PTX Metals Launches 5,000m Drill Program at W2 Copper-Nickel-PGE-Gold Project as Metallurgy, Geophysics, and Infrastructure Agreements Strengthen Outlook

Rhea-AI Summary

PTX Metals (OTCQB:PANXF, TSXV:PTX) launched a 5,000 metre diamond drill program at the W2 Cu‑Ni‑PGE‑Au project in Ontario on December 1, 2025, targeting the Central Target with initial holes at the CA1 and AP zones.

Drilling follows compilation of >120 historic and PTX drill holes, a 2025 high‑resolution magnetic survey, electromagnetic Maxwell plates, and recent preliminary metallurgical work. Operations are based from an exploration camp using local Webequie First Nation support and regional infrastructure agreements.

Positive

- 5,000m diamond drill program started

- Targets initial holes at CA1 and AP zones

- Compilation includes >120 historic and PTX drill holes

- 2025 high‑resolution magnetic survey and 3D inversion completed

- Preliminary metallurgical work progressing

Negative

- None.

News Market Reaction

On the day this news was published, PANXF gained 8.77%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

PANXF was down 6.03% pre-news while peers were mixed: SICNF up 7.17%, TINFF down 5.66%, DGDCF down 1.53%, others flat. Moves do not show a unified sector trend.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Drill program launch | Positive | +8.8% | Announced 5,000 m diamond drill program at W2 Central Target. |

| Nov 24 | Corporate transaction | Positive | +0.0% | Proposed RTO and Marshall Uranium Project acquisition via Green Canada Corporation. |

| Nov 07 | Geophysical results | Positive | +0.6% | Reported positive 3D inversion results enhancing W2 drill targeting. |

| Oct 22 | Shining Tree work | Positive | -1.4% | Initiated pre-drilling work program at Shining Tree Gold Project. |

| Aug 11 | Mineralogy update | Positive | +4.8% | Announced positive mineralogy and multiple technical programs at W2. |

Recent project and technical updates have more often been followed by modestly positive price reactions, with occasional flat or negative responses.

Over the last six months, PTX issued several W2-focused updates, including positive mineralogy results on Aug 11, 2025, geophysical compilation and 3D inversion data on Nov 7, 2025, and now a 5,000 m drill program launch on Dec 1, 2025. It also advanced its Shining Tree Gold Project with a work program starting Oct 22, 2025 and was involved in a proposed Green Canada Corporation transaction. These steps collectively outline steady technical and project de-risking.

Market Pulse Summary

The stock moved +8.8% in the session following this news. A strong positive reaction aligns with prior W2 updates that often saw constructive price responses, such as moves of 4.85% and 0.58% after technical progress. The launch of a 5,000 m drill program builds on geophysical and metallurgical work, reinforcing a de-risking narrative. Investors could weigh how earlier gains held over time and whether low pre-news volume of 122,400 affected follow-through.

Key Terms

diamond drilling technical

electromagnetic survey technical

3D inversion model technical

LIDAR survey technical

paragenesis study technical

National Instrument 43-101 regulatory

qualified person regulatory

AI-generated analysis. Not financial advice.

Toronto, Ontario--(Newsfile Corp. - December 1, 2025) - PTX Metals Inc. (TSXV: PTX) (OTCQB: PANXF) (FSE: 9PX) ("PTX" or the "Company") is pleased to announce commencement of a 5,000m diamond drilling program at its W2 Copper-Nickel and Platinum-Palladium-Gold (PGE) Project in Ontario, Canada. Drilling is focused on the Central Target with the initial holes targeting the CA1 and AP zones.

The objectives of the first phase of the program are to test and delineate known exploratory targets (see press release dated September 4th, 2024) with the goal of enhancing the resource estimate, as well as expand the identified mineralized bodies with step-out holes within geologically prospective zones. Through the first phase of drilling, the Company is also targeting and building it's understanding of the higher-grade zones and possible enrichment within a larger sulfide-bearing envelop previously identified, along with testing geophysical targets.

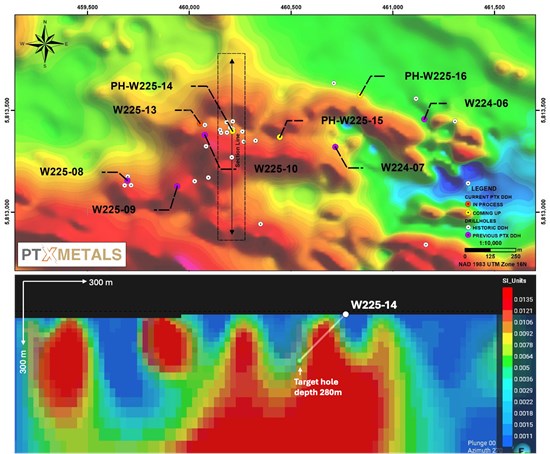

Figure 1: Drill pad location within the CA1 zone of the Central Target and a section of the W225-14 hole targeting the mag anomaly

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/276431_79fdb3e974d3b8e7_001full.jpg

Drill planning was based on multiple lines of geological evidence, leading to targeting of a never-before-tested geological interpretation of the property which is expected to more precisely guide current and future drilling at the W2 property. Data considered during drill planning includes, but is not limited to, previous PTX and historic drilling cumulating more than a 120 drill holes, the recent 2025 high-resolution magnetic survey and the subsequent 3D inversion model, the electromagnetic survey and the resulting Maxwell Plates. Latest compilation of data and the newest drill holes from PTX show that the mineralization is mainly hosted within a deformed, sulfide-bearing, highly magnetic gabbroic unit, which has been affected by various structural regimes. These previous steps allow significant de-risking for targeting wide mineralized intersections and potential localized massive sulfides zones intercepts.

The current work is being conducted and based out of an exploration camp at the property located 60km south of Webequie First Nation (WFN), where various support services at WFN are being used for the W2 Project.

Picture 1: Cyr Drilling rig currently drilling at the W2 Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/276431_79fdb3e974d3b8e7_002full.jpg

Greg Ferron, CEO & President states: "We are particularly excited to be back drilling at the W2 Project this year with a more extensive program. We have taken significant steps for the Project and for the Company to improve our geological understanding of the deposit, that we are now ready to further test and build on the large exploration target issued in 2024. We are also pleased to be partnering with several professional service providers at W2 including Cyr Drilling, SGS, Haveman, Wisk Air, Webequie First Nations and our internal team. Importantly, with three recent infrastructure announcements in the immediate region including two landmark First Nations agreements with Ontario government, positive progress with metallurgy work and a strong commodity environment, W2 is very well positioned today."

Currently progressing additional activities at the W2 Project:

The Company continues to advance the project increasing knowledge with the preliminary metallurgical results received, highly anticipated impending age dating, paragenesis study, resource modeling and geological 3D interpretations still pending for results.

Additionally, a high-resolution topography and orthophoto LIDAR survey was flown by KBM Resources Group and completed on October 25th for the Central Target.

- Qualified Person

The technical information presented in this news release has been reviewed and approved by Kyle Pedersen, a non-independent qualified person to PTX Metals who is responsible for ensuring that the related technical information provided in this news release is accurate and who act as a "qualified person" (QP) as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

- About PTX Metals Inc

PTX is a mineral exploration company focused on high-quality strategic metals assets in northern Ontario, allowing exposure for shareholders to Copper, Gold, Nickel, and PGEs discoveries. The Province of Ontario is a renowned mining jurisdiction for its abundance of mineral resources and safe jurisdiction.

Our corporate objective is to advance our assets, and unveil the potential of two Flagship Projects, the W2 Cu-Ni-PGE located in the strategic Ring of Fire region, and the Shining Tree Gold Project neighbor to other known deposits in the Timmins Gold Camp.

PTX's portfolio of assets was strategically acquired for their geologically favorable attributes, and proximity to established mining companies.

PTX is based in Toronto, Canada, with a primary listing on the TSX under the symbol PTX. The Company is also listed in Frankfurt under the symbol 9PF and on the OTCQB in the United States as PANXF.

For additional information on PTX, please visit the Company's website at https://ptxmetals.com/.

- For further information, please contact:

Greg Ferron, President and Chief Executive Officer

1 (416) 270-5042

gferron@ptxmetals.com

- Forward-Looking Information

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information, including statements regarding the ability of the Company to satisfy the regulatory, stock exchange and commercial closing conditions of Private Placement, and the potential development of mineral resources and mineral reserves which may or may not occur. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and general economic and political conditions. Forward looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary approvals, including governmental and regulatory approvals, will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by applicable laws. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the Company's public filings available under the Company's profile at www.sedarplus.ca.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276431