Orogen Royalties Reports Q2 2025 Financial Results Based on Carve-out Financial Statements

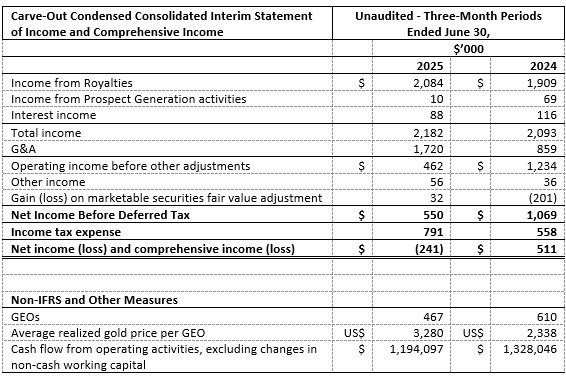

Orogen Royalties (TSXV:OGN)(OTC:OGNNF) reported Q2 2025 financial results following its spinoff from Triple Flag Precious Metals Corp. The company generated royalty revenue of $2.1 million, up 11% year-over-year, from 467 gold equivalent ounces at an average price of US$3,280 per ounce.

Key financial metrics include net income before tax of $0.6 million, a net comprehensive loss of $0.2 million, and operating cash flow of $1.8 million year-to-date. The company maintains a strong financial position with working capital of $27.8 million and no debt.

Following the completion of the Plan of Arrangement with Triple Flag on July 9, 2025, Orogen received total consideration of approximately $421 million, including cash, Triple Flag shares, and a subsequent $10 million subscription placement.

Orogen Royalties (TSXV:OGN)(OTC:OGNNF) ha pubblicato i risultati finanziari del secondo trimestre 2025 dopo lo spinoff da Triple Flag Precious Metals Corp. La società ha registrato ricavi da royalty pari a $2,1 milioni, in crescita dell'11% rispetto all'anno precedente, derivanti da 467 once equivalenti d'oro a un prezzo medio di US$3.280 per oncia.

I principali indicatori finanziari includono un utile netto ante imposte di $0,6 milioni, una perdita complessiva netta di $0,2 milioni e un flusso di cassa operativo di $1,8 milioni da inizio anno. La società conserva una solida posizione finanziaria con capitale circolante di $27,8 milioni e assenza di debiti.

Dopo il completamento del Piano di Ristrutturazione con Triple Flag il 9 luglio 2025, Orogen ha ricevuto un corrispettivo complessivo di circa $421 milioni, comprensivo di contanti, azioni di Triple Flag e un successivo collocamento sottoscritto di $10 milioni.

Orogen Royalties (TSXV:OGN)(OTC:OGNNF) presentó sus resultados financieros del segundo trimestre de 2025 tras su escisión de Triple Flag Precious Metals Corp. La compañía generó ingresos por regalías de $2,1 millones, un 11% más que el año anterior, a partir de 467 onzas equivalentes de oro a un precio promedio de US$3.280 por onza.

Las métricas financieras clave incluyen un ingreso neto antes de impuestos de $0,6 millones, una pérdida integral neta de $0,2 millones y un flujo de caja operativo de $1,8 millones en lo que va de año. La compañía mantiene una posición financiera sólida con capital de trabajo de $27,8 millones y sin deuda.

Tras completarse el Plan de Reorganización con Triple Flag el 9 de julio de 2025, Orogen recibió una contraprestación total de aproximadamente $421 millones, que incluye efectivo, acciones de Triple Flag y una colocación suscrita posterior de $10 millones.

Orogen Royalties (TSXV:OGN)(OTC:OGNNF)는 Triple Flag Precious Metals Corp.로부터의 스핀오프 이후 2025년 2분기 실적을 발표했습니다. 회사는 467 금환산 온스(평균 가격 미화 3,280달러/온스)에서 발생한 로열티 수익 $210만을 기록하며 전년 대비 11% 증가했습니다.

주요 재무 지표로는 법인세 차감 전 순이익 $60만, 총포괄손실 $20만, 연초 이후 영업현금흐름 $180만이 포함됩니다. 회사는 운전자본 $2,780만을 보유하고 부채는 없습니다.

2025년 7월 9일 Triple Flag과의 합의(Plan of Arrangement) 완료 후 Orogen은 현금, Triple Flag 주식 및 이후의 1,000만 달러 후속 유상증자를 포함해 총 약 $4.21억의 대가를 받았습니다.

Orogen Royalties (TSXV:OGN)(OTC:OGNNF) a publié ses résultats du deuxième trimestre 2025 suite à sa scission de Triple Flag Precious Metals Corp. La société a généré des revenus de redevances de 2,1 M$, en hausse de 11% sur un an, provenant de 467onces équivalentes d'or à un prix moyen de 3 280 $ US par once.

Les principaux indicateurs financiers comprennent un résultat net avant impôts de 0,6 M$, une perte globale nette de 0,2 M$ et un flux de trésorerie d'exploitation de 1,8 M$ depuis le début de l'année. La société conserve une position financière solide avec un fonds de roulement de 27,8 M$ et aucune dette.

Après finalisation du Plan d'opération avec Triple Flag le 9 juillet 2025, Orogen a reçu une contrepartie totale d'environ 421 M$, incluant des liquidités, des actions Triple Flag et une augmentation de capital souscrite ultérieure de 10 M$.

Orogen Royalties (TSXV:OGN)(OTC:OGNNF) legte nach dem Spin-off von Triple Flag Precious Metals Corp. die Finanzergebnisse für Q2 2025 vor. Das Unternehmen erzielte Royalty-Erträge von $2,1 Mio., ein Plus von 11% gegenüber dem Vorjahr, aus 467 Goldäquivalent-Unzen bei einem Durchschnittspreis von US$3.280 pro Unze.

Zentrale Finanzkennzahlen sind ein Ergebnis vor Steuern von $0,6 Mio., ein ausgewiesener umfassender Nettoverlust von $0,2 Mio. und ein operativer Cashflow von $1,8 Mio. seit Jahresbeginn. Das Unternehmen verfügt über eine starke Bilanz mit Netto-Umlaufvermögen von $27,8 Mio. und keiner Verschuldung.

Nach Abschluss des Plan of Arrangement mit Triple Flag am 9. Juli 2025 erhielt Orogen eine Gesamtabgeltung von rund $421 Mio., bestehend aus Bargeld, Triple Flag-Aktien und einer anschließenden bezahlten Kapitalerhöhung in Höhe von $10 Mio.

- Royalty revenue increased 11% year-over-year to $2.1 million

- Strong average realized gold price of US$3,280 per ounce, up from US$2,338

- Operating cash flow improved 28% year-over-year to $2.3 million

- Working capital increased to $27.8 million with zero debt

- Received $421 million in total consideration from Triple Flag arrangement

- Secured additional $10 million through subscription placement with Triple Flag

- Net income before tax decreased 45% year-over-year to $0.6 million

- Gold equivalent ounces (GEOs) decreased 24% year-over-year to 467 ounces

- G&A expenses increased 89% to $1.7 million due to foreign exchange losses

- Recorded net comprehensive loss of $0.2 million versus prior year income of $0.5 million

VANCOUVER, BC / ACCESS Newswire / August 26, 2025 / (TSXV:OGN)(OTC:OGNNF) Orogen Royalties Inc. (formerly 1537944 BC Ltd.) ("Orogen" or the "Company") is pleased to announce strong revenue and cash flow from operations for the second quarter ended June 30, 2025. The financial results are presented in carve-out condensed consolidated interim financial statements, prepared in accordance with International Financial Reporting Standards (IFRS). These statements reflect Orogen's financial position and performance as though it had operated as a standalone entity since January 1, 2024. The carve-out financials follow the completion of the Plan of Arrangement (the "Arrangement") with Triple Flag Precious Metals Corp. on July 9, 2025, whereupon Orogen was re-established as an independent royalty and exploration company. For further details regarding the Arrangement and its financial implications, refer to sections below.

Q2-2025 Highlights

All amounts are in Canadian dollars unless otherwise stated.

Net Income Before Tax: The Company reported net income before tax of

$0.6 million for the quarter ended June 30, 2025, compared to$1.1 million in Q2-2024, representing a decrease of45% .Net Comprehensive Loss: After recording an income tax expense of

$0.8 million (Q2-2024 -$0.6 million ), the Company posted a net comprehensive loss of$0.2 million (Q2-2024 - income of$0.5 million ). The loss was primarily driven by an unrealized foreign exchange loss.Royalty Revenue: Royalty revenue totaled

$2.1 million (Q2-2024 -$1.9 million ), up11% from the prior year, generated from the sale of 467 attributable gold equivalent ounces ("GEOs") (Q2-2024 - 610 GEOs) at an average realized price of US$3,280 per ounce (Q2-2024 - US$2,338) . GEO's reflect a decrease of24% year-over-year and7% quarter-over-quarter.G&A Expenses: G&A expenses amounted to

$1.7 million (Q2-2024 -$0.9 million ), up89% from the prior year. The increase was largely due to an unrealized foreign exchange loss of$0.7 million (Q2-2024 - gain of$0.2 million ), resulting from the appreciation of the Canadian dollar against the U.S. dollar and Mexican peso since the beginning of the year.Cash flow: Year-to-date cash flow from operating activities was

$1.8 million (2024 -$1.7 million ). Excluding changes in non-cash working capital, operating cash flow was$2.3 million (2024 -$1.8 million ), up28% year-over-year.Working Capital: As of June 30, 2025, the Company had working capital of

$27.8 million , up from$26.8 million at the beginning of the fiscal year. The Company remains debt-free with no long-term liabilities.

"We are pleased to report another strong financial quarter, achieved during a period when the Company was actively engaged in executing the Plan of Arrangement with Triple Flag. These results reflect the solid financial foundation from which Orogen can continue to grow following the sale of its flagship

For complete details of the Company's financial results, please refer to the carve-out condensed consolidated interim financial statements and MD&A for the six-month period ended June 30, 2025, and 2024. The Company's filings are available on SEDAR+ at www.sedarplus.ca and on Orogen's website at www.orogenroyalties.com. Please also see non-IFRS Measures at the end of this news release.

Summary of Results

Ermitaño Royalty - Sonora, Mexico

First Majestic Silver Corp. ("First Majestic") operates the Ermitaño gold-silver mine, where the Company holds a

During the quarter, 269,830 tonnes of ore were processed, representing a

During the three-month period ended June 30, 2025, a total of 2,268 metres of underground development was completed at the Ermitaño mine. Exploration efforts remained robust, with nine drill rigs deployed including six surface rigs and three underground rigs, resulting in 22,751 metres of drilling completed during the quarter.[1]

Total exploration expenditures increased by

A key milestone during the quarter was First Majestic's announcement of the expansion of the mineralized zone at the Navidad and Winter veins, adjacent and down dip of the Ermitano Mine, with a robust high-grade gold-silver rich zone on the eastern flank of the deposit. Ongoing resource conversion drilling continues to confirm the continuity of gold and silver mineralization in both veins with the mineralized structure now traced for a combined 1.3 kilometres of strike and 450 metres down dip with all the veins current strike and possible projections on Orogen's royalty ground. Mineralization at Navidad remains open in multiple directions. This expansion, along with new discoveries in the region, highlights a district scale exploration strategy that reinforces the potential for long-term resource growth.2

Subsequent to the Period Ended June 30, 2025

i. Plan of Arrangement

1537944 BC Ltd. ("SpinCo") was incorporated for the sole purpose of participating in the Arrangement of Triple Flag Nevada Inc. (formerly Orogen Royalties Inc.) ("TFN") pursuant to the April 21, 2025 arrangement agreement between TFN and Triple Flag Precious Metals Corp. ("Triple Flag"). On July 9, 2025, TFN completed the Arrangement with Triple Flag, through which Triple Flag acquired 210,412,750 common shares of TFN for total consideration of approximately

TFN incurred approximately

Following the recognition of these expenses, TFN contributed net assets with aggregate carrying values exceeding

ii. Subscription Placement

On July 10, 2025 and concurrent with the closing of the Arrangement, the Company closed a subscription placement with Triple Flag and received gross proceeds of

The proceeds from the Triple Flag financing, combined with the net assets contributed by TFN resulted in working capital of greater than

iii. Alliance with Triple Flag

The Company and Triple Flag have entered into a generative exploration alliance in the western United States (the "Alliance") concurrent with the closing of the Arrangement. The objective of the Alliance is to generate gold and silver targets geologically analogous to the Arthur Gold project in Nevada, USA. The alliance has an initial budget of US

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released third-party information and the Company is relying on the interpretation provided. Additional information can be found on the links in the footnotes.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

Forward Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Except where otherwise stated, the disclosure in this news release relating to properties and operations in which Orogen holds a royalty are based on information publicly disclosed by the owners or operators of these properties and information/data available in the public domain as at the date hereof, and none of this information has been independently verified by Orogen. Specifically, as a royalty holder and prospect generator, the Company has limited, if any, access to properties on which it holds royalty or other interests in its asset portfolio. The Company may from time to time receive operating information from the owners and operators of the mining properties, which it is not permitted to disclose to the public. Orogen is dependent on, (i) the operators of the mining properties and their qualified persons to provide information to Orogen, or (ii) on publicly available information to prepare disclosure pertaining to properties and operations on the properties on which the Company holds royalty or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some reported public information in respect of a mining property may relate to a larger property area than the area covered by Orogen's royalty or other interest. Orogen's royalty or other interests may cover less than

Non-IFRS Measures

The Company has included certain results in this news release that do not have any standardized meaning prescribed by International Financial Reporting Standards ("IFRS") including, total GEOs sold, average realized gold price per GEO, working capital, and cash flow from operating activities excluding changes in non-cash working capital adjustments. The Company's royalty revenue is converted to a gold equivalent ounce by dividing the royalty revenue received during the period by the average gold price of the period. The Company uses certain non-IFRS financial measures, including working capital, calculated as current assets minus current liabilities, to assess short-term liquidity and operational efficiency. This measure does not have a standardized meaning under IFRS and may not be comparable to similar measures used by other companies. The Company also uses operating cash flows excluding changes in non-cash working capital, calculated by adjusting cash provided by (used in) operating activities to exclude changes in non-cash working capital. This provides insight into cash flows from core operations.

References

[1] https://www.firstmajestic.com/_resources/financials/FSMDA-Q2-2025.pdf?v=081806

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire