Brasnova Energy Materials Inc. Announces Option of Brazilian Gold Project

Rhea-AI Summary

Brasnova Energy Materials (PMDRF) executed a binding option agreement dated January 16, 2025 to acquire a 50% interest in the BGC Gold Project via earned equity in Bahia Gold Corporation.

The BGC Gold Project covers 3,935.25 hectares in the same gold district as Pan American Silver's Jacobina and Equinox Gold's Santa Luz Bahia complexes. To earn the interest, Brasnova must advance CA$500,000 to BGC over 24 months for work expenditures and holding fees.

Brasnova also announced a non-brokered private placement of up to $750,000 (up to 7.5M units at $0.10 each) with 24-month warrants exercisable at $0.20 and an acceleration clause if shares trade at or above $0.50 for 10 consecutive trading days. The company cancelled a previously announced $0.20 financing.

Positive

- Option to acquire a 50% interest in a 3,935.25-hectare gold project

- Project located near Jacobina and Santa Luz Bahia gold complexes

- Earn-in requires CA$500,000 over 24 months (defined funding schedule)

- Non-brokered financing up to $750,000 to fund project payments

Negative

- Potential dilution from up to 7.5 million new units issued at $0.10

- Warrants exercisable at $0.20 could increase share count if exercised

- Previously announced $0.20 financing was cancelled, signaling change in funding plan

Vancouver, British Columbia--(Newsfile Corp. - January 19, 2026) - Brasnova Energy Materials Inc. (TSXV: BEM) ("BEM'' or the "Company") is pleased to announce that the Company has executed a binding agreement (the "Option Agreement") with Bahia Graphite Corporation (BGC), dated January 16th, 2025 (the "Option Agreement") to acquire, subject to the terms and conditions of the Option Agreement, a

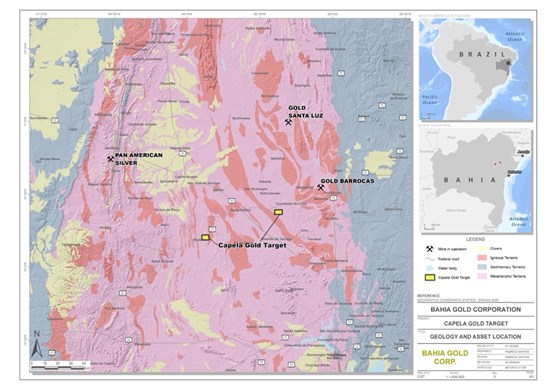

The BGC Gold Project is hosted in the same gold district as both Pan American Silver's Jacobina gold mining complex and Equinox Gold's Santa Luz Bahia complex and spans 3,935.25 hectares.

Figure 1. BGC Gold Project in proximity to Jacobina Gold Complex and Santa Luz Bahia Complex

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5386/280799_befc2d756440b832_001full.jpg

Under the terms, BGC hereby grants to BEM the Option for BEM to acquire an undivided, unencumbered legal and beneficial fifty percent (

Upon BEM having exercised the Option, BGC will transfer to BEM the percentage right, title and interest in and to the Property associated with the Option by transferring fifty percent equity ownership of Bahia Gold Corporation to BEM.

The Company will focus on work programs over the first half of 2026 on the

BEM is also pleased to announce a non-brokered private placement financing for aggregate gross proceeds of up to

BEM announces that it has cancelled its previously announced (see the Company's August 6, 2025 news release)

ABOUT BRASNOVA ENERGY MATERIALS INC.

Brasnova Energy Materials is focused on securing, developing and monetizing Brazilian critical materials assets and related materials technologies, to build shareholder value.

On behalf of the Board of Directors of

BRASNOVA ENERGY MATERIALS INC.

"Maria Conejo"

Maria Conejo, Director

info@brasnovaem.com

FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280799