Holiday Savings Surge: Oportun Reports $6.5 Million Saved for 2025, Up 30% From 2024

Rhea-AI Summary

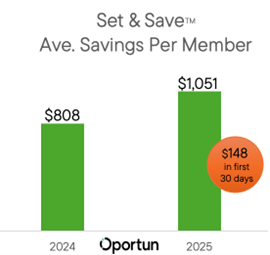

Oportun (Nasdaq: OPRT) released its 2025 Holiday Savings Report showing members saved $6.5 million year-to-date, a 30% increase from 2024. The report covers Set & Save holiday-tagged goals from January through September 2025 and highlights stronger household preparedness for a costlier holiday season.

Key metrics: average member saved $1,051 Jan–Sep 2025; Q3 catch-up savings $431 (Q3 average, +10% YoY); average Q3 withdrawals of $605; top saver states: Kansas, Washington, Colorado; lowest: North Carolina, Michigan, Idaho. The report also notes a consistent 20%+ year-start increase in deadline-driven goals.

Positive

- Total holiday savings reached $6.5M, +30% YoY

- Average member savings of $1,051 Jan–Sep 2025

- Third-quarter holiday savings averaged $431, +10% YoY

- Deadline-driven goals rose 20%+ from year-end to year-start

Negative

- Members averaged $605 in withdrawals in Q3

- Lowest average holiday savings in 2025: North Carolina, Michigan, Idaho

- New deadline goals growth slowed each subsequent quarter in 2025

News Market Reaction

On the day this news was published, OPRT declined 0.21%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

The Oportun 2025 Holiday Savings Report highlights rising participation in automated Set & Save™ accounts and stronger household preparedness for a potentially more expensive holiday season

SAN CARLOS, Calif., Nov. 19, 2025 (GLOBE NEWSWIRE) -- Oportun (Nasdaq: OPRT) today shared results from its 2025 Holiday Savings Report showing that Americans are saving more aggressively for this year’s holiday season. Having saved over

“Whether due to inflation, travel, or personal plans, the data leads us to believe that many Americans expect to spend more this holiday season than last year,” said Annie Ma, Oportun Head of Savings. “The good news is that people are proving to be savvy savers, leaning into automated savings products early to help relieve their financial stress during the holidays.”

The Oportun Holiday Savings Report analyzes member year-over-year savings amounts and behaviors for those savings goals tagged as “holiday” in its Set & Save product. Key findings from the 2025 report indicate:

- Members saved an average of

$1,051 b etween January 2025 and September 2025. - Members accelerated their catch-up savings over the summer, saving an average of

$431 t owards holiday goals in the third quarter, an increase of10% compared to the same period last year. - Kansas, Washington, and Colorado were the top three saver states with an average of over

$1,200 in holiday savings by members in each state. Washington was also a top-three-performing state in 2024. North Carolina, Michigan, and Idaho had the lowest levels of savings in 2025. - On average, members withdrew

$605 from their accounts over the third quarter, continuing an annual pattern of saving through the summer, then beginning to withdraw funds by the start of October. These withdrawals could indicate that members experienced other priority expenses or that they began shopping early to lock in anticipated discounts. - On average, members saved

$148 in the first 30 days after creating a holiday savings account.

Additionally, this year’s report tracked the overall number of deadline-driven goals or accounts created throughout the year. It found that, over the last two years, there has been a consistent

“Consumers are more likely to commit to intentional savings goals at the start of each year,” continued Ma. “This report and our members’ overall experiences reinforce the mantra of start strong and stay consistent with your savings—your future self will thank you.”

About Set & Save

Named the #1 savings app for 2024 and 2025 by Bankrate, Set & Save helps members automatically set aside money for an unlimited number of savings goals. Using artificial intelligence (AI), its smart savings feature learns member income and spending habits to identify and then automatically transfers “safe-to-save” funds into a separate savings account. Oportun members have saved more than

|  |

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven financial services company that puts its members' financial goals within reach. With intelligent borrowing, savings, and budgeting capabilities, Oportun empowers members with the confidence to build a better financial future. Since inception, Oportun has provided more than

Contacts

Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Media Contact

Michael Azzano

Cosmo PR for Oportun

(415) 596-1978

michael@cosmo-pr.com

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/02d22892-0f84-4ef0-a73f-c402c3e8245b

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa60ee86-1321-4111-8c21-0650448d91dd