Orion Acquires Assets in Louisiana

Rhea-AI Summary

Positive

- First entry into Louisiana's Haynesville Shale field, expanding geographical diversification

- Acquisition includes 27 producing wells with 1,740 mcfpd production

- Strategic position in Louisiana, the third-ranked state for natural gas production

- Growing demand for natural gas driven by AI data centers and LNG exports

Negative

- None.

CARSON CITY, NV / ACCESS Newswire / June 12, 2025 / Orion Diversified Holding Co Inc. (OTC PINK:OODH)("Orion"), a revenue generating diversified company, announced today that it has closed on a royalty and non-operated working interest in Louisiana.

LOUISIANA

3.0% non-op working interest & a .024% royalty interest in 27 wells producing 1,740 mcfpd located in Jackson County Louisiana.

TOM LULL COMMENTS

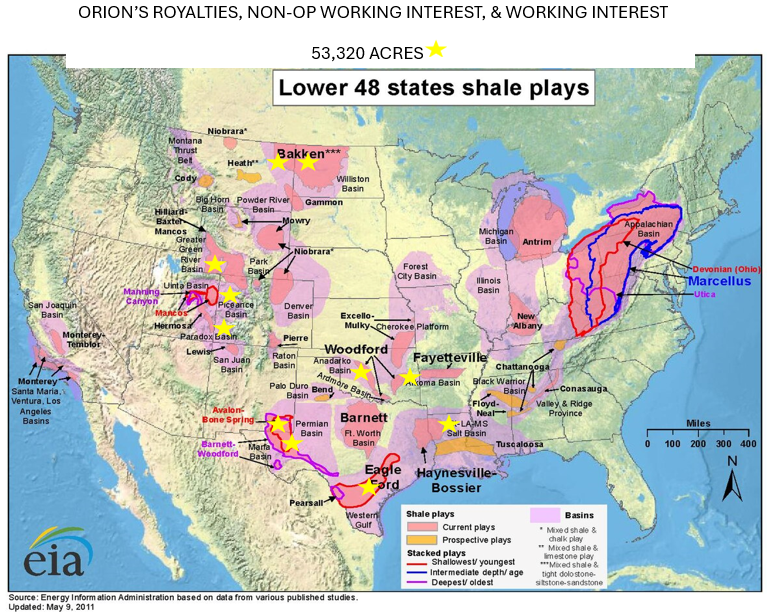

"This recent acquisition should add significant revenue and continues to expand our footprint in great producing oil and gas regions. This is our first entry into the Louisiana oil and gas Haynesville Shale field. Louisiana ranks third in the nation for natural gas production and this property fits into Orion's strategic growth strategy. " Commented Tom Lull, CEO of Orion. The demand for natural gas is increasing with AI data centers and LNG exports. Orion owns properties and mineral interest from the Bakken Shale of North Dakota to the Haynesville Shale of Louisiana. Orion now owns 53,320 mineral acres in the Bakken, Permian Basin, Piceance Basin, Arkoma Basin, Eagle Ford, Haynesville Shale, and Scoop Stack of Oklahoma. "

ABOUT ORION DIVERSIFIED HOLDING CO INC.

Orion Diversified Holding Co Inc. is a holding company with a primary strategy of investing in operated majority working interest, non-operated working interest, royalty, and mineral interests in producing oil & gas properties, with a core area of focus in the premier basins within the United States. Orion receives monthly income from 53,320 mineral acres and receives income from Chevron, Conoco Phillips, Apache, Occidental Petroleum, EOG Resources, Mewbourne Oil, Merit Energy, Hilcorp Oil, Kraken Oil, DCP, Raybaw Operating, Unit Corp, Hanna Oil, Cambrian Resources, Utah Gas Corp and many others. More information about Orion Diversified Holding Co Inc. can be found at www.orionenergyco.com.

CONTACT:

Orion Diversified Holding Co Inc.

Thomas Lull, President

tom@orionenergyco.com

Phone: 760-889-3435

www.x.com/TomLull1

lull_tom@yahoo.com

SAFE HARBOR STATEMENT

This press release may include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements related to anticipated revenues, expenses, earnings, operating cash flows, the outlook for markets, and the demand for products. Forward-looking statements are no guarantees of future performance and are inherently subject to uncertainties and other factors which could cause actual results to differ materially from the forward-looking statements. Such statements are based upon, among other things, assumptions made by, and information currently available to, management, including management's own knowledge and assessment of the Company's industry and competition. The Company assumes no duty to update its forward-looking statements.

SOURCE: Orion Diversified Holding Co Inc.

View the original press release on ACCESS Newswire