Ophir Expands High-Grade Cesium Zone at Depth with 0.92% Cs2O over 1.0 m at the HW3 Pegmatite, Pilipas Property, Quebec

Rhea-AI Summary

Ophir Metals (OTCQB: OPHRF) has announced significant drill results from its 2025 program at the Pilipas Lithium Property in Quebec. The program's highlight includes a high-grade cesium intersection of 0.92% Cs2O over 1.0 m at the HW3 Pegmatite.

Key findings from the 16-hole (936m) drill program include multiple cesium-enriched zones, with sixteen samples returning values >0.06% Cs2O. Notable intercepts include 2.5m at 0.41% Cs2O and strong tantalum values, with a peak of 1,248 ppm Ta2O5 over 0.5m. The property demonstrates rare multi-commodity potential, hosting both cesium and lithium mineralization, including a previously reported 53.2m at 1.22% Li2O from the HW1 pegmatite in 2024.

The results confirm that the HW3 Pegmatites extend to moderate depth with strong mineralization potential, supported by favorable geochemical fertility ratios indicating high prospects for Lithium-Cesium-Tantalum (LCT) mineralization.

Positive

- Discovery of high-grade cesium mineralization with 0.92% Cs2O over 1.0m

- Confirmation of multi-commodity potential with both cesium and lithium mineralization

- Strong tantalum values with peak of 1,248 ppm Ta2O5 over 0.5m

- Property has existing infrastructure with hydroelectric power and all-season road access

- Multiple mineralized zones identified with sixteen samples showing >0.06% Cs2O

Negative

- Pollucite presence in drill core yet to be confirmed by X-ray diffraction

- Limited outcrop exposure in the 4.2 km corridor between HW1 and HW3 showings

News Market Reaction 1 Alert

On the day this news was published, OPHRF declined 27.84%, reflecting a significant negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - August 27, 2025) - Ophir Metals Corp. (TSXV: OPHR) (OTCQB: OPHRF) (FSE: 80M) ("Ophir" or the "Company") is pleased to announce assay results for 16 drillholes from the 2025 drill program on the Pilipas Lithium Property (the "Property" or "Project"), located in the Eeyou Istchee James Bay region, Quebec. The Project is located proximal to existing hydroelectric power that flanks the Property to the east, and an all-season road that crosses the western side of the Property.

"Drilling at HW3 has confirmed cesium mineralization grading nearly

Highlights:

2.5 m at

0.41% Cs2O, including 1.0 m at0.92% Cs2O from drillhole PLP25-0270.5 m at

0.26% Cs2O within pegmatite interval in drillhole PLP25-0281.5 m at

0.46% Cs2O and 1.4 m at0.21% Cs2O within basalt samples on margin of pegmatite dykes from drillhole PLP25-025 and PLP25-037, respectivelyFour samples returned >500 ppm Ta₂O₅, including a peak of 1,248 ppm Ta₂O₅ over 0.5 m, from within larger interval of 375 ppm Ta2O5 over 3.8 m in drillhole PLP25-032

The 2025 drill program concluded in mid-June with the completion of 16 drill holes totaling 936 m at the HW3 Cesium Pegmatite (Table 2). The analytical results reported herein represent all drill holes completed as part of the exploration program. Drillholes were planned on a tight grid spacing targeting the surface expression at depth and along strike.

Drilling in 2025 confirmed that the HW3 Pegmatites are present to moderate depth and capable of hosting strong cesium mineralization, as demonstrated by the intercept of

Strongly anomalous to high-grade tantalum results were also returned from the pegmatites at HW3, with thirty-one (31) samples returning >50 ppm Ta2O5, the highest of which returned 1,248 ppm Ta₂O₅ over 0.5 m (Table 1). Additional intervals of 328 ppm Ta2O5 over 4.0 m and 375 ppm Ta2O5 over 3.8 m were returned from drillholes PLP25-037 and PLP25-032, respectively. These results highlight the multi-commodity potential of the system, extending beyond cesium and lithium.

Although pollucite in drill core has yet to be confirmed by X-ray diffraction (XRD), visual logging noted minerals consistent with pollucite in one interval of PLP25-027 (Figure 1), coincident with elevated cesium grades. This zone is consistent with the pollucite-bearing material confirmed by XRD in 2024 surface channel samples from the same outcrop area, supporting continuity of cesium mineralization from surface into the subsurface. Pollucite, the principal mineralized material cesium, is globally rare, and its occurrence at HW3 is significant. The 2025 drill program results demonstrate that the pegmatites at Pilipas are highly fractionated, consistent with the processes that concentrate cesium, lithium, and tantalum. Much of the 4.2 km corridor between HW1 and HW3 showings has limited outcrop exposure, providing scope for additional discoveries along the pegmatite trend.

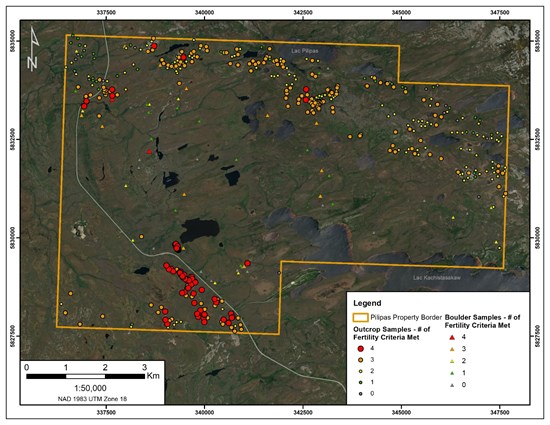

Additionally, other areas of the Pilipas Property remain highly prospective for hosting Lithium-Cesium-Tantalum ("LCT") mineralization for follow-up work, as indicated by strong geochemical fertility ratios obtained in pegmatite grab samples collected in 2024 (See news release dated May 21, 2025). The geochemical ratios of K/Rb, Nb/Ta, Zr/Hf, and Mg/Li are commonly used to assess the potential for pegmatites to host LCT mineralization. Fertile pegmatites (and their source melts) typically have ratios of K/Rb < 150, Nb/Ta < 5, Zr/Hf < 18, and Mg/Li < 10. The more of these indices that are met, the higher the likelihood that a given pegmatite could host LCT mineralization (See Figure 2).

Figure 1: Pegmatite in drillhole PLP25-027 which returned 1.0 m at

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6338/264031_dc213655b42c7b2b_001full.jpg

Figure 2: Fertility Criteria met by 2024 Surface Pegmatite and Intrusive Grab Samples

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6338/264031_dc213655b42c7b2b_002full.jpg

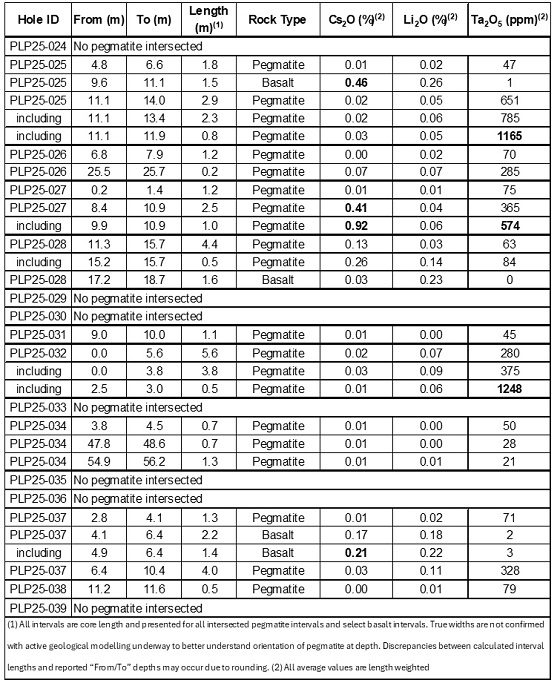

Table 1: Summary of Analytical Results of 2025 Pilipas Drill Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6338/264031_ophir_table1.jpg

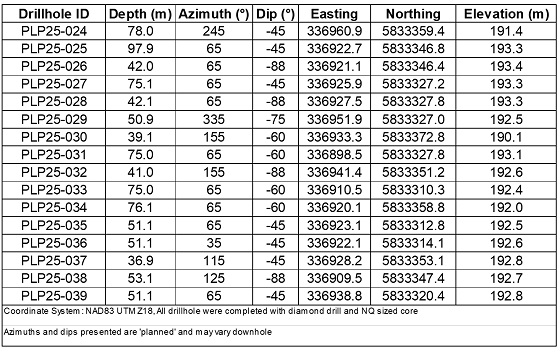

Table 2: 2025 Drillhole Locations and Attributes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6338/264031_ophir_table2.png

Quality Assurance / Quality Control

Drill core was saw-cut with half-core sent for geochemical analysis and half-core remaining in the box onsite. All core samples were securely transported by field staff to SGS Canada's laboratory in Radisson, QC for standard sample preparation (code PRP90) which includes drying at 105°C, crush to

Qualified Person

The technical content of this news release has been reviewed and approved by Kaylyn Niemetz, P.Geo., Geologist for Dahrouge Geological Consulting Ltd., a member in good standing of the Ordre des géologues du Québec (OGQ; permit no. 2418) and a Qualified Person under NI 43-101 Standards of Disclosure for Mineral Projects.

Ms. Niemetz has verified all scientific and technical data disclosed in this news release including the sampling and QA/QC results, and certified analytical data underlying the technical information disclosed. Ms. Niemetz verified the data disclosed (or underlying the information disclosed) in this news release by reviewing the assay data; and checking the performance of blank samples and certified reference materials. Ms. Niemetz detected no significant QA/QC issues during review of the data and noted no errors or omissions during the data verification process. The Company and Ms. Niemetz do not recognize any factors of sampling that could materially affect the accuracy or reliability of the data disclosed in this news release.

About the Pilipas Lithium Project

In December 2023, the Company entered into an option agreement with Azimut Exploration Inc (TSX.V: AZM) (OTCQX: AZMTF) to earn

About the Company

Ophir Metals Corp. is a diversified mineral exploration company focused on the exploration and development of the Pilipas Lithium Property in James Bay, Quebec, and the past-producing Breccia gold property located in Lemhi County, Idaho.

Ophir holds an option to earn a

On behalf of the Board of Directors

"Shawn Westcott"

Ophir Metals Corp.

For further information, please contact:

Shawn Westcott, CEO

Phone 1 (604) 365 6681

swestcott@ophirmetals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note

The information contained herein contains "forward-looking statements" and "forward-looking information" (collectively referred to as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable and include statements in this press release related to the exploration and discovery potential of the Property, plans for a future exploration program on the Property, the strong lithium pegmatite exploration potential on the Property, the strong potential of the Pilipas Property, the interpretation of exploration and sampling results, the use case for Cesium, potential targets on the Property and the Company's future plans with respect to the Property. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risk related to the failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of technical reports, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances, except in accordance with applicable securities laws. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264031