Pelangio Begins Drill Program at Manfo and Provides Corporate Update

Rhea-AI Summary

Pelangio (PGXPF) has started a 6,850‑metre drill program at the Manfo project comprising 3,150 m resource extensional diamond drilling and 3,700 m exploration RC drilling to test Pokukrom extensions, the Bomfaa geochemical anomaly 2.5 km northwest, Nfante East and a possible southern extension of Nkansu.

The company also terminated the Nkosuo (FJ Minerals) option and the Nathawo option, retaining a 27% interest in the known Manfo resource. The current MRE: Indicated 441,000 oz Au @ 1.16 g/t (11,787,000 t); Inferred 396,000 oz Au @ 0.77 g/t (16,048,000 t) (63,000 oz inferred from Nfante West partly on Nkosou).

Positive

- Indicated resource: 441,000 oz Au at 1.16 g/t

- Inferred resource: 396,000 oz Au at 0.77 g/t

- 6,850 m drill program now underway (3,150 m DD + 3,700 m RC)

Negative

- Termination of FJ option removes partner option on 17% interest

- Approximately 63,000 oz Inferred from Nfante West partly located on Nkosou

Toronto, Ontario--(Newsfile Corp. - January 19, 2026) - Pelangio Exploration Inc. (TSXV: PX) ("Pelangio" or the "Company") is pleased to announce that the first phase of its drill program at the Manfo Project is underway. The drill program will consist of resource extensional drilling, as well as an exploration RC drilling program which will include evaluating the highly prospective untested Bomfaa geochemical anomaly situated 2.5 kilometers northwest of the Pokukrom deposits.

The Company also announces that the Nkosuo Option Agreement (the "Agreement") has been terminated. As a result, FJ Minerals Limited ("FJ") no longer has an option to earn a

Following the termination of the FJ Option and the Nathawo Option, Pelangio retains the

Considering both the recent rise in the gold price and the absence of the required Forest Entry Permit from the vendor, the loss of the exploration property is outweighed by securing the

The current Manfo Resource Estimate ("MRE") is defined by a total Indicated Mineral Resource of 441,000 ounces of gold at an average grade of 1.16 g/t Au and totalling 11,787,000 tonnes and a total Inferred Mineral Resource of 396,000 ounces of gold at an average grade of 0.77 g/t Au totalling 16,048,000 tonnes; however 63,000 ounces in the Inferred category are from the Nfante West deposit and approximately one half of the Nfante West deposit is located on the Nkosou property.

"We are pleased to launch phase one of the current Manfo exploration program, which is designed with the objective of both expanding our existing mineral resource and finding new gold discoveries. We continue our constructive engagement with FJ Minerals to explore mutually beneficial opportunities going forward" commented Ingrid Hibbard, President and CEO.

Manfo Exploration Program

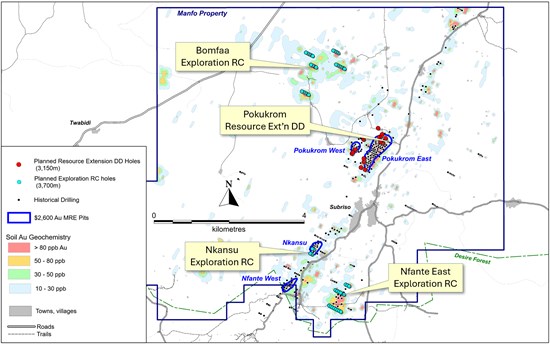

A 6,850-meter drilling program has just commenced on the Manfo project, consisting of 3,150 meters of resource extensional diamond drilling (now underway) to be followed by 3,700 meters of exploration reverse circulation (RC) drilling. This program is the first phase of a larger planned program described in Pelangio's September 2025 NI43-101 Technical Report, which is intended to grow the Manfo project if successful. The diamond drilling in this program will test for extensions to the Pokukrom East and West deposits, along strike, down-dip and down-plunge. Demonstrated extensions to the mineralized zones will be followed up by infill drilling in future programs to quantify potential additions to the Manfo gold resource. The exploration RC drilling program will evaluate the highly prospective untested Bomfaa Au geochemical anomaly situated 2.5 kilometers northwest of the Pokukrom deposits, further explore the Nfante East target where previous drilling returned 6 meters @ 2.99 g/t Au (Pelangio, 2011) and 17 meters @ 1.22 g/t Au (Pelangio, 2010), plus test for a possible southern extension to the small Nkansu deposit.

These drilling programs are expected to take several months to complete with assays being released periodically throughout the programs. Refer to the following figure.

Planned Resource Extensional DD and Exploration RC Drilling Programs, Manfo Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6179/280862_389d661d44492b5a_001full.jpg

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario, #0191), Senior Vice-President, Exploration and Director, is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Thomson approved the technical data disclosed in this release.

Neither TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release

About Pelangio

Pelangio acquires and explores prospective land packages located in gold belts in Ghana, West Africa and Canada. In Ghana, the Company is exploring its two

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

T: 905-336-3828 // E: info@pelangio.com

Forward-Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's exploration plans. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the ability of the Company to conduct our exploration programs as planned, changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana, increases in costs, exchange rate fluctuations, speculative nature of gold exploration and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280862