Nova’s RPM North Drilling Confirms Further Resource Upside with East Extension Discovery

Rhea-AI Summary

Nova (NASDAQ: NVA) reported 2025 diamond‑core results from the RPM North deposit at the Estelle project (Jan 7, 2026), confirming broad near‑surface gold mineralization and a new eastern strike extension that is open along strike.

Key intercepts include RPM-080: 180m @ 0.7 g/t Au from 4m (incl. 108m @ 1.1 g/t; 2m @ 19.7 g/t), RPM-078: 162m @ 1.0 g/t Au from 3m (incl. 54m @ 1.6 g/t), RPM-068: 167m @ 0.7 g/t Au from 187m, and RPM-070: 165m @ 0.6 g/t Au from 3m. Results are planned to be incorporated into an updated Mineral Resource Estimate to support the Feasibility Study, while metallurgical, mining and optimization studies continue.

Positive

- RPM-080: 180m @ 0.7 g/t Au from 4m (includes 2m @ 19.7 g/t)

- RPM-078: 162m @ 1.0 g/t Au from 3m (includes 54m @ 1.6 g/t)

- Multiple long, near‑surface intercepts support eastern resource upside

- Ongoing FS studies: metallurgical, mining, and optimization work

Negative

- One hole (RPM-076) abandoned at 37m due to incorrect dip

- Further assays and surface sample results remain pending before MRE

Key Figures

Market Reality Check

Peers on Argus

Peers in Other Industrial Metals & Mining mostly showed gains, with names like LGO up 4.39% and ATLX up 3.6%, and scanner activity in WWR up 10.05%, but the momentum scanner did not flag a coordinated sector move tied to this stock.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Mon 05 | Project update | Positive | +8.1% | Clarified antimony discussions and highlighted US$43.4M DoD support. |

| Mon 22 | Equity offering close | Negative | +6.0% | Closed ADS offering raising about $20M under Form F-3 shelf. |

| Thu 18 | Equity offering pricing | Negative | -17.7% | Priced ADS offering at $6.83 per ADS for $20M gross. |

| Mon 08 | Investor outreach | Neutral | -12.1% | CEO webinar and conference presentations on Estelle project. |

| Tue 28 | Antimony development | Positive | +0.4% | Commenced key mining and processing equipment procurement. |

Recent news often prompted significant moves, with a mix of aligned and divergent reactions; capital raises and corporate communication sometimes saw sharp downside or upside swings.

Over the last few months, Nova reported multiple milestones around its Estelle Gold and Critical Minerals Project and antimony strategy. A corporate update on Pakistani antimony discussions on Jan 05, 2026 saw a 8.13% gain. December 2025 featured an underwritten ADS offering priced at $6.83 for about $20,000,000 gross proceeds, with reactions of 6.04% and -17.69% over two related offering announcements. Investor outreach via conferences and equipment procurement for starter antimony operations generated mixed but generally smaller price moves. Today’s drilling news adds to this sequence of project-focused updates.

Market Pulse Summary

This announcement underscores continued progress at Estelle, with the 2025 drill program at RPM North confirming broad gold mineralization and an eastern extension that may support future resource upgrades and the planned Feasibility Study. The update fits within a broader sequence of project and antimony development milestones, including recent funding and equipment procurement. Investors may watch upcoming RPM Valley results, the updated Mineral Resource Estimate, and ongoing technical studies for further clarity on project scale and development timing.

Key Terms

feasibility study technical

mineral resource estimate technical

qualified person regulatory

fire assay technical

icp-ms technical

AI-generated analysis. Not financial advice.

Anchorage Alaska, Jan. 07, 2026 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA) (ASX: NVA) (FRA: QM3) ) is pleased to announce further broad, near-surface gold results from its RPM North deposit, within the Company's flagship Estelle Gold and Critical Minerals Project, located in the prolific Tintina Gold Belt in Alaska.

Highlights

- 2025 drilling extends the halo around the high-grade core zone at RPM North with further broad intercepts and a new eastern discovery. RPM Valley results from the high-grade zone expected shortly.

- Broad near-surface gold intersections continue at RPM North, with the 2025 drill program confirming the eastern strike extension and infill results expected to support potential upgrades to the existing Measured and Indicated Mineral Resources at the main deposit, in support of the Feasibility Study (FS). Significant results include (Table 1, and Figures 3 and 5):

- RPM-080

- 180m @ 0.7 g/t Au from 4m, including;

- 108m @ 1.1 g/t Au from 4m

- 27m @ 2.5 g/t Au from 11m, and

- 7m @ 8.1 g/t Au from 11m

- 2m @ 19.7g/t Au from 15m

- RPM-078

- 162m @ 1.0 g/t Au from 3m including;

- 54m @ 1.6 g/t Au from 109m

- 7m @ 6.6 g/t Au from 147m, and

- 2m @ 15.1 g/t Au from 147m

- RPM-068

- 167m @ 0.7 g/t Au from 187m, including;

- 123m @ 0.9 g/t Au from 201m

- 75m @ 1.1 g/t Au from 242m

- RPM-070

- 165m @ 0.6 g/t Au from 3m

- These strong results follow previous drilling and support the continuity of mineralization to the east, highlighting potential resource upside, where earlier drilling (RPM-004) intersected 259m @ 0.5 g/t Au from surface (ASX Announcement: 18 October 2021).

- To view a commentary video from Nova’s CEO, Christopher Gerteisen, discussing the significance of these latest drill results, please click here.

- Additional drill results will be released once received and reviewed under Nova’s QA/QC procedures, after which an updated Mineral Resource Estimate (MRE) will incorporate results from the 2023–2025 drill programs.

- FS-level studies are ongoing, with METS Engineering undertaking additional metallurgical test work to build on the high gold recoveries achieved at RPM to date (ASX Announcement: 5 August 2025), Rough Stock Mining is conducting mining studies, and Whittle Consulting is completing optimization studies.

- Results from the extensive soil and rock chip surface samples taken from across the project area in 2025 will also be reported once received and processed.

Nova CEO, Mr Christopher Gerteisen, commented:

“The latest drilling results at RPM North are excellent and importantly, support the continuity of mineralization across the deposit and indicate that a zone of further mineralization extends to the east, which remains open along strike. This eastern extension has the potential to significantly increase the resource at RPM and will be a focus of the 2026 RPM resource drilling program.

RPM continues to demonstrate the exciting potential of Estelle as a future, tier-one North American gold project. We plan to build on the successes achieved to date, with further exploration aimed at identifying additional mineralization in 2026. All results will be incorporated into an updated resource estimate for the upcoming FS.

“Technical studies and optimization work are progressing to advance the project towards commercial production, and we will keep shareholders informed as relevant studies are completed to realize further value from the Estelle Gold and Critical Minerals Project.”

2025 RPM North Drilling Summary

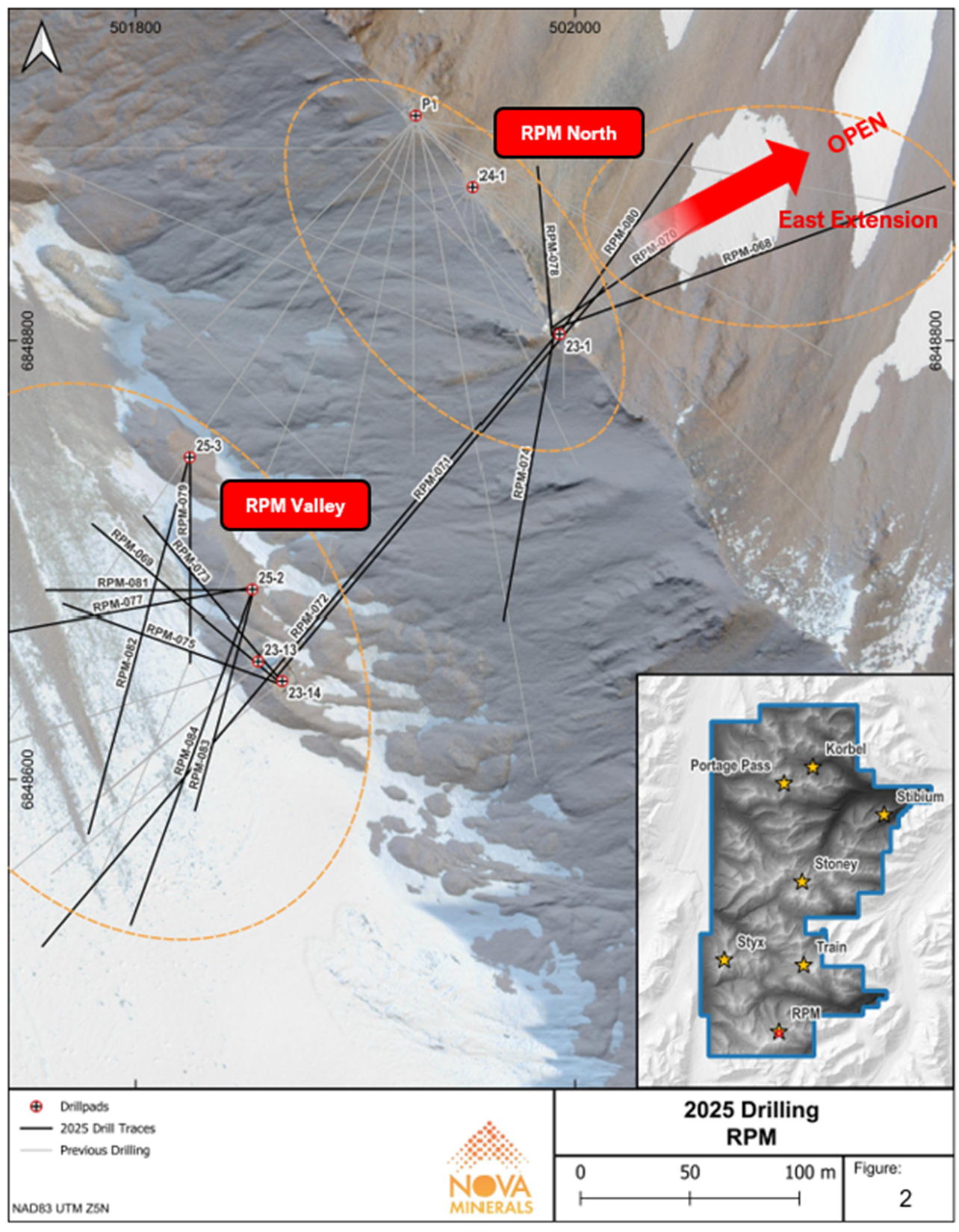

A total of seven diamond core holes were drilled at RPM North in 2025, designed to:

• Follow-up previous drilling to the East, where hole RPM-004 intersected 259m @ 0.5 g/t Au from surface (ASX Announcement: 18 October 2021)

• Conduct infill drilling at the main RPM North deposit to increase resource confidence

• Add definition to the southern boundary of the ore zone

• Test the connection with RPM Valley to the west

The latest diamond core drill results continue to increase resource confidence at RPM North, as well as adding new resource potential to the east. Holes RPM-068, RPM-070, and RPM-080 all intersected approximately 20m or so of granodiorite before transitioning to hornfels predominantly for the remainder. Mineralization occurs within sheeted to stockwork quartz and quartz-tourmaline veins. A large portion of these holes exhibited moderate to strong fractures with clay gouge and healed brecciated zones. These fractured zones contain moderate to strong argillic alteration. Hole RPM-080 had a high-grade intersection of 19.7 g/t Au from 15.2m to 17.6m, which can be attributed to the patchy and disseminated arsenpyrite shown in the two photos below.

Figure: RPM North hole RPM-080 2.4m @ 19.7g/t Au from 15.2m

Hole RPM-074 tested the southwestern extension of the mineralized intrusive and intersected hornfels at approximately 80m.

Hole RPM-076 was abandoned at 37m due to being set at the wrong dip, it was redrilled as hole RPM-078, which was designed to provide infill to the main deposit. The hole was collared in granodiorite and reached the northern contact with hornfels at approximately 125m, which remained the dominant lithology to the end of the hole.

RPM-072 was designed to test the connection between RPM North and RPM Valley and will be presented with the Valley results.

Detailed structural mapping, geophysical surveying, and geochemical sampling were conducted to vector towards the source intrusive. RPM North has exciting resource upside to the east, where drill holes RPM-004, RPM-068, and RPM-070 show extensive intervals of moderate-grade gold hosted in the Kahiltna flysch sedimentary rocks.

Figure 2: RPM plan view with all drill holes to date – Black drill traces represent the 2025 drill holes

Figure 3: RPM North Section RPM-068 and RPM-070 (62.5 azi)

Figure 4: RPM North RPM-078 (155 azi)

Figure 5: RPM North RPM-080 (36 azi)

Table :1 Significant intercepts

| Hole_ID | From (m) | To (m) | Interval (m) | Au g/t |

| RPM-068 | 4 | 186 | 182 | 0.5 |

| Including | 132 | 172 | 39 | 1.0 |

| 124 | 186 | 62 | 0.8 | |

| 132 | 143 | 11 | 1.5 | |

| 187 | 354 | 167 | 0.7 | |

| And | 201 | 325 | 123 | 0.9 |

| Including | 242 | 317 | 75 | 1.1 |

| 253 | 296 | 44 | 1.5 | |

| 261 | 278 | 18 | 2.0 | |

| 207 | 225 | 18 | 1.0 | |

| 132 | 143 | 11 | 1.5 | |

| RPM-070 | 3 | 168 | 165 | 0.6 |

| Including | 75 | 98 | 23 | 0.8 |

| 107 | 144 | 37 | 0.8 | |

| 118 | 135 | 17 | 1.0 | |

| 129 | 135 | 6 | 1.6 | |

| And | 189 | 252 | 64 | 0.4 |

| And | 272 | 357 | 85 | 0.5 |

| RPM-074 | 23 | 43 | 20 | 0.9 |

| RPM-078 | 3 | 165 | 162 | 1.0 |

| Including | 19 | 32 | 12 | 1.2 |

| 43 | 77 | 34 | 1.0 | |

| 52 | 67 | 14 | 1.7 | |

| 25 | 32 | 6 | 1.9 | |

| 109 | 162 | 54 | 1.6 | |

| 130 | 135 | 5 | 2.2 | |

| 142 | 162 | 20 | 2.5 | |

| 147 | 154 | 7 | 6.5 | |

| 147 | 150 | 2 | 15.1 | |

| RPM-080 | 4 | 184 | 180 | 0.7 |

| Including | 4 | 111 | 108 | 1.1 |

| 11 | 38 | 27 | 2.5 | |

| 11 | 18 | 7 | 8.1 | |

| 15 | 18 | 2 | 19.7 | |

| 91 | 107 | 16 | 1.2 |

Table 2: Drill hole details

| Hole_ID | Easting | Northing | Elev (m) | EOH (m) | Azi | Dip | Zone | Assay Results | |

| RPM-068 | 501991 | 6848806 | 1768 | 379 | 70 | -60 | RPM North | ASX: 7/1/26 | |

| RPM-070 | 501990 | 6848806 | 1769 | 357 | 55 | -70 | RPM North | ASX: 7/1/26 | |

| RPM-072 | 501992 | 6848804 | 1769 | 568 | 220 | -50 | RPM Valley | Not released | |

| RPM-074 | 501991 | 6848805 | 1770 | 191 | 190 | -45 | RPM North | ASX: 7/1/26 | |

| RPM-076 | 501989 | 6848803 | 1770 | 37 | 355 | -55 | RPM North | ASX: 7/1/26 | |

| RPM-078 | 501990 | 6848803 | 1770 | 183 | 355 | -65 | RPM North | ASX: 7/1/26 | |

| RPM-080 | 501993 | 6848804 | 1770 | 184 | 35 | -55 | RPM North | ASX: 7/1/26 | |

Upcoming Milestones

- RPM Valley, Korbel, and Stibium drill results

- Further results and potential new discoveries from the 2025 surface exploration mapping and sampling program

- Material PFS test-work results as they become available

- Updated MRE

- Winter trail mobilization of heavy equipment

- Airborne geophysical surveys to commence in the spring of 2026

- Antimony phase 1 project updates

- Metallurgical test work ongoing

- Environmental test work ongoing

- West Susitna access road updates

Qualified Persons

Vannu Khounphakdee, Professional Geologist and member of Australian Institute of Geoscientists contracted by Nova Minerals to provide geologic consulting services. Mr. Khounphakdee holds a Master of Science in Mine Geology and Engineering. He is a qualified person with at least 5 years experience with this type of project. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Khounphakdee fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for data QA/QC checks relevant to this announcement.

Hans Hoffman is a State of Alaska Certified Professional Geologist contracted by Nova Minerals to provide geologic consulting services. Mr. Hoffman is a member of the American Institute of Professional Geologists and holds a Bachelor of Science degree in Geological Engineering with a double major in Geology and Geophysics. He is a qualified person with at least 5 years of experience with these types of projects. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Hoffman fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for the technical information presented in this announcement.

Christopher Gerteisen, Chief Executive Officer of Nova Minerals, is a Professional Geologist and member of Australian Institute of Geoscientists, and has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a "qualified person" for the purposes of SEC Regulation S-K 1300.

Data Verification

For the 2025 diamond core drilling program, core samples were cut in half and crushed to achieve >

ALS is a certified commercial laboratory and is independent of Nova Minerals. Samples are tested for gold using ALS Fire Assay Au-ICP21 technique. This technique has a lower detection limit of 0.001 g/t with an upper detection limit of 10 g/t. If samples have grades in excess of 10 g/t then Au-GRA21 is used to determine the over detect limit. Au-GRA21 has a detection limit of 0.05 g/t and an upper limit of 10,000 g/t. Four acid digestion with ICP-MS finish (ME-MS61) was used to evaluate 48 different elements.

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The

Further discussion and analysis of the Estelle Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” "will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Investor Relations:

Dave Gentry, CEO

RedChip Companies, Inc.

Phone: 1-407-644-4256

Email: NVA@redchip.com

Nova Minerals:

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 196