Onyx Gold Discovers New Gold Zone 250 meters from Argus North

Rhea-AI Summary

Onyx Gold (OTCQX: ONXGF, TSXV: ONYX) announced a new near-surface gold discovery, Argus West, 250 m southwest of Argus North at the 100% owned Munro-Croesus Project (December 3, 2025). Step-out drilling returned 21.2 m @ 2.1 g/t Au (including 14.0 m @ 3.0 g/t and 1.0 m @ 19.7 g/t with visible gold) in MC25-213, and 38.0 m @ 0.5 g/t Au (including 14.0 m @ 1.0 g/t) in MC25-199. The company has defined mineralization over a 900 m strike and traced continuity from surface to ~400 m depth. To date Onyx completed >29,000 m in 85 holes of a 75,000 m program; assays announced for 41 holes. The company also purchased a 1.5% NSR for 50,000 common shares (TSXV approval pending).

Positive

- MC25-213: 21.2 m @ 2.1 g/t Au (includes 14.0 m @ 3.0 g/t and 1.0 m @ 19.7 g/t)

- MC25-199: 38.0 m @ 0.5 g/t Au (includes 14.0 m @ 1.0 g/t)

- Defined mineralization over a 900 m strike and to ~400 m depth

- Visible gold reported in drill hole MC25-213

- Completed >29,000 m in 85 holes of a planned 75,000 m drill program

- Acquired a 1.5% NSR on project claims for 50,000 shares

Negative

- Assays pending for 44 drill holes (85 holes completed; assays announced for 41 holes)

- NSR purchase is subject to TSXV approval, not finalized

News Market Reaction

On the day this news was published, ONXGF gained 10.76%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Gold peers showed mixed moves, from -14.09% (SNGCF) to +12.18% (WVMDF), indicating stock-specific rather than uniform sector momentum.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | New zone discovery | Positive | +10.8% | Argus West near-surface gold discovery with strong MC25-213, MC25-199 intercepts. |

| Nov 17 | Drill results upgrade | Positive | +13.2% | Best Argus North hole to date, 208 m @ 2.3 g/t Au with high-grade zones. |

| Nov 13 | Phase III drilling | Positive | +3.0% | Launch of fully funded 50,000 m Phase Three drill program using three rigs. |

| Oct 22 | Argus North drilling | Positive | -4.9% | New Argus North intercepts up to 99.5 m @ 1.5 g/t Au expanding zone. |

| Oct 07 | Surface mineralization | Positive | +0.1% | Surface channels and shallow drilling define gold right at surface at Argus North. |

Recent drilling and funding news has generally been followed by positive price reactions, with one notable negative divergence.

This announcement continues a sequence of Munro‑Croesus updates in 2025. Prior releases on Oct 7, Oct 22, and Nov 17 detailed progressively stronger Argus North intercepts and an expanding mineralized footprint, while the Nov 13 update launched a fully funded Phase Three drill program with substantial cash on hand. Today’s Argus West discovery and 1.5% NSR acquisition extend that narrative by adding a new near‑surface zone and consolidating project economics within the same 100%-owned land package.

Market Pulse Summary

The stock surged +10.8% in the session following this news. A strong positive reaction aligns with prior patterns where drilling news saw moves of 10.76% and 13.16%. The Argus West discovery adds near-surface mineralization and extends the mineralized strike to 900 m, building on >29,000 m of completed drilling. Investors would still need to weigh how ongoing share-funded transactions, such as the 50,000-share NSR purchase, might affect future upside.

Key Terms

net smelter returns royalty financial

diamond drill program technical

variolitic volcanic rocks technical

hanging wall technical

foot wall technical

quartz-carbonate veining technical

visible gold technical

net smelter royalty financial

AI-generated analysis. Not financial advice.

Argus West Drilling Intersects Multiple Gold Occurrences Returning 21.2 m of 2.1 g/t Au, Including 14.0 m of 3.0 g/t Au and a Second Interval of 5.0 m of 5.1 g/t Au Starting 9.8 m From Surface -- Demonstrates Potential for Repeated Argus North-Style Mineralized Zones

Vancouver, British Columbia--(Newsfile Corp. - December 3, 2025) - Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) ("Onyx" or the "Company") is pleased to the announce the discovery of a new zone of near-surface gold mineralization, 250 meters ("m") southwest of the Argus North Zone ("Argus North"). This new discovery the latest advancement of the Company's ongoing 75,000 m phase I/II/III diamond drill program (the "Program") at its

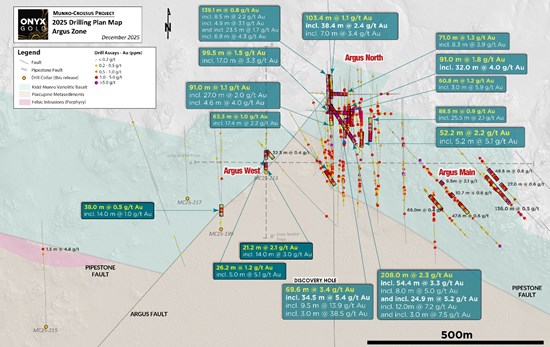

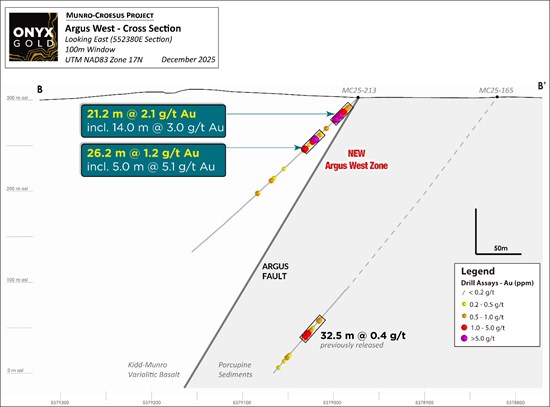

Results reported today from Argus West include two step-out drill holes, MC25-213 and MC25-199, completed 250 m and 430 m respectively from Argus North along the newly prioritized Argus Fault. This northeast-southwest-trending, moderately to steeply northwest-dipping structure is emerging as an important control on gold mineralization. Two additional drill holes are also reported today, which tested targets up to 925 m southwest of Argus North.

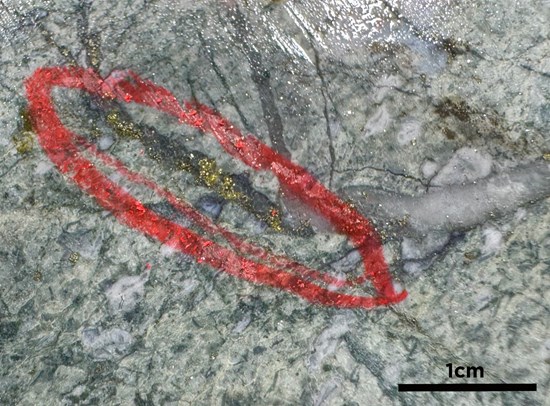

At Argus West, drill hole MC25-213 intersected multiple occurrences of visible gold (Plate 1) returning 21.2 m grading 2.1 grams per tonne gold ("g/t Au") starting at 9.8 m from surface within mafic variolitic volcanic rocks in the structural hanging wall to the Argus Fault. Drill hole MC25-199, a further 180 m to the southwest, intersected 14.0 m grading 1.0 g/t Au hosted by fine-grained metasedimentary rocks, in the structural footwall to the Argus Fault.

New Highlights from Argus West

- 21.2 m grading 2.1 g/t Au, in drill hole MC25-213 (250m from Argus North), including

- 14.0 m grading 3.0 g/t Au, including

- 1.0 m grading 19.7 g/t Au (with visible gold), AND

- 14.0 m grading 3.0 g/t Au, including

- 26.2 m grading 1.2 g/t Au, also in drill hole MC25-213, including

- 5.0 m grading 5.1 g/t Au, including

- 1.5 m grading 13.7 g/t Au (with visible gold)

- 5.0 m grading 5.1 g/t Au, including

- 38.0 m grading 0.5 g/t Au, in drill hole MC25-199 (430m from Argus North), including

- 14.0 m grading 1.0 g/t Au, including

- 3.0 m grading 2.4 g/t Au

- 3.0 m grading 2.4 g/t Au

- 14.0 m grading 1.0 g/t Au, including

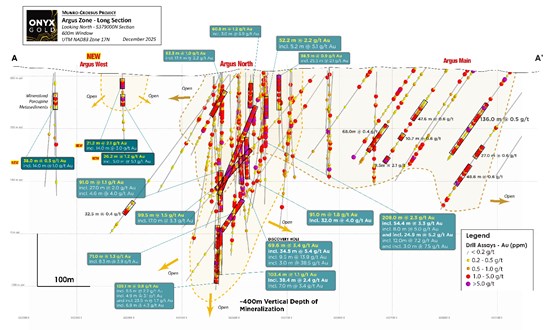

- Ongoing step-out drilling at the Argus North, Main and West discoveries has now defined broad zones of gold mineralization over a total strike length of 900 m and from surface to ~400 m vertically.

- All of the Argus Zones remain open along strike, down-dip, and down-plunge.

- The Company has completed 85 drill holes to date, totalling >29,000 m as part of its 75,000 m Phase I/II/III drill program. Assays have been announced for 41 holes.

"Argus West is a significant new discovery that continues to demonstrate the scale potential of the Argus gold system," said Brock Colterjohn, President & CEO. "Intersecting near-surface gold mineralization 250 meters southwest of Argus North in both volcanic and sedimentary host rocks is a new and encouraging development for us, and highlights the fertility of the newly prioritized Argus Fault. Seeing the system develop across multiple lithologies supports our view that Argus is part of a larger, structurally controlled corridor with meaningful expansion potential. With three rigs active, we are continuing systematic step-outs along strike and down-dip to continue to evaluate the size of this new zone and the broader Argus trend."

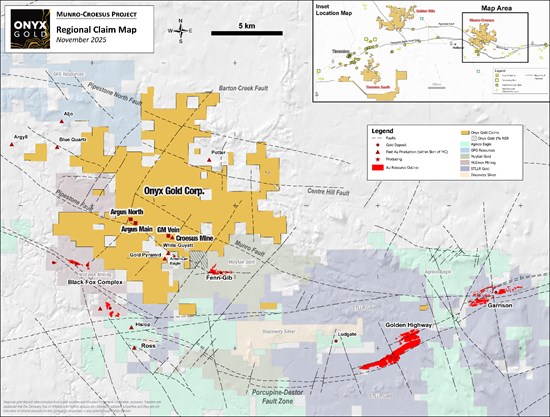

Discussion of 2025 Drill Results

The Argus North Zone is located on the western half of the Munro-Croesus Project, approximately 150 meters north of the regional Pipestone Fault, a major structural corridor that hosts several significant gold deposits in the Timmins camp. The discovery hole at Argus North, MC24-163, was reported earlier this year, and returned 69.6 m grading 3.4 g/t Au, including 34.5 m grading 5.4 g/t Au and 9.5 m grading 13.9 g/t Au (see Company news release dated April 10, 2025).

Argus North lies roughly 100 meters north of the east-west trending Argus Main Zone ("Argus Main"), which represents a separate 750 m x 200 m near-surface bulk-tonnage gold target (e.g., 1.0 g/t Au over 63.3 m and 0.5 g/t Au over 136 m).

Gold mineralization at Argus North is distinguished by both broad zones (50 m to over 100 m) of +1 g/t Au mineralization containing multiple continuous higher-grade sub-intervals (e.g. 34.5 m grading 5.4 g/t in hole MC25-163, 24.9 m grading 5.2 g/t in MC25-232, and 5.2 m grading 5.1 g/t in hole MC25-180) (Figure 1). Geologically, the high-grade sub-intervals at Argus North are closely associated with zones of strong albitization and silicification, pyritic stringers, and localized porphyritic intrusions within variolitic basalt and volcanic breccias cut by dominant northeast-trending faults and associated fractures. This combination of alteration and structural preparation is interpreted to be a key control on gold deposition. Drilling to date has demonstrated excellent vertical continuity of mineralization, now traced from surface to approximately 400 meters depth, with the system remaining open along strike, down-dip and down-plunge.

Results reported today from the new Argus West Zone include two (2) step-out diamond drill holes, MC25-213 and MC25-199, which were completed 250 m and 430 m, respectively, from Argus North Zone along the Argus Fault, a key northeast-southwest-trending, moderately to steeply dipping structure that appears to play an important role in the locus of gold mineralization.

Drill hole MC25-213 returned 21.2 m grading 2.1 g/t Au starting at 9.8 m from surface within mafic variolitic volcanic rocks in the hanging wall to the Argus Fault. The variolitics are strongly albite-altered with a moderate crackle brecciation, and fine-grained disseminated to fracture-controlled pyrite, similar to Argus North. Multiple visible gold occurrences at approximately 27.0 m and 65.5 m depth downhole are associated with quartz ± carbonate veins that define the crackle breccia (Plate 1). Although interpreted to be broadly equivalent mineralizing systems, the limited observation of visible gold at Argus North indicates that Argus West may represent a distinct mineralization style with more efficient gold deposition focused in breccia units near the Argus Fault.

Drill hole MC25-199, a further 180 m to the southwest, intersected 14.0 m grading 1.0 g/t Au within fine-grained metasedimentary rocks, in the foot wall to the Argus Fault. Strong sericite alteration with an increase in quartz-carbonate veining characterizes the mineralized interval.

Drill hole MC25-215 was designed to test for gold mineralization associated with felsic intrusions adjacent to the Pipestone Fault, located 925 m southwest of Argus North. The hole returned 1.5 m grading 4.8 g/t Au in fine-grained metasedimentary rocks, confirming a new, fertile gold mineralizing environment. The metasedimentary rocks are intruded by multiple quartz-feldspar porphyritic intrusions, up to 50 m thick and are strongly sericite-altered with quartz-carbonate veining.

Drill hole MC25-217 was collared 100 m west of drill hole MC25-199, but north of the Argus Fault and returned no significant values.

The Company is aggressively following up on this discovery at Argus West with 50 m spaced step-out drill holes, immediately east, west and down-dip of drill hole MC25-213, with other holes planned to systematically test the Argus Fault along strike.

Details for drill hole assays reported in this news release are shown in Figures 1, 2, 3, 4 and Table 1.

Table 1 - Significant Assay Results from Recent Drilling Completed at the Argus North Zone

| Target | From | To | Length | Au |

| Drill Hole | (m) | (m) | (m) | (g/t) |

| Argus West | ||||

| MC25-199 | 21.5 | 28.5 | 7.0 | 0.2 |

| And | 55.5 | 93.5 | 38.0 | 0.5 |

| Including | 67.5 | 81.5 | 14.0 | 1.0 |

| Including | 78.5 | 81.5 | 3.0 | 2.4 |

| And | 195.9 | 197.4 | 1.5 | 3.0 |

| And | 302.5 | 308.0 | 5.5 | 0.2 |

| MC25-213 | 13.8 | 35.0 | 21.2 | 2.1 |

| Including | 21.0 | 35.0 | 14.0 | 3.0 |

| Including | 27.0 | 28.0 | 1.0 | 19.7 |

| And | 55.8 | 82.0 | 26.2 | 1.2 |

| Including | 64.8 | 69.8 | 5.0 | 5.1 |

| Including | 64.8 | 67.4 | 2.6 | 9.1 |

| Including | 64.8 | 66.3 | 1.5 | 13.7 |

| MC25-215 | 303.5 | 305.0 | 1.5 | 4.8 |

| MC25-217 | No Significant Assays | |||

*Intersections are reported as drilled width; true width is estimated to be 70

Figure 1 - Plan Map Highlighting Argus North/Argus West Zone Drill Holes Reported in this Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/276730_cb5c3229d420db7b_001full.jpg

Figure 2 - Longitudinal Section Highlighting Argus North/Argus West Zone Drill Holes Reported in this Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/276730_cb5c3229d420db7b_002full.jpg

Figure 3 - Cross Section Highlighting Argus West Zone Drill Hole MC25-213 Reported in this Release

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/276730_cb5c3229d420db7b_003full.jpg

Figure 4 - Location of the Munro-Croesus Gold Project, Ontario

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/276730_cb5c3229d420db7b_004full.jpg

Plate 1 - Visible Gold from Drill Hole MC25-213 at 27 m Downhole Depth

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/276730_cb5c3229d420db7b_005full.jpg

The Munro-Croesus Project

The Munro-Croesus Project is located along Highway 101 in the heart of the Abitibi greenstone belt, Canada's premier gold mining jurisdiction (Figure 2). This large,

The Project covers 109 km2 of highly prospective geology within the influence of major gold-bearing structural breaks. Bulk-tonnage gold deposits located in the immediate region include the Fenn-Gib gold project being developed by Mayfair Gold Corp., and the Tower Gold Project being developed by STLLR Gold Inc.

Net Smelter Royalty Purchase Agreement

The Company also wishes to announce that it has signed a net smelter returns royalty purchase agreement (the "Agreement") with two arm's length vendors (the "Vendors") through its wholly-owned subsidiary under which the Company purchased and assumed from the Vendors a one and one-half percent (

About Onyx Gold

Onyx Gold Corp. is a Canadian exploration company focused on unlocking district-scale gold opportunities in two of the country's most prolific and proven mining jurisdictions - Timmins, Ontario, and Yukon Territory.

In the Timmins Gold Camp, Onyx controls an extensive portfolio anchored by the Munro-Croesus Property, host to the historic high-grade Croesus Mine and site of the Company's recent Argus North discovery - one of the most exciting new gold zones emerging in the camp. Complementing Munro-Croesus are two large, early-stage projects - Golden Mile, a 140 km² property situated just 9 km from Newmont's multi-million-ounce Hoyle Pond Mine, and Timmins South, a 187 km² land package strategically positioned around the Shaw Dome structure, offering exceptional discovery potential.

Beyond Ontario, Onyx holds a commanding land position across four properties in Yukon's Selwyn Basin, an area rapidly gaining recognition for new gold discoveries and growing exploration investment. The Company's King Tut Property sits approximately 50km south of Snowline Gold's Valley discovery and adjacent to Fireweed Metals' MacPass property.

Led by an experienced team with a strong track record of discovery, development, and value creation, Onyx Gold (TSXV: ONYX) (OTCQB: ONXGF) is well funded and committed to delivering shareholder value through disciplined exploration, strategic growth, and responsible resource development.

On Behalf of Onyx Gold Corp.,

"Brock Colterjohn"

President & CEO

For further information, please visit the Onyx Gold Corp. website at www.onyxgold.com or contact:

Brock Colterjohn, President & CEO

or

Nicole Hoeller, NIKLI Communications - nicole@onyxgold.com

Phone: 1-604-283-3341

Email: information@onyxgold.com

Website: www.onyxgold.com

LinkedIn: https://www.linkedin.com/company/onyx-gold-corp

Twitter: https://twitter.com/OnyxGoldCorp

Additional Notes:

Starting azimuth, dip and final length (Azimuth/-Dip/Length) for the four (4) drill holes reported today are noted as follows: MC25-199 (000/45/345), MC25-213 (000/45/249), MC25-215 (000/45/414), and MC25-217 (000/45/285).

Samples of drill core were cut by a diamond blade rock saw, with half of the cut core placed in individual sealed polyurethane bags and half placed back in the original core box for permanent storage. Sample lengths typically vary from a minimum 0.2-meter interval to a maximum 1.5-meter interval, with an average 0.5 to 1.0-meter sample length.

Drill core samples were delivered by truck in sealed woven plastic bags were delivered by truck in sealed woven plastic bags to MSA Labs laboratory facility in Timmins, Ontario for sample preparation followed by the photon assay method. MSA Labs operates meeting all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. Drill core samples are crushed to

Coarse rejects returned from MSA Labs and remaining uncut drill core samples were then delivered by truck in sealed woven plastic bags to ALS Geochemistry laboratory facility in Timmins, Ontario for sample preparation with final analysis at ALS Geochemistry Analytical Lab facility in North Vancouver, BC. ALS Geochemistry operate meeting all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. Drill core samples are crushed to

The Company maintains a robust QA/QC program that includes the collection and analysis of duplicate samples and the insertion of blanks and standards (certified reference material).

Ian Cunningham-Dunlop, P.Eng., Executive Vice President for Onyx Gold Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

Forward-looking statements include predictions, projections, and forecasts and are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the potential significance of results from the new Argus North discovery are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company's expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital, and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials, and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276730