Pacific Ridge Intersects 289 m of 0.77% Copper Equivalent or 1.15 g/t Gold Equivalent at Kliyul Copper-Gold Project; Expands Mineralization 110 m to the West

Rhea-AI Summary

Pacific Ridge (OTCQB: PEXZF; TSXV: PEX) reported 2025 drilling at the Kliyul project that returned a highlight interval of 289.0 m @ 0.77% CuEq (1.15 g/t AuEq) in hole KLI-25-070 and expanded mineralization 110 m west with hole KLI-25-071. The company notes a KMZ inferred resource of 334.1 Mt @ 0.33% CuEq. KLI-25-070 is described as one of the best KMZ holes, confirming a northward-dipping, pipe-shaped high-grade zone. Commodity prices and assumed recoveries used to calculate CuEq/AuEq are disclosed; no metallurgical recovery testing has been completed.

Positive

- High-grade interval: 289.0 m @ 0.77% CuEq

- Expanded mineralization 110 m west (KLI-25-071)

- KMZ inferred resource: 334.1 Mt @ 0.33% CuEq

- Confirmed northward-dipping pipe-shaped high-grade zone

Negative

- No metallurgical recovery testing completed for Kliyul mineralization

- CuEq/AuEq based on assumed recoveries (Cu 80%, Au 60%, Ag 60%)

- KLI-25-071 composite: 421 m @ 0.24% CuEq (lower grade)

- 2025 program comprised only two holes (total 1,287 m)

News Market Reaction

On the day this news was published, PEXZF gained 13.47%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - November 18, 2025) - Pacific Ridge Exploration Ltd. (TSXV: PEX) (OTCQB: PEXZF) (FSE: PQW) ("Pacific Ridge" or the "Company") is pleased to announce that drill hole KLI-25-070 intersected 289.0 m of

Drilling Highlights:

- Pacific Ridge completed two drill holes, totaling 1,287 m, at Kliyul in 2025 which were focused on infill and resource expansion at the Kliyul Main Zone ("KMZ"). KMZ hosts 334.1 million tonnes ("Mt") grading

0.33% CuEq*(0.15% copper, 0.26 g/t gold, and 0.95 g/t silver) in the Inferred Mineral Resource category (see news release dated August 6, 2025) (see Figure 2).

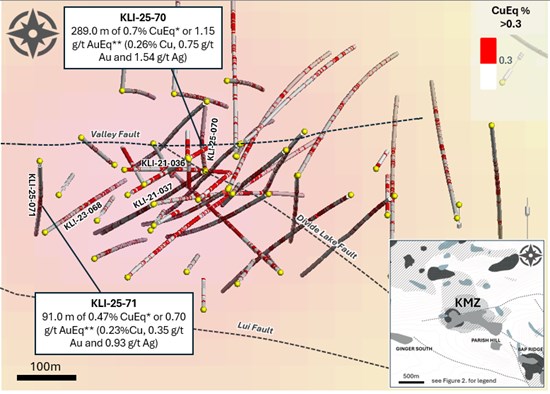

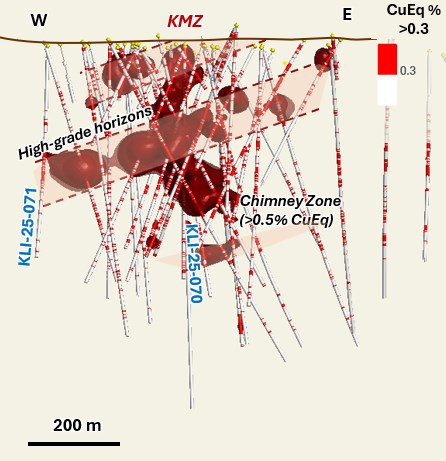

- Drill hole KLI-25-070 returned 289.0 m of

0.77% CuEq* or 1.15 g/t AuEq** (0.26% copper, 0.75 g/t gold, and 1.54 g/t silver) within 489.8 m of0.56% CuEq* or 0.84 g/t AuEq** (0.20% copper, 0.53 g/t gold and 1.34 g/t silver) (see Table 1) (see Figure 3).

- Drill hole KLI-25-071 returned 91.0 m of

0.47% CuEq* or 0.70 g/t AuEq** (0.23% copper, 0.35 g/t gold, and 0.93 g/t silver) within 421 m of 0.24 CuEq* or 0.35 g/t AuEq** (0.12% copper, 0.16 g/t gold, and 0.62 g/t silver) (see Table 1) (see Figure 3).

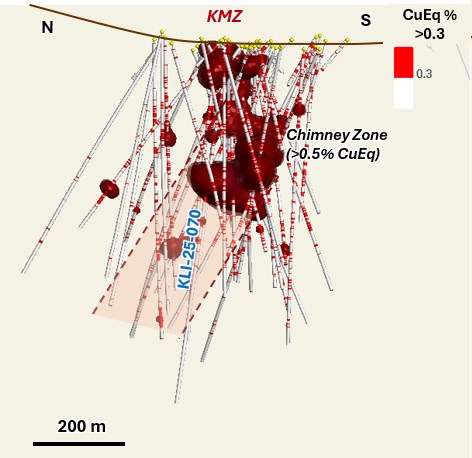

- Drill hole KLI-25-070 is one of the best holes ever drilled at KMZ and filled a 130 m gap between drill holes. It has a high gold g/t: copper % ratio (>2) and is similar in style to drill hole KLI-21-036, which intersected 437 m of

0.64% CuEq* or 0.96 g/t AuEq* (0.22% copper, 0.60 g/t gold and 1.62 g/t silver), and drill hole KLI-21-037 which intersected 566.7 m of0.51% CuEq* or 0.76 g/t AuEq** (0.20 % copper, 0.44 g/t gold, and 1.39 g/t silver) (see news releases dated December 1, 2021, and January 22, 2022, respectively) (see Figures 4 and 5). Further, it confirmed the presence of a high-grade copper gold mineralized northward-dipping pipe-shaped zone that continues north of the Valley Fault (Figure 4).

- Drill hole KLI-25-071 extended copper-gold mineralization 110 m further west of drill hole KLI-23-068, which intersected 455.8 m of

0.43% CuEq* and 0.64 g/t AuEq** (0.17% copper, 0.27 g/t gold, and 0.93 g/t silver) (see news release dated January 9, 2024), and successfully expanded mineralization within the current mineral resource pit shell (see Figure 5).

"The 2025 drill program at Kliyul, focused on infill and resource expansion at KMZ, was a big success," said Blaine Monaghan, President & CEO of Pacific Ridge. "Drill hole KLI-25-070 returned one of the best intervals ever recorded at KMZ and drill hole KLI-25-071 extended copper-gold mineralization 110 m to the west. The 2026 drill program at Kliyul will focus on continued resource expansion drilling at KMZ and testing a number of drill targets that occur along an under explored 6-km mineralized trend."

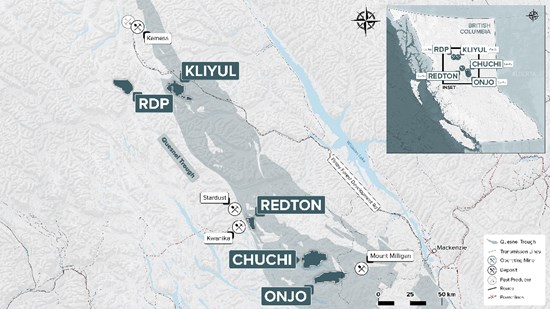

Figure 1

Location of Kliyul and Pacific Ridge's Other Porphyry Copper-Gold Projects

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_001full.jpg

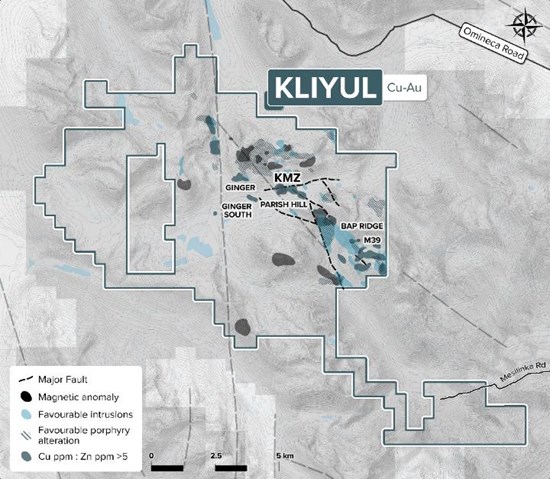

Figure 2

Kliyul Target Areas

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_002full.jpg

Table 1

Kliyul Assay Results Highlights

| Hole | From(m) | To(m) | Width(m) | Cu(%) | Au(g/t) | Ag(g/t) | CuEq(%)* | AuEq(g/t)** |

| KLI-25-70 | 2.7 | 492.5 | 489.8 | 0.20 | 0.53 | 1.34 | 0.56 | 0.84 |

| includes | 2.7 | 401.0 | 398.3 | 0.23 | 0.63 | 1.54 | 0.66 | 0.98 |

| includes | 110.0 | 399.0 | 289.0 | 0.26 | 0.75 | 1.54 | 0.77 | 1.15 |

| and | 193.0 | 221.0 | 28.0 | 0.34 | 0.85 | 2.11 | 0.92 | 1.38 |

| and | 260.0 | 345.0 | 85.0 | 0.45 | 1.49 | 2.50 | 1.47 | 2.19 |

| includes | 279.5 | 317.0 | 37.5 | 0.67 | 2.69 | 3.64 | 2.49 | 3.72 |

| includes | 378.0 | 399.0 | 21.0 | 0.29 | 1.44 | 1.28 | 1.26 | 1.89 |

| KLI-25-71 | 80.0 | 501.0 | 421.0 | 0.12 | 0.16 | 0.62 | 0.24 | 0.35 |

| includes | 170.0 | 369.0 | 199.0 | 0.18 | 0.25 | 0.82 | 0.36 | 0.54 |

| and | 230.0 | 321.0 | 91.0 | 0.23 | 0.35 | 0.93 | 0.47 | 0.70 |

*CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Cu x 22.0462).

**AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Commodity prices: $Cu = US

There has been no metallurgical recovery testing on Kliyul mineralization.

The Company estimates copper recoveries (CuR) of

Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne.

Figure 3

Plan View 2025 KMZ Drill Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_003full.jpg

Figure 4

Thick-Section View to East of KMZ Mineralization

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_004full.jpg

Figure 5

Thick-Section View to North of KMZ Mineralization

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_005full.jpg

2025 Kliyul Drill Program

The 2025 drill program at Kliyul was focused on infill and resource expansion at KMZ.

KLI-25-070, the first drill hole of the program, was collared south of the Valley Fault (Figure 4) and was designed to test an approximate 130 m gap in drilling north of strong copper-gold mineralization in holes KLI-21-036, which intersected 437 m of

KLI-25-071 was collared west of KLI-23-068, which intersected 455.8 m of

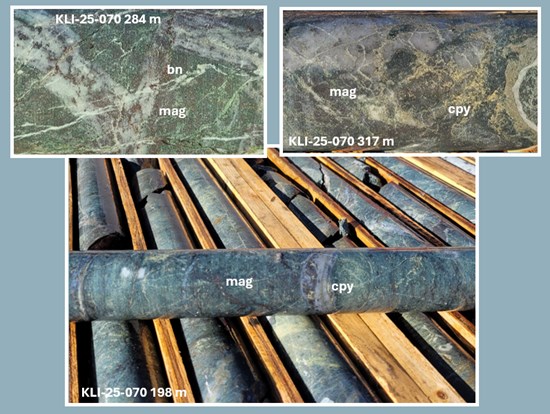

Figure 6

KLI-25-070 Drill Core Photos

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_006full.jpg

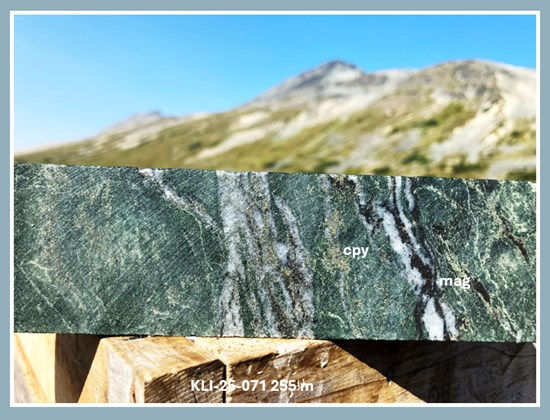

Figure 7

KLI-25-071 Drill Core Photo

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_007full.jpg

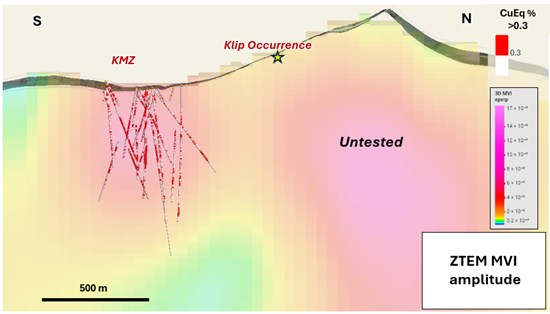

Future Exploration at Kliyul

In addition to continued resource expansion drilling at KMZ, Pacific Ridge also plans to test a number of drill targets that occur along an underexplored 6-km mineralized trend, which include, from south to north, M39, Bap Ridge, Parish Hill, Ginger South and Ginger (see Figure 2). Further, the Company also plans on drill testing the Klip target, which is a new target identified in a 2024 ZTEM survey (see Figure 8). The Klip target is located north of KMZ and is named after a historical BC MINFILE occurrence (094D 185), the Klip Occurrence, located 400 m to the west. The Klip Occurrence records a NE-striking shear zone within QSP-altered volcaniclastic rocks. A one metre chip sample taken across the shear zone in 1985 yielded 3.8 g/t gold and 5.3 g/t silver. Pacific Ridge believes that drilling to date has only tested one part of the porphyry system and that most of the system remains hidden and untested to the north.

Figure 8

Klip Target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5460/274859_6ffa3f311482b90e_008full.jpg

QA/QC (Quality Assurance/Quality Control)

Pacific Ridge's 2025 exploration program was managed by Equity Exploration Consultants Ltd. of Vancouver, B.C. The drill contractor was Dorado Drilling Ltd. of Vernon, B.C. Half-core HQ (63.5mm) or NQ (47.6 mm) sawed samples from continuous intervals throughout the reported drill holes were sealed on site and shipped to ALS Global Laboratories ("ALS") preparation lab in Terrace, BC. Fire assay and multielement analyses were completed at ALS Minerals analytical laboratory in North Vancouver. Drill core was crushed, pulverized and analyzed for 48 elements using a four-acid dissolution followed by ICP-MS (ME-MS61) with over limits by ore grade four-acid dissolution followed by ICP-AES (OG62), with a 30 g sample analyzed for gold by fire assay and atomic absorption finish (Au-AA23). Blanks and commercially certified reference materials were inserted blind into the sample stream with an overall insertion rate 1 per 40 samples. Alternating pulp and crush duplicates are inserted at a rate of 1 in 20 samples. Pulp and crush duplicates are inserted at

About Pacific Ridge

A Fiore Group company, Pacific Ridge's goal is to become British Columbia's leading copper exploration company. The Kliyul copper-gold project, located in the prolific Quesnel terrane close to existing infrastructure, is the Company's flagship project. In addition to Kliyul, Pacific Ridge's project portfolio includes the RDP copper-gold project, the Chuchi copper-gold project, the Onjo copper-gold project, and the Redton copper-gold project, all located in B.C. The Company would like to acknowledge that its B.C. projects are in the traditional, ancestral and unceded territories of the Gitxsan Nation, McLeod Lake Indian Band, Nak'azdli Whut'en, Takla Nation, and Tsay Keh Dene Nation.

On behalf of the Board of Directors,

"Blaine Monaghan"

Blaine Monaghan

President & CEO

Pacific Ridge Exploration Ltd.

Investor Relations:

Tel: (604) 687-4951

Email: ir@pacificridgeexploration.com

Website: www.pacificridgeexploration.com

News Sign up: https://pacificridgeexploration.com/contact/subscribe/

LinkedIn: https://www.linkedin.com/company/pacific-ridge-exploration-ltd-pex-/

Twitter: https://twitter.com/PacRidge_PEX

*CuEq = ((Cu%) x $Cu x 22.0462) + (Au(g/t) x AuR/CuR x $Au x 0.032151) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Cu x 22.0462).

**AuEq = ((Au(g/t) x $Au x 0.032151) + ((Cu%) x CuR/AuR x $Cu x 22.0462) + (Ag(g/t) x AgR/CuR x $Ag x 0.032151)) / ($Au x 0.032151).

Commodity prices: $Cu = US

There has been no metallurgical recovery testing on Kliyul mineralization.

The Company estimates copper recoveries (CuR) of

Factors: 22.0462 = Cu% to lbs per tonne, 0.032151 = Au g/t to troy oz per tonne, and 0.032151 = Ag g/t to troy oz per tonne.

The technical information contained within this News Release has been prepared under the supervision of, and reviewed and approved by. Danette Schwab, P.Geo., Vice President Exploration of the Company, and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information: This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, which address exploration drilling and other activities and events or developments that Pacific Ridge Exploration Ltd. ("Pacific Ridge") expects to occur, are forward-looking statements. Forward-looking statements in this news release include plans to continue drilling KMZ and testing a number of other drill targets at Kliyul. Although Pacific Ridge believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploration successes, and continued availability of capital and financing and general economic, market or business conditions. These statements are based on a number of assumptions including, among other things, assumptions regarding general business and economic conditions, that one of the options will be exercised, the ability of Pacific Ridge and other parties to satisfy stock exchange and other regulatory requirements in a timely manner, the availability of financing for Pacific Ridge's proposed programs on reasonable terms, and the ability of third party service providers to deliver services in a timely manner. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Pacific Ridge does not assume any obligation to update or revise its forward-looking statements, whether because of new information, future events or otherwise, except as required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274859