Orogen Royalties Creates a Royalty on the Camelot Copper-Gold Project

Orogen Royalties (OTC:OGNNF) has signed a purchase and sale agreement with Prospect Ridge Resources for the Camelot copper-gold porphyry project in British Columbia. Under the agreement, Prospect Ridge will acquire 100% interest by paying C$200,000 in cash or shares over six months.

Orogen will retain a 1% NSR royalty with the right to acquire an additional 0.25% NSR from an underlying vendor. The project features a permitted drill target with anomalous copper in soils, magnetic high, and strong chargeability anomaly. Prospect Ridge plans to drill the target in 2025.

Orogen Royalties (OTC:OGNNF) ha firmato un accordo di compravendita con Prospect Ridge Resources per il progetto porfirico di rame-oro Camelot in British Columbia. Con l'accordo, Prospect Ridge acquisirà il 100% dell'interesse versando C$200.000 in contanti o azioni entro sei mesi.

Orogen manterrà una royalty NSR dell'1% e avrà il diritto di acquistare ulteriori 0,25% NSR da un venditore sottostante. Il progetto include un obiettivo di perforazione autorizzato caratterizzato da anomalie di rame nei suoli, un picco magnetico e una forte anomalia di carica. Prospect Ridge intende perforare l'obiettivo nel 2025.

Orogen Royalties (OTC:OGNNF) ha firmado un acuerdo de compraventa con Prospect Ridge Resources por el proyecto pórfido de cobre-oro Camelot en Columbia Británica. Según el acuerdo, Prospect Ridge adquirirá el 100% del interés pagando C$200.000 en efectivo o acciones en un plazo de seis meses.

Orogen conservará una regalía NSR del 1% con derecho a comprar un 0,25% NSR adicional de un vendedor subyacente. El proyecto cuenta con un objetivo de perforación permitido con anomalías de cobre en suelos, alta magnitud magnética y una fuerte anomalía de cargabilidad. Prospect Ridge planea perforar el objetivo en 2025.

Orogen Royalties (OTC:OGNNF)는 브리티시컬럼비아의 카멜롯 구리-금 포피리 프로젝트에 대해 Prospect Ridge Resources와 매매계약을 체결했습니다. 계약에 따라 Prospect Ridge는 6개월 이내에 C$200,000를 현금 또는 주식으로 지급하여 100% 지분을 취득합니다.

Orogen은 1% NSR 로열티를 유지하며, 추가로 0.25% NSR을 기초 공급업체로부터 매입할 권리를 보유합니다. 해당 프로젝트는 토양 내 구리 이상값, 높은 자기값, 강한 전하응답 이상을 보이는 허가된 시추 목표를 포함하고 있습니다. Prospect Ridge는 2025년에 해당 목표를 시추할 계획입니다.

Orogen Royalties (OTC:OGNNF) a signé une convention d'achat avec Prospect Ridge Resources pour le projet porphyrique cuivre-or Camelot en Colombie-Britannique. Conformément à l'accord, Prospect Ridge acquerra 100 % des intérêts en payant C$200 000 en espèces ou en actions sur une période de six mois.

Orogen conservera une redevance NSR de 1% et aura le droit d'acheter 0,25% NSR supplémentaire auprès d'un vendeur sous-jacent. Le projet comporte une cible de forage autorisée présentant des anomalies de cuivre dans les sols, un fort signal magnétique et une importante anomalie de charge. Prospect Ridge prévoit de forer la cible en 2025.

Orogen Royalties (OTC:OGNNF) hat einen Kauf- und Verkaufsvertrag mit Prospect Ridge Resources für das Camelot Kupfer-Gold-Porphyr-Projekt in British Columbia unterzeichnet. Gemäß der Vereinbarung erwirbt Prospect Ridge 100% der Beteiligung gegen Zahlung von C$200.000 in bar oder Aktien innerhalb von sechs Monaten.

Orogen behält sich eine 1% NSR-Royalty vor und hat das Recht, zusätzliche 0,25% NSR von einem zugrunde liegenden Verkäufer zu erwerben. Das Projekt verfügt über ein genehmigtes Bohrziel mit anomalen Kupferwerten im Boden, hoher magnetischer Anomalie und starker Ladungsanomalie. Prospect Ridge plant, das Ziel im Jahr 2025 zu bohren.

- Creation of a new 1% NSR royalty with potential for additional 0.25%

- Immediate cash/share payment of C$200,000 over six months

- Project is fully permitted for drilling

- Property contains promising geological indicators including copper anomalies and magnetic highs

- Payment terms spread over six months rather than immediate

- Royalty percentage is relatively modest at 1%

VANCOUVER, BC / ACCESS Newswire / September 2, 2025 / (TSXV:OGN)(OTC:OGNNF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Company has signed a purchase and sale agreement (the "Agreement") with Prospect Ridge Resources Corp. (CSE:PRR) ("Prospect Ridge") whereby Prospect Ridge has acquired the Camelot (formerly Lemon Lake) copper-gold porphyry project, located in British Columbia, Canada.

To acquire a

Paddy Nicol, CEO of Orogen commented, "The Camelot project contains a fully permitted drill target outlined by the coincidence of anomalous copper in soils, a magnetic high, and a strong chargeability anomaly with an inferred area of potassically altered monzonite. Prospect Ridge is a well funded and managed exploration company with plans to drill this exciting target in 2025. Orogen maintains its upside exposure to the property through its retained royalty and we are excited to see drill results in the coming months."

Orogen and Prospect Ridge acknowledge that the Camelot project is situated within the traditional territory of the Williams Lake Indian Band, Xatsull First Nation, and the Neskonlith Indian Band. Both companies are committed to developing positive and mutually beneficial relationships with First Nations based on trust and respect and a foundation of open and honest communications.

About the Camelot Copper-Gold Project

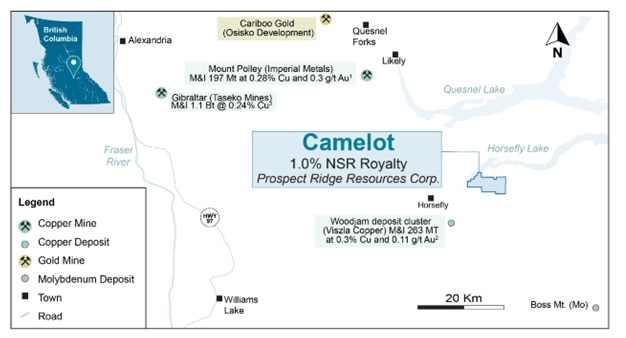

The 2,600 hectares Camelot project is located in the prolific Quesnel Belt in British Columbia, known to host both calc-alkaline copper and alkaline copper-gold porphyry systems including Imperial Metal's Mount Polley and New Gold's New Afton mines, and Vizsla Copper's Woodjam deposit cluster. (Figure 1)

The Camelot property contains the fifteen square kilometre Late Triassic to Early Jurassic composite Lemon Lake pluton with early phases of gabbro and diorite cut by at least two phases of monzonite porphyry, local monzonite breccias and, late monzonite-syenite dykes.

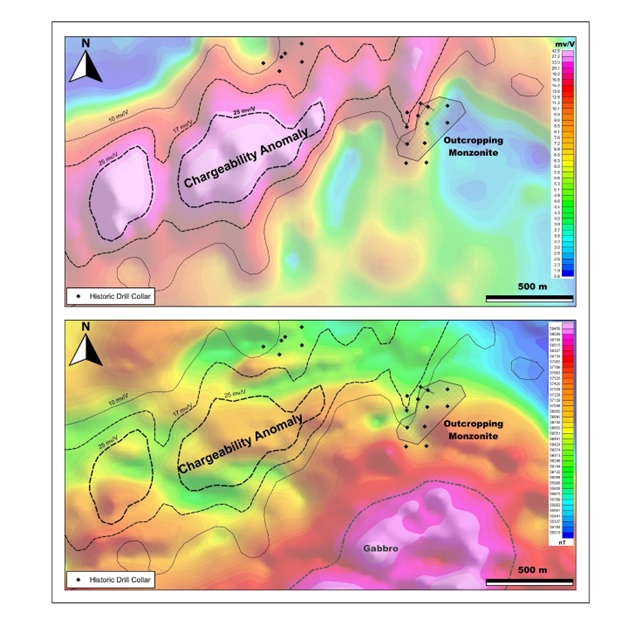

Limited historical exploration work has outlined a multi-kilometre copper in soil anomaly coincident with a 1,700 metre long chargeability (>17mv/V) anomaly developed in an undrilled overburden covered area (Figure 2 Top). The strongest regions of chargeability (>25mV/V) coincide with discrete magnetic highs (Figure 2 bottom).

Drilling in 1974 focused on sparse outcrop exposures of altered monzonite and intersected 21.3 metres of

The mineralization observed in historical drilling consists of chalcopyrite and pyrite associated with moderate K-Feldspar and biotite alteration developed in the monzonitic phase of the intrusive. Quartz veining is absent consistent with a quartz undersaturated alkalic porphyry system analogous to Mount Polley.

The core of the coincident geophysical and geochemical target remains undrilled but is permitted through 2025.

Acquisition Terms

Under the terms of the Agreement, Prospect Ridge can acquire a

Orogen will also retain the right to acquire an additional

The Agreement is subject to regulatory approval of the TSX Venture Exchange.

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's royalty or other interest. Orogen's royalty or other interests may cover less than

1. https://imperialmetals.com/assets/docs/2024-AIF.pdf

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire