NETSOL Technologies launches Check AI: An AI-native credit decisioning engine

Rhea-AI Summary

NETSOL Technologies (Nasdaq: NTWK) launched Check AI, an AI-native credit decisioning engine integrated into its Transcend Finance platform on October 8, 2025. Check AI automates data collection, document processing and in-depth financial analysis to speed underwriting, generate AI-driven research reports and suggest optimized finance structures.

The system uses deep reasoning, intelligent automation and agentic workflows with a human-in-the-loop chat interface to support oversight, explainability and regulatory compliance. NETSOL will demo Check AI at the Auto Finance Summit in Las Vegas, October 15–17, 2025 (Booth 132).

Positive

- None.

Negative

- None.

News Market Reaction

On the day this news was published, NTWK gained 0.43%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

ENCINO, Calif., Oct. 08, 2025 (GLOBE NEWSWIRE) -- NETSOL Technologies, Inc. (Nasdaq: NTWK), a provider of AI-powered solutions and services enabling OEMs, dealerships and financial institutions to sell, finance and lease assets, announced the launch of Check AI – its next-generation AI-powered credit decisioning engine designed to revolutionize the credit underwriting process.

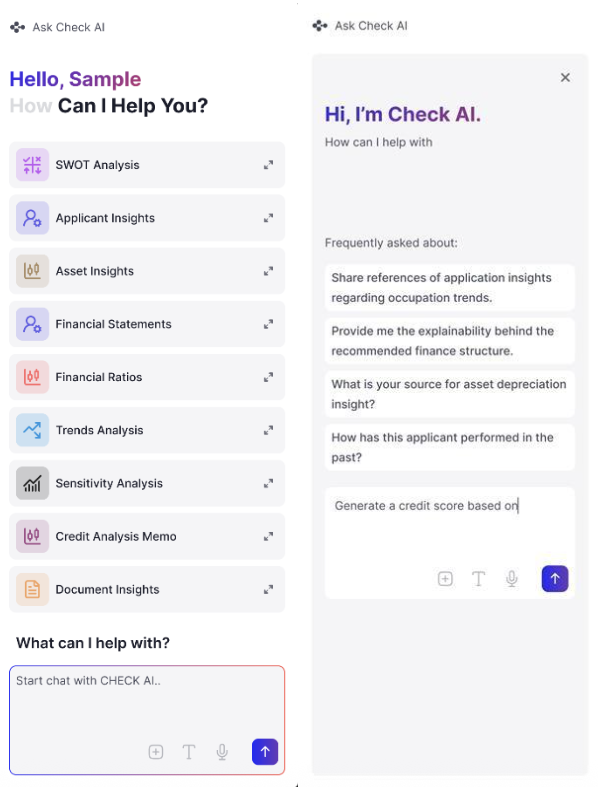

Built as an AI-native solution and part of the company’s Transcend Finance platform, Check AI streamlines and enhances the credit evaluation lifecycle by automating manual tasks, accelerating decision times and improving underwriting accuracy. From gathering data across multiple sources to processing documents and performing in-depth financial analysis, Check AI empowers credit and funding analysts to work smarter, faster and with greater precision.

At the heart of Check AI is a powerful combination of deep reasoning, intelligent automation and agentic workflows – enabling the system to turn data into actionable credit decisions in real-time. Unlike traditional decisioning tools, Check AI doesn’t just aggregate data; it interprets it. One of its standout features is the ability to generate comprehensive, AI-driven research reports. These reports go far beyond surface-level insights, suggesting optimized finance structures, trend forecasting and risk profiling – synthesized from diverse inputs including financial statements, credit histories, market indicators and more.

While Check AI automates and accelerates underwriting, it also embraces a human-in-the-loop approach, ensuring critical oversight at every stage of the decision-making process. This safeguards against bias, supports regulatory compliance and maintains high levels of accuracy and fairness. Through an intuitive chat interface, analysts can interact directly with the AI, asking questions, reviewing insights and refining outcomes in real-time.

According to a Rudder Analytics article from May 23, 2025, using AI in credit processing decisions can reduce credit approval cycles by up to

“At NETSOL, we’ve always believed in building technology that doesn’t just digitize, but transforms,” said Naeem Ghauri, Co-Founder and President of NETSOL Technologies Inc. “With the launch of Check AI, we’re bringing a powerful, AI-native solution to one of the most critical areas of the financial services industry: credit decisioning.”

“Our goal was to rethink the underwriting process from the ground up, using artificial intelligence not as an add-on, but as the engine that drives smarter, faster and more informed decisions,” he further stated. “Check AI is the result of that vision to help institutions unlock new levels of efficiency, accuracy and agility. This isn’t just about accelerating workflows – it’s about fundamentally changing how we evaluate risk and make decisions in a data-driven world. Check AI will deliver measurable efficiencies and qualitative gains. It will enhance the credit underwriters’ ability to make better credit decisions – making it a potential game changer.”

“What makes this product truly stand out is its human-in-the-loop architecture,” said Kamran Khalid, Chief Product and Delivery Officer at NETSOL Technologies Inc. “While we’ve automated large parts of the research and analysis process, we’ve also ensured that human judgment and oversight remain central to the system, because transparency, explainability, fairness and compliance matter just as much as speed.”

“Built as part of our Transcend Finance platform, Check AI empowers financial institutions to move from reactive assessments to predictive, insight-driven lending, seamlessly connecting with other components to create a unified decisioning ecosystem,” he added. “As companies around the world seek smarter ways to handle risk, streamline credit operations and serve customers faster, Check AI positions NETSOL as a technology partner they can trust – not just for today’s challenges, but for the future of lending.”

NETSOL will be demonstrating Check AI at the Auto Finance Summit in Las Vegas from October 15–17, 2025, at Booth 132.

About NETSOL Technologies

NETSOL Technologies delivers state-of-the-art solutions for the asset finance and leasing industry, serving automotive and equipment OEMs, auto captives and financial institutions across over 30 countries. Since its inception in 1996, NETSOL has been at the cutting edge of technology, pioneering innovations with its asset finance solutions and leveraging advanced AI and cloud services to meet the complex needs of the global market. Renowned for its deep industry expertise, customer-centric approach and commitment to excellence, NETSOL fosters strong partnerships with its clients, ensuring their success in an ever-evolving landscape. With a rich history of innovation, ethical business practices and a focus on sustainability, NETSOL is dedicated to empowering businesses worldwide, securing its position as the trusted partner for leading firms around the globe.

Forward-Looking Statements

This press release may contain forward-looking statements relating to the development of the Company's products and services and future operation results, including statements regarding the Company that are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. The words “expects,” “anticipates,” variations of such words, and similar expressions, identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, but their absence does not mean that the statement is not forward-looking. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Factors that could affect the Company's actual results include the progress and costs of the development of products and services and the timing of the market acceptance. The subject Companies expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in the company's expectations with regard thereto or any change in events, conditions or circumstances upon which any statement is based.

Investor Relations Contact:

Investor Relations

(818) 222-9195

investors@netsoltech.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fdcdaaaf-e5f4-4d2d-a4bf-d9ba30afd88f.