Innovation Beverage Group Enters into Definitive Merger Agreement with BlockFuel Energy, Inc.

Rhea-AI Summary

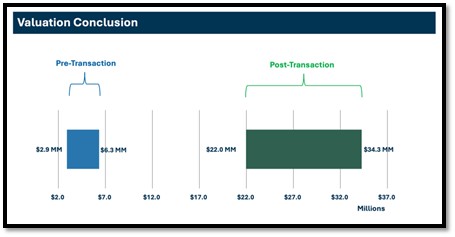

Innovation Beverage Group (Nasdaq: IBG) entered a definitive reverse triangular merger with BlockFuel Energy on Oct 15, 2025, expected to close in the fourth quarter of 2025. The combined company will list on Nasdaq under the ticker FUEL and is expected to have a post-transaction equity valuation range of US$220M–$343M. BlockFuel owners are expected to hold 90% of issued shares post-close; IBG shareholders will hold 10%, implying an IBG post-transaction value of US$22M–$34.3M versus pre-transaction value of US$2.9M–$6.3M. Leadership changes and a new beverage subsidiary are planned.

Positive

- Expected combined equity valuation of US$220M–$343M

- BlockFuel owners to hold 90% of post-close shares

- IBG shareholders to retain 10% of combined company

- Nasdaq listing under ticker FUEL planned in Q4 2025

Negative

- IBG implied post-transaction value US$22M–$34.3M vs pre-transaction US$2.9M–$6.3M (dilution of prior equity)

- Control shift: BlockFuel management to lead combined company

- Transaction closing subject to customary conditions, not guaranteed

News Market Reaction

On the day this news was published, IBG gained 25.16%, reflecting a significant positive market reaction. Argus tracked a peak move of +36.4% during that session. Argus tracked a trough of -26.4% from its starting point during tracking. Our momentum scanner triggered 27 alerts that day, indicating elevated trading interest and price volatility. This price movement added approximately $2M to the company's valuation, bringing the market cap to $9M at that time. Trading volume was very high at 3.9x the daily average, suggesting strong buying interest.

Data tracked by StockTitan Argus on the day of publication.

Transaction expected to close in fourth quarter with combined company to begin trading on the Nasdaq under the ticker “FUEL”

Vertically Integrated business model combines state-of-the-art power generation with oil & gas production to power Bitcoin mining operations

Post-Transaction combined entity expected to have an equity valuation range between US

SYDNEY, Oct. 15, 2025 (GLOBE NEWSWIRE) -- Innovation Beverage Group Ltd (“IBG” or the “Company”) (Nasdaq: IBG), an innovative developer, manufacturer, and marketer of a growing beverage portfolio of 60 formulations across 13 alcoholic and non-alcoholic brands, today announced that it has entered into a definitive agreement for a reverse triangular merger transaction with BlockFuel Energy Inc., a Texas corporation (“BlockFuel” or “BFE”) engaged in oil and gas exploration and state-of-the-art power generation to support Bitcoin mining operations and high-performance data centers across North America. IBG and BFE expect to close the transaction in the fourth quarter of 2025, subject to customary closing conditions and will trade on the Nasdaq under the ticker symbol “FUEL”.

Under the terms of the definitive agreement, IBG will merge with BlockFuel through a reverse triangular merger, with a newly formed subsidiary of IBG formed for the transaction merging with and into BFE, with BFE as the surviving entity and becoming a wholly owned subsidiary. When the transaction closes, the owners of BFE are expected to own ordinary shares in IBG representing

Upon closing of the agreed transaction, Daniel Lanskey, currently President and CEO of BlockFuel and a Director of IBG, will be appointed Chairman of the Board and Chief Executive Officer of the new combined entity. Sahil Beri, currently Chairman of the Board and Chief Executive Officer of IBG, will resign from both positions and will be appointed as President of a newly formed beverage subsidiary.

Sahil Beri, Chief Executive Officer of IBG commented, “The agreement for our reverse merger transaction with BlockFuel Energy marks a pivotal milestone in the IBG story as we work to maximize shareholder value. BlockFuel is uniquely positioned at the forefront of energy innovation and digital asset mining, and we are pleased to provide a public vehicle for BFE to introduce itself to the capital markets. We are separately optimistic about what the future holds for the IBG business as a subsidiary of BlockFuel as we continue to build and grow our award-winning alcoholic and non-alcoholic beverage portfolio.”

Daniel Lanskey, Executive Chairman of BlockFuel added, “With today’s announcement finalizing BlockFuel’s entry into the U.S. capital markets via our reverse merger with IBG, we are well placed to capitalize on significant opportunities across the digital asset, energy capture and oil & gas sectors. Integrating IBG’s public market presence with our advanced energy harnessing and Bitcoin mining technologies creates a powerful foundation for long-term value creation. This transaction strengthens our ability to scale, expand market reach, and build a sustainable growth trajectory at the intersection of cleaner energy and blockchain infrastructure.”

If you have a question or would like to schedule a meeting with IBG or BFE management, please contact BFE@KCSA.com.

About Innovation Beverage Group

Innovation Beverage Group is a developer, manufacturer, marketer, exporter, and retailer of a growing beverage portfolio of 60 formulations across 13 alcoholic and non-alcoholic brands for which it owns exclusive manufacturing rights. Focused on premium and super premium brands and market categories where it can disrupt age old brands, IBG’s brands include Australian Bitters, BITTERTALES, Drummerboy Spirits, Twisted Shaker, and more. IBG’s most successful brand to date is Australian Bitters, which is a well-established and favored bitters brand in Australia. Established in 2018, IBG’s headquarters, manufacturing and flavor innovation center are located in Sydney, Australia with a U.S. sales office located in California. For more information visit: https://www.innovationbev.com/

About BlockFuel Energy

BlockFuel Energy is involved in the acquisition, exploration and development of proven oil fields onshore in North America. By turning natural gas at the source, including stranded and flared gas, into a potent resource for the digital era, BlockFuel Energy intends to redefine the energy industry. BlockFuel Energy combines state-of-the-art power generation with oil and gas exploration to power bitcoin mining operations and high-performance data centers. Our vertically integrated concept allows us to use co-location and modular power generation techniques to optimize efficiency and investment returns. Our cutting-edge solutions for energy optimization and extraction will enable us to transform underdeveloped resources into high-margin, scalable, and sustainable revenue streams. For more information visit: https://blockfuelenergy.com/

Forward Looking Statement

This press release contains “forward-looking statements” and “forward-looking information.” These statements include, but are not limited to, statements about the final terms of the potential merger transaction, the structure of such transaction, benefits of the contemplated transaction between IBG and BlockFuel Energy, expected closing conditions and the parties’ ability to complete the transaction, should definitive documentation be reached as well as other statements that are not historical facts. This information and these statements, which can be identified by the fact that they do not relate strictly to historical or current facts, are made as of the date of this press release or as of the date of the effective date of information described in this press release, as applicable.

The forward-looking statements herein relate to predictions, expectations, beliefs, plans, projections, objectives, assumptions, or future events or performance (often, but not always, using words or phrases such as “expects,” “anticipates,” “plans,” “projects,” “estimates,” “envisages,” “assumes,” “intends,” “strategy,” “goals,” “objectives” or variations thereof or stating that certain action events or results "may,” “can,” “could,” “would,” “might,” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) and include, without limitation, statements with respect to projected financial targets that the Company is looking to achieve.

All forward-looking statements are based on current beliefs as well as various assumptions made by and information currently available to the Company’s management team. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections, and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Such factors include, among others, (1) delays in finalizing definitive documentation for the contemplated transaction, (2) the risk that definitive documentation will reflect different terms than the non-binding terms described herein, (3) the risk of delays in consummating the contemplated transaction, including as a result of required regulatory and stockholder approvals, which may not be obtained on the expected timeline, or at all, (4) the risk of any event, change or other circumstance that could cause the parties to terminate the transaction prior to closing , (5) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction, including potential distraction of management from current plans and operations of IBG or BlockFuel Energy and the ability of IBG and BlockFuel Energy to retain and hire key personnel, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction, (7) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (8) the outcome of any legal or regulatory proceedings that may be instituted against IBG or BlockFuel Energy related to the transaction or merger agreement, should definitive documentation be executed, (9) the risks associated with third party contracts containing consent and/or other provisions that may be triggered by the contemplated transaction, (10) legislative, regulatory, political, market, economic and other conditions, developments and uncertainties affecting IBG’s or BlockFuel Energy’s businesses; (11) the evolving legal, regulatory and tax regimes under which IBG or BlockFuel Energy operate; (12) any restrictions during the pendency of the contemplated transaction that may impact the parties’ ability to pursue certain business opportunities or strategic transactions; and (13) unpredictability and severity of catastrophic events, including, but not limited to, extreme weather, natural disasters, acts of terrorism or outbreak of war or hostilities. We caution any person reviewing this press release not to place undue reliance on these forward-looking statements as several important factors could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions, and intentions expressed in such forward-looking statements. These risk factors may be generally stated as the risk that the assumptions and estimates expressed above do not occur.

The Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by Company or on behalf of the Company except as may be required by law.

Contact:

Innovation Beverage Group Limited

Sahil Beri

CEO

sahil@innovationbev.com

www.innovationbev.com

BlockFuelEnergy Inc.

Daniel Lanskey

President and CEO

dan.lanskey@blockfuelenergy.com

www.blockfuelenergy.com

Investor Relations:

KCSA Strategic Communications

Phil Carlson, Managing Director

BFE@KCSA.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d6543343-3458-4a0b-84b2-aa163fe3f272