554.4 | 43,253.8 | |

Total Reserves | 32.01 | 0.075 | 0.101 | 0.176 | 23,893.7 | 32,447.5 | 56,340.9 | |

Notes on the Mineral Reserve:

Mineral Reserves are reported at a cut‑off grade of

0.10% TREO, based on a basket rare earths oxide price of US$ 86.84 /kg. Mineral Reserves are reported using a conservative basket price of USD 86.84/kg for cut-off determination; economic analysis uses independently benchmarked scenario-based pricing.Mineral Reserves are based on open‑pit mine designs with an average strip ratio of 6.8:1.

Metallurgical recovery at the hydrometallurgical plant is assumed at

62.2% for HREO and52.55% for LREO.Mass recovery for the >10mm primary crushed low-grade material is assumed at

80% .Parameters of XRT sorting are assumed at mass-pull of

25% and metal recovery of65% .The Mineral Reserve Estimate was prepared by a Qualified Person (QP) in accordance with NI43‑101 and CIM Definition Standards (2014).

Mineral Reserves are inclusive of Mineral Resources.

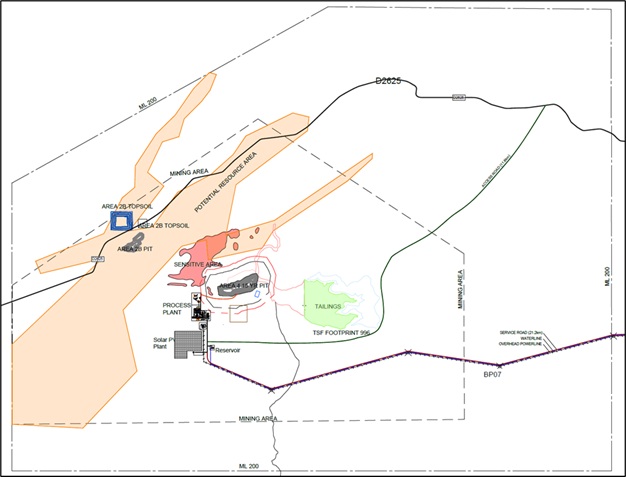

Layout and Utilities

Water supply: The planned Lofdal plant requires about 1.5 million cubic meters of water annually. The Company drilled 16 groundwater boreholes in an aquifer system around Fransfontein, located about 35 kilometers to the northeast of Lofdal. SLR Namibia conducted pump testing on 10 boreholes. Six selected high yielding boreholes have a combined 48-hour Constant Discharge Test (CDT) yield of 237 m3/h, and a recommended abstraction of 180 m3/h which translates to an annual water supply of between 1.7 Mm3 and 1.3 Mm3. CREO Engineering Solutions (CREO) estimated the required CAPEX for the abstraction, delivery and site storage infrastructure at US

Electricity supply: The Lofdal plant is expected to require approximately 94,361 MWh of electricity annually. CREO modelled the preferred bulk power supply mix consisting of grid connected power, supplied through the national power utility NamPower, supplemented by a third of the energy requirements through renewables (solar photovoltaic). The grid connection will require the construction of a new 200 km long 132 kV transmission line together with a 132/11 kV (20 MVA) main incoming substation at the project. The estimated CAPEX for the bulk power infrastructure is US

Road infrastructure: The mine will be connected to the main road network via road D2625 and a newly constructed 10 km gravel road connecting the plant area.

Plant Layout: SGS Bateman provided the detailed plant layout. The plant will consist of three main sections: the crushers and sorters, the concentrator and the refinery. The crushers and sorters will comprise ROM feed reception, low grade ore primary and secondary crushing, ore sorting and tertiary crushing while high-grade ore undergoes only primary, secondary and tertiary crushing.

The concentrator will comprise crushed ore stockpile, milling, and flotation. The flotation circuit will include roughers, cleaners, concentrate thickening and filtration, tails thickening and transfer of the tailings underflow to the tailings storage facility. The water recovered from the tailing and concentrate overflow thickeners will be pumped into the process water storage facility. The concentrate cake will be transferred to the refinery section.

The refinery section of the plant will be dedicated to the extraction, purification, and precipitation of REEs through sulphation roast, water leach, impurities removal, and REE precipitation (see Figure 3). The REE will be precipitated as a Mixed Rare Earths Carbonate and packaged for sale.

Tailings Storage Facility: Effluent streams from the above section will be pumped into the neutralization tank from where it will be transferred with the tailings to the tailings storage facility ("TSF"). The TSF footprint accommodates potential future mine life extension and long-term storage requirements.

A total of approximately 16 million tons of tailings are expected to be produced over the Project Life-of-Mine. Tailings thickened at

The TSF construction strategy includes an initial downstream raise using selected waste rock from the open pit placed during the first years of operation, followed by an upstream raising strategy to final elevation. The TSF final height is approximately 28 m, and the embankment was sized to accommodate potential future expansion inside the valley. Tailings will be discharged through spigots along the face of the embankment and side hills for pool control. Decant water will be pumped back to the processing facility from the return water dam. Tailings classify as silt with trace clay and are non-acid generating with no neutralisation potential.

A liner system is included in the PFS design to reduce seepage and water losses through the weathered foundation. Further geotechnical and hydrogeological investigations along with radionuclide testing will be required to design the most appropriate seepage mitigation measure in the next design stage and potentially reduce the requirement for a liner system while maximizing seepage recovery. The design includes a provision for monitoring instruments such as piezometers and level control system as well as dust mitigation through progressive capping of the TSF.

Capital and Operational Cost

Mining will be conducted via contractor, and all contractor capital recovery is reflected in the mining operating costs. A portion of the mining capital is for contractor mobilization, with the majority of capital applied to pit pre-stripping.

Process capital includes the process plant and ore sorting facility.

Facilities capital includes all non-process site facilities, including water and power supply, non-process site buildings, security and warehousing.

CAPEX increases reflect inflation since the 2022 PEA, expanded hydrometallurgical scope, inclusion of mining pre-strip and revised power infrastructure requirements.

Table 3: Capital Costs Summary of Lofdal PFS "Lofdal 2B-4"

Capital Costs Summary (US$) | |

Mining Capital* | |

Process Capital | |

Facilities Capital | |

Tailings Capital | |

Closure Costs | |

Sub-Total | |

Contingency | |

Total Capital Costs | |

OPEX increases from the 2022 PEA are driven by higher acid and reagent prices, diesel kiln operation and updated power tariffs.

Table 4: Operating Costs Summary of the Lofdal PFS "Lofdal 2B-4"

Operating Costs Summary (US$) | ||||

Life of Mine | Per tonne mined | Per tonne processed | Per kg TREO | |

Mining Cost | ||||

Processing | ||||

G&A | ||||

Total Operating Costs | ||||

Royalties and separation costs are based on total gross revenue.

Table 5: Royalties and Separation Costs of Lofdal PFS "Lofdal 2B-4"

Other Pricing Model Costs - Life of Mine | ||

Base Case | Divergent Case | |

Royalties and Separation Costs | ||

Market Analysis and Pricing

A price deck has been developed for the Lofdal Project based on an independent forecast provided by CRU International Limited ("CRU"), Argus Europe assessments and publicly available third-party intelligence.

The rare earth market is characterized by a bifurcation between China-domestic and ex-China prices for Nd, Pr, Dy, Tb and Y. Export controls and security-of-supply concerns are creating a distinct ex-China price regime for critical raw material deriving from sources outside China. Lofdal's future products are expected to participate in this ex-China price environment.

Divergence price trends

Export restrictions and supply strategy has created a "China price" and a higher "rest-of-world price" for the same material.

Dy/Tb

Chinese spot prices for Dy and Tb oxides (e.g., Dy oxide ~US

$240 /kg, Tb oxide~US$1,000 /kg) represent domestic or FOB China values.According to Benchmark Minerals, markets for heavy rare earths have been facing significant pressure since April 2025 with actual spot prices for ex-China supply reaching US

$900 /kg for Dy oxide and US$3,625 /kg for Tb oxide for imports into the European Union.Long-term assumptions used in recent PFS/DFS studies effectively embed an ex-China premium driven by supply-chain security (e.g. Carina uses US

$829 /kg Dy oxide and US$3,056 /kg Tb oxide).

Nd/Pr

NdPr remain global commodities with relatively tight arbitrage between China and ex-China, but the same forces (tariffs, export controls, strategic stockpiling and ESG filters) are pushing contract prices for ex-China Nd/Pr feedstock above Chinese spot prices for long-term secure supply.

This has been reinforced with the announcement of the US Department of War investing in MP Materials and establishing a floor price of US

$110 /kg for NdPr oxides, almost double the China market pricing at the time.

Yttrium

The Lofdal Mixed Rare Earths Oxide product contains about 40 to

50% Yttrium oxide.European spot prices for yttrium oxide have risen as much as 4,

400% since January 2025 up to US$270 /kg.For the medium to long term (2026-2041), the Base Case assumption is that export controls ease partially and new ex-China supply gradually ramps, resulting in an indicative yttrium oxide price range of US

$30 -80/kg (real 2025 dollars).A tight-supply case (Divergent Case), reflects prolonged export restrictions or slow non-Chinese supply growth, and places yttrium oxide in the US

$80 -150/kg band, consistent with recent ex-China price behavior.

These pricing bands are planning assumptions and do not constitute market forecasts.

The rare earth oxide pricing used in the PFS (average Life of Mine) for the three main value drivers are:

Base Case: Dy2O3 US

$663 /kg, Tb2O3 US$2,880 /kg and Y2O3 US$60 /kgDivergent Case: Dy2O3 US

$855 /kg, Tb2O3 US$3,712 /kg and Y2O3 US$130 /kg.

Y₂O₃ represents approximately 40

Economic Analysis

The economic analysis assumes that the Project will be

Mining and treatment data, capital cost estimates and operating cost estimates have been put into a Base Case and Divergent Case financial model to calculate the IRR and NPV based on calculated Project after tax cash flows. The scope of the financial model has been restricted to the Project level and as such, the effects of interest charges and financing have been excluded.

For the purposes of the PFS, the evaluation is based on

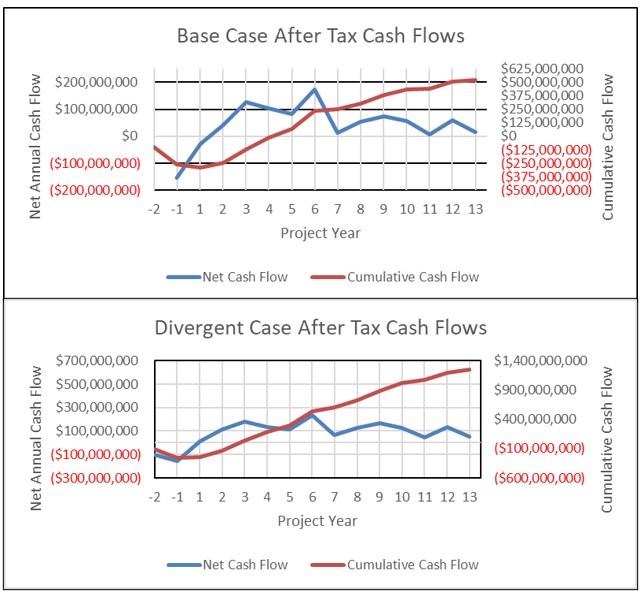

In the Base Case, the Project is anticipated to yield pre-tax IRR of

Cumulative cash flows over the 13 years mine life are: Base Case US

The Project is expected to pay back initial capital within the first 4.2 years (Base Case) and alternatively in 2.75 years (Divergent Case).

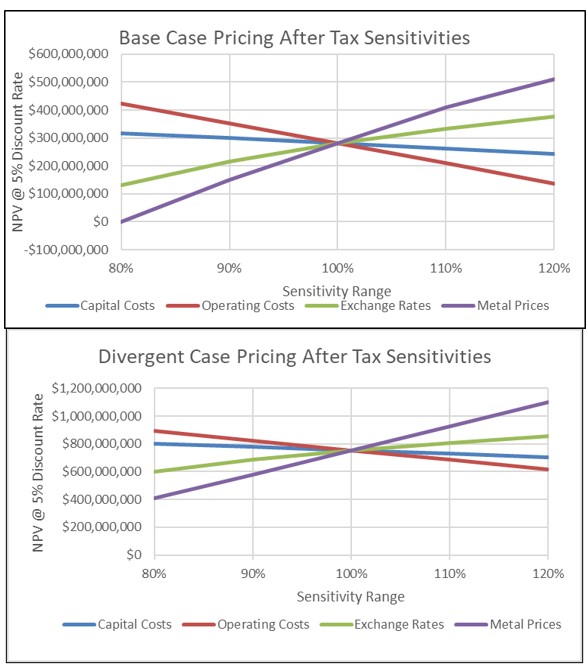

Sensitivity Analysis

Economic Sensitivities & Cash Flow Summary (After-Tax,

The Pre-Feasibility Study confirms that the Project delivers strong early cash flow, rapid capital recovery, and economic resilience under conservative pricing assumptions, with upside leverage under divergent rare earth pricing scenarios. Lofdal exhibits high sensitivity to yttrium pricing due to its HREE dominant basket.

After-Tax Cash Flow Profile

Under the Base Case, the Project generates consistent positive after-tax cash flows throughout the 13 years mine life following construction, with cumulative after-tax cash flow turning positive early in operations and increasing steadily to closure. Annual after-tax cash flows strengthen rapidly following ramp-up and remain stable across mid-mine and late-mine production.

Under the Divergent Case, reflecting higher rare earth pricing, the Project exhibits a material uplift in early-year cash flows and accelerated cumulative cash flow growth, with cumulative after-tax cash flow exceeding US

The Project achieves rapid capital payback of approximately 4.2 years after-tax in the Base Case and approximately 2.75 years in the Divergent Case, supporting strong financing attractiveness.

After-Tax Price, Cost & Exchange Rate Sensitivities

The after-tax sensitivity analysis demonstrates that:

Metal prices are the dominant value driver, with a ±

20% change generating the largest impact on NPV in both, Base and Divergent cases.Operating costs represent the second-most influential variable; however, the Project retains a positive after-tax NPV across all tested cost ranges.

Exchange rate movements provide additional economic leverage, with a weaker local currency significantly enhancing project value.

Capital costs show moderate sensitivity, confirming that the Project's value is not disproportionately dependent on Capex precision.

Importantly, under the Base Case, the Project maintains positive after-tax NPV across all tested price, cost and exchange-rate sensitivity ranges, demonstrating strong downside protection. Under the Divergent Case, after-tax NPV expands materially under higher pricing and remains highly robust under adverse cost scenarios.

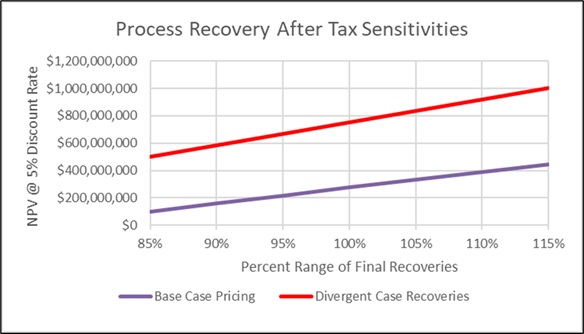

Process Recovery Sensitivity

Metallurgical recoveries represent a high impact, controllable value lever for the Project:

Under Base Case pricing, after-tax NPV increases from approximately US

$100 million at85% of expected recoveries to approximately US$440 million at115% of expected recoveries.Under Divergent Case pricing, after-tax NPV increases from approximately US

$500 million at85% of expected recoveries to approximately US$1.0 billion at115% of expected recoveries.

The linear and consistent response of NPV to recovery improvements demonstrates that ongoing metallurgical optimisation provides meaningful value upside, while the Project remains economically viable even at materially lower-than-design recoveries.

Overall Economic Interpretation

The combined cash flow and sensitivity analyses confirm that the Project:

Is financially robust under conservative assumptions;

Exhibits exceptional leverage to critical heavy rare earth pricing, particularly dysprosium, terbium and yttrium;

Benefits from strong operating margin resilience to cost pressures;

Generates early and sustained after-tax cash flow, supporting attractive project financeability; and

Provides significant embedded strategic optionality in a tightening global heavy rare earth supply environment.

Recommendations

The PFS established a two-stream model as the ideal flow sheet for Lofdal, whereby higher-grade material enters flotation directly and lower-grade material will be upgraded by XRT sorting prior to flotation. Both material streams need constant supply which is challenging by operating one or two open pits only. To increase the efficiency of the upfront processing plant, the development of additional satellite pits as swing producers is advisable. These pits can supply additional supplementary high-grade or low-grade material as required during steady operation. Therefore, resource drilling of Area 5 is recommended.

Current mine life is estimated at 13 years. The PFS made provisions for an extension of mine life by designing a significantly larger than required footprint of the tailings storage facility. Inferred Resources in the northern part of Area 2B are recommended for infill drilling to potentially add additional resources at higher resource categories. Further, reconnaissance drilling at Area 5 showed significant intercepts of HREE mineralization. With its location just to the north of the planned processing plant, it is ideally situated as potential swing producer.

QUALIFIED PERSONS AND NI43-101 TECHNICAL REPORT

A NI 43-101 compliant report entitled Pre-Feasibility Study on the Lofdal Heavy Rare Earths 2B-4 Project, Namibia ("the Report") will be filed on SEDAR within 45 days. SGS Bateman Pty Ltd. is the principal author under the supervision of Joseph M. Keane, B.S, M.S., PE Metallurgy, who is a Qualified Person in accordance with NI43-101 - Standards of Disclosure for Mineral Projects.

Sections of this press release, dealing with mining methods and mine capital and operating costs were completed by Qubeka under the supervision of William van Breugel (BaSc Hons, P.Eng.) who is a Qualified Person in accordance with NI 43-101 - Standards of Disclosure for Mineral Projects.

Sections of this press release dealing with Mineral Resources were completed by Jeremy Witley (MSc (Eng.) Pr. Sci. Nat.) of The MSA Group Pty Ltd., who is a Qualified Person in accordance with NI 43-101 - Standards of Disclosure for Mineral Projects.

Each of Joseph Keane, Jeremy Witley and William van Breugel have reviewed and approved the disclosure in this press release.

Rainer Ellmies, PhD, MScGeol, EurGeol, AusIMM and Vice President of Namibia Critical Metals Inc., is the Company's Qualified Person and has reviewed and approved the geological data in this press release.

About Namibia Critical Metals Inc.

NCMI is developing the Tier-1 Heavy Rare Earth Project, Lofdal, a globally significant deposit of the heavy rare earth metals dysprosium and terbium. Demand for these critical metals used in permanent magnets for electric vehicles, wind turbines and other electronics is driven by innovations linked to energy and technology transformations. The geopolitical risks associated with sourcing many of these metals have become a repeated concern for manufacturers and end users. Namibia is a proven and stable mining jurisdiction.

The Lofdal Project is fully permitted with a 25-year Mining License and is under a Joint Venture agreement with Japan Organization for Metals and Energy Security (JOGMEC).

About Japan Organization for Metals and Energy Security (JOGMEC) and the JV

JOGMEC is a Japanese government independent administrative agency which seeks to secure stable resource supplies for Japan. JOGMEC has a strong reputation as a long term, strategic partner in mineral projects globally. JOGMEC facilitates opportunities with Japanese private companies to secure supplies of natural resources for the benefit of the country's economic development.

Rare earth elements are of critical importance to Japanese industrial interests and JOGMEC has extensive experience with all aspects of the sector. JOGMEC provided Lynas with USD

In March 2025 JOGMEC announced a partnership with Iwatani Corporation to invest 110 million euros in Carester's heavy rare earth separation plant, Caremag, located at Lacq, France.

Namibia Critical Metals owns a

To date, JOGMEC has completed Term 2 and earned a

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Namibia Critical Metals Inc.

Darrin Campbell, President

Tel: +01 (902) 835-8760

Email: Info@NamibiaCMI.com Web site: www.NamibiaCriticalMetals.com

Renmark Financial Communications Inc.

Preston Conable: pconable@renmarkfinancial.com

Tel.: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. The Forward-Looking Statements in this news release relate to, among other things; the estimation of Mineral Resources and Mineral Reserves and the realization of such mineral estimates; the statements under "Lofdal PFS Highlights" and the other results of the PFS discussed in this news release, including, without limitation, project economics, financial and operational parameters such as expected throughput, production, processing methods, cash costs, operating costs, other costs, capital expenditures, cash flow, NPV, IRR, payback period, life of mine and REE price forecasts These statements are only predictions. Forward-looking information is based on the opinions and estimates of management and the QP's at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

[1] Heavy Rare Earth Elements (HREE) as used in all Company presentations comprise europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu) and includes yttrium (Y). Light Rare Earth Elements (LREE) comprise lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd) and samarium (Sm). "TREO" refers to Total Rare Earth Oxides plus yttrium oxide; "HREO" refers to Heavy Rare Earth Oxides plus yttrium oxide; "LREO" refers to Light Rare Earth Oxides

SOURCE: Namibia Critical Metals Inc.

View the original press release on ACCESS Newswire