Oak View Bankshares, Inc. Announces Second Quarter Earnings

Rhea-AI Summary

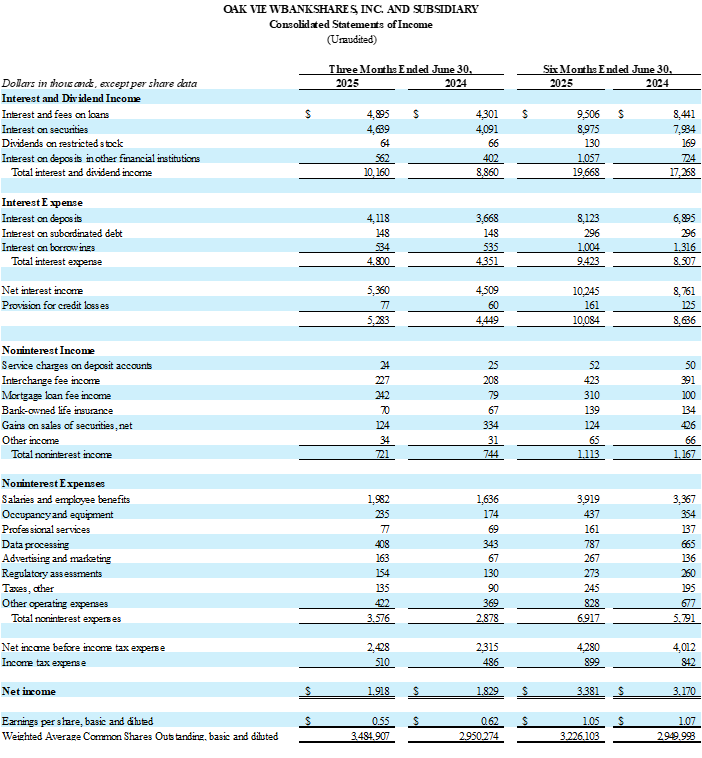

Oak View Bankshares (OTCID:OAKV) reported strong Q2 2025 financial results with net income of $1.9 million, up 4.9% from Q2 2024. The company completed a significant private placement of 558,227 shares at $14.00 per share, raising $7.8 million in gross proceeds.

Key metrics include: total assets of $773.0 million (up $78.6M from Dec 2024), total loans of $334.8 million (up $13.8M), and total deposits of $644.6 million (up $55.8M). The bank maintains strong regulatory capital with a total capital ratio of 18.5% and robust liquidity of $440.2 million in available liquid assets.

The net interest margin was 2.96% for Q2 2025, with net interest income before provision for credit losses at $5.4 million. Asset quality remains outstanding with an allowance for credit losses at 0.94% of total loans.

Positive

- Net income increased by 4.9% YoY to $1.9 million in Q2 2025

- Successful private placement raised $7.8 million in gross proceeds

- Strong regulatory capital with total capital ratio at 18.5%

- Robust liquidity position with $440.2 million in available liquid assets

- Total deposits grew by $55.8 million to $644.6 million

- Outstanding asset quality maintained

- Mortgage loan fee income increased by 206.3% YoY

Negative

- Return on average assets declined to 1.0% from 1.2% YoY

- Return on average equity decreased to 16.6% from 21.7% YoY

- Net interest margin slightly decreased to 2.96% from 2.99% YoY

- Noninterest expenses increased 24.2% YoY

- Accumulated other comprehensive loss increased to $3.6 million from $2.5 million

News Market Reaction

On the day this news was published, OAKV declined 0.36%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

WARRENTON, VA / ACCESS Newswire / July 30, 2025 / Oak View Bankshares, Inc. (the "Company") (OTCID:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of

Basic and diluted earnings per share were

Michael Ewing, CEO and Chairman of the Board, said, "We are pleased with our second quarter results. Your talented and committed team continues to win deposit and lending share and produce compelling, durable returns on the capital entrusted to us. As always, our strong financial performance reflects our unwavering commitment to striking the optimal balance among safety and soundness, profitability, and growth. Your Company's future is bright."

Selected Highlights:

On April 2, 2025, the Company announced the completion of a private placement of 558,227 shares of common stock at a price of

$14.00 per share. Gross proceeds from the private placement totaled$7.8 million , which was used for general corporate purposes.Return on average assets was

1.0% and return on average equity was16.6% for the quarter ended June 30, 2025, compared to1.2% and21.7% , respectively, for the quarter ended June 30, 2024. Return on averageassets was

0.9% and return on average equity was16.0% for the six months ended June 30, 2025, comparedto

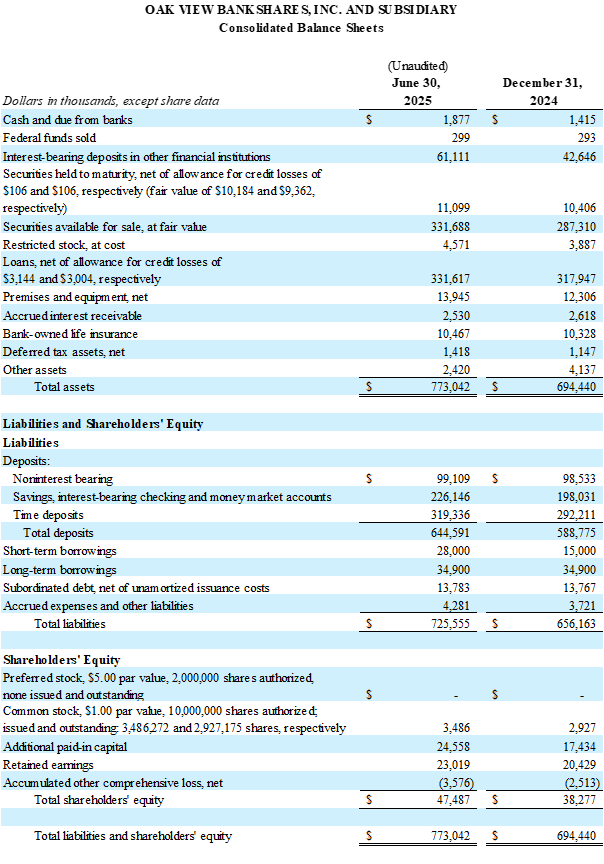

1.0% and19.2% , respectively, for the six months ended June 30, 2024.Total assets were

$773.0 million on June 30, 2025, compared to$694.4 million on December 31, 2024, an increase of$78.6 million .Total loans were

$334.8 million on June 30, 2025, compared to$321.0 million on December 31, 2024, an increase of$13.8 million .The total amortized cost of debt securities was

$342.9 million on June 30, 2025, compared to$297.8 million on December 31, 2024, an increase of$45.1 million .Total deposits were

$644.6 million on June 30, 2025, compared to$588.8 million on December 31, 2024, an increase of$55.8 million .

Asset quality continues to be outstanding.

Liquidity remains strong with cash, unencumbered securities available for sale, and available secured and unsecured borrowing capacity totaling

$440.2 million as of June 30, 2025, compared to$384.8 million as of December 31, 2024.Regulatory capital remains strong with the Bank's ratios exceeding the "well capitalized" thresholds in all categories, with total capital ratio at

18.5% , common equity tier 1 capital ratio at17.6% , tier 1 capital ratio at15.60% and leverage ratio at8.5% .

Net Interest Income

The net interest margin was

The net interest margin was

Noninterest Income

Noninterest income was

Noninterest income was

Other significant changes in noninterest income for the quarter and six months ended June 30, 2025, and 2024 were the increase in interchange fee income of

Noninterest Expense

Noninterest expense was

Noninterest income was

Liquidity

Liquidity remains exceptionally strong with

The Company's deposits proved to be stable with core deposits, which are defined as total deposits excluding brokered deposits, of

Asset Quality

The allowance for credit losses related to the loan portfolio was

The provision for credit losses for the quarter ended June 30, 2025, and 2024 was

The provision for credit losses for the six months ended June 30, 2025, and 2024 was

Shareholders' Equity

Shareholders' equity was

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

Cautionary Note Regarding Forward-Looking Statements

Any statements in this release about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as "may," "should," "could," "would," "predict," "potential," "believe," "likely," "expect," "anticipate," "seek," "estimate," "intend," "plan," "project" and similar expressions. Accordingly, these statements involve estimates, assumptions, and uncertainties, and actual results may differ materially from those expressed in such statements. The following factors could cause the Company's actual results to differ materially from those projected in the forward-looking statements made in this document: changes in assumptions underlying the establishment of allowances for credit losses, and other estimates; the risks of changes in interest rates on levels, composition and costs of deposits, loan demand, and the values and liquidity of loan collateral, securities, and interest sensitive assets and liabilities; the effects of future economic, business and market conditions; legislative and regulatory changes, including changes in banking, securities, and tax laws and regulations and their application by our regulators; the Company's ability to maintain adequate liquidity by retaining deposit customers and secondary funding sources, especially if the Company's or banking industry's reputation becomes damaged; computer systems and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions despite security measures implemented by the Company; risks inherent in making loans, such as repayment risks and fluctuating collateral values; governmental monetary and fiscal policies; changes in accounting policies, rules and practices; competition with other banks and financial institutions, and companies outside of the banking industry, including companies that have substantially greater access to capital and other resources; demand, development and acceptance of new products and services; problems with technology utilized by the Company; changing trends in customer profiles and behavior; success of acquisitions and operating initiatives, changes in business strategy or development of plans, and management of growth; reliance on senior management, including the ability to attract and retain key personnel; and inadequate design or circumvention of disclosure controls and procedures or internal controls. These factors could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by the Company, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for the Company to predict which will arise. In addition, the Company cannot assess the impact of each factor on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

SOURCE: Oak View Bankshares, Inc.

View the original press release on ACCESS Newswire